Anomaly Detection Market Share, Size, Trends, Industry Analysis Report

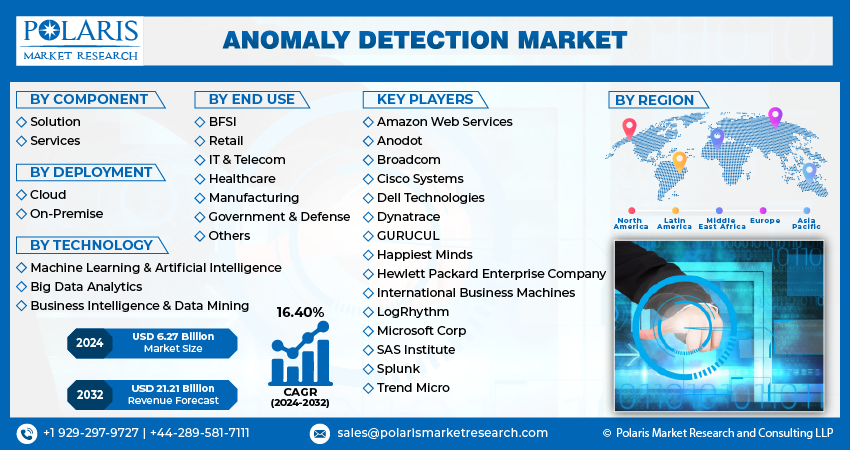

By Deployment (Cloud, On-premise); By Component (Solution, Services); By Technology (Big Data Analytics, ML & AI); By End-use; And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3762

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

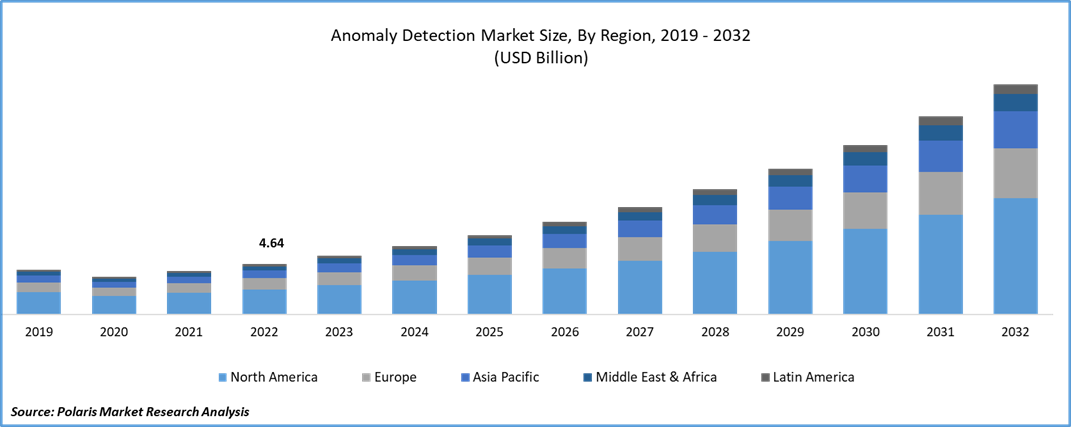

The global anomaly detection market was valued at USD 5.4 billion in 2023 and is expected to grow at a CAGR of 16.40% during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Market is experiencing growth due to the increasing complexity and sophistication of cyber-attacks. As cyber threats become more frequent and intricate, traditional detection and monitoring methods are being challenged, necessitating the adoption of modern approaches. Anomaly detection has emerged as a proactive defense strategy that enables organizations to identify and respond to unexpected threats. The rapid advancements in technology and the availability of vast datasets have made real-time analysis of these datasets feasible through Machine Learning (ML) techniques. This allows organizations to effectively analyze large volumes of data and detect anomalies in real-time.

Anomaly detection plays a crucial role in cybersecurity by leveraging ML algorithms to analyze large volumes of data and identify trends and anomalies that could indicate online threats. The adoption of scalable and effective ML techniques has led to increased implementation of anomaly detection in the cybersecurity domain. Integrating anomaly detection into Security Operations Centers (SOCs) and incident response procedures enhances the overall security posture of organizations. It enables security analysts to effectively prioritize and respond to potential risks by providing real-time alerts and actionable insights. Moreover, insider threats pose a significant risk to organizational security. Anomaly detection can detect unexpected behaviors exhibited by employees or authorized users, such as unauthorized access to sensitive information, unusual file transfers, or abnormal network traffic.

Tracking user behavior and identifying irregularities through anomaly detection helps organizations mitigate the risk of insider threats and protect their critical assets. By utilizing anomaly detection, organizations can effectively monitor and detect security incidents or data breaches, ensuring compliance with regulatory requirements and avoiding potential legal issues. It adds an extra layer of security to safeguard sensitive data and maintain regulatory compliance, thereby driving the anomaly detection market demand across different regions in the forecast period. Additionally, the COVID-19 pandemic created an unstable and vulnerable environment, leading to a significant increase in cyber threats and attacks. Malicious actors took advantage of this situation, further highlighting the importance of robust cybersecurity measures and solutions like anomaly detection.

Industry Dynamics

Growth Drivers

Increasing Cybersecurity Threats

Global increase in phishing attempts, ransomware attacks, and other cybercrimes has significantly heightened the risk for organizations worldwide. To address these escalating threat concerns, organizations are increasingly recognizing the need for anomaly detection solutions that can identify and mitigate emerging cyber threats.

However, the successful implementation and management of anomaly detection systems present challenges. Configuring and optimizing these systems to effectively detect real anomalies while minimizing false positives (false alarms) can be complex. A high rate of false positives can undermine trust in the system's accuracy and lead to alert fatigue, impeding the adoption and effectiveness of the product.

Report Segmentation

The market is primarily segmented based on component, deployment, technology, end use, and region.

|

By Component |

By Deployment |

By Technology |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

Solutions segment accounted for the largest market share in 2022

The ever-evolving cybersecurity threat landscape necessitates advanced solutions to address the increasingly sophisticated and complex threats. Anomaly detection solutions provide a proactive approach to detecting emerging threats by identifying unusual trends or behaviors. These solutions leverage their capability to process and analyze massive datasets, enabling the discovery of hidden patterns and the identification of anomalies that may indicate security vulnerabilities. The adoption and effectiveness of anomaly detection technologies are greatly influenced by their ability to handle large volumes of data. As cyber threats continue to proliferate and become more intricate, the demand for efficient anomaly detection solutions is expected to drive the growth of the industry.

Services segment is projected to gain substantial growth rate. The widespread adoption of cloud computing and managed security services has contributed to this growth. Anomaly detection services are often bundled with managed or cloud-based security service offerings. These services provide organizations with a convenient and cost-effective solution for implementing and maintaining anomaly detection capabilities. By leveraging the expertise and infrastructure of service providers, businesses can focus on their core operations while ensuring reliable anomaly detection.

By Deployment Mode Analysis

On-premises segment held the significant market share in 2022

On-premises segment held the maximum market share. Many organizations have specific legal and regulatory requirements that necessitate direct control and oversight of their data processing and security procedures. On-premise anomaly detection solutions enable organizations to meet these requirements by ensuring that data remains within their premises and under their direct control. By leveraging on-premise anomaly detection, organizations can locally handle and analyze their data, reducing reliance on external networks or cloud infrastructure.

Cloud segment is anticipated to grow at fastest growth rate. Cloud-based anomaly detection solutions offer unmatched versatility and scalability. Organizations can easily scale up or down their anomaly detection capabilities based on their specific needs, thanks to the flexible nature of cloud infrastructure. This eliminates the need for significant infrastructure investments or capacity planning as data volumes and processing requirements change over time. With cloud-based anomaly detection, organizations can dynamically adjust their resources, making it an ideal choice for businesses with varying workloads or rapidly evolving data environments.

By Technology Analysis

ML & AI segment is projected to witness highest growth

ML & AI segment is expected to grow at highest growth rate. ML and AI-based anomaly detection models enable organizations to detect and respond to abnormalities in real-time. This capability is particularly crucial in time-sensitive scenarios such as fraud detection, network security, or system monitoring. ML and AI algorithms can effectively handle streaming data and perform analysis with minimal delay, allowing businesses to swiftly identify and mitigate the impact of anomalies.

Big data analytics segment garnered the largest share. With the rapid growth of digital technology and the proliferation of connected devices. The challenge lies in identifying anomalies within this data, which can be challenging due to its diverse formats, including structured, unstructured, & semi-structured data. Big data analytics anomaly detection addresses this challenge by leveraging advanced analytics techniques to efficiently process & analyze massive data-sets. By scanning and examining this data, businesses can uncover unexpected patterns or behaviors that may indicate security issues or unusual activities, enabling proactive detection and response.

Regional insights

North America region dominated the global market in 2022

North America dominated the global market. The region faces a rapidly changing and unsafe cybersecurity landscape, necessitating robust anomaly detection measures. As organizations generate and accumulate vast amounts of data due to the widespread adoption of digital technology and the rise of big data, various industries such as finance, insurance, e-commerce, and healthcare rely on anomaly detection to combat fraudulent activities. By analyzing transactional data and user behavior, businesses can proactively identify and mitigate fraud risks, safeguarding their operations and protecting against financial losses.

APAC is projected to be the fastest emerging region. With the significant growth in the financial services industry, including banking services and fintech developments, as well as the increasing adoption of digital payments, anomaly detection plays a crucial role in initiatives such as Anti-Money Laundering (AML), fraud detection, and regulatory compliance. By analyzing transactional data and user behavior, anomaly detection helps identify and mitigate potential fraudulent actions while ensuring adherence to financial regulations and compliance standards.

Key Market Players & Competitive Insight

Key players in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Key players include

- Amazon Web Services

- Anodot

- Broadcom

- Cisco Systems

- Dell Technologies

- Dynatrace

- GURUCUL

- Happiest Minds

- Hewlett Packard Enterprise Company

- International Business Machines

- LogRhythm

- Microsoft Corp

- SAS Institute

- Splunk

- Trend Micro

Recent Developments

- In April 2022, HPE has introduced the HPE Swarm Learning solution, a cutting-edge technology that aims to improve the accuracy and reduce biases in the AI model training while maintaining data security. This innovative product offers advanced capabilities in AI, enabling the detection of the global challenges.

Anomaly Detection Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6.27 billion |

|

Revenue forecast in 2032 |

USD 21.21 billion |

|

CAGR |

16.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Deployment, By Technology, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |

FAQ's

The global anomaly detection market size is expected to reach USD 21.21 billion by 2032.

Key players in the anomaly detection market are Amazon Web Services, Anodot, Broadcom, Cisco Systems, Dell Technologies.

North America contribute notably towards the global anomaly detection market.

The global anomaly detection market is expected to grow at a CAGR of 16.4% during the forecast period.

The anomaly detection market report covering key segments are component, deployment, technology, end use, and region.