U.S. Vapor Recovery Units Market Size, Share, Trends, Industry Analysis Report

By Technology (Absorption, Condensation, Membrane Separation, Adsorption, Others), By Application, By End User – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM6322

- Base Year: 2024

- Historical Data: 2020-2023

Overview

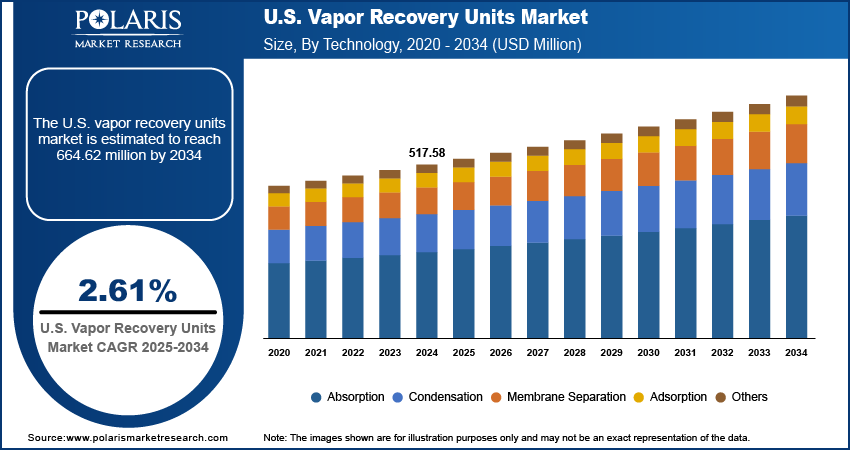

The U.S. vapor recovery units (VRUs) market size was valued at USD 517.58 million in 2024, growing at a CAGR of 2.61% from 2025 to 2034. The U.S. vapor recovery units (VRU) industry is being driven by the growing emphasis on emission control, sustainability, and operational efficiency. In oil and gas operations, VRUs are widely used at wellheads, storage tanks, and terminals to recover valuable hydrocarbons while minimizing losses and ensuring compliance with air quality standards.

Key Insights

- The absorption segment accounted for USD 178.53 million in revenue in 2024 due to increasing adoption of VOC emission control solutions in oil & gas, petrochemical, and fuel storage facilities, along with stringent environmental regulations.

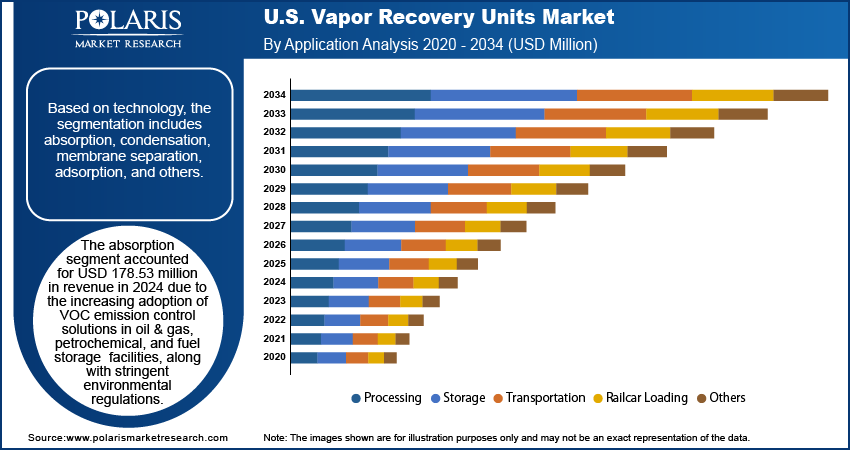

- The transportation segment is projected to register a CAGR of 3.17% during 2025–2034, due to increasing fuel distribution activities, expansion of oil & gas logistics networks, and the growing need to control vapor emissions during storage and transportation operations.

- The oil & gas segment accounted for USD 338.31 million in revenue in 2024. The growth of the segment is attributed to increasing exploration and production activities, strict emission regulations, and the rising need to capture and recover vapors from storage tanks such as hydrogen storage tanks and transportation operations.

Industry Dynamics

- The imposition of stringent environmental regulations is a key driver expanding the U.S. vapor recovery units landscape. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and Environment and Climate Change Canada (ECCC) have implemented rigorous standards to limit the emissions of volatile organic compounds (VOCs) and greenhouse gases. The tightening of emission thresholds is a primary force driving the increased adoption of VRUs in the U.S.

- Growth in renewable energy and low-carbon fuels infrastructure is significantly contributing to the expansion of the vapor recovery units industry.

- The technical limitations in harsh environments are major challenges in the U.S. vapor recovery units market.

- Incentive programs, grants, and carbon trading schemes across the U.S. offer financial motivation for industries to adopt emission-reduction technologies such as VRUs. This policy support can significantly improve return on investment, thus creating opportunities for the U.S. vapor recovery units companies.

Market Statistics

- 2024 Market Size: USD 517.58 million

- 2034 Projected Market Size: USD 664.62 million

- CAGR (2025–2034): 2.61%

AI Impact on U.S. Vapor Recovery Units Market

- AI-driven predictive analytics ensure timely servicing, which helps minimize disruptions and extend equipment life. It also identifies potential failures before they occur. It reduces downtime and maintenance costs.

- AI helps maximize fuel resale value and reduce waste by improving the accuracy of vapor recovery.

- AI-based tools ensure consistent compliance with EPA regulations as they are used to automate reporting and flag anomalies.

The U.S. vapor recovery units market is experiencing strong growth, driven by significant technological advancements that are reshaping how industries capture and manage volatile organic compounds (VOCs). Next-generation VRUs now feature automation, remote monitoring, and compact modular designs, which have made them far more efficient and practical than older systems. Automation allows VRUs to operate with minimal human intervention, ensuring that vapor emissions are consistently captured even in challenging operational environments. Remote monitoring further enhances reliability by enabling operators to track system performance in real-time, identify issues before they become costly problems, and optimize maintenance schedules. This is particularly valuable for facilities located in remote oil fields, chemical plants, or fuel storage terminals, where on-site staff may be limited. Compact, modular VRUs are also easier to install and integrate into existing infrastructure, reducing downtime and project costs for operators.

Technological improvements increase operational efficiency and reduce maintenance requirements, which directly lowers the total cost of ownership. Industries ranging from oil and gas to petrochemicals and fuel distribution are more willing to adopt VRUs as they see tangible benefits in both regulatory compliance and operational savings. In high-risk environments, where any release of vapors could pose safety and environmental hazards, the ability to continuously monitor and control emissions remotely makes these systems highly attractive. As U.S. regulations continue to emphasize environmental protection, these advancements are removing traditional barriers to adoption and accelerating the expansion of the VRU industry. By offering a combination of efficiency, safety, and cost-effectiveness, next-generation VRUs are becoming a key driver across multiple industrial sectors.

Drivers & Opportunities

Stringent Environmental Regulations: Stringent environmental regulations are a major driver behind the growth of the U.S. vapor recovery unit domain. Regulatory authorities, particularly the U.S. Environmental Protection Agency (EPA), have established strict standards to control the release of volatile organic compounds (VOCs) and greenhouse gases from industrial operations. These emissions contribute to air pollution, smog formation, and climate change, prompting regulators to enforce tighter emission thresholds. Facilities involved in oil and gas production, fuel storage, and petrochemical processing are under increasing pressure to comply with these regulations to avoid penalties and maintain operational permits. For example, the EPA’s New Source Performance Standards (NSPS) and regulations under the Clean Air Act require operators to implement emission control technologies such as VRUs to capture and recover vapors that would otherwise escape into the atmosphere. The rising focus on environmental sustainability and community health has pushed industries to adopt VRUs as a cost-effective way to meet these stringent standards. Compliance reduces environmental impact and allows companies to recover and reuse captured vapors, turning regulatory pressure into operational efficiency. As emission thresholds continue to tighten, the adoption of VRUs is expected to accelerate.

Expansion of Renewable and Low-Carbon Fuel Infrastructure: The rapid development of renewable and low-carbon fuel infrastructure is creating new opportunities for the vapor recovery units (VRU) industry in the U.S. As the nation transitions toward cleaner energy sources such as biofuels, renewable diesel, and hydrogen, new storage, distribution, and refueling facilities are being established across the country. These facilities, much like traditional oil and gas operations, handle volatile substances that can emit vapors harmful to the environment if not properly managed. VRUs play a critical role in capturing these vapors, ensuring that renewable fuel operations remain environmentally compliant and efficient. For example, biofuel blending terminals and renewable diesel storage sites require vapor recovery solutions to prevent the release of volatile organic compounds (VOCs) during storage and transfer processes. Additionally, the shift toward low-carbon fuels is often driven by state and federal policies, such as California’s Low Carbon Fuel Standard, which indirectly promotes the installation of VRUs to maintain strict emission controls. By enabling the capture and reuse of vapors, VRUs support both regulatory compliance and sustainability objectives in the growing renewable energy landscape.

Segmental Insights

Technology Analysis

Based on technology, the U.S. vapor recovery units market segmentation includes absorption, condensation, membrane separation, adsorption, and others. Absorption technology in vapor recovery units operates on the principle of capturing hydrocarbon vapors by dissolving them into a liquid absorbent, typically an oil or solvent. This method is widely used in upstream and midstream oil and gas operations across the U.S due to its ability to handle large volumes of vapor efficiently. The process is highly effective in recovering a broad range of hydrocarbons, making it particularly suitable for applications involving mixed gas streams. Absorption systems are also valued for their relatively simple operation and scalability, which make them a viable solution for both small and large facilities.

The membrane separation segment is projected to grow at a substantial pace in the coming years as this technology utilizes semi-permeable membranes to selectively separate hydrocarbon vapors from air or inert gases. This method has gained significant traction in the VRU due to its high efficiency, compact design, and minimal maintenance requirements. The process is ideal for applications requiring high-purity vapor recovery, such as petrochemical facilities and natural gas processing plants. Membrane systems are often modular, allowing for easy scalability and integration into existing industrial infrastructure.

Application Analysis

In terms of application, the U.S. vapor recovery units market segmentation includes processing, storage, transportation, railcar loading, and others. The storage segment held 31.39% share of the market in 2024, as these storage tanks are subject to strict air quality and emission control regulations, prompting operators to integrate VRUs as a standard practice. Facilities dealing with gasoline, crude oil, ethanol, or petrochemicals are especially reliant on vapor recovery systems to remain in compliance. The growing adoption of floating roof tanks and vapor balancing systems, combined with digital emission monitoring tools, is enhancing the effectiveness of VRUs in the storage segment. As sustainability goals and public scrutiny intensify, the importance of vapor control in storage operations will continue to grow demand.

The transportation segment is projected to register a CAGR of 3.17% during the forecast period. Transportation companies are realizing the economic advantages of recovering and reusing vaporized fuel or chemicals, which enhances profit margins and aligns with ESG objectives. With the growing movement of oil and chemical products between inland and coastal facilities in the U.S., VRUs are becoming an integral part of transportation infrastructure to ensure safe, efficient, and environmentally compliant operations.

End User Analysis

The U.S. vapor recovery units market segmentation, based on end user, includes into oil & gas, chemicals & petrochemicals, landfills, and others. The oil & gas segment accounted for USD 338.31 million revenue share in 2024, driven by extensive upstream, midstream, and downstream operations. VRUs are commonly installed at well sites, gas processing plants, storage tanks, and refineries to capture fugitive emissions and reduce product loss. These systems help control volatile organic compounds (VOCs), methane, and other hydrocarbons, enabling compliance with environmental regulations such as the U.S. Clean Air Act and Canada’s Greenhouse Gas Reporting Program. Given the high volume of hydrocarbon handling in this industry, the implementation of VRUs supports regulatory compliance and improves profitability by reclaiming valuable product.

The landfills segment is projected to capture a 10.35% share of the market by 2034, due to its growing application area for vapor recovery units, particularly in capturing and treating landfill gas emissions that contain methane, VOCs, and other harmful vapors. In the U.S, municipal and private landfill operators are increasingly deploying VRUs to mitigate environmental risks and comply with regulations targeting greenhouse gas reduction. These units are typically used to recover vapors during the collection and flaring of landfill gas, improving both safety and energy efficiency.

Key Players & Competitive Analysis

The U.S. vapor recovery units sector is witnessing intensifying competition, fueled by the rapid growth of the oil & gas, petrochemical, and renewable energy sectors. Key players in the industry are adopting diverse strategies to strengthen their presence, including strategic partnerships, investment in advanced VRU technologies, and geographic expansion to cater to high-demand regions. Emphasis is being placed on the development of next-generation VRUs with automation, remote monitoring, and modular designs to meet evolving regulatory and operational requirements. Companies are increasingly focusing on enhancing system efficiency, reducing maintenance costs, and offering customized solutions for sectors such as fuel storage terminals, refineries, petrochemical plants, and renewable fuel infrastructure. This industry is also witnessing the entry of tech-driven firms that bring innovative emission monitoring and digital control solutions, intensifying competition for established players.

A few key players such as Aereon, Inc.; Cimarron Energy, Inc.; Cool Sorption A/S; Dover Corporation; Flogistix, LP; John Zink Hamworthy Combustion; PSG Dover / Blackmer; S&S Technical, Inc.; Symex Technologies LLC; and Zeeco, Inc dominate the market through their extensive fleets and nationwide service networks.

Key Players

- Aereon, Inc.

- Cimarron Energy, Inc.

- Cool Sorption A/S

- Dover Corporation

- Flogistix, LP

- John Zink Hamworthy Combustion

- PSG Dover / Blackmer

- S&S Technical, Inc.

- Symex Technologies LLC

- Zeeco, Inc.

U.S. Vapor Recovery Units Industry Developments

- May 2023: Cimarron, Inc., a leading provider of BTEX environmental solutions for the oil and gas production and transportation sectors, announced a strategic alliance to deliver an integrated BTEX and emissions control solution. This collaboration combines the strengths and expertise of both organizations to offer cost-effective, reliable, and innovative systems that recover methane and return it to the value stream.

- June 2024: SCS Technologies unveiled a new line of pre-engineered vapor recovery units (VRUs). These configurable systems are designed to meet specific customer needs while offering cost-efficient pricing.

U.S. Vapor Recovery Units Market Segmentation

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Absorption

- Condensation

- Membrane Separation

- Adsorption

- Others

By Application Capacity Outlook (Revenue, USD Million, 2020–2034)

- Processing

- Storage

- Transportation

- Railcar Loading

- Others

By End User Outlook (Revenue, USD Million, 2020–2034)

- Oil & Gas

- Upstream (Wellhead, Tank Batteries)

- Midstream

- Downstream

- Chemicals & Petrochemicals

- Landfills

- Others

U.S. Vapor Recovery Units Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 517.58 Million |

|

Market Size in 2025 |

USD 527.14 Million |

|

Revenue Forecast by 2034 |

USD 664.62 Million |

|

CAGR |

2.61% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 517.58 million in 2024 and is projected to grow to USD 664.62 million by 2034.

The market is projected to register a CAGR of 2.61% during the forecast period.

A few of the key players in the market are Aereon, Inc.; Cimarron Energy, Inc.; Cool Sorption A/S; Dover Corporation; Flogistix, LP; John Zink Hamworthy Combustion; PSG Dover / Blackmer; S&S Technical, Inc.; Symex Technologies LLC; and Zeeco, Inc.

The absorption segment accounted for USD 178.53 million revenue share in 2024.

The transportation segment is projected to register a CAGR of 3.17% during the forecast period.