Warehouse Automation Market Size, Share, Trends, & Industry Analysis Report

By Type, By Technology, By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 118

- Format: PDF

- Report ID: PM2010

- Base Year: 2024

- Historical Data: 2020-2023

Overview

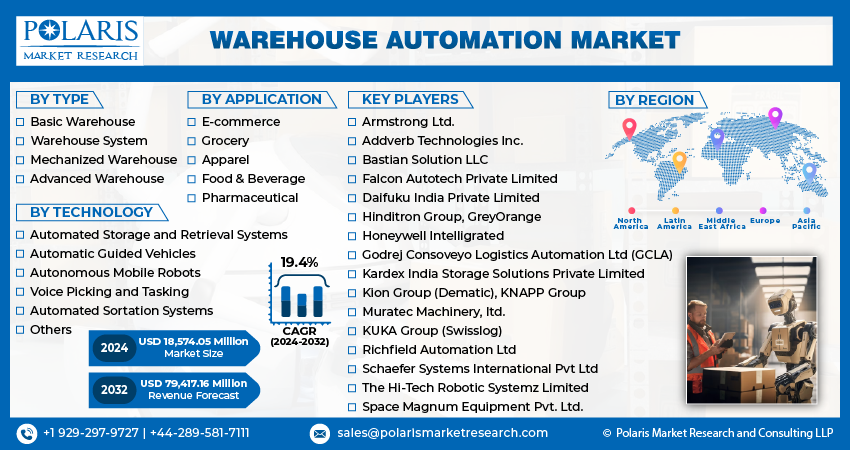

The warehouse automation market was valued at USD 23.7 billion in 2024 growing at a CAGR of 17.5% from 2025-2032. Rising e-commerce demand and ongoing labor shortages in logistics pushed the adoption of automated storage, retrieval, and robotic handling systems.

Key Insights

- Advanced warehouse segment dominated in 2024 due to high adoption of robotics and AI-driven systems.

- Pharmaceutical segment is expected to grow fastest, driven by automation in inventory tracking and handling sensitive products.

- North America led the global market in 2024 due to strong manufacturing infrastructure.

- The U.S. dominated North America in 2024 with robust e-commerce and logistics investments.

- Asia Pacific is projected to record the fastest growth, driven by rising industrialization and e-commerce expansion.

- China led Asia Pacific due to large-scale manufacturing and government support for smart logistics.

Industry Dynamics

- Rising e-commerce activity is increasing the demand for automated storage and retrieval systems.

- Labor shortages in logistics are driving the adoption of robotics and material handling automation.

- High installation and maintenance costs continue to restrain the expansion of warehouse automation.

- Third-party logistics and cold chain expansion present new market growth opportunities.

Market Statistics

- 2024 Market Size: USD 23.97 Billion

- 2034 Projected Market Size: USD 119.79 Billion

- CAGR (2025-2034): 17.5%

- North America: Largest Market Share

Automated warehouse systems provide material handling, storage, and order fulfillment efficiency with robotics, sensors, and data technology. Automated storage and retrieval systems, conveyors, and warehousing management software are integrated into these solutions to enhance productivity and minimize operation errors.

Increasing e-commerce business and increasing logistics volumes are driving the need for automation in warehouses. Organizations are using robotics, AI, and IoT-based solutions to streamline inventory management, improve accuracy, and reduce delivery times. For instance, last month in July 2025, Amazon has installed its one millionth robot and launched DeepFleet, a generative AI model to increase the efficiency of its robotic fleet by 10%, streamlining travel times, and lowering delivery expenses.

Logistics operators across geographies like Europe and North America are investing in next-generation automation to tackle labor scarcity, provide quick throughput, and enhance operational security. Top vendors are launching modular, AI-based, cloud-integrated warehouse automation offerings to enhance scalability, real-time monitoring, and overall supply chain effectiveness.

Drivers & Opportunity

Global E-Commerce Expansion Reshaped Warehouse Operations: The explosive growth of e-commerce has boosted the volume of orders and inventory turnover, generating a strong demand for effective storage and retrieval. B2C e-commerce revenue worldwide is anticipated to be USD 5.5 trillion by 2027, says International Trade Administration (ITA). This growth demonstrates a consistent CAGR of 14.4%. Automated systems assist in supporting large SKU assortments, enhancing picking accuracy, and lowering fulfillment time. Retailers and logistics companies are investing in automated warehouses to fulfill same-day delivery promises and efficiently handle peak-season demand.

Labor Shortages in Logistics Are Driving Market Adoption: Sustained shortages of labor and increasing costs of the workforce in logistics operations have hastened the move to robotics and automation. Automatic guided vehicles, robotic pickers, and conveyor systems are enhancing productivity and lessening reliance on manual workers. Organizations are implementing these technologies to ensure continuity of operations, improve workplace safety, and deliver uniform production in high-volumeworkroom settings.

Segmental Insights

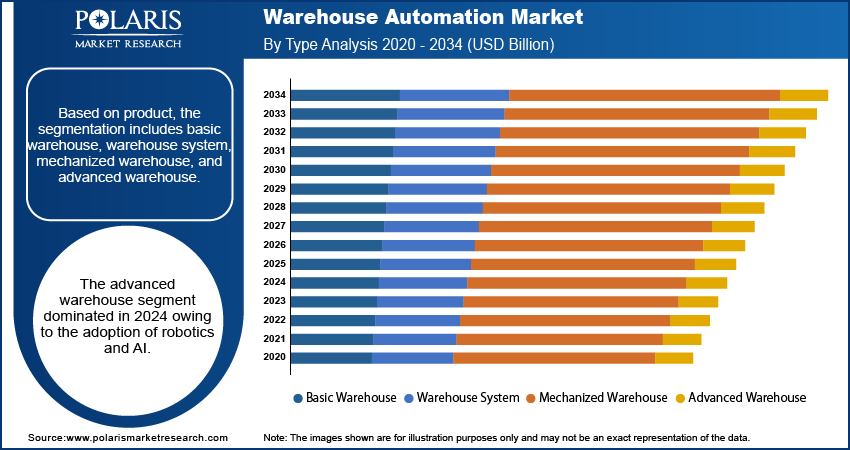

Type Analysis

Based on product, the segmentation includes basic warehouse, warehouse system, mechanized warehouse, and advanced warehouse. The advanced warehouse segment captured the market in 2024 with the penetration of robotics, artificial intelligence, and real-time data systems, which boost operational efficiency. In addition, large e-commerce and 3PL operators increasingly make use of advanced warehouses for quicker fulfilment.

The mechanized warehouse segment is projected to grow at the fastest CAGR during the forecast period due to rising automation adoption among mid-sized logistics firms. In addition, cost-effective conveyor systems and semi-automated equipment are improving throughput and storage flexibility.

Technology Analysis

Based on technology, the segmentation includes automated storage and retrieval systems (AS/RS), automatic guided vehicles (AGVs), autonomous mobile robots (AMRs), voice picking and tasking, automated sortation systems, and others. The automated storage and retrieval systems (AS/RS) segment led the market in 2024 due to excessive demand for effective inventory management. In October 2025, Integrated Systems Design (ISD) unveiled the URBX Cube Robotic ASRS to maximize warehouse space and labor with modular storage and autonomous robots. Additionally, Increasing use in e-commerce and manufacturing warehouses boosted accuracy, space utilization, and workflow speed.

The autonomous mobile robots (AMRs) segment is anticipated to expand at the highest CAGR over the forecast period, as it benefits from flexibility in material handling. Moreover, ongoing innovation in AI-based navigation and fleet management facilitates comprehensive deployment across varied warehouse environments.

Application Analysis

Based on application, the segmentation includes e-commerce, grocery, apparel, food & beverage, and pharmaceutical. The e-commerce segment led the market in 2024 on account of growing online buying activity and the demand for quick order fulfilment. In addition, big warehouses are implementing integrated automation systems to manage varying inventories effectively.

The pharmaceutical segment is also likely to expand with the highest CAGR between the forecast period owing to Increasing demand for accurate inventory tracking and compliance-driven storage solutions. Furthermore, automation maintains accuracy while handling temperature-sensitive and high-cost medical products.

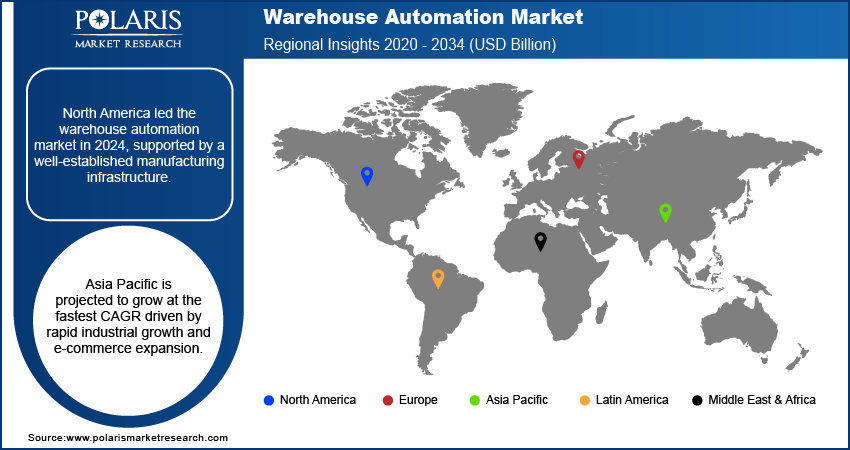

Regional Analysis

North America is the leader in the warehouse automation market due to high penetration of e-commerce, raising the demand for advanced storage and retrieval systems. Further, increasing labor costs in logistics are encouraging the use of robotics and automated solutions. Apart from this, the U.S. is ahead with heavy investments in warehouse infrastructure that supports AI.

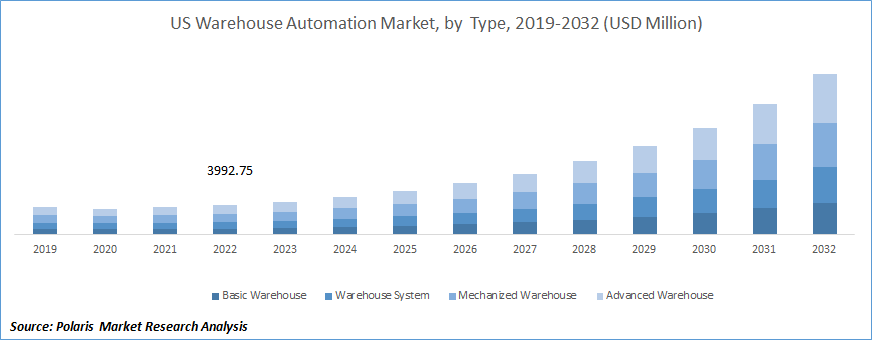

The U.S. Warehouse Automation Market Insights

The U.S. dominated the warehouse automation industry due to strong e-commerce adoption fueling the need for automated storage and retrieval solutions. Additionally, labor shortages and increasing wages encourage businesses to use robotics and artificial intelligence-powered solutions. According to the U.S. Census Bureau's Quarterly Survey of Plant Capacity Utilization (QSPC), during Q3 2024, approximately 20.6% of U.S. factories reported a shortage of labor as a limitation to production, declining from 46.3% during Q3 2021 and comparable to 2018-2019 levels.

Europe Warehouse Automation Market Insights

Europe holds the substantial share in the warehouse automation market due to the growing presence of third-party logistics providers, which demand high-efficiency operations. Moreover, stringent workplace safety regulations encourage deployment of autonomous mobile robots. For instance, in July 2025, DHL Italy launched a USD 16.2 million Exotec automation system with 138 robots at its Livraga Health Logistics Campus to improve pharmaceutical logistics.

Asia Pacific Warehouse Automation Market Insights

Asia Pacific is the fastest growing market driven by rapid e-commerce growth in countries like China and India. Furthermore, growing industrial and manufacturing industries are boosting warehouse automation implementation. Also, increasing government efforts to transform supply chains further substantiate market expansion.

China Warehouse Automation Market Insights

China is experiencing fastest adoption of warehouses following a surge in e-commerce and online retail growth. According to the China National Bureau of Statistics, online retail sales Increasing 9.2% during the first seven months of 2025, with agricultural products, electronics, and textiles increasing by 14.5%, 7.9%, and 6.5% year on year. Additionally, increasing manufacturing production fuel the demand for cost-effective material handling systems. Finally, government initiatives supporting smart logistics and the adoption of Industry 4.0 fuel market growth.

Key Players & Competitive Analysis Report

The market of warehouse automation is moderately competitive, with companies improving robotics, AI, and IoT-based system capabilities. Additionally, investment in cloud-integrated warehouse management software, real-time monitoring, and partnerships with e-commerce, logistics, and manufacturing firms improves efficiency, scalability, and global market presence.

Major companies operating in the warehouse automation market include Dematic, Swisslog Holding AG, Honeywell International Inc., Daifuku Co., Ltd., KNAPP Group, SSI SCHAEFER Group, Vanderlande, Toyota Industries Corporation, Körber AG, GreyOrange, Locus Robotics, and Zebra Technologies.

Key Players

- Daifuku Co., Ltd.

- Dematic

- GreyOrange

- Honeywell International Inc.

- KNAPP Group

- Körber AG

- Locus Robotics

- SSI SCHAEFER Group

- Swisslog Holding AG

- Toyota Industries Corporation

- Vanderlande

- Zebra Technologies

Industry Development

- August 2025: Symbotic unveiled a next-generation storage system for its warehouse automation platform, lowering customer footprint by as much as 40%, increasing case handling speeds, and facilitating quick deployment through pre-assembled parts.

- April 2025: OMRON released the OL-450S, an omni-directional low-profile AMR with advanced navigation and lifting abilities, optimizing material handling across various industries.

- March 2025: Scott Technology introduced NexBot, an AGV with interchangeable modules and advanced navigation, aimed at increasing automation in warehousing, production, and logistics.

Warehouse Automation Market Segmentation

By Type (Revenue, USD Billion, 2020–2034)

- Basic Warehouse

- Warehouse System

- Mechanized Warehouse

- Advanced Warehouse

By Technology (Revenue, USD Billion, 2020–2034)

- Automated Storage and Retrieval Systems (AS/RS)

- Automatic Guided Vehicles (AGVs)

- Autonomous Mobile Robots (AMRs)

- Voice Picking and Tasking

- Automated Sortation Systems

- Others

By Application (Revenue, USD Billion, 2020–2034)

- E-commerce

- Grocery

- Apparel

- Food & Beverage

- Pharmaceutical

By Region (Revenue, USD Billion, 2020–2034)

- North America

- The U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherland

- Russia

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

- Latin America

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of South Africa

Warehouse Automation Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 23.97 Billion |

|

Market Size in 2025 |

USD 28.07 Billion |

|

Revenue Forecast by 2034 |

USD 119.79 Billion |

|

CAGR |

17.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2025-2034 |

|

Forecast Period |

2025-2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Application |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions and segmentation. |

FAQ's

The global market size was valued at USD 23.97 billion in 2024 and is projected to grow to USD 119.79 billion by 2034.

The global market is projected to register a CAGR of 17.5% during the forecast period.

North America dominated the warehouse automation market in 2024 due to strong manufacturing infrastructure.

A few of the key players in the market are Dematic, Swisslog Holding AG, Honeywell International Inc., Daifuku Co., Ltd., KNAPP Group, SSI SCHAEFER Group, Vanderlande, Toyota Industries Corporation, Körber AG, GreyOrange, Locus Robotics, and Zebra Technologies.

The advanced warehouse segment dominated in 2024 due to robotics and AI adoption.

The pharmaceutical segment is projected to grow fastest, driven by precise inventory tracking and automated handling of sensitive products.