U.S. Premium Bottled Water Market Size, Share, Trend, Industry Analysis Report

By Product (Spring Water, Sparkling Water, Mineral Water, Others), By Distribution Channel – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 123

- Format: PDF

- Report ID: PM6319

- Base Year: 2024

- Historical Data: 2020-2023

Overview

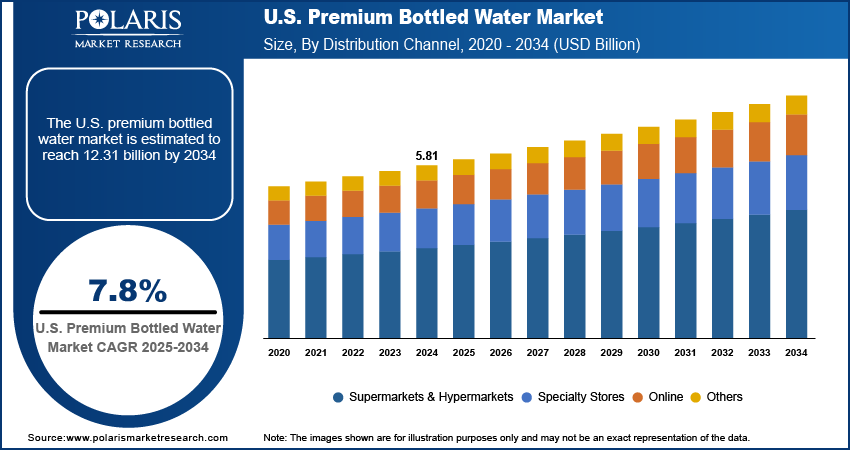

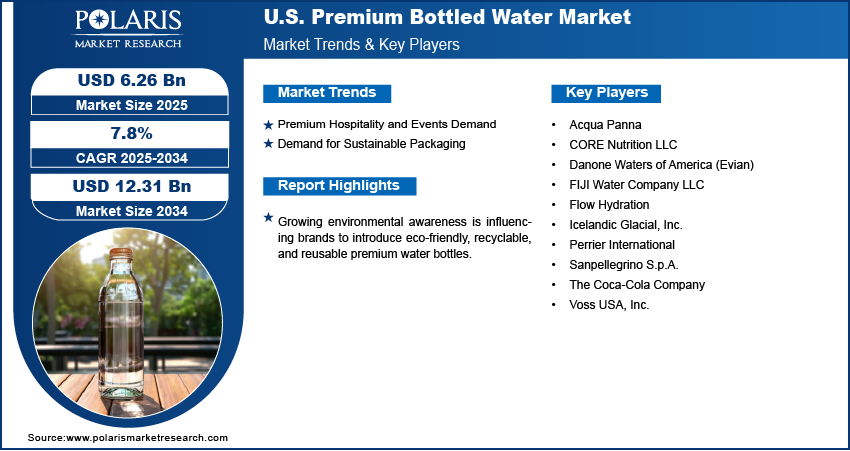

The U.S. premium bottled water market size was valued at USD 5.81 billion in 2024, growing at a CAGR of 7.8% from 2025 to 2034. Growing environmental awareness is influencing brands to introduce eco-friendly, recyclable, and reusable premium water bottles. Consumers are drawn to sustainable options without compromising quality, encouraging manufacturers to innovate in biodegradable materials and reduce plastic waste.

Key Insights

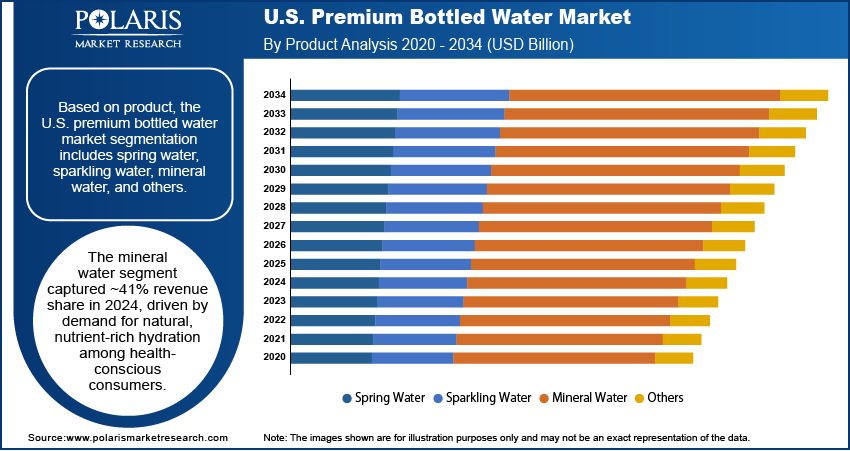

- The mineral water segment held ~41% of the market share in 2024, driven by its image as a natural, nutrient-rich choice among health-conscious consumers.

- The supermarkets & hypermarkets segment captured ~38% of the revenue share in 2024, offering wide premium water selections in a single destination.

Industry Dynamics

- Rising consumer preference for premium hydration options is driving demand for high-end bottled water in retail and foodservice channels.

- Growing association with wellness, sustainability, and luxury lifestyles is boosting brand appeal among affluent and health-conscious consumers.

- Expansion into premium on-premise channels such as fine dining and boutique hotels enhances brand visibility and consumer engagement opportunities.

- High price sensitivity in mass markets limits volume growth and restricts mainstream adoption of premium bottled water brands.

Market Statistics

- 2024 Market Size: USD 5.81 billion

- 2034 Projected Market Size: USD 12.31 billion

- CAGR (2025–2034): 7.8%

The premium bottled water market refers to high-quality packaged water positioned as a luxury or lifestyle product, often sourced from natural springs, mineral-rich origins, or purified through advanced filtration. It emphasizes superior taste, unique packaging, brand exclusivity, and health benefits. Increasing consumer focus on hydration, wellness, and natural beverage options is driving demand for premium bottled water. Many buyers perceive it as a healthier, calorie-free alternative to sugary drinks, boosting consistent adoption in both urban and suburban markets

Premium bottled water is marketed as a symbol of sophistication and exclusivity. Distinctive packaging, brand collaborations, and celebrity endorsements strengthen its appeal among affluent and image-conscious consumers, particularly in hospitality, travel, and fine dining segments. Moreover, busy lifestyles and increased travel have boosted demand for convenient, high-quality hydration solutions. Premium bottled water fits this need, especially in professional, fitness, and leisure settings where portability and brand prestige matter.

Drivers & Opportunities

Premium Hospitality and Events Demand: Hotels, luxury resorts, fine-dining restaurants, and exclusive corporate events are increasingly integrating premium bottled water into their offerings to create a refined guest experience. This trend positions premium water as part of the overall luxury ambiance, aligning with high service standards. The presence of premium brands at such venues elevates brand image and also raises loyalty among affluent customers who associate the product with quality and sophistication. Bulk purchases by hospitality businesses ensure recurring demand, while event-based promotions and partnerships with luxury venues enhance visibility and drive wider consumer adoption beyond the point of initial experience.

Demand for Sustainable Packaging: Environmental consciousness is shaping the preferences of premium bottled water consumers, leading to greater interest in eco-friendly packaging solutions. Brands are responding by introducing recyclable, reusable, and biodegradable packaging without compromising water quality or visual appeal. Glass bottles, biodegradable plastics, and aluminum bottles and cans are gaining popularity as alternatives to single-use plastics. This shift appeals to sustainability-focused consumers who want their purchases to reflect responsible choices. Manufacturers are also adopting sustainable sourcing and production practices to strengthen their brand identity. The combination of premium quality and environmental responsibility is creating opportunities for brands to capture a growing segment of eco-conscious buyers. The escalation of government investments in sustainable packaging is boosting the development and adoption of eco-friendly materials and processes. For instance, in September 2024, the U.S. Department of Commerce allocated USD 500,000 to advance the development of the environmentally sustainable packaging sector in Wisconsin.

Segmental Insights

Product Analysis

Based on product, the U.S. premium bottled water market segmentation includes spring water, sparkling water, mineral water, and others. The mineral water segment accounted for the largest revenue share of ~41% in 2024 due to its strong positioning as a naturally sourced, nutrient-rich hydration option favored by health-conscious consumers. The segment benefits from perceptions of purity, balanced mineral composition, and consistent taste, making it a preferred choice for daily consumption. Premium mineral water brands emphasize source credibility, traceability, and minimal processing to retain natural qualities, which resonates with consumers seeking both health benefits and premium quality. Marketing strategies highlighting origin and mineral content further strengthen consumer trust and loyalty, driving repeat purchases and commanding higher price points compared to standard bottled water.

The sparkling water segment is expected to register the highest CAGR of 9.0% from 2025 to 2034 due to growing demand for healthier beverage alternatives that replace sugary carbonated drinks. The segment’s appeal lies in its refreshing texture, flavor innovation, and positioning as a sophisticated, low-calorie option. Premium sparkling waters are increasingly infused with natural flavors, botanicals, or functional ingredients, targeting both lifestyle-oriented and wellness-focused consumers. Expansion in on-the-go formats and premium hospitality offerings is enhancing accessibility and visibility. Social media and influencer marketing are amplifying the category’s aspirational image, while younger demographics are driving experimentation and brand switching, fueling long-term growth of the U.S. premium bottled water market.

Distribution Channel Analysis

In terms of distribution channel, the U.S. premium bottled water market segmentation includes, supermarkets & hypermarkets, specialty stores, online, and others. Supermarkets & hypermarkets segment held the largest revenue share of ~38% in 2024 driven by their ability to offer diverse premium bottled water selections under one roof, catering to varied consumer tastes. High foot traffic, strategic shelf placements, and promotional activities enhance brand exposure and encourage impulse purchases. Retail partnerships enable prominent in-store displays, tastings, and cross-promotions with complementary products, boosting trial rates. Consumers value the convenience of one-stop shopping combined with the opportunity to physically compare product packaging, size, and price. Bulk purchase options and loyalty programs in these retail formats further stimulate repeat buying behavior among both everyday consumers and institutional buyers.

The online segment is expected to register the highest CAGR of 9.8% during 2025–2034. The growth is attributed to the increasing adoption of e-commerce platforms for premium beverage purchases, driven by convenience and access to wider assortments. Direct-to-consumer channels enable brands to offer exclusive products, subscription services, and personalized recommendations, fostering loyalty. Digital marketing, influencer endorsements, and targeted ads enhance consumer engagement while emphasizing product quality and sustainability credentials. Growth in quick commerce and delivery services makes premium bottled water more accessible for last-minute needs. Flexible delivery options, bundled offers, and transparent sourcing information online appeal to tech-savvy and health-conscious buyers seeking both ease of purchase and premium value.

Key Players & Competitive Analysis

The competitive landscape of the U.S. premium bottled water market is shaped by intense brand positioning, innovation, and differentiation strategies aimed at capturing a growing consumer base. Industry analysis highlights a strong focus on market expansion strategies, including the introduction of niche product lines and premium packaging innovations. Companies are engaging in joint ventures and strategic alliances to enhance distribution networks, expand product portfolios, and access new market segments.

Mergers and acquisitions play a vital role, with post-merger integration strategies ensuring operational efficiency and brand synergy. Technology advancements in bottling, sustainability, and smart packaging are driving competitive advantage, while data-driven marketing and consumer engagement initiatives enhance brand loyalty. The market’s growth trajectory is influenced by evolving consumer preferences for health-focused, sustainable, and high-quality products, compelling players to continuously adapt their product offerings and operational strategies to maintain relevance and competitiveness in the dynamic U.S. premium bottled water market.

Key Players

- Acqua Panna

- CORE Nutrition LLC

- Danone Waters of America (Evian)

- FIJI Water Company LLC

- Flow Hydration

- Icelandic Glacial, Inc.

- Perrier International

- Sanpellegrino S.p.A.

- The Coca‑Cola Company

- Voss USA, Inc.

U.S. Premium Bottled Water Industry Developments

October 2024: Evian strengthened its premium brand image in the U.S. through a multi-year partnership with the MICHELIN Guide.

U.S. Premium Bottled Water Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Spring Water

- Sparkling Water

- Mineral Water

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets & Hypermarkets

- Specialty Stores

- Online

- Others

U.S. Premium Bottled Water Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.81 billion |

|

Market Size in 2025 |

USD 6.26 billion |

|

Revenue Forecast by 2034 |

USD 12.31 billion |

|

CAGR |

7.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 5.81 billion in 2024 and is projected to grow to USD 12.31 billion by 2034.

The U.S. market is projected to register a CAGR of 7.8% during the forecast period.

A few of the key players in the market are Acqua Panna; CORE Nutrition LLC; Danone Waters of America (Evian); FIJI Water Company LLC; Flow Hydration; Icelandic Glacial, Inc.; Perrier International; Sanpellegrino S.p.A.; The Coca Cola Company; and Voss USA, Inc.

The mineral water segment accounted for the largest revenue share of ~41% in 2024 due to its strong positioning as a naturally sourced, nutrient-rich hydration option favored by health-conscious consumers.

The supermarkets & hypermarkets segment held the largest revenue share of ~38% in 2024 driven by their ability to offer diverse premium bottled water selections under one roof, catering to varied consumer tastes.