Wheat Protein Market Size, Share, Trends, Industry Analysis Report

: By Product (Wheat Gluten, Wheat Protein Isolate, Textured Wheat Protein, and Wheat Protein Hydrolysate), Concentration, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 118

- Format: PDF

- Report ID: PM2982

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

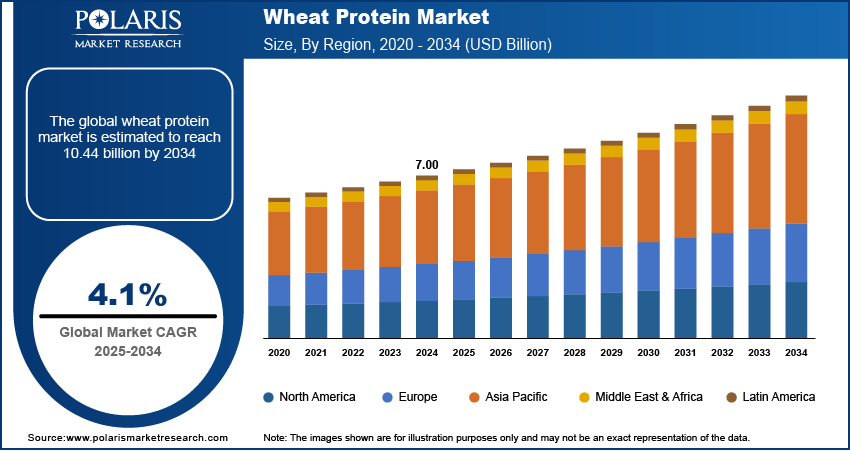

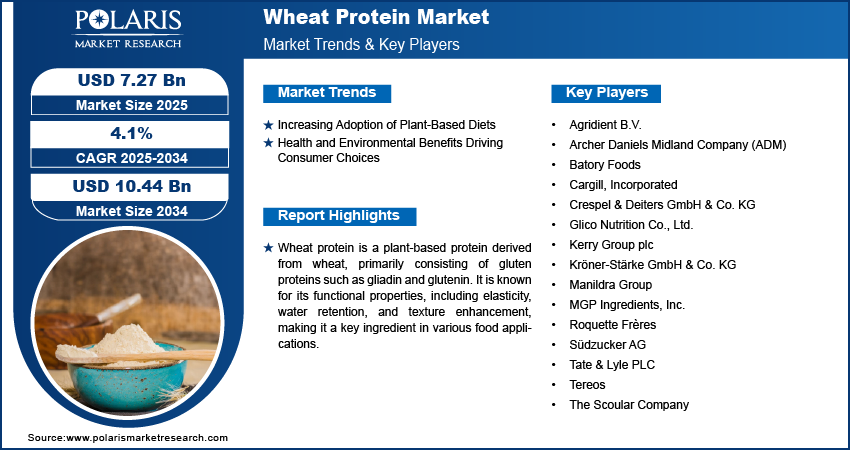

The wheat protein market size was valued at USD 7.00 billion in 2024, growing at a CAGR of 4.1% during 2025–2034. The rising adoption of plant-based diets and the rising need for sustainable protein sources are a few of the key factors driving market growth.

Key Insights

- The wheat gluten segment leads the market. The segment’s dominance is primarily attributed to its extensive functional applications across various sectors.

- The 75% segment is anticipated to register significant growth during the projection period. The segment’s growth is driven by the extensive applications of the concentration across various industries.

- North America accounts for the largest market share. The presence of a well-established food processing industry and rising consumer preference for nutritional products drive the region’s leading market position.

- Europe holds a significant position in the global market. The regional market growth is driven by its well-established bakery industry and rising consumer preference for plant-based diets.

Industry Dynamics

- The increased adoption of plant-based diets as an alternative to protein-derived products is fueling market growth.

- Growing awareness about the health and environmental benefits associated with plant-based diets is another factor fueling the demand for wheat protein.

- The expanding use of wheat protein in personal care products is expected to provide significant market opportunities.

- Poor wheat crop quality may present market challenges.

-

Market Statistics

2024 Market Size: USD 7.00 billion

2034 Projected Market Size: USD 10.44 billion

CAGR (2025-2034): 4.1%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

The wheat protein market is experiencing significant growth due to increasing demand for plant-based protein alternatives, rising consumer awareness of functional food ingredients, and expanding applications in the food and beverage industry. Wheat protein, derived primarily from wheat gluten, is widely used in bakery products, meat substitutes, sports nutrition, and animal feed due to its high protein content and functional properties. The market is further driven by the growing preference for clean-label and non-GMO food products, as well as advancements in food processing technologies that enhance wheat protein's texture and nutritional profile. Additionally, the rising prevalence of lactose intolerance and gluten-free product innovation has influenced product diversification, though wheat protein remains a preferred choice for various applications.

Key drivers of the wheat protein market include the increasing adoption of plant-based diets, rising health consciousness among consumers, and a growing need for sustainable protein sources. The expanding food and beverage industry, particularly in developing regions, is also contributing to market growth as manufacturers seek cost-effective protein alternatives. Furthermore, government initiatives promoting plant-based nutrition and advancements in wheat protein extraction and processing technologies are expected to support market expansion.

Market Dynamics

Increasing Adoption of Plant-Based Diets

The global shift towards plant-based diets has significantly influenced the wheat protein market. Consumers are increasingly seeking plant-based protein sources as alternatives to animal-derived products, driven by health concerns, environmental awareness, and ethical considerations. In India, a report by the Plant Based Foods Industry Association (PBFIA) in 2023 highlighted a "noticeable increase" in the adoption of plant-based eating habits, attributing this trend to growing awareness of animal agriculture's ethical and environmental implications, as well as the increased availability and affordability of plant-based food products. This growing preference for plant-based diets has increased the demand for wheat protein, commonly used in meat substitutes and other plant-based food products.

Health and Environmental Benefits Driving Consumer Choices

The recognition of health and environmental benefits associated with plant-based diets is a significant driver of the wheat protein market. Plant-based diets are linked to improved health outcomes, including reduced risks of chronic diseases such as heart disease, stroke, and cancer. Additionally, these diets contribute to environmental sustainability by lowering greenhouse gas emissions and conserving water resources. A 2023 report by the Plant Based Foods Industry Association (PBFIA) noted that individuals adopting plant-based diets could lower their risk of chronic diseases and promote environmental sustainability. This growing awareness has led consumers to seek out plant-based protein sources, such as wheat protein, to align their dietary choices with health and environmental goals.

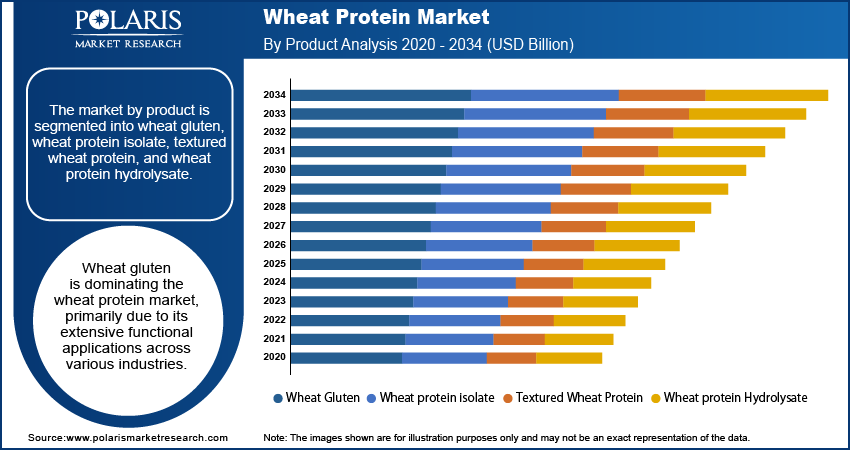

Segment Insights

Market Assessment by Product

The wheat protein market segmentation, based on product, includes wheat gluten, wheat protein isolate, textured wheat protein, and wheat protein hydrolysate. Wheat gluten is dominating the market, primarily due to its extensive functional applications across various industries. Renowned for its viscoelastic properties, wheat gluten is extensively utilized in bakery products to enhance texture and elasticity. Its binding and emulsification capabilities make it a preferred ingredient in meat substitutes, aligning with the rising demand for plant-based diets. The cost-effectiveness and widespread availability of wheat gluten further contribute to its market leadership.

Market Evaluation by Concentration

The wheat protein market is segmented by concentration into 75%, 80%, and 95%. The 75% segment is expected to witness significant wheat protein market growth, primarily due to its extensive applications across various food industries. This concentration level offers an optimal balance between protein content and functional properties, making it a preferred choice for manufacturers aiming to enhance the nutritional profile of their products without incurring substantial costs. It is commonly utilized in the production of baked goods, meat substitutes, and snacks, where it improves texture, moisture retention, and overall product quality. The versatility and cost-effectiveness of the 75% protein concentration contribute to its substantial market share and sustained demand.

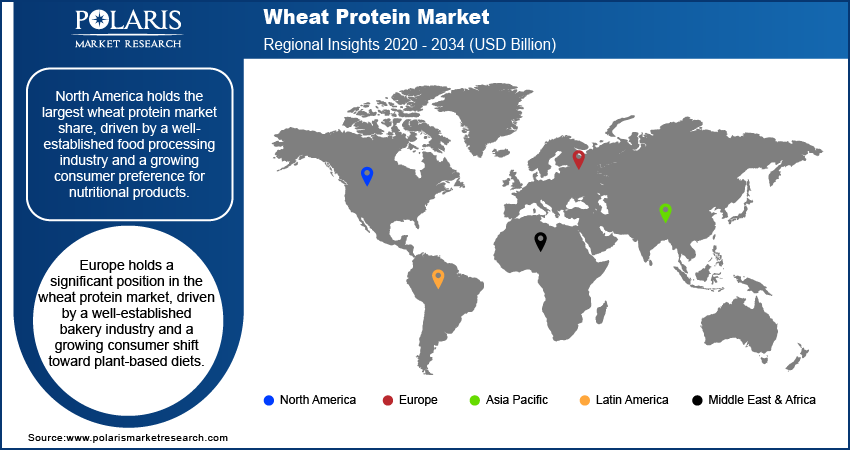

Regional Insights

By region, the study provides wheat protein market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest wheat protein market share, driven by a well-established food processing industry and a growing consumer preference for nutritional products. The region's high wheat production ensures a steady supply of raw materials, supporting the extensive use of wheat protein in various applications. The increasing interest in plant-based and sustainable diets among consumers in North America further boosts the demand for wheat protein, as it offers versatility and nutritional benefits.

Europe holds a significant position in the wheat protein market, driven by a well-established bakery industry and a growing consumer shift toward plant-based diets. The region's rich tradition of bakery products, combined with the functional benefits of wheat protein, has led to its widespread use in enhancing the texture and nutritional profile of baked goods. Additionally, increasing awareness of health and sustainability has prompted consumers to seek plant-based protein sources, further boosting the demand for wheat protein in various food applications.

The rapid urbanization and evolving dietary patterns in Asia Pacific have led to a surge in demand for convenience foods and meat alternatives, positioning wheat protein as a valuable ingredient. Countries such as China and Japan are witnessing a growing interest in plant-based diets driven by health considerations and environmental concerns. This shift has resulted in increased utilization of wheat protein in bakery products and meat substitutes, catering to the preferences of health-conscious consumers.

Key Players and Competitive Insights

The wheat protein market features several key players actively contributing to its growth and innovation. Notable companies include Archer Daniels Midland Company (ADM), Cargill, Incorporated, Tereos, Südzucker AG, MGP Ingredients, Inc., Roquette Frères, Glico Nutrition Co., Ltd., Kerry Group plc, Manildra Group, Kröner-Stärke GmbH & Co. KG, Crespel & Deiters GmbH & Co. KG, Batory Foods, Agridient B.V., Tate & Lyle PLC, and The Scoular Company.

These companies maintain a strong presence in the wheat protein market through diverse strategies. For instance, ADM and Cargill leverage their extensive agricultural supply chains to ensure consistent raw material availability, supporting large-scale production and distribution. European firms such as Tereos and Südzucker AG benefit from established regional networks, facilitating efficient market penetration. Specialized companies such as MGP Ingredients focus on niche applications, catering to specific industry needs. Meanwhile, Roquette Frères and Glico Nutrition Co., Ltd. emphasize research and development to enhance product functionalities, aligning with evolving consumer preferences.

The competitive landscape is characterized by continuous innovation and strategic collaborations. Companies such as Kerry Group and Tate & Lyle invest in developing plant-based protein solutions to meet the rising demand for alternative proteins. Manildra Group and Kröner-Stärke GmbH & Co. KG focus on sustainable production practices, appealing to environmentally conscious consumers. Additionally, partnerships between ingredient suppliers and food manufacturers are common, aiming to create tailored solutions that address specific market requirements. This dynamic environment fosters a culture of adaptability, ensuring that companies remain responsive to global trends and consumer demands.

Archer Daniels Midland Company (ADM) is a global food processing and commodities trading corporation headquartered in Chicago, Illinois. The company operates an extensive network of processing facilities and supply chains and provides products and services across various sectors, including food ingredients, animal nutrition, and biofuels. Its focus on sustainability and innovation has positioned it as a key player in the agricultural industry.

Cargill, Incorporated is a privately held American global food corporation based in Minnetonka, Minnesota. With operations spanning agriculture, food, industrial products, and financial services, Cargill plays a significant role in the global food supply chain. The company's diversified portfolio and commitment to sustainability have contributed to its prominence in the market.

List of Key Companies

- Agridient B.V.

- Archer Daniels Midland Company (ADM)

- Batory Foods

- Cargill, Incorporated

- Crespel & Deiters GmbH & Co. KG

- Glico Nutrition Co., Ltd.

- Kerry Group plc

- Kröner-Stärke GmbH & Co. KG

- Manildra Group

- MGP Ingredients, Inc.

- Roquette Frères

- Südzucker AG

- Tate & Lyle PLC

- Tereos

- The Scoular Company

Wheat Protein Industry Developments

- January 2023: Amber Wave began operations at North America's largest wheat protein facility following an investment from Summit Agricultural Group. The company now produces AmberPro Vital Wheat Gluten, providing a domestic gluten source for industries such as commercial bakeries, food ingredient manufacturers, alternative meat producers, pet food processors, and specialty feed companies.

Market Segmentation

By Product Outlook (Revenue-USD Billion, 2020–2034)

- Wheat Gluten

- Wheat Protein Isolate

- Textured Wheat Protein

- Wheat Protein Hydrolysate

By Concentration Outlook (Revenue-USD Billion, 2020–2034)

- 75%

- 80%

- 95%

By Application Outlook (Revenue-USD Billion, 2020–2034)

- Bakery & Confectionary

- Animal Feed

- Dairy

- Personal Care

- Sports & Nutrition

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 7.00 billion |

|

Market Size Value in 2025 |

USD 7.27 billion |

|

Revenue Forecast by 2034 |

USD 10.44 billion |

|

CAGR |

4.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is Report Valuable for Organization?

Workflow/Innovation Strategy: The wheat protein market has been segmented into detailed segments of product, concentration, and application. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Growth/Marketing Strategy: Companies in the wheat protein market focus on growth and marketing strategies that include product innovation, expansion of production capacity, and strategic partnerships. Many firms invest in research and development to enhance the functional properties of wheat protein for applications in food, beverage, and nutrition industries. Market players also emphasize sustainability by adopting eco-friendly processing techniques and sourcing raw materials responsibly. Geographic expansion, particularly in emerging markets, allows companies to tap into rising demand for plant-based proteins. Additionally, digital marketing and consumer education initiatives play a key role in promoting wheat protein-based products to health-conscious consumers.

FAQ's

The wheat protein market size was valued at USD 7.00 billion in 2024 and is projected to grow to USD 10.44 billion by 2034.

The market is projected to register a CAGR of 4.1% during the forecast period, 2024-2034.

North America had the largest share of the market.

The wheat protein market key players include Archer Daniels Midland Company (ADM), Cargill, Incorporated, Tereos, Südzucker AG, MGP Ingredients, Inc., Roquette Frères, Glico Nutrition Co., Ltd., Kerry Group plc, Manildra Group, Kröner-Stärke GmbH & Co. KG, Crespel & Deiters GmbH & Co. KG, Batory Foods, Agridient B.V., Tate & Lyle PLC, and The Scoular Company.

The wheat gluten segment accounted for the larger share of the market in 2024.

Wheat protein is a plant-based protein derived from wheat, primarily composed of gluten proteins such as gliadin and glutenin.