U.S. Procure To Pay Solution Market Size, Share, Trends & Industry Analysis Report

: By Component (Software and Services), By Deployment, By Enterprise Size, and By End Use – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5864

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

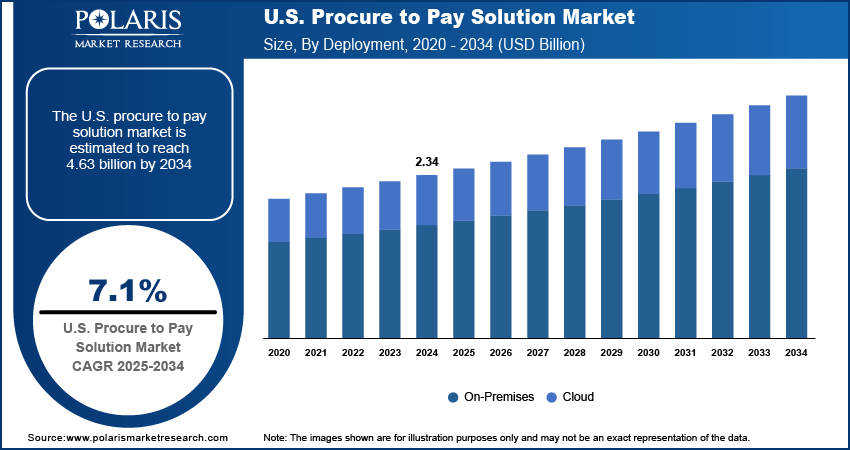

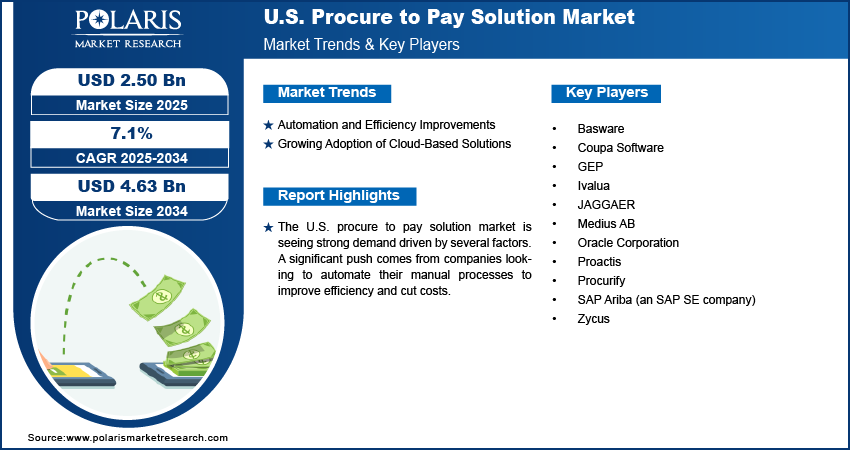

The U.S. procure to pay solution market size was valued at USD 2.34 billion in 2024, and is anticipated to grow at a CAGR of 7.1% from 2025 to 2034. The U.S. procure to pay (P2P) solution market is being driven by a few key factors. Companies are increasingly focused on automating their procurement and payment processes to boost efficiency and reduce costs.

The U.S. procure to pay (P2P) solution is an integrated system that manages the entire process of acquiring goods and services, from the initial request to the final payment to suppliers. This includes tasks like requisitioning, purchasing, receiving, invoicing, and accounts payable, all aimed at streamlining operations and increasing efficiency for businesses.

The growing need for organizations to ensure regulatory compliance and effectively manage risks is a significant driver for the U.S. procure to pay solution market. Businesses operate under increasingly complex regulatory environments, requiring strict adherence to various. laws and internal policies related to spending, financial reporting, and supplier relationships. P2P solutions offer critical functionalities like audit trails, automated compliance checks, and centralized data management, which help minimize the risk of fraud, ensure policy adherence, and streamline audit processes.

The continuous pursuit of enhanced spend visibility and aggressive cost optimization strategies is another crucial driver for the U.S. procure to pay solution market. In today's competitive landscape, businesses are keen to understand exactly where their money is going, identify opportunities for savings, and eliminate wasteful spending. P2P solutions provide comprehensive analytics and reporting tools that offer real-time insights into spending patterns, supplier performance, and contract compliance.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics

Automation and Efficiency Improvements

The increasing focus on automating procurement and payment processes is a major driver for the U.S. procure to pay (P2P) solution. Organizations are constantly looking for ways to streamline their operations, reduce manual errors, and cut down on operational costs. By implementing P2P solutions, businesses can automate tasks like purchase order creation, invoice processing, and payment approvals, leading to quicker cycle times and improved accuracy.

For example, a review published in the International Journal of Environmental Research and Public Health in 2022, titled "Digital Transformation of Public Health and Health Care: A Review of the Last 10 Years," highlighted how digital transformation, including automation, significantly enhances efficiency and reduces administrative burden across public health systems. This drive for efficiency is not limited to healthcare but is a pervasive trend across all industries, pushing the adoption of automated P2P solutions. Therefore, the continuous demand for operational efficiency and cost reduction through automation is significantly driving the growth of the U.S. procure to pay solution.

Growing Adoption of Cloud-Based Solutions

The shift towards cloud-based solutions is another significant driver in the U.S. market. Cloud solutions offer several advantages over traditional on-premise systems, including scalability, flexibility, reduced infrastructure costs, and enhanced accessibility. This makes them particularly appealing to businesses of all sizes, from small and medium-sized enterprises (SMEs) to large corporations.

According to a 2024 analysis from the U.S. General Services Administration (GSA) on "Cloud Adoption in Federal Agencies," there is a clear trend of federal agencies increasingly moving their IT infrastructure and applications to the cloud to improve agility, reduce costs, and enhance security. This movement reflects a broader trend across the US, where organizations recognize the benefits of cloud deployment for their critical business functions, including procure to pay. The growing preference for flexible, cost-effective, and easily accessible cloud-based platforms is a strong force propelling the growth of the U.S. procure to pay solution.

Segmental Insights

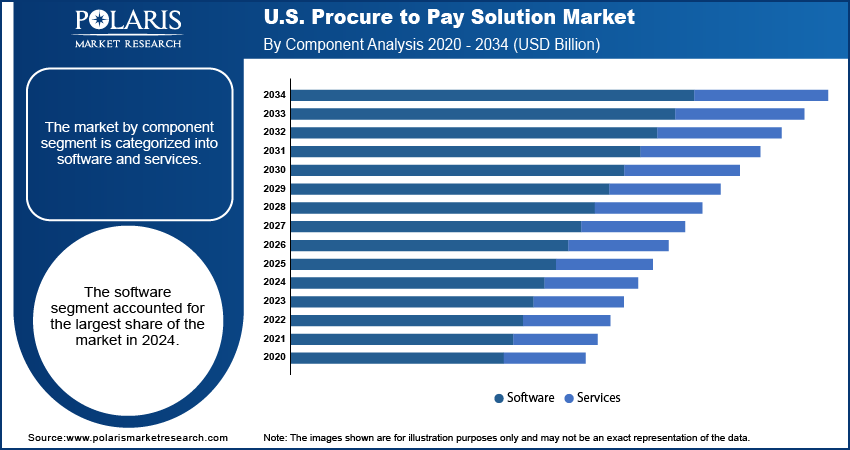

By Component

The software segment held the largest share in 2024. This dominance stems from the increasing demand for integrated platforms that can manage the entire procurement lifecycle, from initial requisition to final payment. Businesses are prioritizing comprehensive software suites that offer real-time data insights, customizable workflows, and smooth integration with existing enterprise resource planning (ERP) and financial systems. The drive for digital transformation and the need for greater control and visibility over spending are key factors pushing companies to invest in these robust software solutions.

The services segment is anticipated to grow at the highest growth rate during the forecast period. This growth is driven by the rising need for specialized support in implementing, integrating, and maintaining complex P2P software. As P2P solutions become more advanced, incorporating technologies like artificial intelligence and machine learning, organizations require expert guidance for successful deployment and ongoing optimization.

By Deployment

The cloud-based deployment segment held the largest share in 2024. This dominance is due to the compelling advantages cloud solutions offer, such as lower upfront costs, enhanced scalability, and greater accessibility compared to traditional on-premises systems. Businesses are increasingly adopting cloud P2P to manage their entire purchasing and payment cycle more efficiently, allowing teams to work remotely and integrate seamlessly with other cloud-based business applications. This shift reflects a broader industry trend towards flexible and agile IT infrastructures.

The cloud deployment segment is also anticipated to grow at the highest growth rate during the forecast period. This accelerated growth is fueled by the continuous push for digital transformation across various industries and the increasing recognition of cloud's long-term benefits. For instance, the U.S. General Services Administration (GSA) often highlights how cloud adoption in federal agencies leads to improved agility, reduced operational burdens, and enhanced data management capabilities, which are attractive to organizations seeking to modernize their procurement operations. The flexibility to scale resources up or down as needed, along with automatic updates and robust security features offered by cloud providers, makes it the preferred choice for future P2P investments.

By Enterprise Size

Large enterprises held the highest share in 2024. This dominance is due to their complex and extensive procurement operations, which involve numerous transactions, diverse supplier networks, e-commerce platforms, and significant spending. These larger organizations often have the substantial budgets and resources required to invest in comprehensive P2P software suites, which help them achieve greater efficiency, cost savings, and compliance across their vast supply chains. The need for advanced features like sophisticated analytics, global scalability, and deep integration with existing enterprise resource planning (ERP) systems further cements their leading position in the adoption of these solutions.

The small and medium enterprises (SMEs) segmentis also anticipated to grow at the highest growth rate during the forecast period. While historically slower adopters due to budget constraints and perceived complexity, SMEs are increasingly recognizing the significant benefits of P2P solutions in streamlining their operations and improving cash flow. The availability of more affordable, user-friendly, and cloud-based P2P options is making these solutions more accessible. For instance, government initiatives supporting digital transformation and technology adoption for smaller businesses, often highlighted by agencies like the Small Business Administration (SBA), are encouraging SMEs to invest in such tools to enhance competitiveness and operational efficiency.

By End Use

The manufacturing sector has traditionally held the largest share in 2024. This is primarily due to the complex and high-volume nature of procurement within manufacturing, involving raw materials, components, and machinery from numerous suppliers. Manufacturers seek P2P solutions to optimize their intricate supply chains, enhance inventory management, and ensure timely procurement to avoid production delays. The industry's consistent drive for operational efficiency and cost reduction, alongside the need to manage extensive supplier relationships, has made them early and significant adopters of comprehensive P2P systems.

The healthcare and IT & telecom sectors is also anticipated to grow at the highest growth rate during the forecast period. In healthcare, the push for digital transformation, as seen in initiatives promoting electronic health records and streamlined administrative processes by bodies like the National Institutes of Health (NIH), is driving the adoption of P2P solutions to manage vast and sensitive procurement needs, from medical supplies to specialized equipment. Similarly, the IT & telecom sector, with its rapid technological advancements and large-scale infrastructure investments, is increasingly leveraging P2P solutions to manage complex vendor contracts, high-volume IT purchases, and services efficiently, aiming for improved cost control and agility.

Key Players and Competitive Insights

The U.S. procure to pay (P2P) solution landscape is characterized by intense competition among various providers, all striving to offer comprehensive and innovative solutions. Companies are continually enhancing their platforms with advanced features like artificial intelligence and machine learning, focusing on user experience, seamless integration, and robust analytics to gain a competitive edge.

Prominent companies in the industry include Coupa Software, SAP Ariba, GEP, JAGGAER, Oracle Corporation, Basware, Zycus, Ivalua, Proactis, Medius. AB, and Procurify.

Key Players

- Basware

- Coupa Software

- GEP

- Ivalua

- JAGGAER

- Medius AB

- Oracle Corporation

- Proactis

- Procurify

- SAP Ariba

- Zycus

Industry Developments

March 2025: Vroozi was named a Value Leader in Spend Matters’ Spring SolutionMap for Procure-to-Pay (P2P) in the mid-market segment, earning distinctions in both E-Procurement and AP Automation.

February 2025: Stampli introduced its new procure-to-pay solution aimed at streamlining procurement by consolidating processes, documents, and communications into a unified workflow. The platform offers complete oversight from purchase requests through to payments and integrates seamlessly with existing ERP systems.

U.S. Procure To Pay Solution Market Segmentation

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Software

- Services

By Deployment Outlook (Revenue – USD Billion, 2020–2034)

- On-Premises

- Cloud

By Enterprise Size Outlook (Revenue – USD Billion, 2020–2034)

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- BFSI

- Retail

- Healthcare

- IT & Telecom

- Others

U.S. Procure To Pay Solution Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.34 billion |

|

Market Size in 2025 |

USD 2.50 billion |

|

Revenue Forecast by 2034 |

USD 4.63 billion |

|

CAGR |

7.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 2.34 billion in 2024 and is projected to grow to USD 4.63 billion by 2034.

The market is projected to register a CAGR of 7.1% during the forecast period.

Key players in the market include Coupa Software, SAP Ariba, GEP, JAGGAER, Oracle Corporation, Basware, Zycus, Ivalua, Proactis, Medius AB, and Procurify.

The software segment accounted for the largest share of the market in 2024.

The cloud segment is expected to witness the fastest growth during the forecast period.