U.S. Plant-Based Meat Market Size, Share, Trends, Industry Analysis Report

By Source (Soy, Wheat), By Product, By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM6301

- Base Year: 2024

- Historical Data: 2020-2023

Overview

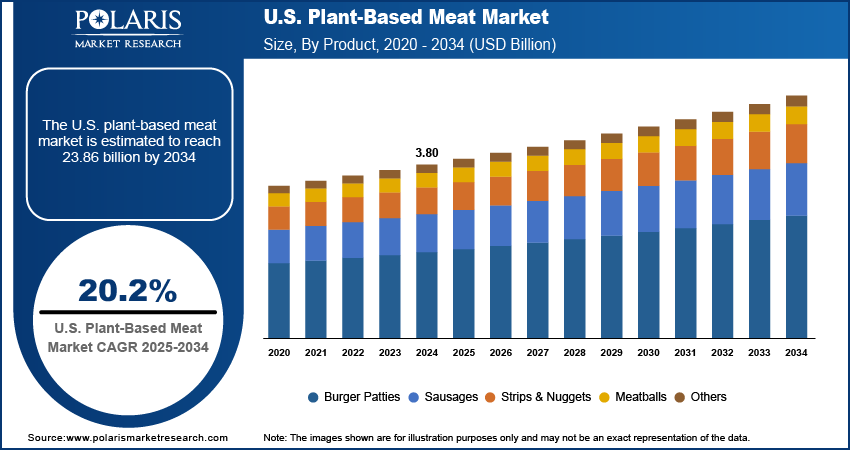

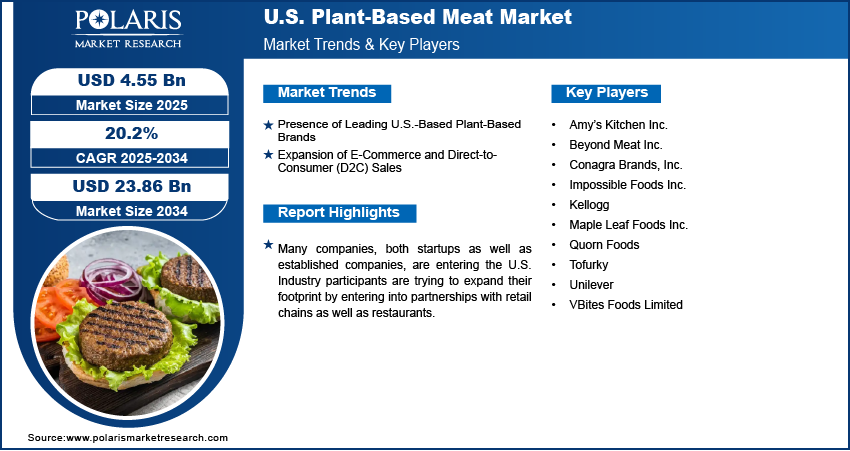

The U.S. plant-based meat market size was valued at USD 3.80 billion in 2024, growing at a CAGR of 20.2% from 2025 to 2034. Key factors driving demand are the presence of leading U.S.-based plant-based brands and the expansion of e-commerce and direct-to-consumer (D2C) sales.

Key Insights

- The soy segment is anticipated to register a CAGR of 20.2% during the forecast period, driven by its high protein content and strong ability to mimic the texture of traditional meat.

- The wheat segment is expected to capture a notable market share during the forecast period. Wheat-based ingredients, particularly wheat gluten (seitan), are becoming increasingly popular for delivering a chewy, meat-like texture.

- The burger patties segment accounted for 43.43% of the U.S. plant-based meat market revenue in 2024, with consumers readily embracing plant-based versions from well-known brands such as Beyond Meat and Impossible Foods.

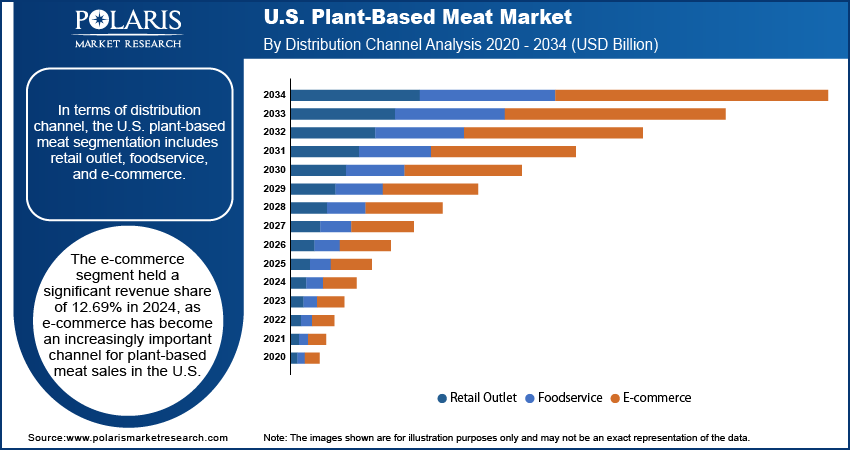

- The e-commerce segment held a 12.69% revenue share in 2024, reflecting the growing importance of online platforms in distributing plant-based meat products across the U.S.

Industry Dynamics

- The presence of leading U.S.-based plant-based brands is driving the demand for plant-based meat.

- The expansion of e-commerce and direct-to-consumer (D2C) sales is driving the U.S. plant-based meat market

- Industry participants are trying to expand their footprint by entering into partnerships with retail chains, as well as restaurants.

- High product prices compared to conventional meat limit the growth.

Market Statistics

- 2024 Market Size: USD 3.80 Billion

- 2034 Projected Market Size: USD 23.86 Billion

- CAGR (2025–2034): 20.2%

AI Impact on U.S. Plant-Based Meat Market

- AI speeds up product development by analyzing large datasets related to taste, texture, and nutrition, helping create plant-based meat that closely resembles traditional animal products.

- AI-driven tools provide deep insights into consumer behavior, preferences, and market trends, supporting more focused product innovation and marketing strategies.

- AI also streamlines supply chain and production processes, helping manufacturers reduce food waste, cut costs, and boost overall efficiency in plant-based meat production.

Plant-based meat in simple terms can be defined as products manufactured by using plant ingredients that mimic the animal-derived meat both in terms of taste and appearance and are designed in a way to be indistinguishable from animal meat. These products are made by using a variety of sources such as peas, wheat, soy among others and as they directly substitute animal meat hence are often referred to as meat products.

Rising concerns about health in the U.S. have significantly influenced food choices. Many Americans are aware of the negative effects of consuming red and processed meats, which have been linked to heart disease, obesity, diabetes, and certain types of cancer. This has led to a growing demand for healthier alternatives, such as plant-based meat, which is generally lower in saturated fat and cholesterol. The popularity of clean-label and protein-rich foods has further fueled the demand. Consumers are turning to plant-based meat as a nutritious substitute to traditional meat products as they prioritize wellness and preventive healthcare, thereby driving the growth.

The U.S. is experiencing a steady rise in flexitarian diets, which means those who still consume meat but aim to reduce their intake for health, environmental, or ethical reasons. This lifestyle is more practical for many Americans than adopting a strict vegan or vegetarian diet. Flexitarians are a key consumer group for the U.S. plant-based meat market as they seek alternatives that offer the taste and texture of meat without the drawbacks. In the U.S., supermarkets and restaurants are increasingly offering plant-based meat options to cater to this trend. Flexitarian drive strong demand for meat alternatives as it becomes more mainstream in the U.S., thereby fueling the growth.

Drivers & Opportunities

Presence of Leading U.S.-Based Plant-Based Brands: The U.S. is home to a few of the most influential plant-based meat companies, such as Beyond Meat, Impossible Foods, and Eat Just. These companies have led the way in innovation, product development, and marketing. Their partnerships with major fast-food chains such as Burger King and Starbucks and retail giants such as Walmart and Target have made plant-based meat widely accessible. Their strong branding and continuous investment in improving taste and texture have made them household names. The presence of these pioneering brands has helped normalize plant-based meat consumption in the U.S., thereby driving the growth.

Expansion of E-Commerce and Direct-to-Consumer (D2C) Sales: Online shopping has transformed how U.S. consumers buy food, and plant-based meat brands have adopted this shift. Online retail platforms and D2C sales channels allow companies to reach consumers nationwide, even in areas without major retail stores. This model provides convenience, subscription options, and access to a wider product range. Brands further gain valuable customer insights through direct sales, helping them tailor marketing and improve products. Americans became comfortable buying groceries online during and after the COVID-19 pandemic, including alternative proteins, thereby accelerating the growth.

Segmental Insights

Source Analysis

Based on source, the segmentation includes soy, wheat, peas, and other sources. The soy segment is projected to register a CAGR of 20.2% over the forecast period due to its high protein content and ability to replicate the texture of real meat. It is commonly used in products such as sausages, nuggets, and ground meat alternatives. In the U.S., consumers adopt soy-based products because they are familiar, affordable, and often fortified with additional nutrients. Soy continues to be a preferred base for many manufacturers as health and sustainability remain top priorities. Its long history in vegetarian diets and proven functionality fuel the segment growth.

The wheat segment is expected to witness a significant share over the forecast period as wheat-based ingredients, especially wheat gluten (seitan), are gaining popularity for their chewy, meat-like texture. These products appeal to consumers seeking high-protein alternatives that offer a satisfying bite. Many U.S. brands use wheat in deli slices, sausages, and meat-style strips. While gluten-free product concerns limit appeal for some, wheat remains a favored option for others due to its cost-effectiveness and availability. The segment continues to grow as companies refine formulations to improve taste and reduce allergens. Moreover, wheat-based meat alternatives offer versatility in cooking, which boosts the segment growth.

Product Analysis

In terms of product, the segmentation includes burger patties, sausages, strips & nuggets, meatballs, and other products. The burger patties held 43.43% of revenue share in 2024. American consumers, already familiar with traditional beef burgers, have quickly adopted plant-based versions offered by leading brands such as Beyond Meat and Impossible Foods. These patties are commonly found in restaurants, fast-food chains, and retail stores across the country. Their popularity is driven by taste improvements, high protein content, and broad availability. Many flexitarians choose plant-based burgers as an easy way to reduce meat consumption without sacrificing flavor, thereby fueling the segment growth.

Distribution Channel Analysis

In terms of distribution channel, the segmentation includes retail outlets, foodservice, and e-commerce. The e-commerce segment held a significant revenue share in 2024, holding 12.69% as e-commerce has become an increasingly important channel for plant-based meat sales in the U.S. Consumers appreciate the convenience of ordering products online and having them delivered directly to their homes. Brands are using direct-to-consumer (D2C) websites, grocery delivery apps, and online retailers such as Amazon to reach a wider audience. E-commerce further allows companies to test new products, offer subscriptions, and collect feedback. Plant-based meat brands are investing more in online marketing and distribution with digital shopping now a normal part of American life, thereby driving the segment growth.

Key Players & Competitive Analysis

The U.S. plant-based meat market features a competitive landscape dominated by both specialized plant-based companies and major food corporations. Leading innovators like Beyond Meat Inc. and Impossible Foods Inc. have set industry benchmarks with their realistic meat alternatives, strong retail presence, and partnerships with fast-food chains. Amy’s Kitchen Inc., Tofurky, and Quorn Foods maintain steady consumer bases with a focus on natural ingredients and vegetarian heritage. Large players such as Conagra Brands, Inc., Unilever, Kellogg, and Maple Leaf Foods Inc. have expanded into the space through innovation and acquisitions to meet rising consumer demand. VBites Foods Limited adds further competition with its diverse range of products. These companies compete on innovation, taste, texture, price, and sustainability. Increasing investments in R&D, marketing, and direct-to-consumer models reflect the market’s growth potential. As consumer preferences evolve, competition is expected to intensify, particularly in product quality, distribution, and health-focused offerings.

Key Players

- Amy’s Kitchen Inc.

- Beyond Meat Inc.

- Conagra Brands, Inc.

- Impossible Foods Inc.

- Kellogg

- Maple Leaf Foods Inc.

- Quorn Foods

- Tofurky

- Unilever

- VBites Foods Limited

U.S. Plant-Based Meat Industry Developments

In August 2025, Juicy Marbles partnered with Revo Foods to launch Kinda Salmon, a raw, plant-based salmon filet featuring 13g of protein and omega-3s. Released in the U.S., the product followed the sellout success of Kinda Cod.

U.S. Plant-Based Meat Market Segmentation

By Source Outlook (Revenue, USD Billion, 2021–2034)

- Soy

- Wheat

- Peas

- Other Sources

By Product Outlook (Revenue, USD Billion, 2021–2034)

- Burger Patties

- Sausages

- Strips & Nuggets

- Meatballs

- Other Products

By Distribution Channel Outlook (Revenue, USD Billion, 2021–2034)

- Retail Outlet

- Foodservice

- E-commerce

U.S. Plant-Based Meat Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.80 Billion |

|

Market Size in 2025 |

USD 4.55 Billion |

|

Revenue Forecast by 2034 |

USD 23.86 Billion |

|

CAGR |

20.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.80 billion in 2024 and is projected to grow to USD 23.86 billion by 2034.

The market is projected to register a CAGR of 20.2% during the forecast period.

A few of the key players in the market are Amy’s Kitchen Inc.; Beyond Meat Inc.; Conagra Brands, Inc.; Impossible Foods Inc.; Kellogg; Maple Leaf Foods Inc.; Quorn Foods; Tofurky; Unilever; and VBites Foods Limited.

The soy segment dominated the market revenue share in 2024.

The e-commerce segment is projected to witness the fastest growth during the forecast period.