Amphoteric Surfactants Market Size, Share, & Industry Analysis Report

: By Type (Betaine, Amine Oxide, Amphoacetate, Amphopropionate, and Others), Application, End-user Industry, and Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM5220

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

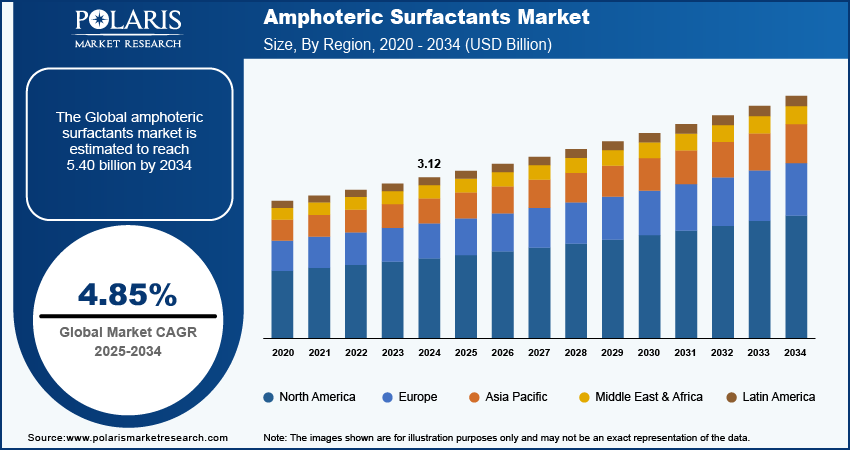

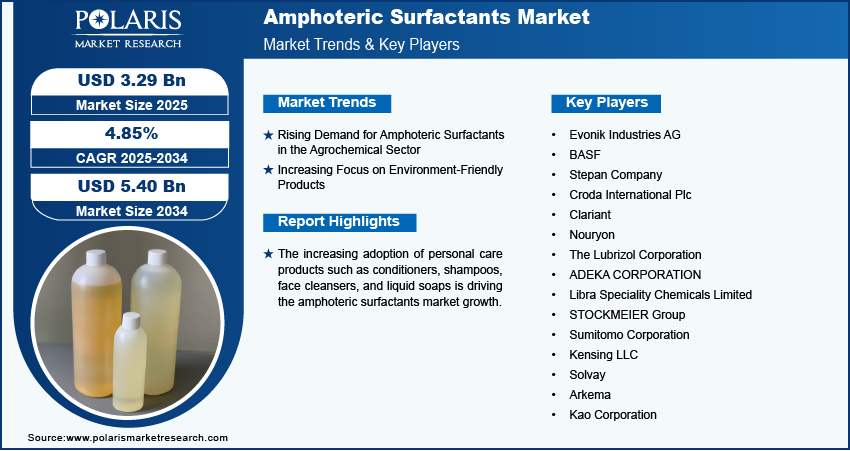

The global amphoteric surfactants market size was valued at USD 3.12 billion in 2024, exhibiting a CAGR of 4.85% during 2025–2034. The market is driven by increasing use in personal care and cleaning products, rising environmental awareness, and demand for mild and multifunctional surfactants.

Key Insights

- The betaine segment captured a major market share in 2024, driven by its extensive use in personal care and household cleaning products due to its mildness and cleaning efficiency.

- The personal care segment led the market, fueled by growing consumer preference for gentle yet effective skincare and haircare products.

- The Asia-Pacific region is the fastest-growing and largest market, supported by rising demand across personal care, household cleaning, and industrial sectors.

- China dominates the Asia-Pacific market, due to its large manufacturing base, strong domestic consumption, and focus on export-driven production.

Industry Dynamics

- The growing demand for mild and biodegradable cleaning products, combined with increasing consumer awareness of eco-friendly ingredients, is driving the adoption of amphoteric surfactants in the personal care and household cleaning industries.

- Expansion of the cosmetics and pharmaceutical sectors is driving the need for versatile surfactants with conditioning and antimicrobial properties.

- High production costs and complex manufacturing processes limit widespread adoption, especially in price-sensitive markets.

- Rising demand for natural and sustainable surfactants presents opportunities for innovation and growth in emerging markets.

Market Statistics

- 2024 Market Size: USD 3.12 billion

- 2034 Projected Market Size: USD 5.40 billion

- CAGR (2025-2034): 4.85%

- Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Amphoteric surfactants are unique compounds that contain cationic and anionic-charged hydrophilic groups within the same molecule. This dual nature of amphoteric surfactants allows them to show different properties based on the pH of their environment, making them versatile in various applications such as cosmetics and home cleaning.

The increasing adoption of personal care products such as conditioners, shampoos, face cleansers, and liquid soaps is driving the amphoteric surfactants market growth. Amphoteric surfactants are known for their mildness and skin-friendly properties, making them ideal for use in products such as shampoos, body washes, and facial cleansers.

The growing demand for household cleaning detergents is estimated to expand the global amphoteric surfactants market. Household cleaning detergents need to tackle various types of dirt and stains, from greasy kitchen residues to bathroom surfaces. Amphoteric surfactants are highly versatile in comparative to natural surfactants and effectively clean a wide range of dirt and stains due to their ability to switch between anionic and cationic behavior depending on the pH of the solution. This makes amphoteric surfactant a crucial element in household cleaning detergents.

The amphoteric surfactants market is driven by the rising industrialization across the globe. According to data published in the 29th edition of the International Yearbook of Industrial Statistics, a 2.3% growth in industrial sectors was registered in 2023, encompassing manufacturing, mining, electricity, water supply, waste management, and other utilities. Industries require surfactants for various functions, including cleaning, emulsification, foaming, and wetting. Amphoteric surfactants are valued for their versatility and ability to perform effectively across various pH conditions, making them suitable for diverse industrial applications such as textile processing, oil recovery, and metal cleaning.

Market Dynamics:

Rising Demand for Amphoteric Surfactants in the Agrochemical Sector

Amphoteric surfactants improve the wetting and spreading properties of agrochemical products. This helps ensure that pesticides, herbicides, and fungicides are evenly distributed and penetrate plant surfaces effectively, leading to improved efficacy. This encourages farmers to adopt agrochemical products that contain amphoteric surfactants. Thus, rising adoption in the agrochemical sector boosts the market.

Increasing Focus on Environment-Friendly Products

The demand for sustainable and eco-friendly products is increasing across various sectors globally. Amphoteric surfactants have a lower toxicity profile for aquatic life and other organisms. This reduced environmental footprint makes them attractive for formulations where environmental impact is a major concern. Therefore, increasing focus on sustainable and environment-friendly products would create lucrative opportunities for the market during the forecast period.

Segment Analysis

By Type Insights

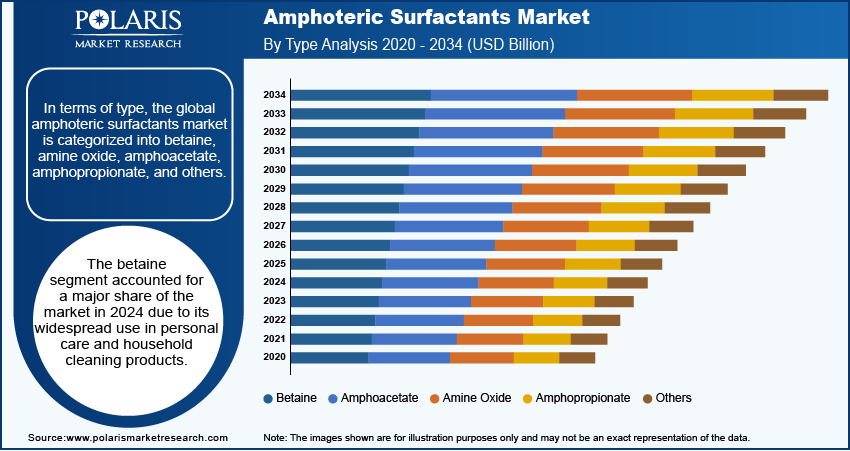

In terms of type, the global amphoteric surfactant market is categorized into betaine, amine oxide, amphoacetate, amphopropionate, and others. The betaine segment accounted for a major share of the market in 2024 due to its widespread use in personal care and household cleaning products. Betaines, such as cocamidopropyl betaine, are well-regarded for their skin-friendly properties, which make them ideal for use in shampoos, body washes, and facial cleansers. Additionally, it offers excellent foaming and conditioning properties, contributing to their popularity in various cleaning products. These properties of betaine further solidify its major market position.

The amphoacetate segment is expected to grow at a robust pace in the coming years, owing to the increasing consumer demand for eco-friendly and biodegradable ingredients. Amphoacetates align with the rising trend toward sustainability as they are derived from renewable resources and have low toxicity and effective performance across various pH levels. Furthermore, the ability of amphoacetates to enhance product performance while adhering to stricter environmental regulations contributes to their growing adoption.

By Application Insights

In terms of application, the global amphoteric surfactants market is segmented into personal care, home care and cleaning, oil field chemicals, agriculture, and others. The personal care segment held the largest market share in 2024 due to the increasing consumer preference for gentle and effective skincare and haircare products. Ingredients such as cocamidopropyl betaine are widely used in shampoos, conditioners, and facial cleansers, as they offer mildness and skin compatibility. These surfactants offer excellent foaming and conditioning properties, which enhance the sensory experience of personal care products. Moreover, the rising trend toward natural and non-irritating formulations drives the segment expansion.

The home care and cleaning segment is estimated to register a significant CAGR during the projected period, owing to the increasing emphasis on environmentally friendly and nontoxic cleaning products. Consumers are increasingly opting for household cleaners that are effective and safe for the environment. This increases the demand for amphoteric surfactants that offer strong performance with minimum environmental impact.

Regional Analysis

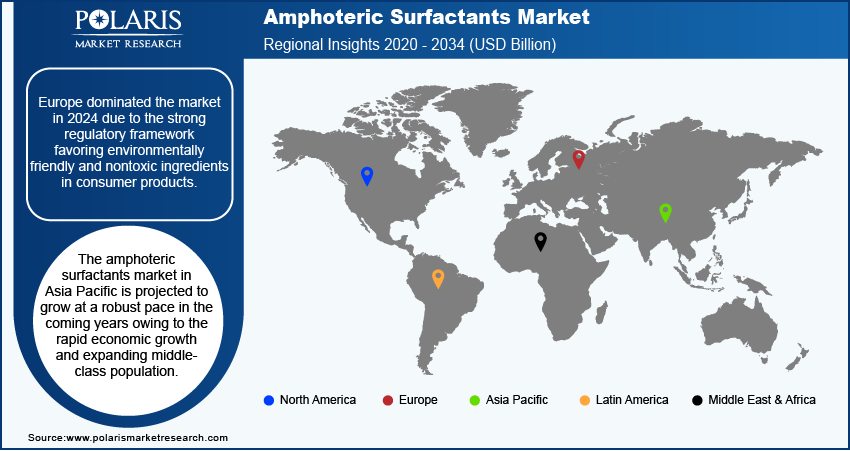

Asia-Pacific Amphoteric Surfactants Market is the fastest-growing and largest regional market, driven by rising demand from personal care, household cleaning, and industrial applications. The region benefits from high consumption of shampoos, facial cleansers, liquid soaps, and baby care products—all of which increasingly incorporate amphoteric surfactants like betaines and amine oxides due to their mildness and compatibility with other surfactants. Additionally, the growth of the textile, agrochemical, and oilfield sectors further supports demand.

China Amphoteric Surfactants Market dominates the Asia-Pacific industry due to its expansive manufacturing base, strong domestic demand, and export-oriented production capacity. Chinese consumers’ growing preference for mild and skin-friendly ingredients in personal care products has led to a surge in the use of these surfactants in shampoo, body wash, and baby care formulations. Major domestic brands, as well as major FMCG companies operating in China, are reformulating products to include these surfactants due to their excellent foaming and conditioning properties. Moreover, China’s robust chemical production infrastructure allows for cost effective production of surfactant raw materials. Rising environmental awareness and regulatory shifts—such as increased scrutiny over traditional anionic surfactants—are prompting formulators to favor biodegradable and less irritating amphoteric alternatives. Furthermore, the increasing urban middle-class population and rapid e-commerce growth have spurred demand for premium home and personal care products. Going forward, China’s position as both a producer and consumer of amphoteric surfactants will remain strong, supported by advancements in green chemistry, sustainable sourcing, and favorable government policies for the specialty chemicals sector.

.

Europe amphoteric surfactants market is expanding significantly, driven by stringent environmental regulations, consumer demand for eco-friendly formulations, and innovation in personal care and industrial cleaning sectors. European regulations under REACH and the EU Ecolabel encourage the use of low-toxicity, biodegradable surfactants, positioning amphoteric surfactants as a preferred alternative to harsher chemical agents. Additionally, the growing adoption of sulfate-free and allergen-free products is a key market driver.

Germany amphoteric surfactants market is the largest specialty chemicals market in Europe, plays a critical role in regional demand and innovation. With strong expertise in formulation science and a high concentration of global cosmetic and detergent manufacturers, Germany sees consistent demand for betaines, amphoacetates, and sultaines across personal care, home care, and institutional cleaning applications. Consumers in Germany are highly conscious of product safety, skin compatibility, and environmental impact, pushing brands toward using milder and sustainable ingredients. Furthermore, German chemical companies like BASF and Evonik are investing in plant-based, bio-derived surfactants - including amphoteric types to align with sustainability goals and carbon reduction targets. The country’s focus on circular economy principles and green chemistry provides a supportive ecosystem for innovation in amphoteric surfactant production and application. Industrial uses, such as metal cleaning and oilfield chemicals, also contribute to demand, though personal and home care lead in volume. With Germany’s leadership in clean label product development and regulatory compliance, it will continue to be a pivotal market within Europe for advanced, safe, and sustainable amphoteric surfactants.

Key Players and Competitive Insights

Leading market players are investing heavily in research and development to expand their offerings, which will boost the market in the coming years. Market participants are undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations. To expand and survive in a more competitive and rising market environment, the market players must offer innovative solutions.

The market is fragmented, with the presence of numerous global and regional market players. The players are leveraging extensive resources and customer bases to enhance amphoteric surfactant capabilities. A few major players in the market are Evonik Industries AG, BASF, Stepan Company, Croda International Plc, Clariant, Nouryon, The Lubrizol Corporation, ADEKA CORPORATION, Libra Speciality Chemicals Limited, STOCKMEIER Group, Sumitomo Corporation, Kensing LLC, Solvay, Arkema, and Kao Corporation.

Croda International Plc, founded in 1925 and headquartered in Snaith, England, is a British specialty chemicals company. The company operates globally and is listed on the London Stock Exchange. It manufactures and sells specialty chemicals, including cosmetic oils and active ingredients, to various sectors such as life sciences, consumer care, personal care, and industrial specialties. In July 2023, Croda International Plc acquired Solus Biotech, a global leader in premium, biotechnology-derived active ingredients for beauty care and pharmaceuticals. This acquisition will help Croda International Plc in its strategic growth.

Clariant, established in 1995, is a Swiss multinational specialty chemicals company headquartered in Muttenz, Switzerland. Clariant operates globally with 68 subsidiaries across 36 countries. The company operations are organized into three main business units: care chemicals, adsorbents & additives, and catalysts. It has received numerous awards for its sustainable practices and innovative solutions, including recognition for its efforts in sustainable packaging and product development. In October 2022, Clariant announced that it had completed the acquisition of BASF’s US-based Attapulgite business assets for USD 60 million in cash. The acquisition is estimated to aid Clariant in expanding its product portfolio.

Key Companies

- Evonik Industries AG

- BASF

- Stepan Company

- Croda International Plc

- Clariant

- Nouryon

- The Lubrizol Corporation

- ADEKA CORPORATION

- Libra Speciality Chemicals Limited

- STOCKMEIER Group

- Sumitomo Corporation

- Kensing LLC

- Solvay

- Arkema

- Kao Corporation

Industry Developments

July 2024: The Lubrizol Corporation, a global specialty chemical company, signed a Memorandum of Understanding to purchase a 120-acre plot in Aurangabad, India. The company announced its plans to construct a new manufacturing facility in Aurangabad to initially support the region’s growing transportation and industrial fluid markets. The initial phase of the project represents a projected investment of ∼USD 200 million. The plant will become the company’s second-largest manufacturing facility globally and its largest manufacturing facility in India.

August 2022: Kensing, LLC, a major manufacturer of natural vitamin E, plant sterols, specialty esters, and high-purity anionic surfactants, acquired the Hopewell, Virginia amphoteric surfactants and specialty esters manufacturing operations from Evonik Corporation.

January 2021: Solvay, a Belgian-based multinational chemical company, agreed to sell its North American and European amphoteric surfactant business to OpenGate Capital, a private equity firm with headquarters in Los Angeles.

Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Betaine

- Amine Oxide

- Amphoacetate

- Amphopropionate

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Personal Care

- Home Care and Cleaning

- Oil Field Chemicals

- Agriculture

- Others

End-user Industry Outlook (Revenue, USD Billion, 2020–2034)

- Agrochemicals

- Personal Care & Cosmetics

- Paints & Coatings

- Pharmaceuticals

- Oil & Gas

- Textile

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 3.12 billion |

|

Market Size Value in 2025 |

USD 3.29 billion |

|

Revenue Forecast by 2034 |

USD 5.40 billion |

|

CAGR |

4.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global amphoteric surfactants market size was valued at USD 3.12 billion in 2024 and is projected to grow to USD 5.40 billion by 2034.

The global market is projected to register a CAGR of 4.85% during the forecast period.

Asia-Pacific held the largest share of the global market in 2024.

A few key players in the market are Evonik Industries AG, BASF, Stepan Company, Croda International Plc, Clariant, Nouryon, The Lubrizol Corporation, ADEKA CORPORATION, Libra Speciality Chemicals Limited, STOCKMEIER Group, Sumitomo Corporation, Kensing LLC, Solvay, Arkema, and Kao Corporation.

The amphoacetate segment is projected for significant growth in the global market during the forecast period.

The personal care segment dominated the amphoteric surfactants market in 2024.