Animal Feed Antioxidants Market Size, Share, & Industry Analysis Report

: By Type (Natural and Synthetic Antioxidants), By Livestock, By Form, and By Region – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM1203

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

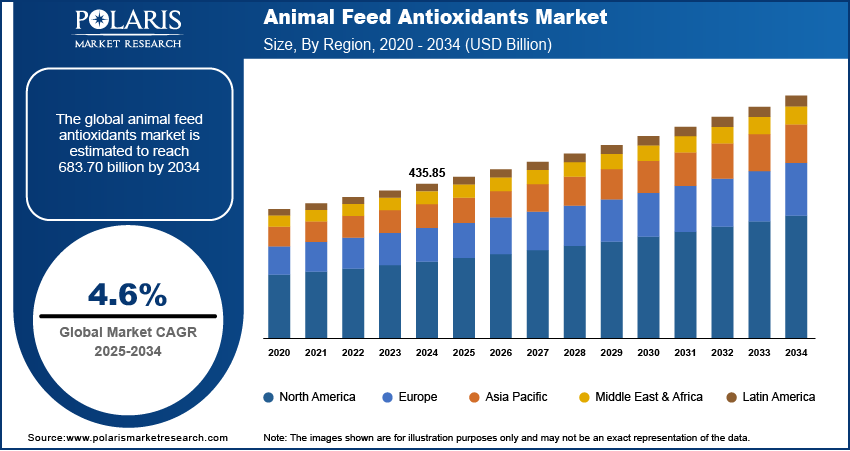

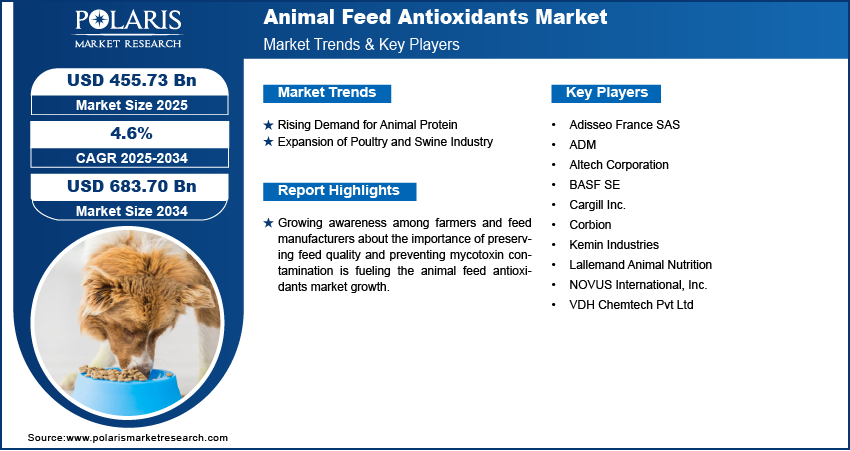

The global animal feed antioxidants market size was valued at USD 435.85 billion in 2024 and is projected to register a CAGR of 4.6% during 2025–2034. Expansion of the livestock industry due to rising population and urbanization has increased the usage of compound feeds, necessitating the use of antioxidants to maintain feed quality. Growing awareness among farmers and feed manufacturers about the importance of preserving feed quality and preventing mycotoxin contamination is fueling market growth.

The animal feed antioxidants market involves the production, distribution, and sale of antioxidants used in animal feed. These antioxidants are added to animal diets to prevent the oxidation of fats and other nutrients, thereby preserving feed quality, enhancing shelf life, and improving the health and performance of livestock. They play a crucial role in maintaining the nutritional value of feed, supporting animal immunity and ensuring food safety in the animal-derived food chain (such as meat, milk, and eggs).

To Understand More About this Research: Request a Free Sample Report

The imposition of stringent regulations by food safety authorities regarding feed quality and the use of safe additives encourages the adoption of antioxidants in animal feed. Moreover, ongoing R&D in feed production and the development of more effective and cost-efficient antioxidant formulations are contributing to market growth.

Market Dynamics

Rising Demand for Animal Protein

The global appetite for animal protein, including meat, dairy, and eggs, is surging, particularly in developing nations. According to the USDA Livestock and Poultry data, global beef production has shown a steady increase over the past decade, with total world output reaching approximately 76 million metric tons in recent years. Urbanization, rising disposable incomes, and shifting dietary preferences are fueling this trend. As a result, the production of livestock has intensified to meet growing consumer needs. High-quality animal feed is essential to support efficient and healthy livestock growth. Antioxidants play a critical role in preserving feed nutrients and preventing oxidative damage. This increasing reliance on nutritionally rich feed drives higher demand for feed antioxidants to ensure optimal animal health and productivity.

Expansion of Poultry and Swine Industry

The poultry and swine industry is experiencing rapid growth due to their short production cycles and high demand for affordable protein sources. These animals are especially prone to oxidative stress, which can negatively affect their growth, immunity, and overall performance. To combat this, antioxidants are increasingly incorporated into their feed formulations. According to the US Department of Agriculture, in 2024, total production of red meat and poultry rose by approximately 1%, reaching 107.6 billion pounds compared to 2023. The expanding scale of poultry and swine farming, particularly in emerging economies, has significantly increased the consumption of feed antioxidants. The incorporation of antioxidants in the feed of poultry and swine supports better feed efficiency, animal health, and meat quality, further boosting the demand for animal feed antioxidants in the poultry and swine segments.

Segment Insights

Market Assessment by Type

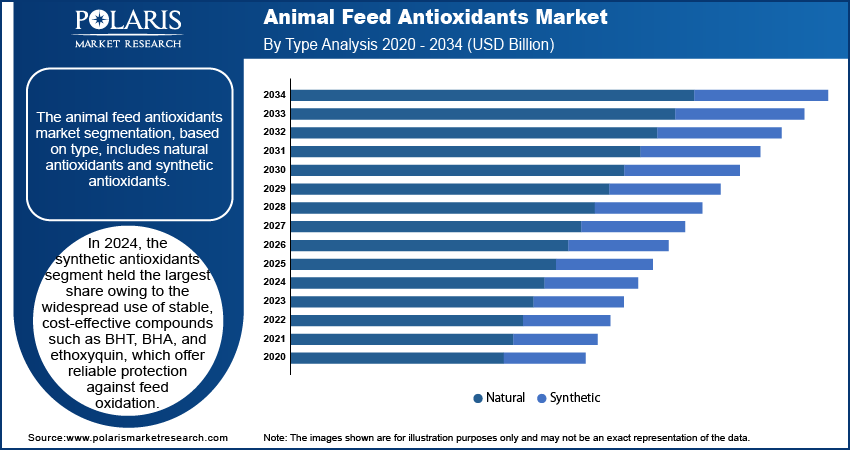

The animal feed antioxidants market segmentation, based on type, includes natural antioxidants and synthetic antioxidants. In 2024, the synthetic antioxidants segment held a larger share owing to the widespread use of stable, cost-effective compounds such as BHT, BHA, and ethoxyquin, which offer reliable protection against feed oxidation. These additives are crucial in preserving high-energy feed components such as fats and fat-soluble vitamins, especially in regions with extended storage and transport conditions. Their proven efficacy in maintaining feed quality and improving shelf life in intensive farming systems made them a preferred choice for commercial feed producers. The availability of well-established regulatory frameworks supporting their use further contributed to their dominance in the global market.

The natural antioxidants segment is expected to witness the highest CAGR during the forecast period due to increasing pressure from consumers and regulatory bodies to reduce synthetic chemical use in animal nutrition. Feed producers are rapidly adopting plant-based antioxidants such as tocopherols, rosemary extract, and grape seed polyphenols, which offer bioactive benefits beyond oxidative protection. Growing awareness around the health impact of feed ingredients on animal welfare and end-product quality is encouraging investments in clean-label feed additives. Natural antioxidants are also gaining favor in export-driven markets where residue-free certifications and sustainability benchmarks are becoming critical for feed ingredient acceptance.

Market Evaluation by Livestock

The animal feed antioxidants market segmentation, based on livestock, includes poultry, swine, ruminants, aquaculture, and others. In 2024, the poultry segment held the largest market share due to high-volume production, especially in Asia Pacific and North America, where poultry serves as a primary protein source. Broiler chickens, with their fast growth cycles, require optimized feed quality to ensure uniform weight gain and prevent disease outbreaks, making antioxidant inclusion essential. The frequent use of fat-rich feed to support rapid development heightens the need for oxidative stability. Additionally, the cost sensitivity of poultry operations has driven demand for antioxidant solutions that maximize feed utilization and reduce spoilage, further solidifying the poultry segment's position as the dominant revenue contributor in the market.

The aquaculture segment is expected to witness the highest CAGR during the forecast period due to the rising global demand for fish protein and the growing significance of aqua feed preservation. Fish feed contains high levels of unsaturated fats, which are particularly prone to oxidation, impacting nutrient value and palatability. Oxidative damage can lead to poor growth performance, increased mortality, and economic losses. Expanding intensive fish farming operations, especially in China, India, and Southeast Asia, are driving the adoption of specialized antioxidant blends designed for aquatic environments. Technological advancements in microencapsulation and lipid protection strategies are also accelerating uptake in this rapidly evolving segment.

Regional Analysis

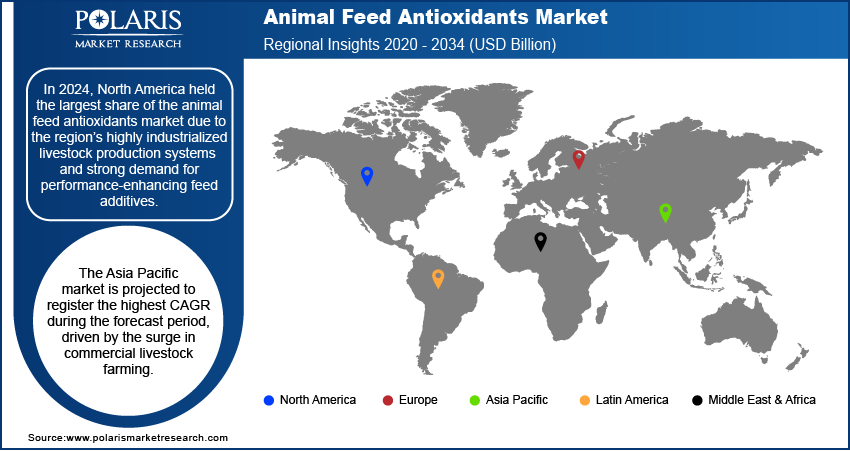

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest share due to the region’s highly industrialized livestock production systems and strong demand for performance-enhancing feed additives. According to the US Department of Agriculture, in the US, the poultry sector with broiler meat production exceeds 20 million metric tons annually. These trends indicate robust demand for feed additives, including antioxidants, to ensure feed quality, animal health, and efficient production. The US and Canada have well-established commercial farming sectors that rely heavily on antioxidant-enriched feed to enhance shelf life, reduce nutrient degradation, and maintain feed efficacy during storage and transport. High awareness among producers regarding oxidative stress and its impact on animal health further drives the uptake of both synthetic and emerging natural antioxidants. Supportive regulatory frameworks and the presence of key market players have fueled the North America animal feed antioxidants market expansion.

The Asia Pacific animal feed antioxidants market is projected to register the highest CAGR during the forecast period, driven by the surge in commercial livestock farming and the rapid expansion of aquaculture operations across China, India, Vietnam, and Indonesia. According to the US Department of Agriculture, India's beef production, primarily consisting of carabeef, is projected to reach 4.64 million metric tons (MMT) in 2025, reflecting an increase from 4.57 MMT in 2024. Rising demand for high-quality animal protein among a growing middle class is pushing feed manufacturers to adopt advanced formulations, including antioxidants, to improve feed efficiency and reduce spoilage. Local governments are investing in modernizing feed production and animal husbandry practices, which further fuels antioxidant adoption. Increasing environmental concerns and regulatory transitions toward cleaner feed ingredients also contribute to the region’s accelerated market growth.

Key Players and Competitive Analysis

The competitive landscape of the animal feed antioxidants market is characterized by dynamic industry analysis, where key players are actively engaged in expansion strategies to strengthen their regional and global presence. Strategic alliances and joint ventures are becoming increasingly common, enabling companies to access advanced feed formulation technologies and broaden their product portfolios. Mergers and acquisitions play a critical role in consolidating share, with post-merger integration focused on enhancing distribution capabilities and streamlining operational efficiency. Technology advancements in antioxidant delivery systems, such as encapsulation and slow-release mechanisms, are driving innovation, particularly in response to the rising demand for natural and residue-free additives. Product launches targeting specific livestock segments such as poultry, swine, and aquaculture demonstrate a clear shift toward tailored solutions that address oxidative stress and enhance feed stability under varying environmental conditions. The adoption of digital tools and precision nutrition platforms further supports R&D and production optimization, enabling more sustainable feed practices. Regulatory compliance, especially in emerging regions, is influencing formulation strategies and encouraging the development of alternatives to synthetic antioxidants.

BASF SE is a chemical corporation that operates all over the world. The company operates through seven segments, including chemicals, industrial solutions, materials, surface technologies, nutrition & care, agricultural solutions, and others. The Nutrition & Care sector provides nutrition and care ingredients for pharmaceutical and food antioxidants and feed producers, detergent, cleaner industries, and cosmetics. The agricultural solutions segment offers seeds and crop protection products, such as insecticides, herbicides, fungicides, biological crop production products, and seed treatment products.

Cargill is a global provider of food, ingredients, agricultural solutions, and industrial products, serving multiple sectors with a focus on safety, responsibility, and sustainability. The company's diverse product and service offerings span agrficulture, animal nutrition, beauty, bio-industrial solutions, data asset solutions, food and beverage, food service, industrial applications, meat and poultry, pharmaceuticals, risk management, supplements, and transportation. In the agricultural sector, Cargill supplies grains, oilseeds, cotton, and palm oil, contributing to global food systems. The company's animal nutrition division offers specialized products, including NutreBeef Cattle Feeds, Right Now Minerals, Fescue EMT Mineral Defense, Cattle Grazers Mineral, Ranger Limiter, and Safe-Guard 32SG Mineral to support livestock health and performance.

List of Key Companies in Animal Feed Antioxidants Market

- Adisseo France SAS

- ADM

- Altech Corporation

- BASF SE

- Cargill Inc.

- Corbion

- Kemin Industries

- Lallemand Animal Nutrition

- NOVUS International, Inc.

- VDH Chemtech Pvt Ltd

Animal Feed Antioxidants Industry Developments

In March 2025, Feedworks USA launched a new natural antioxidant formulation designed to enhance the bioavailability of Vitamin E. This innovative product aims to minimize oxidative stress while optimizing Vitamin E sparing effects, thereby improving nutritional efficacy in various applications.

In October 2024, Brenntag Specialties entered into a distribution agreement with BTSA to market 'Oxabiol,' a range of natural antioxidants tailored for animal nutrition, across Europe.

Animal Feed Antioxidants Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Natural Antioxidants

- Synthetic Antioxidants

By Livestock Outlook (Revenue, USD Billion, 2020–2034)

- Poultry

- Swine

- Ruminants

- Aquaculture

- Others

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Dry Form

- Liquid Form

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Animal Feed Antioxidants Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 435.85 billion |

|

Market Size Value in 2025 |

USD 455.73 billion |

|

Revenue Forecast by 2034 |

USD 683.70 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 435.85 billion in 2024 and is projected to grow to USD 683.70 billion by 2034

The global market is projected to register a CAGR of 4.6% during the forecast period.

In 2024, North America held the largest share due to the region’s highly industrialized livestock production systems and strong demand for performance-enhancing feed additives.

A few of the key players are Adisseo France SAS; ADM; Altech Corporation; BASF SE; Cargill Inc.; Corbion; Kemin Industries; Lallemand Animal Nutrition; NOVUS International, Inc.; and VDH Chemtech Pvt Ltd.

In 2024, the synthetic antioxidants segment held a larger share owing to the widespread use of stable, cost-effective compounds.

The aquaculture segment is expected to witness the highest CAGR over the forecast period due to the rising global demand for fish protein and the growing significance of aquafeed preservation.