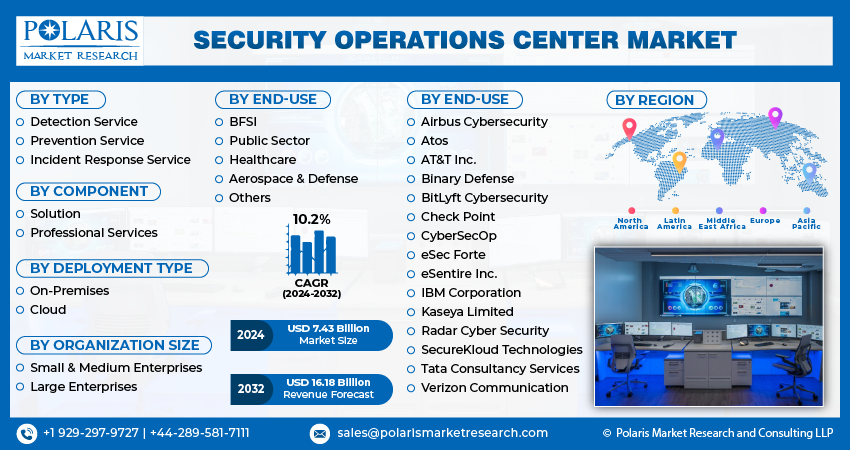

Security Operations Center (SOC) Market Size, Share, Trends, Industry Analysis Report

: By Type, By Component, By Deployment Type (On-Premises, Cloud), By Organization Size, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1843

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global security operations center (SOC) market size was valued at USD 42.85 billion in 2024, growing at a CAGR of 7.9% during 2025–2034. The market is driven by rising cyber threats, increasing network complexity, cloud adoption, data privacy regulations, and demand for AI-enabled, compliant, and real-time threat detection and response solutions.

Key Insights

- The detection service segment held the largest share in 2024 due to its essential role in real-time threat monitoring and early identification.

- In 2024, professional services dominated the component segment as organizations rely on specialized expertise for SOC integration and regulatory compliance.

- The BFSI sector held the largest share due to its regulatory exposure and demand for 24/7 security monitoring of sensitive financial data.

- North America led the market in 2024 due to a mature cybersecurity landscape, strict compliance mandates, and early adoption of AI-enabled SOCs.

- Asia Pacific is expected to witness the highest CAGR due to digital transformation, growing cyber threats, and strong government cybersecurity initiatives.

Industry Dynamics

- Rising cyberattacks and zero-day vulnerabilities are pushing organizations to adopt real-time threat detection and response through advanced SOC systems.

- Increasing regulatory pressures such as GDPR and HIPAA are driving demand for SOCs that offer compliance reporting, auditing, and continuous monitoring.

- Adoption of AI, automation, and cloud-native technologies enables scalable SOC solutions with faster response times and reduced operational complexity.

- High implementation costs, skilled workforce shortages, and integration challenges with legacy systems limit widespread SOC deployment across smaller enterprises.

Market Statistics

2024 Market Size: USD 42.85 billion

2034 Projected Market Size: USD 91.88 billion

CAGR (2025–2034): 7.9%

North America: Largest market in 2024

AI Impact on Security Operations Center Market

- AI enhances threat detection by analyzing vast data in real-time, identifying anomalies and potential threats faster and more accurately.

- Machine learning models help predict and prevent future attacks by continuously learning from historical data, improving SOC response.

- Advanced AI tools integrate with existing SIEM and XDR platforms, improving threat intelligence fusion and operational efficiency in SOCs.

- The growing reliance on AI increases demand for skilled professionals to manage, fine-tune, and interpret AI-driven security insights.

Market Share.png)

To Understand More About this Research: Request a Free Sample Report

The security operations center market refers to the ecosystem of services, solutions, and infrastructure designed to monitor, detect, respond to and mitigate cybersecurity threats in real time. SOCs integrate advanced managed security information and event management (SIEM) services, threat intelligence platforms, incident response tools, and analytics engines to provide continuous protection across digital assets and IT infrastructures. The market plays a critical role in strengthening organizational security posture, enhancing threat visibility, ensuring regulatory compliance, and minimizing downtime from cyber incidents. Rising cybersecurity risks, increasing network complexity, and growing data privacy regulations are driving the rapid expansion of the market.

Widespread migration to cloud environments and hybrid IT architectures is driving the need for scalable and agile SOC solutions, accelerating the SOC industry growth. Additionally, Innovations in AI, machine learning, and automation are enhancing threat detection and response capabilities, creating new opportunities within the industry.

Market Dynamics

Rising Cybersecurity Threats

Rising cybersecurity threats are significantly contributing to the SOC market growth. According to a Cybersecurity and Infrastructure Security Agency (CISA) report published in December 2023, threat actors continue to exploit vulnerabilities at an increasing rate, with over 6,500 known exploited vulnerabilities tracked in fiscal year 2023 alone, marking a 45% increase compared to FY 2022. The evolving threat landscape, characterized by increasingly sophisticated ransomware attacks, zero-day vulnerabilities, and state-sponsored cyber-espionage, has made traditional security frameworks insufficient. Organizations across industries are facing relentless pressure to proactively monitor, detect, and respond to advanced threats in real time. The escalating financial and reputational damage associated with security breaches is compelling enterprises to prioritize investments in robust SOC infrastructures. Incorporating capabilities such as behavioral analytics, threat intelligence integration, and automated incident response, SOCs are becoming indispensable for modern cybersecurity strategies. The urgent need to safeguard critical assets and ensure operational continuity continues to drive market demand at an accelerated pace.

Regulatory Compliance Requirements

Organizations are navigating an increasingly complex regulatory environment shaped by stringent mandates such as GDPR, HIPAA, CCPA, and other regional data protection laws. Failure to comply with these frameworks results in severe penalties, legal liabilities, and reputational damage, creating a strong business case for investment in comprehensive SOC solutions. Advanced SOCs offer real-time monitoring, audit trails, incident documentation, and reporting capabilities critical for demonstrating compliance. The need to establish continuous visibility into network activity, data flows, and user behaviors under strict regulatory standards is driving market expansion. Enterprises are recognizing SOCs not merely as operational assets but as strategic tools to meet evolving compliance and governance requirements. Hence, regulatory compliance requirements are strongly contributing to the security operations center (SOC) market growth.

Segment Insights

Market Assessment by Type

The global security operations center market segmentation, based on type, includes detection service, prevention service, and incident response service. In 2024, the detection service segment accounted for the largest market share due to its pivotal role in real-time monitoring, threat identification, and intelligence gathering. SOCs increasingly rely on advanced threat detection capabilities powered by behavioral analytics, threat intelligence feeds, and AI-based anomaly detection to counter evolving attack vectors. High-profile breaches and the proliferation of zero-day vulnerabilities have intensified investments in detection frameworks that can identify threats before damage occurs. This segment remains integral to early warning systems and serves as the cornerstone of proactive cyber defense strategies in highly regulated sectors such as BFSI and critical infrastructure.

The incident response service segment is projected to register the highest CAGR during the forecast period due to escalating sophistication in cyberattacks that demand immediate containment, investigation, and remediation capabilities. Organizations are prioritizing incident response readiness to align with compliance mandates such as NIST and GDPR, and to minimize the financial and reputational risks of breaches. The growing adoption of digital forensics, playbook-driven response automation, and managed detection and response (MDR) offerings is further accelerating demand. Additionally, the increasing convergence of IT and OT environments is driving tailored incident response services across industrial and energy sectors.

Market Evaluation by Component

The global SOC market, based on component, is bifurcated into solution and professional services. In 2024, the professional services segment accounted for a larger share due to the rising need for specialized consulting, integration, and threat-hunting expertise across hybrid SOC environments. Enterprises are increasingly outsourcing functions such as vulnerability assessments, red teaming, and SOC maturity evaluations to address talent shortages and rapidly evolving threat landscapes. Demand for custom SOC build-outs, framework alignment (MITRE ATT&CK, ISO 27001), and regulatory compliance consulting has surged, especially among multinational corporations operating under varied jurisdictional mandates. Professional services are critical for organizations undergoing cloud transformations or implementing SOC-as-a-Service (SOCaaS) models.

The solution segment is expected to register a higher CAGR during the forecast period, driven by automation-centric platforms that integrate SIEM, SOAR, UEBA, and XDR capabilities into unified SOC stacks. Vendors are rapidly innovating with AI/ML-driven analytics, threat intelligence fusion, and low-code orchestration features that significantly reduce mean time to detect (MTTD) and mean time to respond (MTTR). Cloud-native SOC solutions are witnessing accelerated adoption as organizations seek scalability, centralized visibility, and cost-effective security operations across distributed environments. The growing preference for API-first and interoperable solutions is also contributing to rapid market expansion.

Market Evaluation by End Use

The global market segmentation, based on end use, includes BFSI, public sector, healthcare, aerospace & defense, and others. In 2024, the BFSI segment accounted for the largest share due to the sector’s extensive attack surface, stringent regulatory oversight, and high-value data assets that necessitate robust, real-time security monitoring and response. Financial institutions are implementing 24/7 SOC capabilities with embedded fraud detection, advanced behavioral analytics, and threat intelligence correlation to defend against ransomware, credential stuffing, and insider threats. Emphasis on zero trust architecture, PCI-DSS compliance, and multi-cloud security management has fueled continuous investments in SOC infrastructure tailored to financial operations and customer data protection.

The healthcare segment is expected to register the highest CAGR during the forecast period, driven by an exponential rise in ransomware attacks on hospitals, electronic health record (EHR) systems, and medical IoT devices. For instance, in March 2024, the US Department of Health and Human Services released data showing that ransomware attacks disrupted more than 40 healthcare organizations in the US just in Q1 2024, affecting over 10 million patients. These attacks often targeted hospital SOC systems, disrupting emergency services, electronic health records, and diagnostic tools. Healthcare providers are increasingly deploying SOCs to safeguard patient data and ensure continuity of care, particularly in light of HIPAA, HITECH, and other evolving data privacy laws. The integration of threat intelligence with clinical workflows, growing adoption of SOCaaS in mid-sized hospitals, and implementation of secure data exchange protocols for telehealth and remote care services are propelling rapid market growth for this segment.

Regional Outlook

The study provides security operations center market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America held the largest market share due to the region’s mature cybersecurity ecosystem, high concentration of Fortune 500 enterprises, and early adoption of next-generation SOC technologies. Regulatory mandates such as the CCPA, HIPAA, and SEC cybersecurity rules are driving the deployment of advanced SOC infrastructures with built-in compliance and audit capabilities. Leading US-based technology providers offer integrated SOC solutions that leverage AI, machine learning, and extended detection and response (XDR), making them preferred choices across banking, government, and defense sectors. For instance, in March 2024, the White House National Cybersecurity Strategy Implementation Plan emphasized expanding AI-driven threat detection and XDR-based SOC environments across federal agencies. Additionally, continuous cyber warfare threats and nation-state-sponsored attacks have led to federal investments in SOC modernization programs across the US and Canada.

The Asia Pacific SOC market is projected to experience the highest CAGR during the forecast period due to rapid digital transformation, increasing cyberattack frequency, and heightened government initiatives focused on national cybersecurity frameworks. Countries such as India, China, Japan, and South Korea are scaling their cloud adoption, 5G infrastructure, and fintech ecosystems, all of which demand real-time threat detection and response capabilities. Regional enterprises are increasingly investing in cloud-native SOC platforms and managed SOC services to mitigate rising risks. Furthermore, talent development initiatives, such as cybersecurity skill-building programs in ASEAN countries, are accelerating SOC adoption across both public and private sectors.

Key Players and Competitive Analysis

The competitive landscape of the security operations center market is marked by intense industry analysis, with players adopting a range of market expansion strategies to strengthen their global footprint. Strategic alliances and joint ventures are increasingly being pursued to integrate advanced threat intelligence, endpoint detection, and security orchestration into unified platforms. Market participants are engaging in mergers and acquisitions to access proprietary technologies, enhance managed security service offerings, and expand customer reach across verticals such as BFSI, healthcare, and critical infrastructure. Post-merger integration efforts focus on aligning threat detection capabilities, unifying security information and event management (SIEM) platforms, and optimizing extended detection and response (XDR) pipelines.

Technology advancements in artificial intelligence, machine learning, and behavioral analytics are driving innovation in SOC automation, enabling real-time anomaly detection, threat hunting, and incident response across hybrid and multi-cloud environments. The SOC industry is witnessing a surge in product launches aimed at improving visibility, threat intelligence correlation, and compliance readiness. Additionally, organizations are investing in modular and cloud-native SOC architectures to ensure scalability, faster deployment, and integration with security policy enforcement mechanisms. This competitive environment is further fueled by rising demand for security analytics, managed detection and response (MDR), and compliance-as-a-service in response to evolving cyber threats and regulatory requirements.

IBM Corporation is engaged in providing comprehensive security operations center (SOC) solutions that unify and coordinate cybersecurity technologies and operations for organizations worldwide. The company specializes in threat detection, response, and prevention through continuous, around-the-clock monitoring of IT infrastructure, including applications, servers, cloud services, and endpoints. IBM’s SOC product portfolio features advanced technologies such as Security Information and Event Management (SIEM), extended detection and response (XDR), and log management tools, which aggregate and analyze real-time alerts and telemetry to identify potential threats. The company offers services such as asset inventory management, routine maintenance, vulnerability assessments, penetration testing, incident response planning, and recovery and remediation after security incidents. IBM also provides consulting for SOC design, security intelligence, and analytics to streamline threat analysis and compliance with privacy regulations. Its managed security services are delivered through a global network of X-Force Command Centers, supporting clients in more than 170 countries, with a significant presence in North America, Europe, Asia Pacific, and emerging markets.

Airbus Cybersecurity, a business unit within Airbus Defense and Space, is engaged in designing, developing, integrating, and deploying tailored security operations center (SOC) solutions for defense, governmental, and institutional clients. The company specializes in cyber protection for critical infrastructure, aerospace systems, and defense platforms. Airbus Cybersecurity’s product portfolio includes offerings such as CyberRange (a simulation platform), Ectocryp (high-grade encryption and key management), Orion Malware detection, Secure Gateway, and Tactical SOC for mobile cyber defense operations. Services provided encompass asset discovery, risk assessment, security maturity checks, OT security design and integration, managed SOC operations, and cyber resilience consulting. The company operates across multiple European countries, with offices in France, Germany, the UK, and Spain, and serves clients in Europe and internationally, focusing on defense, aerospace, and critical infrastructure sectors.

List of Key Companies in Security Operations Center (SOC) Market

- Airbus Cybersecurity

- Atos

- AT&T Inc.

- Binary Defense

- BitLyft Cybersecurity

- Check Point

- CyberSecOp

- eSentire Inc.

- IBM Corporation

- Kaseya Limited

- Radar Cyber Security (RadarServices Smart IT-Security GmbH)

- SecureKloud Technologies

- Tata Consultancy Services

- Verizon Communication

Security Operations Center (SOC) Industry Developments

In July 2025: The French Directorate General of Armaments (DGA) signed an eight-year contract with Airbus Defence and Space. Airbus stated that the contract will focus on educating and training all cybersecurity experts at the Ministry of the Armed Forces.

In April 2025, IBM introduced new agentic and automation capabilities to its managed detection and response services to enable autonomous security operations and predictive threat intelligence for clients.

In February 2025, Atos Group launched its Google Cloud Managed Security Services Provider (MSSP) offering and achieved the Security Specialization in the Google Cloud Partner Advantage Program in EMEA and North America.

Security Operations Center Market Segmentation

By Type Outlook (Revenue – USD Billion, 2020–2034)

- Detection Service

- Prevention Service

- Incident Response Service

By Component Outlook (Revenue – USD Billion, 2020–2034)

- Solution

- Professional Services

By Deployment Type Outlook (Revenue – USD Billion, 2020–2034)

- On-Premises

- Cloud

By Organization Size Outlook (Revenue – USD Billion, 2020–2034)

- Small & Medium Enterprises

- Large Enterprises

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- BFSI

- Public Sector

- Healthcare

- Aerospace & Defense

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

SOC Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 42.85 billion |

|

Market Size Value in 2025 |

USD 46.15 billion |

|

Revenue Forecast in 2034 |

USD 91.88 billion |

|

CAGR |

7.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 42.85 billion in 2024 and is projected to grow to USD 91.88 billion by 2034.

The global market is projected to register a CAGR of 7.9% during the forecast period.

In 2024, North America held the largest market share due to the region’s mature cybersecurity ecosystem, high concentration of Fortune 500 enterprises, and early adoption of next-generation SOC technologies.

A few of the key players in the market are Airbus Cybersecurity, Atos, AT&T Inc., Binary Defense, BitLyft Cybersecurity, Check Point, CyberSecOp, eSec Forte, eSentire Inc., IBM Corporation, Kaseya Limited, Radar Cyber Security (RadarServices Smart IT-Security GmbH), SecureKloud Technologies, Tata Consultancy Services, and Verizon Communication.

In 2024, the detection service segment accounted for the largest market share due to its pivotal role in real-time monitoring, threat identification, and intelligence gathering.

In 2024, the professional services segment accounted for a larger share due to the rising need for specialized consulting, integration, and threat-hunting expertise across hybrid SOC environments.