U.S. Recycled Polyolefin Market Size, Share, Trends, Industry Analysis Report

By Product Type [Low-Density Polyethylene (LDPE), High-Density Polyethylene (HDPE)], By Source, By Application – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6096

- Base Year: 2024

- Historical Data: 2020-2023

Overview

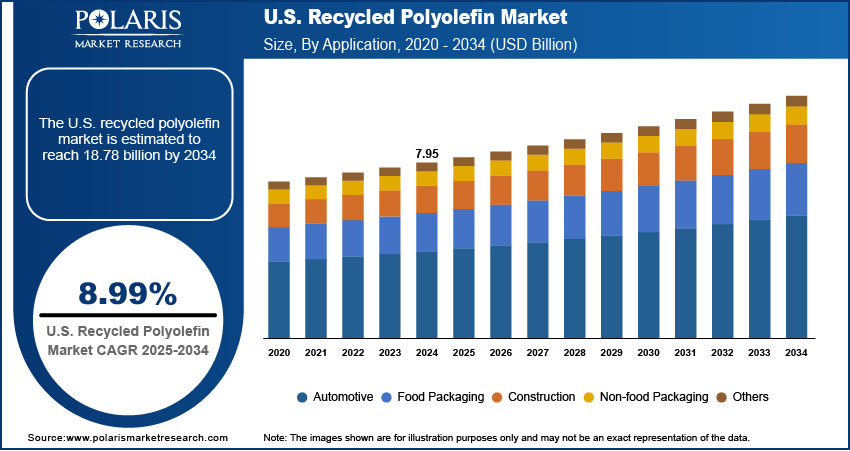

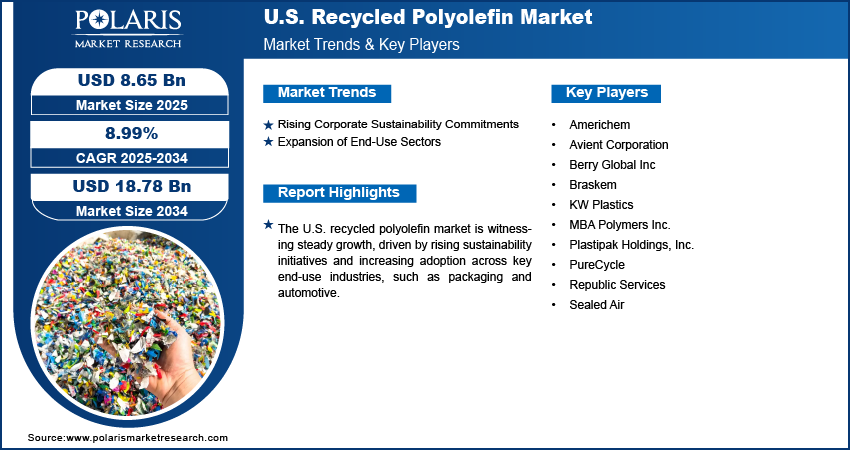

The U.S. recycled polyolefin market size was valued at USD 7.95 billion in 2024, growing at a CAGR of 8.99% from 2025 to 2034. The rising demand for recycled polyolefins is driven by multiple factors, such as increasing consumer preference for sustainable products, stronger corporate sustainability commitments, and the expansion of key end-use industries such as packaging, automotive, and construction. These trends are accelerating the shift toward circular material solutions.

Key Insights

- The low-density polyethylene (LDPE) segment accounted for 34.2% revenue share in 2024, primarily due to its extensive application in flexible packaging and film-based products.

- The plastic bottles segment dominated the revenue share in 2024, driven by their high availability and ease of recyclability.

- The automotive segment is expected to witness the fastest growth during the forecast period due to rising demand for lightweight, durable, and cost-efficient materials.

Industry Dynamics

- Growing corporate sustainability efforts are creating demand for recycled materials, as firms prioritize eco-friendly operations and supply chains, targeting goals such as waste reduction, lower emissions, and increased recycled content.

- Expanding industries such as automotive, packaging, construction, and consumer goods are fueling demand for recycled polyolefin due to the adoption of recycled materials in product designs.

- Rising demand for recycled plastics in the packaging and automotive sectors offers expansion opportunities for companies in advanced recycling technology.

- High recycling costs and regulations restrict competition with low cost virgin plastics, which restrains the U.S. recycled polyolefin market expansion.

Market Statistics

- 2024 Market Size: USD 7.95 billion

- 2034 Projected Market Size: USD 18.78 Billion

- CAGR (2025–2034): 8.99%

To Understand More About this Research: Request a Free Sample Report

Recycled polyolefin are thermoplastic polymers derived from post-consumer or post-industrial waste materials, such as polypropylene (PP) and polyethylene (PE), that are reprocessed for reuse in various applications. In the U.S., the market is witnessing robust growth, primarily driven by increasing consumer demand for sustainable and eco-conscious products. Recycled polyolefin have emerged as a viable alternative to virgin plastics as environmental awareness rises across industries and households. This trend is further supported by brand owners and manufacturers aligning their strategies with circular economy goals, reducing their environmental footprint while maintaining material functionality and quality.

The establishment of stable and cost-competitive supply chains for these polyolefins in the U.S. is facilitated by advancements in recycling infrastructure and increased collaboration among stakeholders, ranging from material recovery facilities to end-product manufacturers. This collaboration has led to improved consistency in material availability and pricing. In March 2025, Axens and SOREMA collaborated to deliver integrated plastic waste recycling solutions, combining Axens’ chemical recycling tech (TAC, Rewind) with SOREMA’s mechanical sorting expertise. Their modular systems optimize yield, enabling the production of food-grade recycled polyolefin and PET. This reliability enables manufacturers to integrate recycled polyolefin into their production processes without compromising on efficiency or cost. Additionally, the scalability and economic feasibility of recycled polyolefin position them as a strategic material choice in packaging, automotive, and construction sectors, reinforcing long-term adoption across end-use industries.

Drivers and Opportunities

Rising Corporate Sustainability Commitments: Companies across various sectors are increasingly prioritizing environmental responsibility within their operational and supply chain strategies. Many businesses are setting ambitious sustainability goals, such as reducing plastic waste, lowering carbon emissions, and incorporating higher percentages of recycled content in their products. According to a 2023 climate change report by Ford Motor Company, the automaker has transitioned to using 100% nylon and polypropylene in the battery trays of its electric vehicles, such as the F-150 Lightning and Mustang Mach-E. This shift is prompting manufacturers to adopt recycled polyolefins as a core material due to their reduced environmental impact compared to virgin resins. The alignment of sustainability targets with material innovation is enhancing brand value and also meeting growing regulatory and consumer expectations. Thus, rising corporate sustainability commitments drive growth opportunities.

Expansion of End-Use Sectors: The expansion of end-use sectors such as automotive, packaging, construction, and consumer goods further reinforces the growth opportunities. According to a 2024 IEA report, U.S. electric vehicle registrations reached 1.4 million in 2023, marking a year-over-year growth of over 40% compared to 2022. This surge highlights the accelerating adoption of recycled materials in EVs across the country. Recycled polyolefins offer an attractive solution due to their durability, cost-effectiveness, and adaptability as these industries seek more sustainable material alternatives without compromising on performance. The increasing integration of recycled materials into mainstream product designs across diverse applications is broadening the addressable market for recycled polyolefin. This ongoing diversification of end-use industries ensures sustained demand and opens new growth avenues, solidifying the material’s strategic relevance in the evolving industrial ecosystem.

Segmental Insights

Product Type Analysis

Based on product type, the U.S. recycled polyolefin market segmentation includes low-density polyethylene (LDPE), high-density polyethylene (HDPE), polyethylene terephthalate (PET), polypropylene, and other product types. The low-density polyethylene (LDPE) segment accounted for 34.2% revenue share in 2024, primarily due to its extensive application in flexible packaging and film-based products. LDPE is favored for its lightweight structure, excellent chemical resistance, and high flexibility, making it suitable for sectors such as food packaging, agricultural films, and everyday consumer goods. Its compatibility with established recycling technologies and ease of reprocessing further strengthen its market position. Additionally, the increasing emphasis on minimizing plastic waste and promoting circular solutions for flexible plastics in the U.S. is driving demand for recycled LDPE across multiple industries.

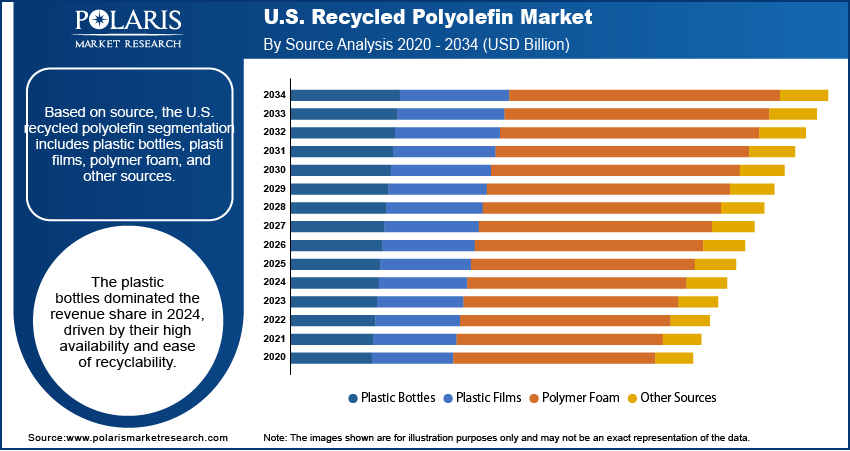

Source Analysis

In terms of source, the U.S. recycled polyolefin market segmentation includes plastic bottles, plastic films, polymer foam, and other sources. The plastic bottles segment dominated the revenue share in 2024, driven by their high availability and ease of recyclability. In the U.S., plastic bottles account for a significant portion of post-consumer plastic waste, particularly in urban areas, due to their widespread use and robust collection infrastructure. Their uniform material quality and high recovery rates make them a reliable and cost-effective raw material for polyolefin recyclers. Furthermore, advancements in bottle sorting and washing processes have enhanced the efficiency of recycling operations, making plastic bottles a preferred feedstock in the U.S. for recycled polyolefin production.

Application Analysis

The U.S. recycled polyolefin market segmentation, based on application, includes, food packaging, construction, automotive, non-food packaging, and other applications. The automotive segment is expected to witness the fastest growth during the forecast period due to rising demand for lightweight, durable, and cost-efficient materials. Recycled polyolefins are increasingly used in automotive interiors, engine components, and external trim parts, aligning with the industry's focus on reducing vehicle weight and meeting fuel efficiency and emissions standards. Therefore, as the U.S. automakers boost their efforts toward sustainability, the adoption of recycled materials supports both regulatory compliance and broader environmental commitments, thereby reinforcing the growing role of these polyolefins in the automotive sector.

Key Players and Competitive Analysis

The U.S. recycled polyolefin market is shaped by competitive intelligence and strategy, with key players leveraging strategic investments to capitalize on revenue opportunities. Industry trends, such as sustainable value chains and economic and geopolitical shifts, are driving demand, while technological advancements enhance processing efficiency. Small and medium-sized businesses are gaining traction by addressing latent demand and opportunities in niche segments. Disruptions and trends in supply chains, such as material shortages, are prompting companies to adopt future development strategies to ensure resilience. Revenue growth analysis highlights the potential in emerging market segments, particularly in packaging and automotive applications. Leading vendors focus on competitive positioning through expansion and pricing insights to capture expansion opportunities.

Expert's insight suggests that growth projections will remain strong, supported by regulatory push and consumer preference for circular economies. Business transformation initiatives, including partnerships and R&D, are critical to maintaining an industry-leading competitive intelligence edge in this evolving landscape.

A few major companies operating in the industry include Americhem; Avient Corporation; Berry Global Inc; Braskem; MBA Polymers Inc.; KW Plastics; Plastipak Holdings, Inc.; PureCycle; Republic Services; and Sealed Air.

Key Players

- Americhem

- Avient Corporation

- Berry Global Inc

- Braskem

- KW Plastics

- MBA Polymers Inc.

- Plastipak Holdings, Inc.

- PureCycle

- Republic Services

- Sealed Air

Recycled Polyolefin Industry Developments

- May 2025: Borealis and Borouge showcased their joint polyethylene and polypropylene pipe solutions portfolio, featuring over 15 pipe and fitting samples. The display highlighted durable infrastructure solutions for sewage, drinking water, gas, and industrial applications, leveraging Borstar technology for performance and sustainability.

- September 2024: Dow launched REVOLOOP Recycled Plastics Resins, integrating PCR material into cable jacketing to balance performance and sustainability. This supports circularity goals, diverting waste while aiding customers in meeting eco-targets. Dow aims to commercialize 3 million metric tons of circular solutions by 2030.

U.S. Recycled Polyolefin Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Low-Density Polyethylene (LDPE)

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene

- Other Product Types

By Source Outlook (Revenue, USD Billion, 2020–2034)

- Plastic Bottles

- Plastic Films

- Polymer Foam

- Other Sources

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Food Packaging

- Construction

- Automotive

- Non-food Packaging

- Other Applications

U.S. Recycled Polyolefin Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.95 Billion |

|

Market Size in 2025 |

USD 8.65 Billion |

|

Revenue Forecast by 2034 |

USD 18.78 Billion |

|

CAGR |

8.99% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The U.S. market size was valued at USD 7.95 billion in 2024 and is projected to grow to USD 18.78 billion by 2034.

The U.S. market is projected to register a CAGR of 8.99% during the forecast period.

A few of the key players in the market are Americhem; Avient Corporation; Berry Global Inc; Braskem; MBA Polymers Inc.; KW Plastics; Plastipak Holdings, Inc.; PureCycle; Republic Services; and Sealed Air.

The plastic bottles dominated the revenue share in 2024.

The automotive segment is expected to grow fastest during the forecast period.