Combined Heat and Power Market Size, Share, Trends, Industry Analysis Report

By Fuel (Coal, Natural Gas, Biomass, Nuclear, Others), By Prime Mover, By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 122

- Format: PDF

- Report ID: PM2485

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

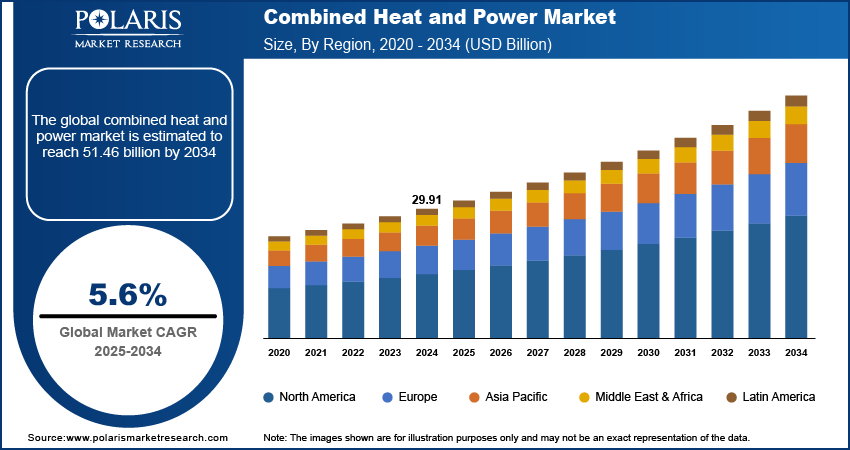

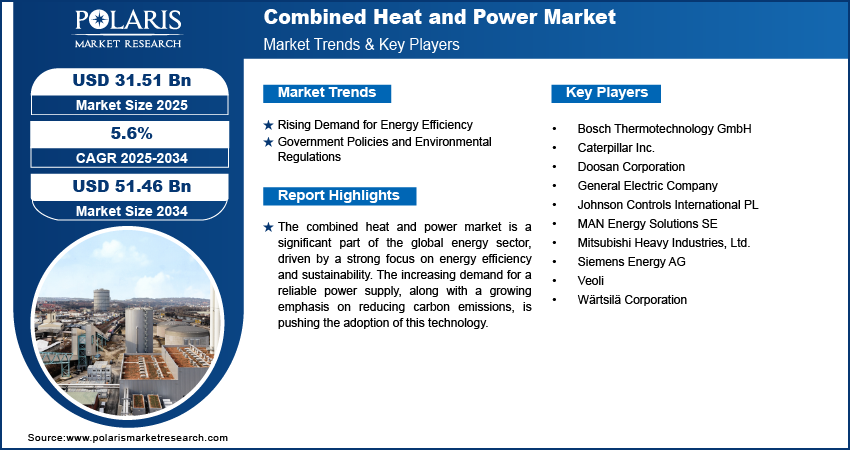

The global combined heat and power (CHP) market size was valued at USD 29.91 billion in 2024 and is anticipated to register a CAGR of 5.6% from 2025 to 2034. The growth is driven by the growing need for energy efficiency and the reduction of carbon emissions. Governments are also encouraging the use of these systems through various incentives and favorable policies. These factors, along with the rising use of natural gas as a cleaner fuel, are pushing the growth forward.

Key Insights

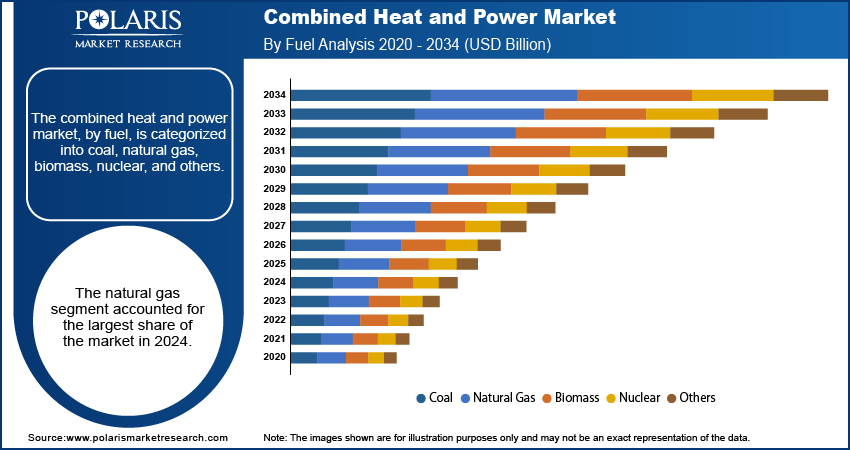

- By fuel, natural gas was the dominant segment in 2024. This is driven by the increasing availability of natural gas and its lower carbon emissions compared to coal and oil, alongside government incentives promoting cleaner energy sources.

- By prime mover, the reciprocating engines held the largest share in 2024, due to their higher efficiency, quicker startup times, and suitability for decentralized power generation, which makes them a preferred choice for small- and medium-scale CHP installations.

- By end use, the industrial segment held the largest share in 2024, as there is a rise in demand for energy efficiency, cost savings, and reliable power supply in energy-intensive industries such as chemicals, food processing, and pulp & paper.

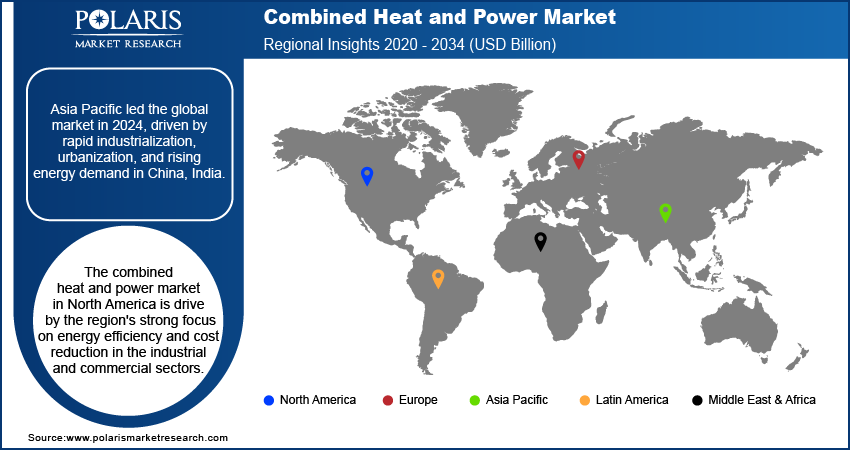

- By region, Asia Pacific held the largest share in 2024, driven by rapid urbanization, government policies supporting cogeneration, and growing energy demand from expanding manufacturing and commercial sectors across countries such as China, India, and Japan.

Industry Dynamics

- The rising global demand for energy efficiency is a key driver. With systems that can reach up to 90% efficiency, this technology significantly reduces energy waste and lowers operating costs for businesses and industries, making it a desirable solution.

- Supportive government policies and incentives are also propelling the industry growth. Many governments offer financial benefits such as subsidies, tax breaks, and grants to encourage the use of these systems, which helps reduce carbon emissions and meet climate goals.

- Another major factor is the growing need for more reliable and resilient power. This technology provides on-site power generation, which helps facilities and critical infrastructure, such as hospitals and data centers, avoid disruptions from power outages.

Market Statistics

- 2024 Market Size: USD 29.91 billion

- 2034 Projected Market Size: USD 51.46 billion

- CAGR (2025–2034): 5.6%

- Asia Pacific: Largest market in 2024

AI Impact on Combined Heat and Power Market

- CHP systems are a significant part of smart energy ecosystems. In this ecosystem, AI is used to coordinate power generation, grid interaction, and heat recovery.

- AI tools analyze various variables, including humidity, temperature, and fuel mix, to optimize heat rate and power output.

- AI systems monitor equipment condition and predict failures before they happen. It helps in reducing downtime and extending asset life.

- AI technology helps CHP operators comply with net-zero goals by integrating renewable energy inputs and fine-tuning combustion processes.

Combined heat and power (CHP), also known as cogeneration, is an efficient process that generates electricity and useful thermal energy from a single fuel source. It does so by capturing and using the heat that is a natural byproduct of generating electricity. This process significantly increases overall energy efficiency, reduces energy waste, and lowers a facility's operating costs and greenhouse gas emissions compared to producing heat and power separately.

A few drivers in the combined heat and power are the growing trend toward decentralized energy systems and continuous technological advancements. Decentralized energy systems involve generating power closer to where it's consumed, which helps reduce the strain on large, centralized power grids. This makes the power supply more reliable and helps prevent disruptions from grid failures. The development of smaller, more modular CHP systems allows them to be used in a broader range of places, from industrial facilities to local campuses and even residential buildings.

Technological advancements have become a key factor. Innovations in areas such as prime movers, such as reciprocating engines and fuel cells, have greatly improved the performance and efficiency of these systems. Furthermore, integrating these systems with smart grids and other digital controls allows for remote monitoring and better management, making the technology more user-friendly and effective. A good example of how technology is improving is the growing use of fuel cells in these systems. Fuel cells, which produce electricity through a chemical reaction, offer high efficiency, low emissions, and quiet operation. Their use in these systems is gaining attention as a clean solution, especially when powered by hydrogen, which helps businesses and homeowners lower their carbon footprint.

Drivers and Trends

Rising Demand for Energy Efficiency: The increasing need for energy efficiency is a major driver for the growth of the combined heat and power industry. Industries and commercial buildings are constantly seeking ways to lower their operating costs and improve their energy use. By generating both electricity and useful heat from a single fuel source, CHP systems can achieve much higher overall efficiency than traditional methods that produce electricity and heat separately. This helps reduce energy waste and allows businesses to save money.

According to a 2024 report by the International Energy Agency (IEA), titled "Energy Efficiency 2024," global energy efficiency improvements in 2023 and 2024 were weak, showing only about a 1% improvement. This finding highlights a clear opportunity for more efficient technologies to enter the sector and meet the growing demand for better energy use. The need for more efficient systems continues to grow, and CHP technology offers a proven way to meet that need. This driver is boosting the industry growth as businesses and other large energy users focus on adopting solutions to reduce their energy consumption and costs.

Government Policies and Environmental Regulations: Government policies and strict environmental regulations are also key drivers. Many governments around the world are pushing for cleaner energy and lower carbon emissions. They are putting policies in place and offering incentives to encourage the use of technologies such as CHP. These policies include tax credits, grants, and other financial benefits that make it more affordable for companies to adopt these systems.

India’s Energy Conservation and Sustainable Building Code for commercial buildings aim to reduce electricity consumption. Such measures create a favorable environment for CHP technology by encouraging businesses to invest in efficient solutions to comply with new regulations. This ongoing support from governments and the need to meet environmental targets are strong factors driving the growth forward.

Segmental Insights

Fuel Analysis

Based on fuel, the segmentation includes coal, natural gas, biomass, nuclear, and others. The natural gas segment held the largest share in 2024. Its dominance can be attributed to its widespread availability and relatively low cost compared to other fossil fuels. Natural gas is also considered a cleaner-burning fuel, which aligns with global efforts to reduce carbon emissions and improve air quality. The efficiency of natural gas-powered systems is another key factor, as they can convert a large percentage of fuel energy into useful heat and electricity. This makes them a highly efficient and cost-effective choice for various applications, including industrial, commercial, and residential sectors, where there is a constant demand for both heat and power. The established infrastructure for natural gas distribution in many regions also makes it an easy and reliable option for adopting these energy systems.

The biomass segment is anticipated to register the highest growth rate during the forecast period. This segment is gaining traction due to the increasing push for renewable energy sources and the need to move away from fossil fuels. Biomass fuels, which come from organic materials such as agricultural waste, wood, and other plant matter, are considered carbon-neutral. Using them in combined heat and power systems helps meet environmental goals and government regulations aimed at reducing greenhouse gas emissions. The sector for this type of fuel is also being driven by supportive government policies and financial incentives for renewable energy projects. As companies and governments seek more sustainable and eco-friendly energy solutions, the biomass segment is becoming an increasingly important part.

Prime Mover Analysis

Based on prime mover, the segmentation includes gas turbine, fuel cell, reciprocating engine, combined cycle, steam turbine, and others. The reciprocating engine segment held the largest share in 2024 as they are a highly versatile and reliable technology, suitable for a wide range of applications and power outputs. Reciprocating engines are particularly well-suited for smaller-scale and distributed energy systems, which are becoming increasingly popular. They are a mature and well-understood technology, and their efficiency and performance have improved over the years. This makes them a trusted choice for many industrial, commercial, and even residential projects. The established supply chain and ease of maintenance also contribute to their strong position.

The fuel cells segment is anticipated to register the highest growth rate during the forecast period. This growth is driven by the increasing global focus on clean energy solutions and the push for reduced emissions. Fuel cells use a chemical reaction to produce electricity and heat, with water as the only byproduct when using hydrogen, making them an ultra-low or zero-emission technology. As environmental regulations become stricter and companies seek to improve their sustainability, automotive fuel cells are becoming a more attractive option. While they are newer and more expensive technologies compared to others, ongoing research and development are making them more cost-effective and efficient. Their silent operation and high efficiency, especially in smaller applications, are also helping to drive their adoption.

End Use Analysis

Based on end use, the segmentation includes commercial, industrial, residential, utilities, and others. The industrial segment held the largest share in 2024. Using a single system to provide both power and heat is highly efficient for these operations, leading to significant cost savings and better energy management. The industrial sector's large energy requirements and its focus on operational efficiency make it a primary user of this technology. The ability of these systems to provide reliable, on-site power is also a major benefit for factories and plants, helping to prevent production losses from power grid issues. This segment's dominance is expected to continue due to the ongoing push for sustainability and cost reduction in manufacturing.

The utilities segment is anticipated to register the highest growth rate during the forecast period. Utilities are facing increasing pressure to modernize their infrastructure and adopt more efficient, sustainable, and flexible energy solutions. As traditional power grids become more strained, utilities are turning to distributed energy resources, and combined heat and power systems are a key part of this shift. These systems can be integrated into the existing grid to provide local power and heat, which improves the overall reliability and efficiency of the energy supply. Furthermore, the growing demand for cleaner energy and the need to reduce emissions from large power plants are encouraging utilities to invest in these advanced solutions, which can help them meet environmental goals and serve their customers better.

Regional Analysis

The Asia Pacific combined heat and power market accounted for the largest share in 2024. The growth is fueled by rapid industrialization and urbanization across the region, which has created a massive demand for energy. Governments in countries throughout the area are focusing on energy efficiency and are introducing new regulations and policies to combat air pollution and reduce emissions. This has led to a major shift toward more efficient energy systems, with CHP being a key solution for industrial and commercial users.

China Combined Heat and Power Market Insights

China dominated the Asia Pacific market for combined heat and power in 2024. The country’s ongoing industrial growth and massive energy consumption have made it a leader in CHP deployment. China's government has implemented policies to encourage the use of these systems to help meet its energy and environmental goals. The country has a huge number of industrial plants that require both power and process heat, making it ideal for CHP technology. The continued development of new industries and infrastructure in China will further support the expansion.

North America Combined Heat and Power Market Trends

The industry in North America is driven by the region's strong focus on energy efficiency and cost reduction in the industrial and commercial sectors. Businesses are seeking ways to lower their energy bills and improve the reliability of their power supply. The presence of a mature energy infrastructure and the widespread availability of natural gas, a common fuel for these systems, also support the growth. North America has seen an increase in the number of CHP installations, especially in sectors such as healthcare, data centers, and universities, which have a constant need for both electricity and thermal energy.

U.S. Combined Heat and Power Market Outlook

The U.S. holds the largest share of the industry in North America and is a key contributor to regional growth. The country's strong industrial and commercial sectors, combined with a focus on sustainable energy, are major drivers. Government policies and incentives at both the state and federal levels also encourage the adoption of these systems. The U.S. has a high number of CHP producers and distributors, and a number of states have specific regulations that promote the use of this technology, particularly in industries that require continuous power and heat.

Europe Combined Heat and Power Market Analysis

Europe is a leader in the adoption of combined heat and power, with a long history of using this technology to improve energy efficiency. The region's strong environmental regulations and ambitious decarbonization goals are significant factors in its sector development. Many European countries have established policies and support schemes that promote CHP, especially for district heating networks. The market is also driven by the need to modernize aging energy infrastructure and transition away from traditional, less efficient power plants.

In Europe, the Germany combined heat and power market held the major revenue share. The German government has a dedicated law to support CHP and has set clear targets for its use. This has led to significant investments in new systems, particularly for large district heating networks. The country's strong industrial base, especially in the chemical and refining sectors, also has a high demand for efficient on-site power and heat. Germany's focus on transitioning to a cleaner energy system makes it a key example of how a country can successfully integrate CHP technology.

Key Players and Competitive Insights

The combined heat and power market features a competitive landscape with several major global players. These companies, including Siemens Energy AG, General Electric Company, Caterpillar Inc., Wärtsilä Corporation, and Mitsubishi Heavy Industries, Ltd., are at the forefront of providing diverse solutions across different end-use sectors. It is also seeing strong competition from other companies such as Veolia, MAN Energy Solutions SE, and Johnson Controls International PLC. Companies are focused on developing more efficient and flexible systems, often by incorporating advanced digital controls and technologies. The competition is driven by innovation in prime movers, with a particular focus on technologies such as fuel cells and microturbines, which are gaining popularity due to their low emissions and high efficiency.

A few prominent companies in the industry include Siemens Energy AG, General Electric Company, Caterpillar Inc., Wärtsilä Corporation, Veolia, Mitsubishi Heavy Industries, Ltd., MAN Energy Solutions SE, Bosch Thermotechnology GmbH, Johnson Controls International PLC, and Doosan Corporation.

Key Players

- Bosch Thermotechnology GmbH

- Caterpillar Inc.

- Doosan Corporation

- General Electric Company

- Johnson Controls International PL

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- Siemens Energy AG

- Veoli

- Wärtsilä Corporation

Combined Heat and Power Industry Developments

August 2023: GE Vernova secured two orders for a total of four gas turbines to be used in two natural gas-fired combined heat and power projects in China.

In July 2021, Capstone Green Energy signed a 10-year service contract for 1.2 MWs of micro-turbines in New York City. The skyscraper's 1.2 MW energy efficiency plant consists of two Capstone C600S microturbines with Capstone's Integrated Heat Recovery Modules.

In March 2021, The European Marine Energy Centre (EMEC) and Highlands and Islands Airports Limited (HIAL) partnered to decarbonize combined heat and power at Kirkwall Airport through green hydrogen technology.

In February 2021, Siemens signed an agreement with the Guangdong Energy Group to provide F-class gas turbine island equipment for the China Zhaoqing Dinghu Combined Heat and Power (CHP) generation project.

In February 2021, Wärtsilä signed an agreement with Kraftwerke Mainz-Wiesbaden to deliver a 100 MW CHP plant to supply excess combined heat generated during power generation into the Mainz district heating network of almost 40,000 modern single-family homes.

Combined Heat and Power Market Segmentation

By Fuel Outlook (Revenue – USD Billion, 2020–2034)

- Coal

- Natural Gas

- Biomass

- Nuclear

- Others

By Prime Mover Outlook (Revenue – USD Billion, 2020–2034)

- Gas Turbine

- Fuel Cell

- Reciprocating Engine

- Combined Cycle

- Steam Turbine

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Commercial

- Industrial

- Residential

- Utilities

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Combined Heat and Power Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 29.91 billion |

|

Market Size in 2025 |

USD 31.51 billion |

|

Revenue Forecast by 2034 |

USD 51.46 billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 29.91 billion in 2024 and is projected to grow to USD 51.46 billion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

Asia Pacific dominated the revenue share in 2024.

A few key players in the market include Siemens Energy AG, General Electric Company, Caterpillar Inc., Wärtsilä Corporation, Veolia, Mitsubishi Heavy Industries, Ltd., MAN Energy Solutions SE, Bosch Thermotechnology GmbH, Johnson Controls International PLC, and Doosan Corporation.

The natural gas segment accounted for the largest share of the market in 2024.

The fuel cell segment is expected to witness the fastest growth during the forecast period.