Welding Sticks Market Size, Share, Trends, Industry Analysis Report

: By Type, End Use (Automotive & Transportation, Building & Construction, Marine, Repair & Maintenance, and Others), and Region– Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5649

- Base Year: 2024

- Historical Data: 2020-2023

Welding Sticks Market Overview

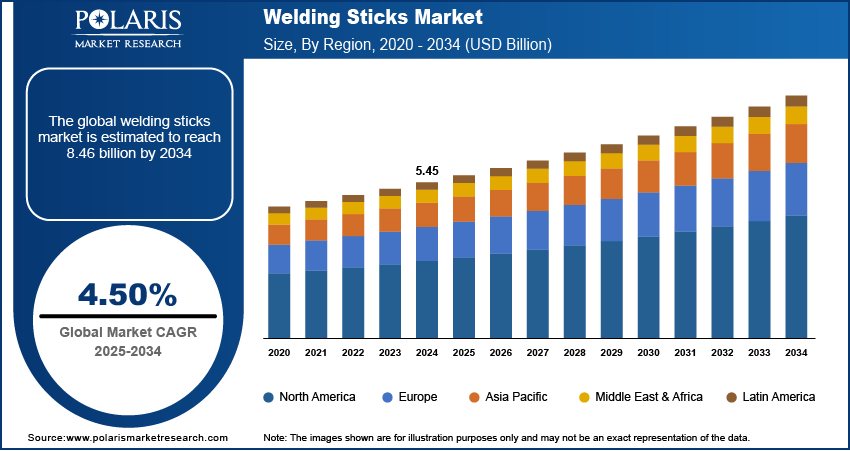

The global welding sticks market size was valued at USD 5.45 billion in 2024. It is expected to grow from USD 5.69 billion in 2025 to USD 8.46 billion by 2034, at a CAGR of 4.50% during 2025–2034.

Welding sticks, also known as welding electrodes, are consumable rods used in arc welding to conduct current and fuse metals together. Demand for welding sticks is increasing due to their expanding industrial applications as integral components of manual metal arc welding (MMAW). This growth is also attributed to the rise in renewable energy projects across the globe. A January 2024 IEA report indicated global renewable energy capacity additions increased by 50% year-over-year in 2023, reaching ∼510 GW of new installed capacity worldwide. The development of solar panels, wind power plants, and hydroelectric facilities requires extensive fabrication and installation of metal structures, transmission lines, and support infrastructure, all of which rely on efficient welding processes. The demand for reliable and easy-to-use welding materials such as sticks continues to rise as these projects often take place in remote or outdoor environments, contributing significantly to the overall expansion.

To Understand More About this Research: Request a Free Sample Report

The industry-wide shift toward portable welding solutions has increased due to the growing adoption of mobile fabrication, maintenance, and repair services in the construction, automotive, and shipbuilding anti-vibration industries, creating a heightened demand for flexible and portable welding tools. Welding sticks, being compact and suitable for use with portable welding machines, align well with this trend. Their ease of handling, minimal requirement for auxiliary equipment, and adaptability to various materials make them ideal for on-site operations. This shift toward mobility and operational efficiency is prompting industries to prefer welding sticks over other methods, reinforcing their relevance in evolving welding applications.

Market Dynamics

Increasing Demand from Construction and Manufacturing Industries

Welding plays a critical role in structural assembly and biofabrication. A January 2025 IBEF report indicated strong growth in India's industrial sectors, with manufacturing expanding at 11.6% annually and construction growing at 9.5%. Welding sticks are extensively used for joining metal components in applications ranging from infrastructure development to heavy machinery production. The requirement for durable, cost-effective, and versatile welding solutions rises in parallel as these industries continue to grow and modernize. Their effectiveness in high-strength bonding and ease of use further position them as essential tools in the construction and manufacturing activities. Therefore, the increasing demand from the construction and manufacturing industries is boosting the market growth.

Rising Advancements in Welding Equipment

Rising advancements in welding equipment are driving the welding sticks market development by enhancing the overall efficiency and accessibility of welding operations. Modern welding machines are increasingly being designed to be compatible with a broad range of electrode types, including those used in stick welding. For instance, in October 2021, TRUMPF launched the TruLaser Weld 1000 at Blechexpo, targeting small-to-mid-sized sheet-metal fabricators. The compact, automated laser welding system features simplified cobot-assisted programming via e-learning, enabling faster adoption than conventional systems while maintaining precision for electrical cabinets and enclosures. These technological improvements are making welding processes more stable, precise, and user-friendly, which boosts the usability of welding sticks across various skill levels and environments. Moreover, innovations aimed at improving energy efficiency, safety, and portability of welding equipment encourage continued use of stick welding techniques, particularly in fieldwork and repair operations. Welding sticks remain a foundational element in meeting evolving performance and productivity demands as the welding industry adopts these advancements.

Segment Insights

Market Assessment by End Use Outlook

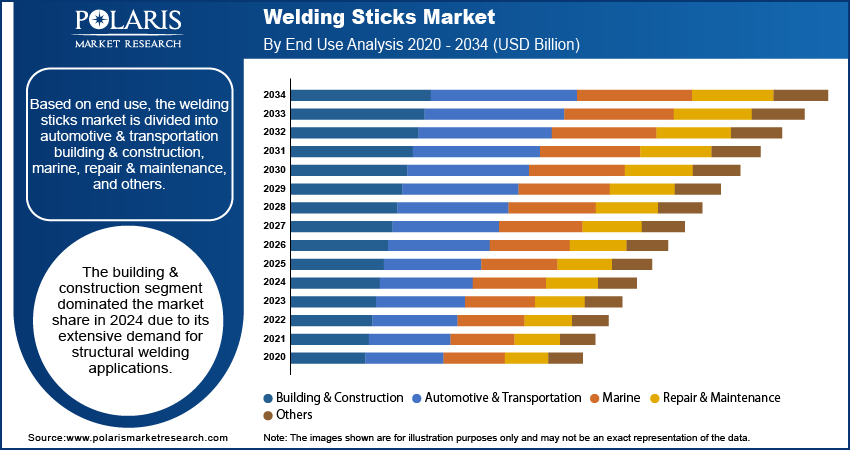

The global market segmentation, based on end use, includes automotive & transportation, building & construction, marine, repair & maintenance, and others. The building & construction segment dominated the market share in 2024 due to its extensive demand for structural welding applications. The construction of residential, commercial, and industrial infrastructure requires robust and consistent welding to ensure structural integrity and safety. Welding sticks, known for their adaptability and cost-effectiveness, are widely used across various stages of construction, such as steel framework, pipelines, and reinforcement work. The segment’s dominance is further supported by the continued urban development and increasing investments in infrastructure across developed and emerging economies, positioning construction as a major end-use sector for welding sticks.

Market Evaluation by Type Outlook

The global market segmentation, based on type, includes mild steel electrodes, low hydrogen electrodes, cast iron electrodes, stainless steel electrodes, and others. The low hydrogen electrodes segment is expected to witness the fastest market growth during the forecast period due to their superior performance characteristics in critical applications. These electrodes are designed to minimize hydrogen content in the weld area, thereby reducing the risk of weld cracking and enhancing the mechanical strength of welded joints. The rising demand for high-quality welds in demanding conditions is encouraging end users to adopt low hydrogen electrodes, thereby driving the segment growth.

Regional Analysis

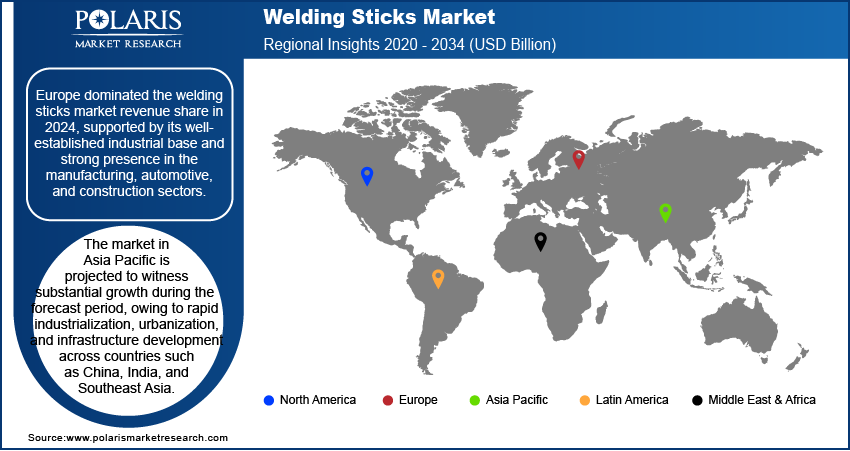

By region, the report provides the insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe dominated the market revenue share in 2024, supported by its well-established industrial base and strong presence in the manufacturing, automotive, and construction sectors. This leadership is further evidenced by the region’s extensive adoption of welding technologies. A 2020 European Commission report noted 3 million welding units in use across the EU27, with manual metal arc (MMA) accounting for 47% of demand, reflecting the persistent need for traditional yet reliable methods. The region’s advanced infrastructure, strict quality standards, and focus on sustainable industrial practices have driven consistent demand for high-grade consumables such as electrodes. Additionally, the concentration of major market players and investments in efficient welding techniques have solidified Europe’s global market position.

The Asia Pacific is projected to witness substantial growth during the forecast period, primarily due to rapid industrialization, urbanization, and infrastructure development across countries such as China, India, and Southeast Asia. The region’s expanding construction activities, along with substantial investments in transportation, energy, and manufacturing sectors, are generating consistent demand for welding consumables. For instance, a March 2025 report by India's Ministry of Commerce & Industry noted that PLI Schemes allocated over USD 26 billion across 14 key sectors, such as specialty steel, automobiles, and others, to strengthen manufacturing capabilities and drive technological progress. Additionally, the growing availability of cost-effective labor and raw materials is attracting manufacturing activities, further fueling the need for versatile welding solutions such as welding sticks. This dynamic industrial landscape positions Asia Pacific as a key high-growth region for the market.

Welding Sticks Market – Key Players & Competitive Analysis Report

The welding sticks market features intense competition among established manufacturers and regional specialists competing for revenue growth through technological advancements in electrode coatings and metallurgy. Industry leaders leverage strategic investments in R&D to develop high-performance electrodes with enhanced durability and specialized applications while simultaneously pursuing sustainability transformation through eco-friendly coating formulations. Economic and geopolitical shifts significantly impact raw material availability and pricing, creating supply chain disruptions that regional players often navigate more effectively through local sourcing networks. Growth opportunities exist in emerging technologies such as low-hydrogen electrodes for critical infrastructure projects, while expansion opportunities in developing economies drive international collaboration among manufacturers. Competitive benchmarking reveals market leaders focusing on product offerings that address specific end-user challenges, with successful vendors developing joint ventures to strengthen regional footprints in high-growth markets. Price trend forecasts indicate potential volatility due to fluctuating metal prices, making procurement strategies increasingly important for maintaining profitability. Companies investing in online distribution channels gain a competitive advantage as digitalization transforms buying patterns, with expert insights suggesting future demand will favor specialized electrodes for infrastructure development projects across rapidly industrializing regions. A few key major players are Ador Welding Ltd.; Air Liquide S.A.; Bohler Welding Group; ESAB Group, Inc.; Hyundai Welding Co., Ltd.; Illinois Tool Works Inc.; Kobe Steel, Ltd.; Lincoln Electric Holdings, Inc.; Tianjin Bridge Welding Materials Group Co., Ltd.; and Voestalpine Böhler Welding.

Böhler Welding Group, part of the Voestalpine AG Metal Engineering Division, is a global manufacturer of high-quality welding consumables and accessories. Headquartered in Düsseldorf, Germany, the company has over 50 subsidiaries across more than 25 countries and serves customers in ∼150 countries. Böhler Welding specializes in providing solutions for joint welding, repair and maintenance, overlay welding, and brazing applications. Its product portfolio comprises stick electrodes, flux-cored wires, solid wires, GTAW rods, and submerged arc welding consumables. Böhler Welding is particularly renowned for its expertise in medium to high alloyed consumables and super alloys, catering to industries such as offshore technologies, pipeline construction, petrochemical plants, and power stations. Böhler Welding offers premium stick electrodes designed for Shielded Metal Arc Welding (SMAW), ensuring excellent weld quality with minimal spatter formation. These electrodes are tailored for challenging applications involving mild steel, stainless steel, duplex steels, and nickel alloys. Böhler’s commitment to quality is evident through its EN ISO 9001 certification and stringent quality control processes. Böhler Welding continues to deliver reliable solutions that meet the demanding requirements of industrial welding projects worldwide with over 100 years of experience and a focus on innovation.

Hyundai Welding Co., Ltd., established in 1975 and headquartered in Seoul, South Korea, specializes in welding consumables and equipment. The company has grown to serve industries such as shipbuilding, automotive, construction, power generation, and offshore projects as part of the Hyundai alliance. Hyundai Welding offers a comprehensive portfolio of welding products, such as stick electrodes, flux-cored wires, solid wires, and submerged arc welding consumables, with a strong focus on innovation and customer-centric solutions. The company operates state-of-the-art manufacturing facilities in South Korea, China, Vietnam, and Russia, with an annual production capacity of 22,000 tons for stick electrodes alone. Hyundai Welding provides an extensive range of stick electrodes designed for diverse applications, such as high-tensile steel, weatherproof steel, low-temperature service steel, and heat-resistant low-alloy steel. These electrodes are known for their excellent weld quality, low fume emission, and crack resistance, making them ideal for heavy-duty applications such as machinery parts, ships, bridges, and pressure vessels. Hyundai Welding’s commitment to quality is reflected in its ISO-certified processes and global distribution network spanning over 150 countries. Hyundai Welding continues to be a trusted partner in the global welding industry by combining advanced technology with customer-focused service.

List of Key Companies in Welding Sticks Market

- Ador Welding Ltd.

- Air Liquide S.A.

- Bohler Welding Group

- ESAB Group, Inc.

- Hyundai Welding Co., Ltd.

- Illinois Tool Works Inc.

- Kobe Steel, Ltd.

- Lincoln Electric Holdings, Inc.

- Tianjin Bridge Welding Materials Group Co., Ltd.

- Voestalpine Böhler Welding

Welding Sticks Industry Developments

June 2024: Lincoln Electric acquired Inrotech A/S, a Danish automation firm specializing in vision-based adaptive welding systems. The technology eliminates programming needs, offering precision for shipbuilding and heavy industries, and will be integrated into Lincoln’s broader welding solutions.

September 2023: Castolin Eutectic launched EnDOtec DO*6070N, a high-temperature flux-cored welding wire designed for extreme conditions (800°C). The product enhances component durability against erosion, abrasion, and corrosion while reducing maintenance costs in demanding industrial applications.

Welding Sticks Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Mild Steel Electrodes

- Low Hydrogen Electrodes

- Cast Iron Electrodes

- Stainless Steel Electrodes

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Automotive & Transportation

- Building & Construction

- Marine

- Repair & Maintenance

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Welding Sticks Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 5.45 billion |

|

Market Size Value in 2025 |

USD 5.69 billion |

|

Revenue Forecast in 2034 |

USD 8.46 billion |

|

CAGR |

4.50% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.45 billion in 2024 and is projected to grow to USD 8.46 billion by 2034.

The global market is projected to register a CAGR of 4.50% during the forecast period.

Europe dominated the market share in 2024.

A few of the key players in the market are Ador Welding Ltd.; Air Liquide S.A.; Bohler Welding Group; ESAB Group, Inc.; Hyundai Welding Co., Ltd.; Illinois Tool Works Inc.; Kobe Steel, Ltd.; Lincoln Electric Holdings, Inc.; Tianjin Bridge Welding Materials Group Co., Ltd.; and Voestalpine Böhler Welding.

The building & construction segment dominated the market share in 2024.

The low hydrogen electrodes segment is expected to witness the fastest growth during the forecast period.