Wireless Audio Devices Market Share, Size, Trends, Industry Analysis Report

By Product (Headphones, Soundbars, Earphones, Earbuds, Headsets, Speakers, Others); By Technology; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3872

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

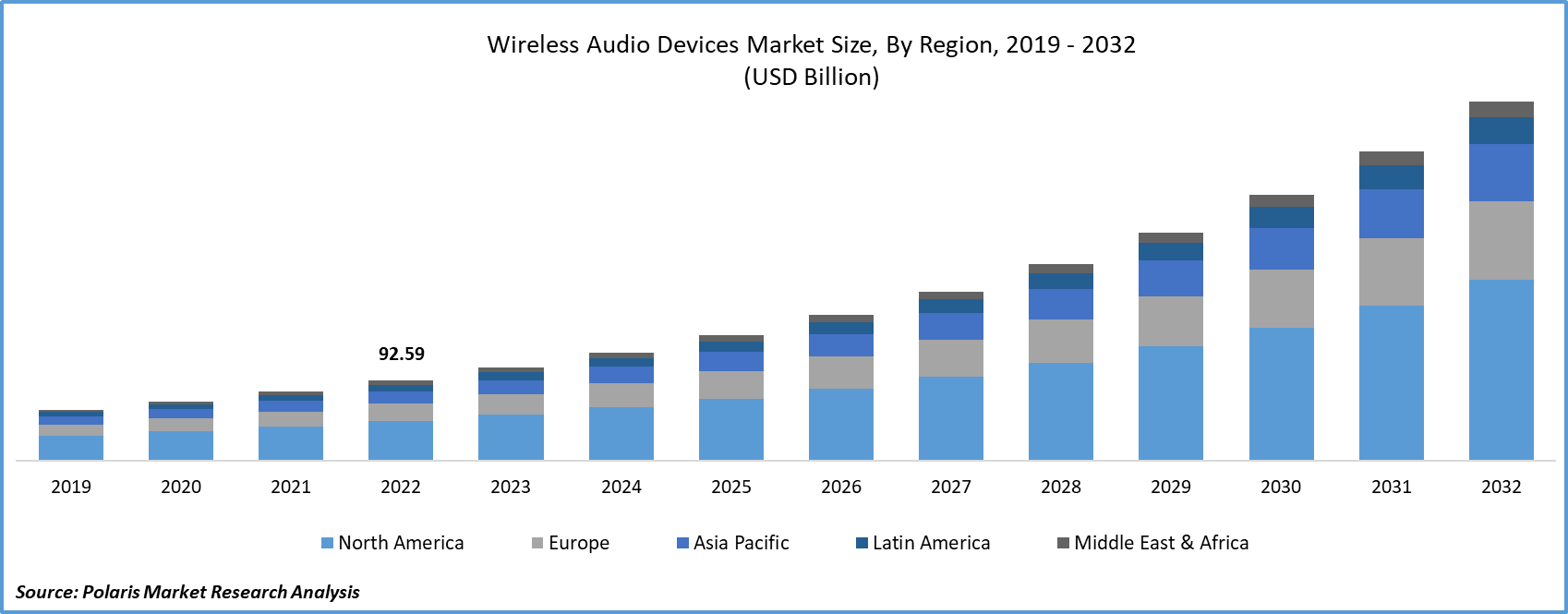

The global wireless audio devices market was valued at USD 107.44 billion in 2023 and is expected to grow at a CAGR of 16.2% during the forecast period.

The advancements in technology present a pathway to enhanced audio quality, reduced latency, and extended battery life for wireless audio devices. These improvements elevate the user experience and encourage greater adoption. Major manufacturers have made substantial investments in elevating the sound quality of wireless audio devices. Features such as top-notch drivers and noise-cancellation technology have garnered consumer interest.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the market are introducing new products to cater to the growing consumer demand.

- For instance, in March 2023, Nothing, a London-based tech company, introduced Ear (2), a pair of wireless earbuds offering high-resolution audio streaming. The product offers updates to its previous version with enhanced audio performance and sound personalization.

The wireless audio market has experienced significant expansion in terms of product variety and availability. Consumers can choose from a wide gamut of wireless headphones, earbuds, and speakers, encompassing diverse features and price points, catering to varied preferences and budget constraints. The trend towards personalized audio experiences, including tailored sound profiles and adaptive noise cancellation, opens up opportunities for manufacturers to cater to individual preferences and hearing profiles. Wireless audio devices can deepen integration with health and fitness applications, offering real-time data and feedback to users during workouts and physical activities.

The widespread deployment of 5G networks is poised to enhance overall connectivity and performance for wireless audio devices. Reduced latency and faster data speeds will further enhance the appeal of wireless audio, especially for streaming high-quality audio content.

The post-COVID-19 era witnessed a transformation in the market. As consumer lifestyles and needs adapted to the changes, the market responded by catering to remote work, online learning, and home entertainment demands. Innovation, price sensitivity, and sustainability considerations played pivotal roles in shaping the evolving market. As society continues to navigate the ongoing changes, the wireless audio devices market remains dynamic, poised to meet evolving consumer preferences and expectations.

Industry Dynamics

Growth Drivers

Increased demand for wireless connectivity and technological advancements are projected to drive the market demand.

The fundamental driver influencing the rising prominence of wireless audio devices is the seamlessness they bring to audio consumption. These devices untether users from the constraints of entangled wires, allowing them to indulge in music, podcasts, and calls with effortless ease.

Ongoing technological advancements in wireless communication, notably Bluetooth technology, have ushered in notable improvements in the quality and reliability of wireless audio connections. Bluetooth 5.0 and 5.1, for instance, have elevated data transfer speeds, prolonged battery life, and overall performance, augmenting the user experience.

The ubiquitous presence of smartphones equipped with Bluetooth capabilities is pivotal in propelling the wireless audio devices market. The innate compatibility of wireless audio devices with smartphones streamlines the connection process, making it hassle-free and user-friendly.

Report Segmentation

The market is primarily segmented based on product, technology, end use, and region.

|

By Product |

By Technology |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

The Earbuds segment held the fastest market share in the 2022

In 2022, the Earbuds segment held the fastest market share. Their compact and easily transportable design makes wireless earbuds an ideal choice for those constantly on the move. They conveniently fit into pockets or petite cases, granting users the luxury of music or call enjoyment anywhere. Makers of wireless earbuds prioritize comfort, crafting lightweight and ergonomic designs that ensure a snug fit even during prolonged use. They often come with a range of ear tip sizes to accommodate different ear shapes. Strides in battery technology have resulted in longer life spans for wireless earbuds. Many models offer several hours of playback on a single charge, and the accompanying charging cases extend usage further. Wireless earbuds come in a myriad of chic designs and colors, elevating them to a fashion accessory for many users. Certain brands offer customization options, allowing individuals to showcase their uniqueness.

By Technology Analysis

Bluetooth segment held the largest market share in 2022

The Bluetooth segment held the largest market share in 2022. The process of pairing Bluetooth devices is straightforward and user-intuitive. Most devices can be paired with minimal effort, making them accessible to a diverse user base. Bluetooth stands as a universally embraced standard, enjoying support from a vast array of devices, encompassing smartphones, tablets, laptops, headphones, speakers, and more. This extensive compatibility ensures that Bluetooth audio devices can effortlessly connect to various sources. Many Bluetooth audio devices facilitate multi-device pairing, enabling users to switch between multiple paired gadgets seamlessly. This functionality proves especially advantageous for individuals who employ their audio devices with several different devices. Over time, Bluetooth audio quality has witnessed substantial enhancements. Bluetooth audio codecs such as aptX, AAC, and LDAC ensure high-quality sound transmission, approaching the audio fidelity of wired connections.

By End-Use Analysis

The personal segment held a significant market revenue share in 2022

In 2022, the personal segment held a significant revenue share. The surge in demand for wireless audio devices designed for personal use has experienced a consistent uptick in recent times. Individuals can enjoy various activities, such as workouts, commutes, or daily routines, without being restricted by the constraints of physical connections. The seamless integration of wireless audio devices with contemporary smartphones is another critical driver. Most modern smartphones come equipped with Bluetooth capabilities, simplifying the connection process and propelling the adoption of wireless audio solutions. The aesthetics and style quotient associated with wireless audio gadgets have garnered significant attention. These devices are available in a multitude of appealing designs, colors, and forms, allowing users to align their audio accessories with their personal preferences and fashion sensibilities.

Regional Insights

North America dominated the largest market in 2022

North America dominated the largest market in 2022. Continuous technological progress has given rise to the development of wireless audio gadgets featuring advanced attributes like noise cancellation, prolonged battery longevity, and flawless connectivity. Furthermore, the rising adoption of music streaming, podcasts, and video content has spurred the desire for wireless audio devices. These products provide a means of enjoying top-tier audio content without the need for cables.

The Asia-Pacific region is expected to experience the fastest growth during the forecast period. The reason behind the growth of this industry can be attributed to the use of smartphones, tablets, and other handheld devices. These devices have become the platforms for streaming audio. Furthermore, with an increase in income in Asian countries, people are spending more on electronic gadgets like wireless headphones, earbuds, and speakers. This rise in consumer spending has been a factor in driving the market expansion. In addition, urbanization continues to accelerate in nations. There is a growing demand for wireless audio solutions that cater to the mobile lifestyles of city dwellers. Consequently, wireless earbuds and headphones have gained popularity among residents.

Key Market Players & Competitive Insights

The wireless audio devices industry is characterized by its fragmentation and is poised for increased competition as multiple players are actively participating. Prominent companies within this market are consistently unveiling novel products as part of their strategy to fortify their market standing. These industry leaders prioritize forming partnerships, enhancing product offerings, and fostering collaborations to secure a competitive advantage over their counterparts and establish a substantial market presence.

Some of the major players operating in the global market include:

- Apple Inc.

- Bose Corporation

- HARMAN International

- LG Electronics Inc.

- Marshall Amplification PLC

- Microsoft Corporation

- Panasonic Corporation

- Poly

- Samsung Electronics Co., Ltd.

- Sennheiser electronic GmbH & Co. KG

- Skullcandy Inc.

- Sonos

- Sony Corporation

- Ultimate Ears (Logitech International S.A.)

- Yamaha Corporation

Recent Developments

- In July 2023, Sony Electronics Inc. introduced its new truly wireless earbuds model, WF-1000XM5. The new product provides enhanced noise canceling by reducing external noise over a wide bandwidth. The product is designed to be smaller and lighter with improved performance.

- In January 2023, JBL launched its new soundbar series, including the JBL Bar 300, JBL Bar 500, JBL Bar 700, JBL Bar 1000, and JBL Bar 1300X. The new offering is developed to enhance the music experience with various options for up-drivers, detachable wireless surround speakers, subwoofers, and 3D surround sound.

Wireless Audio Devices Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 124.71 billion |

|

Revenue forecast in 2032 |

USD 414.66 billion |

|

CAGR |

16.20% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Product, By Technology, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |