4D Imaging Radar Market Size, Share, Trends, Industry Analysis Report

By Type (Short Range Radar, Medium Range Radar, and Long Range Radar), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 120

- Format: PDF

- Report ID: PM5890

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

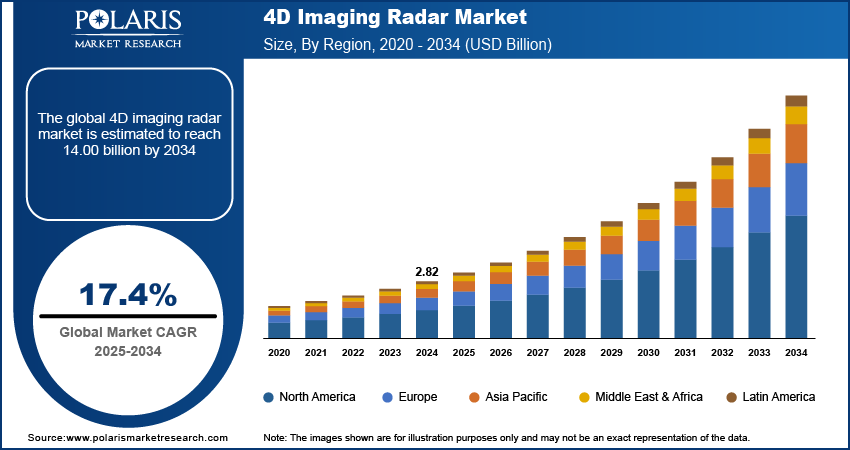

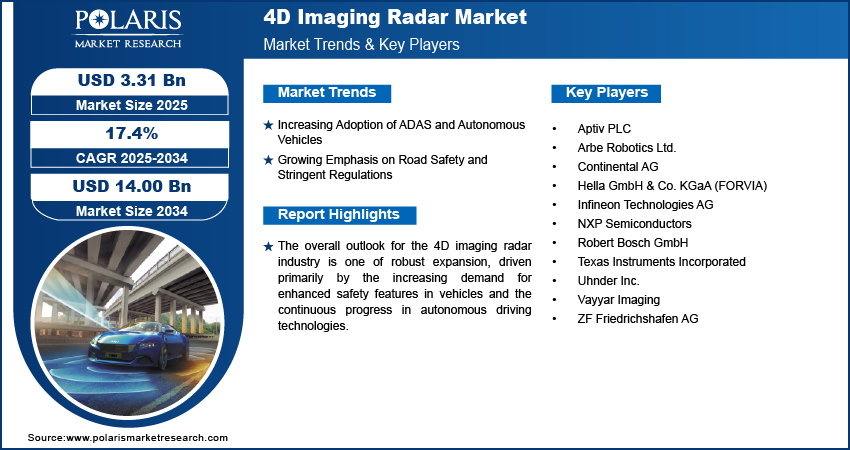

The global 4D imaging radar market size was valued at USD 2.82 billion in 2024, and is anticipated to register a CAGR of 17.4% from 2025 to 2034. The growing demand for advanced driver assistance systems (ADAS) and autonomous vehicles is a major driver for the 4D imaging radar industry growth.

The 4D imaging radar market involves advanced sensor technology that goes beyond traditional 3D radar by adding vertical (elevation) information, allowing for a more detailed and precise understanding of an object's height and exact position. This technology uses radio waves to create a comprehensive four-dimensional picture of the surrounding environment, including range, azimuth, elevation, and velocity data.

To Understand More About this Research: Request a Free Sample Report

Continuous advancements in radar technology are significantly propelling the 4D imaging radar market expansion. These improvements include higher resolution, better signal processing capabilities, and more compact designs. Innovations such as the development of advanced algorithms and the use of denser antenna arrays (MIMO) enable 4D imaging radar to provide an ultra-high-resolution picture of the environment, making it capable of distinguishing between very close objects.

The global trend toward developing smart cities and intelligent transportation systems boosts the demand for 4D imaging radar systems. Beyond automotive applications, 4D imaging radar is being increasingly adopted for various infrastructure-related uses such as traffic monitoring, intelligent intersection management, and public safety. Its ability to perform reliably in diverse weather conditions and provide real-time, comprehensive data makes it an ideal sensor for optimizing urban mobility and enhancing security.

Industry Dynamics

Increasing Adoption of ADAS and Autonomous Vehicles

The rising integration of advanced driver assistance systems (ADAS) and the ongoing development of autonomous vehicles are significant forces behind the growth. As vehicles become more automated, the need for highly reliable and precise environmental perception sensors increases dramatically. 4D imaging radar provides superior capabilities in challenging weather conditions and offers better resolution compared to traditional radar, making it essential for complex ADAS functions and for achieving higher levels of autonomous driving.

Research published in Scientific Data in March 2025, titled "Dual Radar: A Multi-modal Dataset with Dual 4D Radar for Autonomous Driving," highlights that 4D radar offers higher point cloud density and accurate vertical resolution, making it very promising for autonomous driving in difficult environments. The study further indicates its advantage over conventional 3D radar in environmental perception for autonomous vehicles. This ongoing technological improvement and its critical role in enhancing vehicle perception directly drive the demand for 4D imaging radar in the automotive sector.

Growing Emphasis on Road Safety and Stringent Regulations

The global push for improved road safety and the imposition of stringent government regulations drive the market. Governments and international organizations are actively working to reduce road accidents and fatalities by mandating advanced safety features in new vehicles. 4D imaging radar, with its ability to provide accurate and robust object detection, is becoming a crucial component in meeting these evolving safety standards.

According to the World Health Organization's (WHO) "Global status report on road safety 2023," road traffic injuries remain a leading cause of death globally, with 1.19 million annual fatalities. The report emphasizes the need for urgent action and the application of proven measures to reduce these deaths. Such dire statistics and the continuous efforts by organizations such as WHO to improve road safety directly encourage the adoption of advanced sensor technologies such as 4D imaging radar. This regulatory environment and the societal demand for safer roads contribute significantly to the growth of the 4D imaging radar market.

Segmental Insights

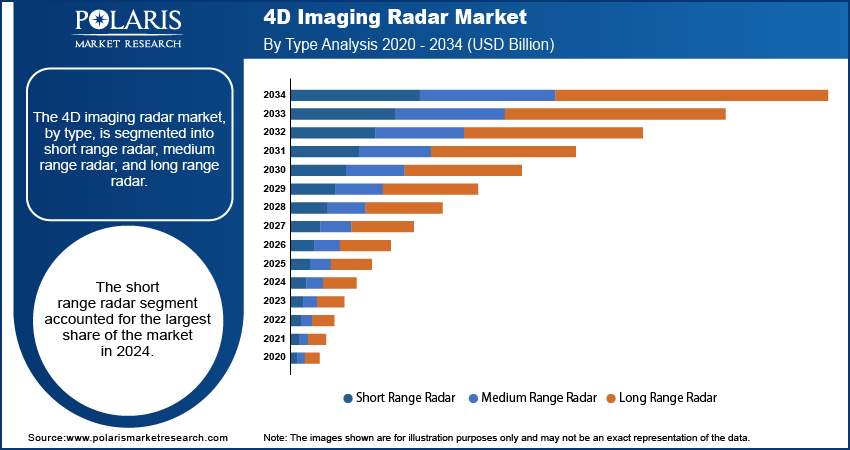

Type Analysis

The short range radar segment held the largest share in 2024. This is because short range radar plays a vital role in various close-proximity automotive applications, which are increasingly common in modern vehicles. These include features such as parking assistance, blind-spot monitoring, and pedestrian detection, especially in urban areas. The ability of short range 4D imaging radar to provide highly precise object detection and spatial awareness, even in challenging conditions such as heavy rain, fog, or direct sunlight, makes it ideal for enhancing safety during low-speed maneuvers and urban navigation.

The medium-range radar segment is anticipated to grow at the highest growth rate during the forecast period. This growth is driven by the rising demand for advanced safety features that require a balance between range and resolution, which medium-range radar effectively provides. Functions such as adaptive cruise control and collision avoidance systems heavily rely on the accurate object tracking and identification capabilities of medium-range 4D imaging radar. As these ADAS features become more sophisticated and widely adopted across vehicle segments, the demand for medium range radar is projected to increase in the coming years.

Application Analysis

The automotive segment held the largest share in 2024, due to the critical role 4D imaging radar plays in modern vehicle safety and autonomous driving technologies. Its ability to provide high-resolution, real-time data on distance, speed, azimuth, and elevation of objects makes it indispensable for ADAS such as automatic emergency braking, adaptive cruise control, and parking assistance. As car manufacturers continue to integrate more sophisticated ADAS features and move toward higher levels of autonomous driving, the demand for 4D imaging radar in passenger and commercial vehicles remains consistently high, driving this segment's leading position.

The traffic monitoring and management segment is anticipated to grow at the highest growth rate during the forecast period. This rapid expansion is fueled by the global trend toward smart cities and the increasing need for efficient and intelligent urban infrastructure. 4D imaging radar offers superior capabilities for real-time traffic flow optimization, congestion reduction, and accident prevention. For example, by accurately detecting vehicle speeds, classifying different types of vehicles, and tracking their trajectories in all weather conditions, 4D imaging radar systems enable authorities to make informed decisions for traffic signal adjustments, speed limit enforcement, and overall urban mobility.

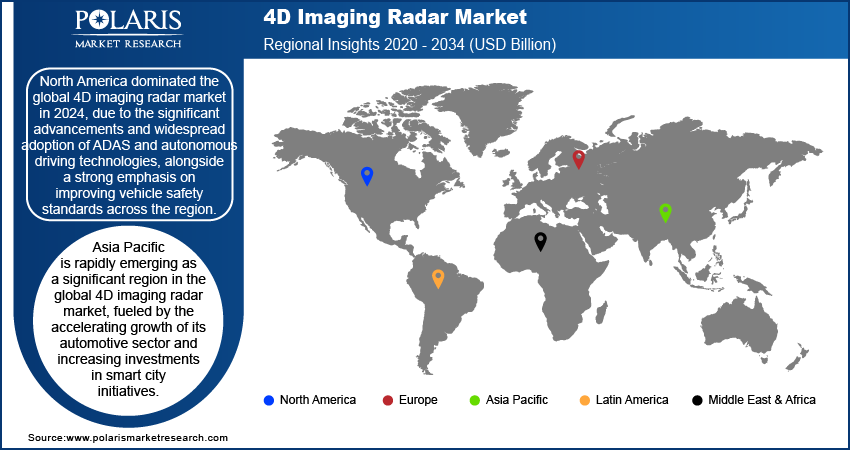

Regional Analysis

The North America 4D imaging radar market held the largest share in 2024, largely due to the rapid advancements and adoption of advanced driver assistance systems (ADAS) and autonomous driving technologies. There is a strong focus on enhancing vehicle safety, which drives the demand for sophisticated sensor solutions such as 4D imaging radar. The presence of major automotive manufacturers and technology providers in the region further contributes to its prominent position, as these companies are actively investing in research, development, and integration of advanced radar systems into their vehicle offerings.

U.S. 4D Imaging Radar Market Insight

In North America, the U.S. leads in the 4D imaging radar landscape. The country's strong automotive radar sector and a proactive approach to developing self-driving vehicles are key factors influencing this. Stricter safety regulations and increasing consumer awareness about the benefits of advanced safety features are accelerating the integration of 4D imaging radar into new car models. Additionally, a robust ecosystem of technology companies specializing in radar and sensor fusion supports the ongoing innovation and deployment of these systems across various applications, making the U.S. a vital hub for the industry's growth.

Europe 4D Imaging Radar Market Trends

Europe represents a substantial share of the global 4D imaging radar market, driven by its well-established automotive sector and a strong emphasis on vehicle safety standards. European countries are at the forefront of implementing strict regulations for automotive safety, which necessitates the adoption of advanced sensing technologies. The region's commitment to reducing road accidents and promoting intelligent transportation systems encourages the integration of 4D imaging radar in passenger cars and commercial vehicles. This regulatory push, combined with ongoing technological advancements, solidifies Europe's position as a key market.

Germany 4D Imaging Radar Market Insights

Germany, in particular, is a major player in the European landscape, This is due to its highly innovative and technologically advanced automotive sector, and home to several leading car manufacturers and Tier 1 suppliers. These companies are heavily investing in research and development to integrate advanced radar solutions into their vehicle platforms, especially for high-end and luxury segments. The country's strong engineering capabilities and focus on precision and performance contribute significantly to the development and adoption of sophisticated 4D imaging radar systems for next-generation mobility solutions.

Asia Pacific 4D Imaging Radar Market Overview

The Asia Pacific is rapidly emerging as a significant region in the global 0market, fueled by the accelerating growth of its automotive sector and increasing investments in smart city initiatives. The region is witnessing a surge in demand for advanced vehicle safety features and autonomous driving capabilities, particularly in countries with large and expanding automotive markets. This, coupled with government support for technological advancements and smart infrastructure development, is propelling the adoption of 4D imaging radar across various applications beyond just automotive. The China 4D imaging radar market stands out as a dominant country in Asia Pacific. Its vast domestic automotive market and significant government support for developing autonomous driving and intelligent transportation systems are key drivers. Local automotive manufacturers and technology companies in China are aggressively investing in and deploying advanced radar solutions, often collaborating to accelerate the integration of 4D imaging radar into both passenger and commercial vehicles. This strong internal demand and a focus on domestic innovation position China as a powerhouse in the regional development of 4D imaging radar technology.

Key Players and Competitive Insights

The competitive landscape of the 4D imaging radar industry is marked by a mix of established automotive suppliers, semiconductor giants, and innovative startups. Companies are intensely focused on developing advanced solutions that offer higher resolution, wider fields of view, and improved performance in challenging environmental conditions. This competitive environment drives continuous innovation in chip design and signal processing algorithms.

A few prominent companies in the market include Continental AG, Robert Bosch GmbH, ZF Friedrichshafen AG, Aptiv PLC, Hella GmbH & Co. KGaA (FORVIA), Texas Instruments Incorporated, NXP Semiconductors, Infineon Technologies AG, Arbe Robotics Ltd., Vayyar Imaging, and Uhnder Inc.

Key Players

- Aptiv PLC

- Arbe Robotics Ltd.

- Continental AG

- Hella GmbH & Co. KGaA (FORVIA)

- Infineon Technologies AG

- NXP Semiconductors

- Robert Bosch GmbH

- Texas Instruments Incorporated

- Uhnder Inc.

- Vayyar Imaging

- ZF Friedrichshafen AG

Industry Developments

May 2023: NXP Semiconductors N.V. announced that NIO Inc. adopted its advanced automotive radar technology, featuring an innovative 4D imaging radar solution. This advancement improved front radar capabilities, enabling vehicles to detect and identify objects—such as other cars and pedestrians—at distances of up to 300 meters across diverse driving conditions.

April 2025: HiRain Technologies launched its LRR615, a production-intent long-range imaging radar system powered by Arbe's chipset. This system, designed for L2+ and L3 autonomy applications in the Chinese market, signifies a significant step toward commercial deployment of Arbe's technology.

4D Imaging Radar Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Short Range Radar

- Medium Range Radar

- Long Range Radar

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Automotive

- Aerospace & Defense

- Security & Surveillance

- Traffic Monitoring & Management

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

4D Imaging Radar Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.82 billion |

|

Market Size in 2025 |

USD 3.31 billion |

|

Revenue Forecast by 2034 |

USD 14.00 billion |

|

CAGR |

17.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.82 billion in 2024 and is projected to grow to USD 14.00 billion by 2034.

The global market is projected to register a CAGR of 17.4% during the forecast period.

North America dominated the market share in 2024.

A few key players in the market include Continental AG, Robert Bosch GmbH, ZF Friedrichshafen AG, Aptiv PLC, Hella GmbH & Co. KGaA (FORVIA), Texas Instruments Incorporated, NXP Semiconductors, Infineon Technologies AG, Arbe Robotics Ltd., Vayyar Imaging, and Uhnder Inc.

The short range radar segment accounted for the largest share of the market in 2024.

The traffic monitoring and management segment is expected to witness the fastest growth during the forecast period.