Hydrogen Storage Tanks and Transportation Market Size, Share, & Industry Analysis Report

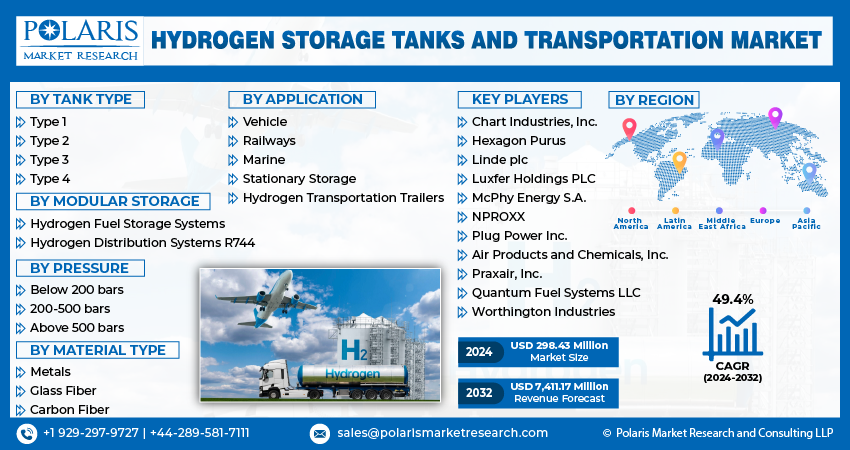

By Modular Storage (Stationary Hydrogen Storage Systems and Mobile Hydrogen Distribution Systems), Tank Type, Pressure, Application, Transportation & Distribution, Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM4912

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

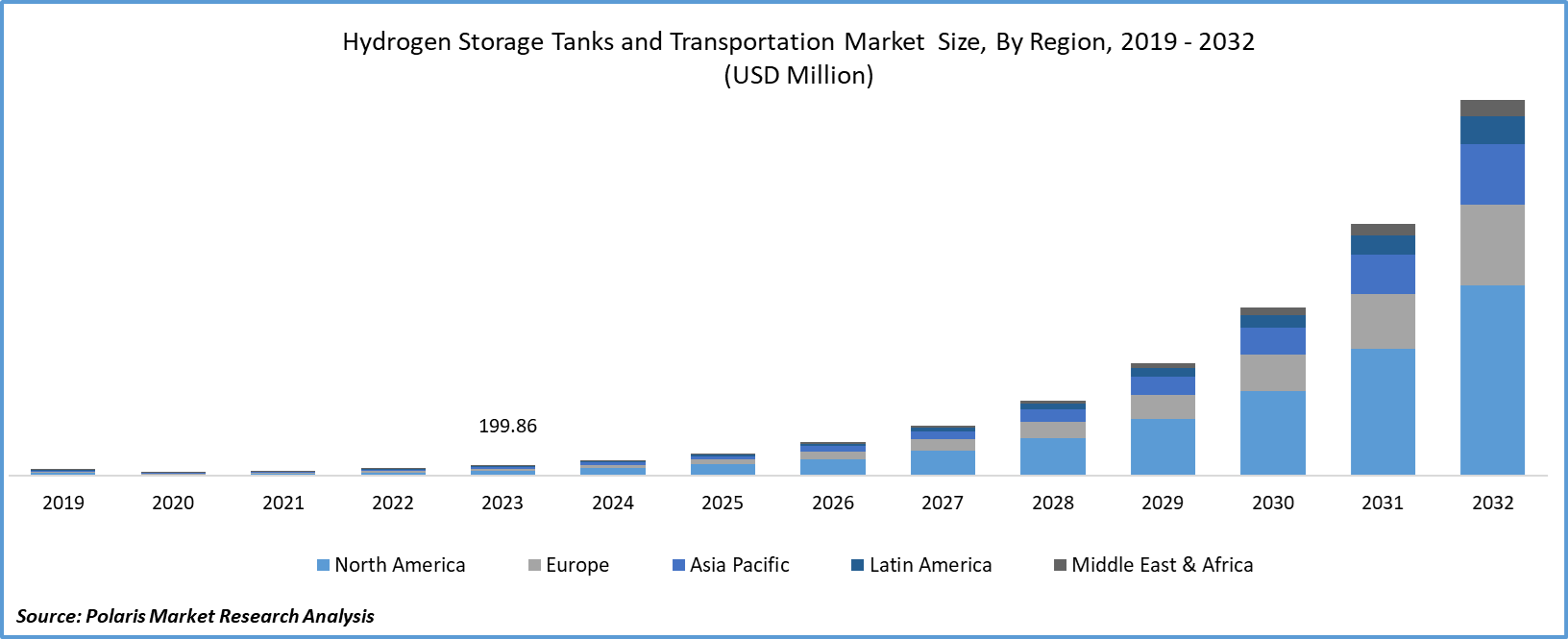

The global hydrogen storage tanks and transportation market was valued at USD 410.18 million in 2024 and is expected to register a CAGR of 40.7% during 2025–2034. The growth of clean energy applications such as fuel cell vehicles, grid-scale energy storage, and low-carbon industrial operations is driving the market, as effective hydrogen logistics are essential for supporting these clean energy applications. The development of robust, cost-effective, and safe storage and transportation infrastructure is key to scaling up the hydrogen economy and reducing global dependence on fossil fuels.

Hydrogen storage and transportation involve specialized systems designed to handle hydrogen in compressed natural gaseous or liquefied form. Gaseous hydrogen is stored in high-pressure tanks (up to 700 bar), often made from carbon fiber composites or steel alloys, ensuring safety and efficiency. Liquid hydrogen requires cryogenic tanks cooled below -253°C to maintain its state. These storage solutions are integrated into transport systems such as pipelines, tube trailers, railcars, and ships, enabling safe delivery from production facilities to end users or refueling stations. Hydrogen plays a crucial role in industrial decarbonization across sectors such as steel, chemicals, and refining. Industries are increasingly using hydrogen as a clean energy source and chemical feedstock to replace fossil fuels. In steelmaking, hydrogen replaces carbon-intensive coke in direct reduction processes, encouraging companies involved in steelmaking to adopt hydrogen. For instance, Hitachi Energy supports green hydrogen projects worldwide, including H2 Green Steel’s DRI plant in Sweden. The company's advanced digital tools help manage power efficiently, allowing steel production with hydrogen from renewable energy instead of coking coal. Chemical and refining industries also use hydrogen for low-emission production as it helps reduce emissions by up to 95%.

To Understand More About this Research: Request a Free Sample Report

Rising investments in green hydrogen production globally are accelerating overall growth. In January 2025, the New York State Energy Research and Development Authority allocated over USD 1.2 million to four R&D projects focused on advancing clean hydrogen electrolyzer technologies. These initiatives aim to develop novel system designs that improve efficiency, reduce material dependency, lower costs, and enhance scalability. The research further supports decarbonization of energy-intensive sectors by enabling fossil-free hydrogen production for industrial and transport applications, creating the need for hydrogen storage tanks and transportation.

Market Dynamics

Expansion of Fuel Cell Electric Vehicles (FCEVs) in Commercial Transport

The rapid expansion of fuel cell electric vehicles (FCEVs), especially in commercial transport, significantly boosts demand for hydrogen storage and transportation systems. According to the International Energy Agency (IEA), global FCEV sales reached over 18,000 units in 2023, with heavy-duty vehicles accounting for more than 60% of that total. China leads deployment, with over 14,000 FCEVs on roads, primarily in logistics and public transit. Commercial fleets ranging from heavy-duty trucks to buses and logistics vans require high-capacity hydrogen refueling infrastructure, driving deployment of mobile and stationary storage tanks. Unlike passenger vehicles, commercial FCEVs operate on fixed routes with centralized depots, necessitating scalable hydrogen supply chains and high-throughput refueling stations. This shift increases reliance on tube trailers, liquid hydrogen tankers, and pipeline-fed storage units to ensure continuous fuel availability. Major automotive manufacturers and fleet operators are forming strategic alliances with hydrogen suppliers to secure stable delivery schedules, reinforcing the need for robust transportation infrastructure. In February 2024, Plug Power Inc., engaged in hydrogen solutions for the green hydrogen economy, secured a contract to deliver advanced hydrogen infrastructure and fuel cell technology to the US automotive manufacturer. This partnership aims to enhance material handling operations through the integration of innovative hydrogen-based systems, promoting efficiency and sustainability in their supply chain processes.

Government Support and Hydrogen Strategies Promoting Infrastructure Development

Governments across key global markets are accelerating hydrogen infrastructure development through comprehensive policy frameworks and targeted investment strategies. For instance, in October 2024, the US Department of Energy (DOE) issued a notice of funding opportunity (NOFO) for up to USD 46 million to advance research, development, and demonstration (RD&D) of cost-effective clean hydrogen and fuel cell technologies. The European Union’s Hydrogen Strategy lays out a phased approach, focusing initially on installing at least 6 GW of renewable hydrogen electrolyzers and expanding to 40 GW by 2030. This strategic initiative drives demand for hydrogen storage tanks and transportation systems by funding large-scale electrolyzer projects, hydrogen valleys, and cross-border hydrogen corridors. In the US, the Department of Energy’s Hydrogen Shot initiative and the rollout of Hydrogen Hubs under the Infrastructure Investment and Jobs Act stimulate nationwide deployment of hydrogen technologies. These hubs focus on creating regional hydrogen economies where production, storage, transportation, and end use are tightly integrated. This structured funding model pushes market participants to scale hydrogen delivery systems rapidly, particularly through the deployment of high-pressure tanks and cryogenic trailers. Governments also incentivize private-sector investments by offering tax credits, R&D grants, and public-private partnerships. For instance, according to the US Department of Energy, the Inflation Reduction Act of 2022 (IRA) introduces a range of clean energy tax incentives to boost domestic renewable energy production. Thus, government support and hydrogen strategies promoting infrastructure development boost the market expansion.

Segment Insights

Market Assessment by Tank Type

Based on tank type, the segmentation includes type 1, type 2, type 3, type 4, type 5, and liquid hydrogen tanks. In 2024, the type 3 segment accounted for 25.9% of the share. Type 3 hydrogen storage tanks are advanced high-pressure tanks designed with a full composite overwrap of carbon fiber or a hybrid of carbon and glass fiber, reinforced around a metal liner, usually made of aluminum. This combination results in a significantly lighter tank than type 1 and type 2 tanks, while maintaining a solid structure capable of withstanding high pressures. The aluminum liner ensures impermeability to hydrogen and acts as a gas barrier, while the composite material provides the necessary structural strength to contain the high-pressure gas. Type 3 tanks are known for their excellent performance-to-weight ratio, making them highly suitable for mobile applications where weight reduction directly influences energy efficiency, vehicle range, and payload capacity. These tanks are commonly used in fuel cell electric vehicles (FCEVs), including passenger cars, buses, trucks, and trains. They are also increasingly deployed in aerospace and drone applications, where lightweight design is critical. In addition to transportation, type 3 tanks are utilized in mobile hydrogen refueling stations, portable power systems, and emergency backup systems that require both high pressure and mobility. The lightweight and corrosion-resistant features of type 3 tanks make them favorable in maritime hydrogen projects and off-grid renewable energy storage systems, where space, weight, and durability are key considerations.

The type 2 segment is projected to register a CAGR of 41.1% during the forecast period. Type 2 hydrogen storage tanks represent a hybrid design that combines a metal liner, usually steel or aluminum, with composite reinforcement made from materials such as glass fiber or carbon fiber. These tanks are designed to offer a balance between strength and weight, providing improved performance compared to type 1 tanks while maintaining cost-effectiveness and safety. The metal liner serves as the primary gas containment vessel, while the external composite wrap enhances the tank’s pressure-bearing capabilities, allowing it to store hydrogen at pressures typically ranging from 250 to 300 bar (3,600 to 4,350 psi), and in some cases, even higher. The key benefit of this design is a reduction in overall weight, around 30% to 40% lighter than Type 1 tanks, while offering structural integrity.

Market Assessment by Modular Storage

Based on modular storage, the segmentation includes stationary hydrogen storage systems and mobile hydrogen distribution systems. In 2024, the stationary hydrogen storage systems segment accounted for 52.25% share, due to their widespread adoption across several sectors. Stationary hydrogen storage systems are fixed infrastructure solutions designed to store hydrogen in either gaseous, liquid, or solid form for long or short durations at a specific site. Unlike mobile storage, which is used in transportation, stationary systems are permanently installed and integrated into industrial facilities, refueling stations, power generation plants, or energy storage hubs. In industrial applications, hydrogen is stored for use in refining, chemical production, and metal processing. In the energy sector, stationary hydrogen storage supports power-to-gas systems, where renewable electricity is converted to hydrogen via electrolysis and stored for later reconversion into electricity or injected into the natural gas grid. At hydrogen refueling stations, stationary storage ensures a ready supply for fuel cell vehicles by buffering hydrogen between deliveries or on-site production. Additionally, stationary systems are being deployed in microgrids and remote energy systems to provide backup power or extend the reach of renewables.

The mobile hydrogen distribution systems segment is expected to register a CAGR of 40.2% during the forecast period. The growing demand for mobile hydrogen distribution systems is driven by the global push toward decarbonization and the use of hydrogen as a clean energy carrier for sectors such as transportation, industry, and power generation. The rise of heavy-duty and long-range hydrogen-powered transport, such as freight trucks, trains, and even ships, requires dependable refueling logistics, and mobile systems enable hydrogen supply to be routed dynamically based on demand and route planning. The growth of industrial hydrogen use, for applications such as steelmaking, refining, ammonia production, and food processing, also necessitates the use of mobile hydrogen distribution systems, particularly in regions where uses are not located near hydrogen generation plants. The flexibility, scalability, and lower initial investment of mobile hydrogen distribution systems also make them an attractive option in the early and transitional phases of hydrogen development.

Market Evaluation by Application

Based on application, the segmentation includes automotive, railways, marine, aerospace, industrial, stationary, portable, and others. In 2024, the automotive segment holds over 52.25% of the share. Hydrogen storage tanks and transportation systems play a crucial role in the automotive sector’s transition toward cleaner and sustainable mobility. In fuel cell electric vehicles (FCEVs), hydrogen serves as the primary energy carrier, stored onboard in high-pressure tanks to fuel proton exchange membrane (PEM) fuel cells that generate electricity to power electric motors. These tanks are typically type 3 or type 4 composite cylinders that safely contain hydrogen under extremely high pressures while minimizing weight and maximizing fuel capacity. Hydrogen tanks are used in passenger vehicles and in commercial fleets such as delivery vans, transit buses, long-haul trucks, and even trains. Governments worldwide have set ambitious targets for achieving net-zero emissions. The transportation sector, responsible for a significant portion of global CO₂ emissions, is under intense pressure to decarbonize. Hydrogen offers a compelling solution to this by reducing a high portion of global CO₂ emissions, leading to high demand for hydrogen storage tanks for the transportation sector.

The aerospace segment is projected to register a CAGR of 42.8% from 2025 to 2034. Hydrogen emerges as a crucial fuel for decarbonizing aviation and enabling next-generation, high-efficiency propulsion technologies. In aerospace applications, hydrogen can be used in two primary ways: as a fuel for hydrogen fuel cells that generate electricity to power electric propulsion systems, or as a direct combustion fuel in modified gas turbines and potentially in advanced propulsion concepts such as hydrogen-powered air-breathing engines or rocket propulsion. Hydrogen’s high energy-to-weight ratio makes it particularly attractive for aerospace, where minimizing mass is critical. Advances in cryogenic tank design, composite materials, insulation systems, and thermal management are enabling more efficient and compact storage of liquid hydrogen. Aerospace manufacturers, including Airbus, Boeing, and a range of startups, are actively developing hydrogen-powered aircraft concepts with innovative tank geometries and storage methods to overcome traditional limitations.

Market Evaluation by Transportation & Distribution

Based on transportation & distribution, the segmentation includes tube trailers, cryogenic tankers, pipelines, and others. In 2024, the tube trailers segment holds over 50.0% of the share. Tube trailers are specialized high-pressure transport systems designed for the safe and efficient storage and transportation of gaseous hydrogen over long distances. They consist of multiple long, cylindrical pressure vessels, often made from steel or advanced composite materials, mounted onto a trailer frame, pulled by a truck. These vessels, also known as tubes, are designed to store hydrogen gas at pressures ranging from 200 to over 500 bar, depending on the application and material used. In the context of hydrogen storage and distribution, tube trailers serve as a vital link between centralized hydrogen production facilities and end-use locations, including refueling stations, industrial plants, laboratories, and remote energy installations. The modular design of tube trailers allows them to deliver hydrogen to multiple locations without fixed pipeline infrastructure.

The cryogenic tankers segment is projected to register a CAGR of 40.9% from 2025 to 2034. Cryogenic tankers are specialized insulated transport vehicles designed to store and transport liquid hydrogen (LH₂) at extremely low temperatures, below -253°C, where hydrogen exists in its liquid state. These tankers are built with double-walled vacuum-insulated containers that minimize heat transfer and prevent the evaporation or boil-off of liquid hydrogen during transit. Cryogenic tankers are essential for high-volume hydrogen distribution, particularly when energy density and long-distance transport are priorities. Unlike gaseous hydrogen stored in high-pressure tube trailers, liquid hydrogen offers significantly higher volumetric energy density, making cryogenic tankers ideal for supplying large-scale quantities to end users such as industrial facilities, aerospace launch sites, marine terminals, and hydrogen refueling stations with high throughput requirements. These tankers can be mounted on road trailers, rail cars, or marine vessels and are designed to handle the thermal and pressure demands of cryogenic fluids safely.

Regional Analysis

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific accounted for 43.0% share of the global market, due to aggressive government policies, rising industrial demand, and large-scale investments in hydrogen infrastructure, particularly in major economies such as China and Japan. The region is grappling with energy security concerns, such as urban air pollution, leading to commitments to carbon neutrality. In this scenario, hydrogen emerges as a strategic solution, driving rapid growth in storage and transport technologies. China, the world’s largest emitter and a global manufacturing powerhouse, has positioned hydrogen as a key pillar in its energy transition strategy. In March 2022, Chinese authorities released a plan on the development of hydrogen energy for 2021–2035, aiming to produce 100,000 to 200,000 tonnes of green hydrogen annually and deploy 50,000 hydrogen-powered vehicles by 2025. The government has designated many cities and industrial clusters as hydrogen hubs, inspiring the development of supply chains, including high-pressure storage tanks and transportation solutions. In March 2021, CIMC Enric and Hexagon Purus signed two agreements. One agreement focuses on cylinder production and the other on systems production, to support the growth of fuel cell electric vehicles (FCEVs) and hydrogen distribution in China and Southeast Asia. These factors boost the Asia Pacific hydrogen storage tanks and transportation market expansion.

The China hydrogen storage tanks and transportation market holds a 30.23% share in Asia Pacific, driven by the rapid expansion of FCEVs and hydrogen refueling stations. The World Nuclear Association published a report in May 2024 stating that China plans to have one million FCEVs and 1000 hydrogen refueling stations by 2030. This expansion plan for FCEVs and hydrogen refueling stations is directly fueling the industry growth in the region, as hydrogen storage tanks in refueling stations serve as reservoirs for holding compressed or cryogenic hydrogen, which is then dispensed to fuel cell vehicles.

The India hydrogen storage tanks and transportation market is expected to grow significantly from 2025 to 2034 due to increasing government initiatives in hydrogen infrastructure development. For instance, the Indian government, under its National Green Hydrogen Mission, is prioritizing infrastructure development to support the entire hydrogen value chain. India is now accelerating efforts to scale up hydrogen storage and transportation systems with a target to produce 5 million metric tonnes of green hydrogen annually by 2030. Energy companies, logistics providers, and technology developers in the country are also actively collaborating to build hydrogen storage and transportation solutions that ensure safety, efficiency, and cost-effectiveness across the supply chain.

The North America hydrogen storage tanks and transportation market is projected to grow significantly at a CAGR of 40.5% over the forecast period, due to advanced infrastructure, favorable policy framework, and strong investment activity. The US and Canada are actively promoting hydrogen as a key component of their clean energy transitions, supported by government initiatives. In August 2022, the US government invested $60 million in projects focused on advancing hydrogen storage tanks and transportation infrastructure as part of broader decarbonization efforts. This funding aims to develop cleaner energy solutions and enable more efficient and safer handling of hydrogen, both at production sites and during transportation.

The US hydrogen storage tanks and transportation market accounted for 68.4% of the share in North America, due to a robust ecosystem of public-private partnerships and federal initiatives that incentivize infrastructure development. Strategic funding programs and R&D investments are fueling rapid innovation across the hydrogen value chain, particularly in storage and transport technologies. This momentum strengthens the country’s position in building a scalable and resilient hydrogen economy. In October 2024, the US Department of Energy (DOE) announced a funding opportunity for up to USD 46 million to accelerate the research, development, and demonstration of adorable clean-hydrogen and fuel-cell technologies. This investment targets enhancements in hydrogen production, infrastructure, and fuel cell technologies, all are important for scaling up the hydrogen economy. This funding further supports the development of advanced hydrogen storage solutions, including high-performance storage tanks that can safely and efficiently handle liquid hydrogen. This funding also promotes innovation in hydrogen transportation systems by inspiring the development of more efficient and cost-effective methods for moving hydrogen from production sites to end users.

The Europe hydrogen storage tanks and transportation market is expected to register a CAGR of 40.6% during the forecast period, driven by the region’s strong climate policies, ambitious decarbonization goals, and heavy investments in green hydrogen infrastructure. The European Commission introduced the REPowerEU Strategy of 2022, which has become a major catalyst for growth in Europe. As part of its broader plan to reduce dependency on Russian fossil fuels and accelerate the green energy transition, the strategy sets an ambitious target to produce 10 million tonnes and import another 10 million tonnes of renewable hydrogen by 2030. This large-scale hydrogen deployment directly drives demand for robust infrastructure, especially in storage and transport.

The Germany hydrogen storage tanks and transportation market holds a 21.05% share in Europe, due to its strong emphasis on hydrogen mobility innovation and strategic industry collaborations. The country’s proactive approach in integrating cryogenic storage technologies into commercial transport infrastructure supports its leadership in hydrogen adoption. Additionally, government support and industrial partnerships are accelerating deployment, positioning Germany as a central hub for hydrogen logistics and infrastructure advancement within the European clean energy transition. In January 2022, German hydrogen mobility start-up Cryomotive collaborated with commercial vehicle manufacturer MAN Truck & Bus and Clean Logistics, a truck and bus retrofitter, to develop high-capacity cryogenic hydrogen gas storage systems with fast refuelling technology for long-haul hydrogen trucks. The deployment of such systems necessitates specialized high-pressure or cryogenic storage tanks and a corresponding transportation network to deliver hydrogen from production sites to refueling stations. As Europe works to cut emissions from freight and transport, Cryomotive’s technology helps build the needed infrastructure, thus boosting demand for better hydrogen storage and transport systems.

The Latin America hydrogen storage tanks and transportation market is growing steadily, due to the region's increasing focus on renewable energy and decarbonization. Latin America countries are aiming to meet international climate commitments and to reduce dependence on fossil fuels. In countries such as Chile, Brazil, and Argentina, governments and private sectors are investing in green hydrogen projects where renewable energy resources such as solar and wind are abundant and cost-competitive. This investment in green hydrogen is fueling the demand for efficient storage and transportation infrastructure, including advanced tank technologies. Argentina’s energy companies and investors are deploying pilot projects that integrate hydrogen storage with renewable energy hubs. Companies such as YPF, Hychico, and Fortescue Future Industries are exploring pressurized gaseous tanks and cryogenic storage to manage hydrogen produced from wind and solar electrolysis. These companies favor modular storage designs to adapt to varying scales of production, ranging from distributed hydrogen stations to export-grade facilities. In regions such as Río Negro and Santa Cruz, developers incorporate storage planning into large-scale hydrogen export projects aimed at Europe and Asia.

The Middle East & Africa hydrogen storage tanks and transportation market is increasing rapidly, primarily due to the region's strategic push toward diversifying energy sources and becoming a global hub for green hydrogen production. Countries such as the UAE, Saudi Arabia, Oman, and South Africa are investing in large-scale green hydrogen projects. The UAE hydrogen storage tanks and transportation market is being driven by the country's commitment to clean energy and its ambition to become a global hydrogen hub. Major investments in green and blue hydrogen projects, such as those led by ADNOC and Masdar, are fueling demand for advanced storage and transport infrastructure.

Key Players and Competitive Analysis Report

The competitive landscape of the hydrogen storage tanks and transportation industry is shaped by intense innovation, strategic alignment, and industry consolidation as stakeholders pursue leadership in a rapidly evolving hydrogen economy. Industry analysis reveals a surge in market expansion strategies aimed at addressing the increasing demand for safe, efficient, and lightweight hydrogen containment solutions, particularly for high-pressure applications in mobility and renewable energy storage. Technology advancements in composite materials, Type IV cylinders, and cryogenic hydrogen storage are key factors to gain a competitive advantage. Strategic alliances between material suppliers, tank manufacturers, and energy integrators are enabling cross-sectoral synergy and accelerating deployment timelines. Mergers and acquisitions are being leveraged to integrate complementary technologies, streamline manufacturing, and strengthen global footprints, often followed by post-merger integration focused on R&D scaling and cost efficiency.

Joint ventures between traditional energy firms and clean tech innovators are facilitating shared expertise in hydrogen fuel logistics, tank design optimization, and compliance with evolving hydrogen transportation standards. Launches of next-generation storage systems with higher volumetric and gravimetric efficiencies underscore a trend toward system miniaturization and vehicle integration readiness. Amid this competitive environment, regulatory alignment and standardization efforts play a pivotal role, influencing design specifications and market entry timelines, while the race to achieve decarbonization targets continues to drive investment.

List of Key Companies

- Forvia SE (Faurecia)

- GRZ Technologies

- Hexagon Purus

- Iljin composites

- Linde plc

- Luxfer Holdings PLC

- NPROXX

- Plug Power Inc.

- Quantum Fuel Systems LLC

- Worthington Industries

Hydrogen Storage Tanks and Transportation Industry Developments

In April 2025, Quantum Fuel Systems, in collaboration with OneH2, developed a 930-bar high-pressure hydrogen Type 4 cylinder and was showcased in mobile refueling trailers at ACT Expo 2025.

In January 2025, Nproxx launched the AH620-70 and AH710-70 high-pressure hydrogen storage tanks, designed for heavy-duty transportation and energy storage. With a 700-bar capacity, they enable rapid refueling for enhanced operational efficiency.

In January 2024, Hexagon Purus expanded its Weeze, Germany, facility from 11,000m² to 16,000m², doubling annual production capacity for high-pressure hydrogen storage, distribution, and refueling systems to meet rising demand.

In May 2023, Luxfer Gas Cylinders launched the G-Stor Go H2, a lightweight Type 4 hydrogen cylinder with 350-bar capacity, designed for fuel cell vehicles and transport applications.

Hydrogen Storage Tanks and Transportation Market Segmentation

By Tank Type Outlook (Revenue, USD Million, 2020–2034)

- Type 1

- Type 2

- Type 3

- Type 4

- Type 5

- Liquid Hydrogen Tanks

By Modular Storage Outlook (Revenue, USD Million, 2020–2034)

- Stationary Hydrogen Storage Systems

- Mobile Hydrogen Distribution Systems

By Pressure Outlook (Revenue, USD Million, 2020–2034)

- <200 bar

- 200–500 bar

- >500 bar

By Application Outlook (Revenue, USD Million, 2020–2034)

- Automotive

- Railways

- Marine

- Aerospace

- Industrial

- Stationary

- Portable

- Others

By Transportation & Distribution Outlook (Revenue, USD Million, 2020–2034)

- Tube Trailers

- Cryogenic Tankers

- Pipelines

- Others

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Hydrogen Storage Tanks and Transportation Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 410.18 million |

|

Market Size Value in 2025 |

USD 601.58 million |

|

Revenue Forecast by 2034 |

USD 19,058.62 million |

|

CAGR |

40.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 410.18 million in 2024 and is projected to grow to USD 19,058.62 million by 2034.

The global market is projected to register a CAGR of 40.7% during the forecast period.

In 2024, Asia Pacific accounted for the largest share due to aggressive government policies, rising industrial demand, and large-scale investments in hydrogen infrastructure.

A few of the key players include Forvia SE (Faurecia), GRZ Technologies, Hexagon Purus, Iljin composites, Linde plc, Luxfer Holdings PLC, NPROXX, Plug Power Inc., Quantum Fuel Systems LLC, and Worthington Industries.

In 2024, the type 3 segment captured the largest share, primarily due to its lighter tank as compared to type 1 and type 2 tanks, while maintaining a solid structure capable of withstanding high pressures.

In 2024, the automotive segment dominated the market. Hydrogen storage tanks and transportation systems play a crucial role in the automotive sector’s transition toward cleaner and sustainable mobility.