U.S. Veterinary Oncology Diagnostics Market Size, Share, Trends, Industry Analysis Report

: By Animal Type (Canine, Feline, and Others), Test Type, Cancer Type, and End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM5646

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

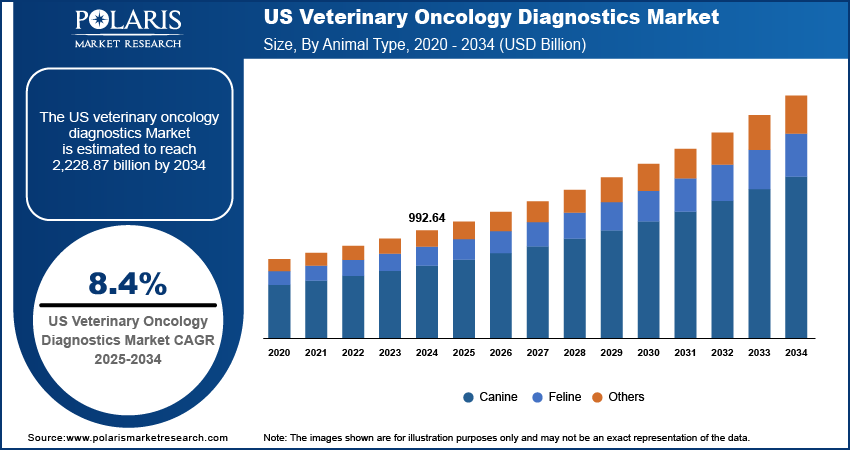

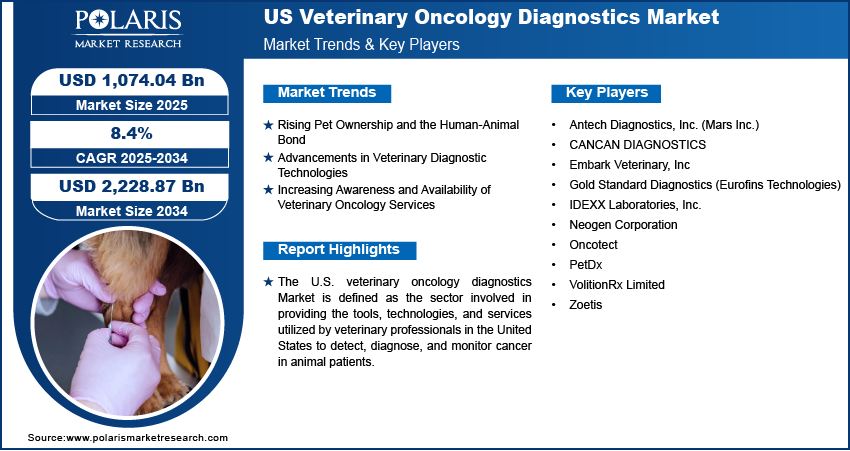

The U.S. veterinary oncology diagnostics market size was valued at USD 992.64 billion in 2024, exhibiting a CAGR of 8.4% during 2025–2034. The market is growing due to rising pet cancer cases, increasing pet ownership, and advancing diagnostic technologies.

Key Insights

- Canine segment leads due to higher cancer prevalence in dogs and a larger dog population in U.S. households.

- Imaging holds the largest share as a non-invasive, widely used method for detecting and staging animal cancers.

- Sarcomas are expected to grow fastest due to advanced imaging and molecular techniques enabling earlier detection.

- Reference laboratories hold the largest market share, providing specialized, complex cancer diagnostic tests outsourced by vets.

Industry Dynamics

- Rising pet ownership and emotional bonds are driving higher spending on advanced diagnostics for early and accurate cancer detection in pets.

- Technological advancements such as liquid biopsies and AI tools are improving diagnostic accuracy, enabling earlier intervention and better treatment outcomes.

- Growing awareness and availability of veterinary oncology services are increasing early diagnosis rates and expanding market reach across urban regions.

- Expanding pet insurance coverage supports the affordability of high-cost diagnostics, encouraging broader adoption across middle-income households.

- High cost and limited access in rural areas remain key restraints, restricting diagnostic penetration in low-resource or underserved regions.

Market Statistics

2024 Market Size: USD 992.64 billion

2034 Projected Market Size: USD 2,228.87 billion

CAGR (2025–2034): 8.4%

AI Impact on U.S. Veterinary Oncology Diagnostics Market

- AI enhances diagnostic accuracy by analyzing complex imaging and genetic data faster and with higher precision.

- Machine learning algorithms help identify subtle patterns in cancer markers, improving early detection rates in pets.

- AI-powered tools enable personalized treatment plans by integrating diagnostic results with veterinary clinical data.

- Automation reduces turnaround time for test results, allowing quicker decision-making and improved patient care.

To Understand More About this Research: Request a Free Sample Report

The U.S. veterinary oncology diagnostics Market focuses on the methods and tools employed to identify and characterize cancer in animal patients. This specialized area plays a crucial role in the overall management of cancer in veterinary medicine, providing essential information for diagnosis, prognosis, and treatment monitoring. The market encompasses a range of diagnostic modalities, including imaging techniques like MRI and CT scans, laboratory tests such as blood tests and biopsies, and advanced molecular diagnostics like genome testing and liquid biopsies. The increasing prevalence of cancer in the pet population and increasing North America veterinary clinical trial, particularly in aging animals, is a significant market drive. As pet ownership rises and the human-animal bond strengthens, owners are increasingly seeking advanced medical care for their companions, contributing to the growing market demand for sophisticated diagnostic services in veterinary oncology.

Several factors are propelling the market development of veterinary oncology diagnostics in the U.S. A key market growth factor is the rising awareness among pet owners regarding the availability and importance of early cancer detection. This growing focus on preventative animal healthcare is leading to increased demand for routine check-ups and advanced diagnostic procedures. Furthermore, continuous advancements in veterinary diagnostic testing technologies are enhancing the accuracy and speed of cancer diagnoses.

Market Dynamics

Rising Pet Ownership and the Human-Animal Bond

The increasing rate of pet ownership in the U.S., coupled with the deepening of the human-animal bond, represents a significant market drive for the U.S. veterinary oncology diagnostics Market. Approximately 66% of households in the United States own a pet, equating to over 86.9 million households. Dogs and cats are the most popular companion animals.In 2023, total pet care expenditure in the U.S. reached $136.8 billion, a significant increase from previous years. A substantial portion of this spending goes towards veterinary care, including specialized services like oncology.

A study published on the National Center for Biotechnology Information (NCBI) website in 2023, titled "The Impact of the Human-Animal Bond on Pet Healthcare Expenditure," highlighted a direct correlation between the strength of the owner-pet relationship and the amount spent on veterinary care, including diagnostic tests for serious illnesses like cancer. This growing pet population naturally leads to a larger pool of animals susceptible to cancer, thereby increasing the overall market potential for veterinary oncology diagnostics. As owners become more educated about pet health and the availability of advanced veterinary care, the demand for early and accurate cancer detection through specialized diagnostics continues to rise. This heightened focus on the quality of life and longevity of companion animals, driven by the strong human-animal bond and increasing pet ownership, is a crucial factor propelling the market growth of the U.S. veterinary oncology diagnostics Market.

Advancements in Veterinary Diagnostic Technologies

The continuous advancements in veterinary diagnostic technologies are a major market development driving the U.S. veterinary oncology diagnostics Market. Innovations in imaging, laboratory testing, and molecular diagnostics are providing veterinarians with more accurate, faster, and less invasive methods for detecting and characterizing cancer in animals. For example, a research article published on PubMed in 2024, "Novel Applications of Liquid Biopsies in Canine Cancer Diagnostics," discussed the promising role of minimally invasive liquid biopsy techniques in detecting circulating tumor DNA and other biomarkers in canine blood samples. The study showcased the potential of these advanced molecular diagnostics to provide real-time insights into tumor dynamics without the need for invasive veterinary surgical procedure of biopsies. These advancements often mirror developments in human oncology, with adaptations and refinements tailored to the specific biological characteristics of different animal species. Consequently, the ongoing progress in veterinary diagnostic technologies is a fundamental market growth factor, enabling more effective cancer management and driving the expansion of the U.S. veterinary oncology diagnostics Market.

Increasing Awareness and Availability of Veterinary Oncology Services

The growing awareness among pet owners about the prevalence of cancer in animals and the increasing availability of specialized veterinary oncology services are significantly contributing to the market demand within the U.S. veterinary oncology diagnostics Market. As information about pet health and disease management becomes more accessible through various channels, including veterinary clinics, online resources, and pet owner communities, there is a greater understanding of the importance of early cancer detection and treatment. For instance, the American College of Veterinary Internal Medicine (ACVIM) website provides directories of board-certified specialists, indicating a steady increase in the number of veterinary oncologists over the past several years. Therefore, the combination of heightened pet owner awareness and the expanding availability of specialized veterinary oncology services is a crucial market drive, fueling the market growth of the U.S. veterinary oncology diagnostics Market by encouraging early detection and intervention.

Segment Insights

Market Assessment – By Animal Type

The U.S. veterinary oncology diagnostics market is segmented by animal type into canine, feline, and others. Among these categories, the canine segment currently holds the largest market share. This dominance can be attributed to several factors, including the higher prevalence of cancer in canines compared to other companion animals and the larger population size of dogs in households across the United States. The strong emotional bond owners share with their canine companions often translates to a greater willingness to pursue advanced diagnostic procedures when cancer is suspected.

Conversely, while the canine segment represents the largest share, the feline segment is anticipated to exhibit the highest growth rate in the U.S. veterinary oncology diagnostics Market. This increasing growth is driven by a rising awareness among cat owners regarding the susceptibility of felines to various forms of cancer and a growing inclination to seek advanced veterinary care for their cats. Improvements in diagnostic modalities tailored for feline patients, along with a greater understanding of feline-specific oncological diseases, are contributing to this upward trend.

Market Evaluation– By Test Type

The U.S. veterinary oncology diagnostics market is segmented by test type into blood tests, biopsy, genome testing, endoscopy, urinalysis, and imaging. Currently, the imaging segment accounts for the largest share of the market. This significant market presence is primarily due to the widespread utilization of various imaging modalities, such as radiography, ultrasound, CT scans, and MRI, in the initial detection and staging of a broad spectrum of cancers in animals. Imaging techniques provide crucial non-invasive or minimally invasive methods for visualizing internal structures, identifying tumors, and assessing the extent of disease.

Conversely, the genome testing segment is anticipated to experience the highest growth rate within the U.S. veterinary oncology diagnostics market. This rapid expansion is fueled by the increasing understanding of the genetic basis of various cancers in animals and the development of more accessible and affordable genetic testing platforms including Veterinary Pharmacovigilance. Genome testing offers valuable insights into the specific molecular characteristics of tumors, which can aid in diagnosis, prognosis, and the selection of targeted therapies. The growing availability of commercial genetic tests for cancer predisposition and mutation analysis in pets, coupled with the increasing interest among veterinarians in personalized medicine approaches, is driving the adoption of genome testing.

Market Assessment – By Cancer Type

The U.S. veterinary oncology diagnostics market is segmented by cancer type into lymphoma, sarcomas, mammary gland tumors, skin cancers, and others. Currently, the lymphoma segment accounts for the largest share of the market. This dominance is primarily due to the relatively high incidence of lymphoma in both canine and feline populations, making it one of the most commonly diagnosed cancers in veterinary medicine. The well-established diagnostic pathways and the frequent need for comprehensive staging and monitoring in lymphoma cases contribute significantly to the high demand for various diagnostic tests within this segment. Furthermore, ongoing research and the development of specific diagnostic tools and biomarkers for different subtypes of lymphoma further solidify its leading position in the U.S. veterinary oncology diagnostics Market.

Conversely, the sarcomas segment is anticipated to exhibit the highest growth rate within the U.S. veterinary oncology diagnostics market. This increasing growth is driven by advancements in diagnostic imaging and molecular techniques that allow for earlier and more accurate detection of these often aggressive tumors. The growing awareness of the diverse subtypes of sarcomas and the importance of precise histological and molecular characterization for treatment planning are also contributing factors.

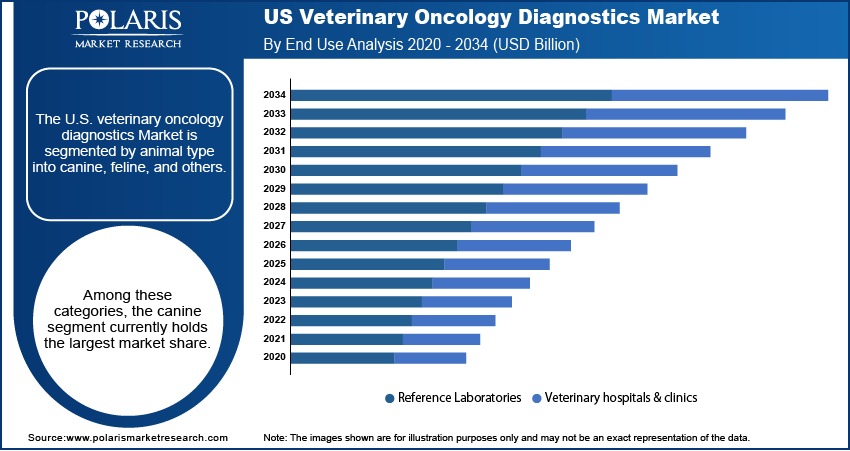

Market Assessment – By End Use

The U.S. veterinary oncology diagnostics market is segmented by end use into reference laboratories and veterinary hospitals & clinics. Currently, the reference laboratories segment holds the largest share of the market. This is primarily attributed to the fact that a significant volume of specialized diagnostic testing, particularly advanced molecular diagnostics, histopathology, and complex biomarker analyses for cancer, is outsourced to these specialized facilities. Reference laboratories possess the necessary infrastructure, advanced equipment, and expertise to conduct a wide array of sophisticated tests efficiently and accurately.

The veterinary hospitals & clinics segment is anticipated to exhibit the highest growth rate within the U.S. veterinary oncology diagnostics Market. This increasing growth is driven by the trend of expanding in-house diagnostic capabilities within veterinary practices. The development of more user-friendly and cost-effective diagnostic instruments, along with the increasing availability of point-of-care testing options, is enabling more hospitals and clinics to perform a wider range of diagnostic tests on-site. This shift towards in-house testing is often motivated by the desire for faster turnaround times, improved patient management, and the ability to offer a more comprehensive suite of services directly to pet owners.

Key Players and Competitive Insights

The prominent entities actively operating within the U.S. veterinary oncology diagnostics market include Antech Diagnostics, Inc. (Mars Inc.), CANCAN DIAGNOSTICS, Embark Veterinary, Inc; Gold Standard Diagnostics (Eurofins Technologies); IDEXX Laboratories, Inc.; Neogen Corporation; Oncotect; PetDx; VolitionRx Limited; and Zoetis. These organizations are engaged in the development, manufacturing, and provision of a diverse array of diagnostic tests, reagents, equipment, and services crucial for the detection, characterization, and monitoring of cancer in animal patients across the United States.

The competitive landscape of the U.S. veterinary oncology diagnostics market is characterized by a mix of large, well-established players and smaller, more specialized companies. Competition is primarily driven by factors such as the breadth of test portfolios, technological innovation, accuracy and reliability of diagnostic results, turnaround time, geographic reach, and the level of customer support and integration with veterinary practice workflows. Key competitive strategies employed by these entities include the introduction of novel diagnostic assays, expansion of testing capabilities, strategic collaborations with veterinary hospitals and clinics, and investments in research and development to address the evolving needs of the veterinary oncology community. The market exhibits a trend towards the development of more advanced and minimally invasive diagnostic techniques, including molecular diagnostics and liquid biopsies, intensifying the competition among players striving to offer cutting-edge solutions.

IDEXX Laboratories, Inc., headquartered in Westbrook, Maine, offers a comprehensive suite of diagnostic products and services for the veterinary market. Their offerings relevant to veterinary oncology diagnostics include a wide range of blood tests, imaging diagnostics through their reference laboratories and in-house analyzers, cytology and histopathology services, and molecular diagnostic tests that aid in the detection and characterization of various animal cancers.

Antech Diagnostics, part of Mars, Incorporated, with its main operational hub in Fountain Valley, California, provides a broad spectrum of veterinary diagnostic services. Their contributions to the veterinary oncology diagnostics market encompass advanced imaging interpretations, a comprehensive menu of laboratory tests including hematology, clinical chemistry, and cytology, as well as specialized tests for cancer biomarkers and molecular diagnostics.

List of Key Companies

- Antech Diagnostics, Inc. (Mars Inc.)

- CANCAN DIAGNOSTICS

- Embark Veterinary, Inc

- Gold Standard Diagnostics (Eurofins Technologies)

- IDEXX Laboratories, Inc.

- Neogen Corporation

- Oncotect

- PetDx

- VolitionRx Limited

- Zoetis

U.S. Veterinary Oncology Diagnostics Market Industry Developments

- January 2025: IDEXX Laboratories launched IDEXX Cancer Dx, a cost-effective blood test designed for early detection of canine lymphoma, delivering results within 2–3 days.

- January 2025: Affordable Pet Labs collaborated with Oncotect to introduce a non-invasive, at-home urine test capable of detecting four common canine cancers, improving accessibility to early diagnosis

U.S. Veterinary Oncology Diagnostics Market Segmentation

By Animal Type Outlook (Revenue-USD Billion, 2020–2034)

- Canine

- Feline

- Others

By Test Type Outlook (Revenue-USD Billion, 2020–2034)

- Blood Tests

- Biopsy

- Genome testing

- Endoscopy

- Urinalysis

- Imaging

By Cancer Type Outlook (Revenue-USD Billion, 2020–2034)

- Lymphoma

- Sarcomas

- Mammary Gland Tumors

- Skin Cancers

- Others

By End Use Outlook (Revenue-USD Billion, 2020–2034)

- Reference Laboratories

- Veterinary hospitals & clinics

U.S. Veterinary Oncology Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 992.64 billion |

|

Market Size Value in 2025 |

USD 1,074.04 billion |

|

Revenue Forecast by 2034 |

USD 2,228.87 billion |

|

CAGR |

8.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The U.S. veterinary oncology diagnostics market has been segmented into detailed segments of animal type, test type, cancer type, and end use. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

The U.S. veterinary oncology diagnostics market's growth strategy hinges on several key pillars. Increasing awareness among pet owners about pet cancer and the benefits of early detection is paramount. Educating veterinarians on the latest diagnostic advancements and their clinical utility will drive adoption. Strategic collaborations between diagnostic companies and veterinary hospitals/clinics can enhance market penetration. Leveraging digital marketing and online resources can reach a wider audience of pet owners. Furthermore, focusing on the development of more accessible, cost-effective, and minimally invasive diagnostic solutions will cater to a broader range of veterinary practices and pet owner budgets, fostering overall market expansion.

FAQ's

The U.S. veterinary oncology diagnostics market size was valued at USD 992.64 billion in 2024 and is projected to grow to USD 2,228.87 billion by 2034.

The market is projected to register a CAGR of 8.4% during the forecast period, 2024-2034.

Key players in the U.S. veterinary oncology diagnostics market include Antech Diagnostics, Inc. (Mars Inc.), CANCAN DIAGNOSTICS, Embark Veterinary, Inc; Gold Standard Diagnostics (Eurofins Technologies); IDEXX Laboratories, Inc.; Neogen Corporation; Oncotect; PetDx; VolitionRx Limited; and Zoetis.

The feline segment accounted for the larger share of the market in 2024.

Following are some of the U.S. veterinary oncology diagnostics market trends: ? Increasing Prevalence of Cancer in Pets: A growing number of companion animals, particularly dogs and cats, are being diagnosed with cancer, driving the demand for diagnostic services. ? Advancements in Liquid Biopsy: The development and adoption of minimally invasive liquid biopsy techniques for early cancer detection and monitoring are on the rise. ? Growth in Molecular Diagnostics and Genome Testing: There is an increasing demand for genetic and genomic tests to provide more accurate diagnoses, prognoses, and personalized treatment options.

U.S. veterinary oncology diagnostics encompasses the methods, tools, and services used to identify and characterize cancer in animal patients within the United States. This specialized field is essential for the diagnosis, prognosis, and monitoring of cancer in veterinary medicine. It includes a range of techniques such as imaging (like X-rays, ultrasound, CT, and MRI), laboratory tests (including blood tests, urinalysis, and biopsies), and advanced molecular diagnostics (like genome testing and liquid biopsies). The goal of these diagnostics is to provide veterinarians with the necessary information to effectively manage cancer in their animal patients, ultimately aiming to improve their health and quality of life.