Anti-pollution Nasal Spray Market Size, Share, Trends, Industry Analysis Report

By Product Type (Pollution Defense Products, Symptomatic Relief Nasal Sprays), By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6057

- Base Year: 2024

- Historical Data: 2020-2023

Overview

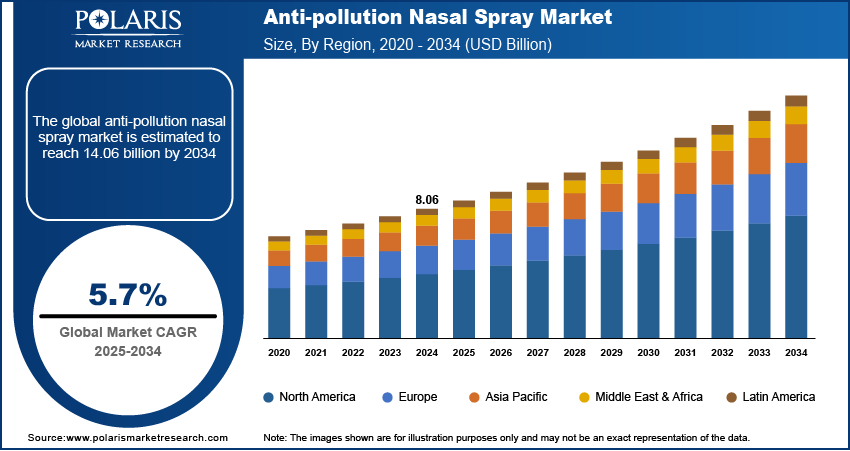

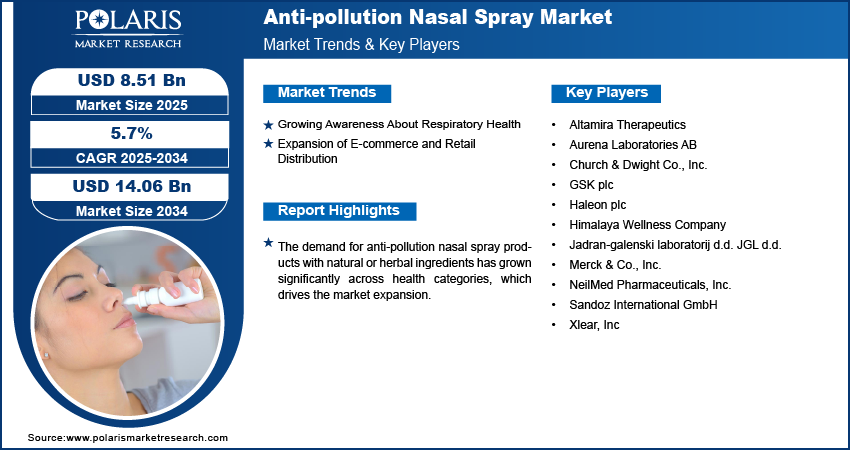

The global anti-pollution nasal spray market size was valued at USD 8.06 billion in 2024, growing at a CAGR of 5.7% from 2025 to 2034. The market growth is driven by growing awareness about respiratory health and the expansion of e-commerce and retail distribution.

Key Insights

- In 2024, the pollution defense products segment dominated with the largest share as these products are designed to form a protective barrier in the nasal passage.

- The online channels segment is expected to experience significant growth during the forecast period due to increased internet penetration and changing shopping behavior.

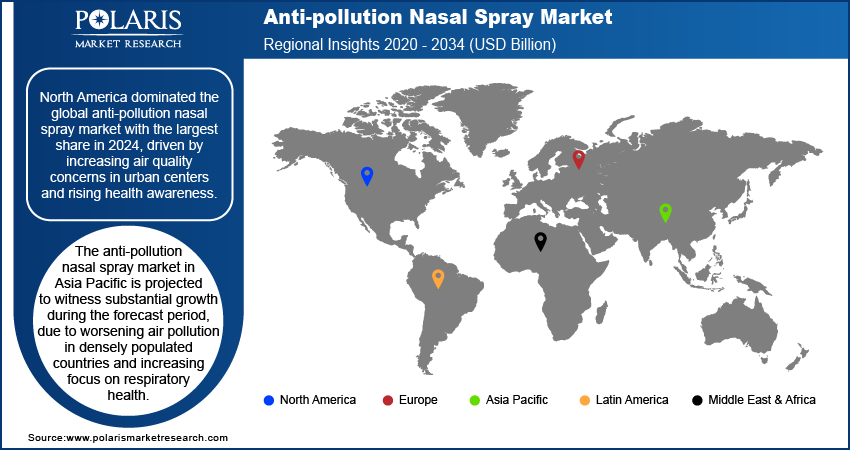

- The market in North America dominated with the largest share in 2024, driven by increasing air quality concerns in urban centers and rising health awareness.

- The industry in the U.S. is expected to witness significant growth in the coming years, due to high pollution exposure in metropolitan areas, coupled with the prevalence of allergies and sinus conditions.

- The anti-pollution nasal spray market in Asia Pacific is projected to witness substantial growth during 2025–2034, due to worsening air pollution in densely populated countries and increased focus on respiratory health.

Industry Dynamics

- Growing awareness about respiratory health drives the demand for anti-pollution nasal sprays.

- Expansion of e-commerce and retail distribution is fueling the industry growth by boosting product accessibility.

- The demand for products with natural or herbal ingredients has grown significantly across health categories, including nasal sprays.

- Limited clinical evidence supporting the long-term efficacy and safety of anti-pollution nasal sprays hinders consumer trust and widespread adoption.

Market Statistics

- 2024 Market Size: USD 8.06 billion

- 2034 Projected Market Size: USD 14.06 billion

- CAGR (2025–2034): 5.7%

- North America: Largest market in 2024

Anti-pollution nasal spray is a nasal formulation designed to protect the nasal passages from airborne pollutants, allergens, and particulate matter. It works by forming a protective barrier or cleansing the nasal cavity to reduce irritation and block pollutant entry. These sprays are often used in urban environments with high levels of air pollution to support respiratory health.

Increasing air pollution in major cities is a major factor driving demand for anti-pollution nasal sprays. Pollutants such as dust, smoke, pollen, and fine particulate matter (PM2.5 and PM10) enter the nasal passages. These pollutants can cause irritation, allergies, and respiratory problems such as chronic obstructive pulmonary disorder (COPD). The need for protective solutions that reduce the impact of polluted air has grown as more people live and work in urban environments. Nasal sprays that create a barrier against airborne particles offer a simple, over-the-counter (OTC) option for daily use, particularly among individuals who commute or spend extended time outdoors, thereby driving the growth.

The demand for products with natural or herbal ingredients has grown significantly across health categories, including nasal sprays. Many anti-pollution sprays now include ingredients such as aloe vera, eucalyptus oil, xylitol, or saline, which offer a more natural way to protect and clean nasal passages. This appeals to health-conscious consumers and parents who prefer chemical-free options for themselves or their children. The expansion of herbal and Ayurvedic brands into this segment has increased product variety, making natural nasal sprays more accessible in mainstream and traditional retail channels, thereby driving the growth.

Drivers & Opportunities

Growing Awareness About Respiratory Health: People are becoming more aware of the importance of respiratory health due to frequent cases of sinus issues, asthma, and allergic rhinitis. According to the National Asthma Council of Australia, in Australia alone, 2.8 million people were affected by asthma in 2022. Media coverage, public health campaigns, and post-pandemic health consciousness have led consumers to adopt preventive healthcare practices. Anti-pollution nasal sprays are increasingly viewed as easy-to-use products that help maintain nasal hygiene and reduce exposure to harmful substances in the air. These products are gaining popularity as part of daily self-care and respiratory protection as consumers shift toward proactive wellness routines, especially in polluted environments, thereby driving the growth.

Expansion of E-commerce and Retail Distribution: The growth of e-commerce platforms has made it easier for consumers to access anti-pollution nasal sprays. According to Eurostat, in 2023, B2C e-commerce turnover was USD 1,036.65 billion or EUR 887 billion. Online health and wellness stores, pharmacy delivery services, and major e-retailers provide detailed product information, user reviews, and promotional offers that help build consumer trust. At the same time, physical retail stores, supermarkets, and pharmacy chains have expanded their wellness product offerings. This multi-channel availability allows consumers to discover, compare, and purchase nasal sprays conveniently, contributing to wider penetration and growing sales across both urban and semi-urban regions, thereby driving the growth.

Segmental Insights

Product Analysis

The segmentation, based on product, includes pollution defense products, symptomatic relief nasal sprays, cleansing nasal sprays, hydrating nasal sprays, and others. In 2024, the pollution defense products segment dominated with the largest share as these products are designed to form a protective barrier in the nasal passage, preventing airborne pollutants such as dust, smoke, and pollen from entering the body. They are widely used for daily prevention, especially in cities with high pollution levels. Their drug-free nature and ease of use have made them a preferred choice among health-conscious consumers. Growing awareness about pollution-related health risks and increased usage for routine protection fuel the segment growth.

The symptomatic relief nasal sprays segment is expected to experience significant growth during the forecast period as these sprays are used to relieve symptoms such as nasal congestion, irritation, or inflammation caused by pollutant exposure. Demand for fast-acting relief products is rising due to the increasing cases of allergic rhinitis and sinus-related issues. Many consumers seek nasal sprays that protect and alleviate discomfort after exposure to pollution. The segment is growing as manufacturers combine decongestant or anti-inflammatory ingredients with pollution-blocking formulations to provide dual-action benefits.

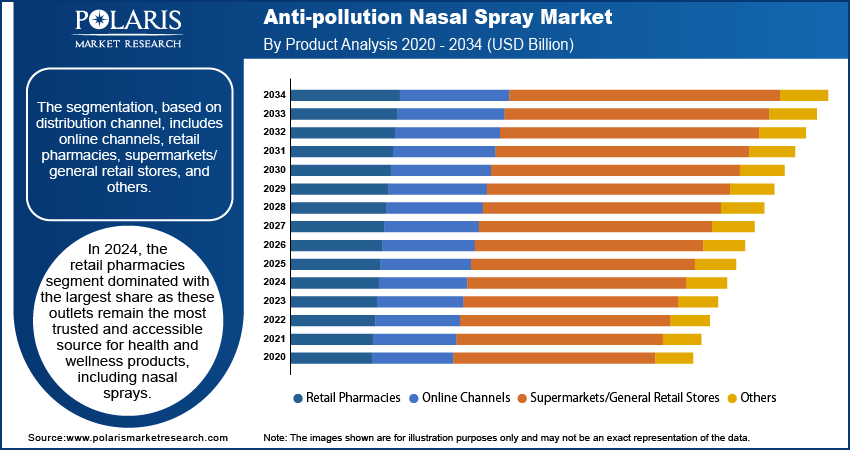

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online channels, retail pharmacies, supermarkets/general retail stores, and others. In 2024, the retail pharmacies segment dominated with the largest share, as these outlets remain the most trusted and accessible sources for health and wellness products, including nasal sprays. Consumers prefer to buy these sprays from nearby pharmacies due to immediate availability, product recommendations from pharmacists, and the assurance of authenticity. Retail pharmacies, including chain stores and local chemists, offer a wide variety of brands and formulations, which supports strong in-store demand, particularly in urban locations where pollution is a daily concern, thereby driving the segment.

The online channels segment is expected to experience significant growth during the forecast period, due to increasing internet penetration and changing shopping behavior. Consumers increasingly turn to online retail platforms for convenience, wider product selection, and access to reviews. Online channels are especially popular among younger users who prefer doorstep delivery and digital payment options. Many brands invest in digital marketing and direct-to-consumer platforms to boost visibility. Seasonal pollution spikes and health alerts further drive online purchases, especially in metro cities and tier-1 towns where air quality is often poor, thereby fueling the growth.

Regional Analysis

North America Anti-pollution Nasal Spray Market Trends

The market in North America dominated with the largest share in 2024, driven by increasing air quality concerns in urban centers and rising health awareness. Major cities experience seasonal pollution and allergens, which drive consistent demand for both preventive and symptomatic nasal sprays. Consumers in the region are highly aware of self-care products and prefer non-prescription solutions for respiratory wellness. Availability through retail chains, pharmacies, and online platforms supports broad product access. Regulatory approvals and product claims around safety and efficacy further influence consumer trust, thereby driving the growth.

U.S. Anti-pollution Nasal Spray Market Insights

The industry in the U.S. is expected to witness significant growth during the forecast period, due to high pollution exposure in metropolitan areas and the rising prevalence of allergies and sinus conditions. Consumers seek fast relief and preventive options, especially during allergy seasons and wildfire events. The U.S. benefits from a well-developed retail and e-commerce structure, allowing easy access to a range of OTC nasal sprays. Ongoing marketing by health brands and growing awareness of indoor and outdoor air pollutants further strengthen the demand across different age groups and health-conscious households, thereby driving the growth in the country.

Asia Pacific Anti-pollution Nasal Spray Market Analysis

The Asia Pacific industry is projected to witness substantial growth during the forecast period, due to worsening air pollution in densely populated countries and increasing focus on respiratory health. Rapid urbanization, industrial activities, and traffic emissions in cities contribute to daily exposure to harmful pollutants. Consumers are becoming more aware of protective health measures, especially in countries such as India and Southeast Asian nations. Rising middle-class income, urban living, and the expansion of pharmacies and e-commerce platforms make nasal sprays more accessible. International and regional brands are actively entering this region with pollution-specific product positioning and natural ingredient formulations to attract a broad consumer base, thereby driving the growth.

China Anti-pollution Nasal Spray Market Assessment

The market in China is expected to experience rapid growth in the coming years due to persistent air quality issues in major cities. Public awareness about the adverse effects of pollution on health, especially after long-term exposure, is rising steadily. Consumers are adopting nasal sprays as part of their daily routines to protect against smog, dust, and allergens. The popularity of traditional medicine further influences preferences for herbal-based or natural formulations. Domestic and international brands are expanding their presence in both retail and digital spaces, responding to demand from health-conscious urban populations, thereby driving the growth.

Europe Anti-pollution Nasal Spray Market Insights

The industry in Europe is expected to experience significant growth in the future, driven by growing demand linked to rising pollution awareness and allergy-related respiratory issues. Major cities across Western and Central Europe experience seasonal pollution, pollen spikes, and smog, driving interest in daily nasal protection. Consumers in this region prioritize clinically validated and natural formulations, with strong preferences for noninvasive, over-the-counter health products. Stringent EU regulations around product safety and claims have led to the availability of high-quality nasal sprays. Widespread access through pharmacies and online platforms supports steady sales across countries such as France, Italy, Spain, and the UK.

Germany Anti-pollution Nasal Spray Market Outlook

The market in Germany is expected to experience significant growth as urban centers such as Berlin, Munich, and Frankfurt face seasonal air pollution and high pollen counts, contributing to growing respiratory health concerns. German consumers are highly health-conscious and inclined toward preventive healthcare, making nasal sprays a common part of wellness routines. The country sees strong participation from both domestic pharmaceutical companies and global brands. Products with herbal ingredients and clinically supported benefits are particularly favored. The widespread network of Apotheken (pharmacies), along with increased digital health retailing, ensures easy product availability, thereby driving the growth.

Key Players and Competitive Analysis

The industry is moderately competitive, with several global and regional players focusing on product innovation, clinical efficacy, and natural formulations. Companies such as GSK plc, Merck & Co., Inc., and Sandoz International GmbH have leveraged their strong distribution networks and brand presence to secure a significant market share. Altamira Therapeutics and Xlear, Inc. focus on scientifically backed nasal sprays formulated with natural or xylitol-based ingredients. Himalaya Wellness Company and Church & Dwight Co., Inc. cater to the growing demand for herbal and over-the-counter solutions. NeilMed Pharmaceuticals, Inc. specializes in saline and xylitol nasal sprays with a strong footprint in North America. Aurena Laboratories AB and JGL d.d. support private label manufacturing and regional supply. Strategic collaborations, R&D investments, and expanding OTC availability are key factors shaping competition. Companies are also aligning product claims with anti-pollution efficacy to meet rising consumer demand in urban and high-pollution regions.

Key Players

- Altamira Therapeutics

- Aurena Laboratories AB

- Church & Dwight Co., Inc.

- GSK plc

- Haleon plc

- Himalaya Wellness Company

- Jadran-galenski laboratorij d.d. JGL d.d.

- Merck & Co., Inc.

- NeilMed Pharmaceuticals, Inc.

- Sandoz International GmbH

- Xlear, Inc.

Anti-pollution Nasal Spray Industry Developments

In July 2025, Lupin launched Ipratropium Bromide Nasal Solution in the U.S. market as a generic version of Atrovent, offering 0.03% and 0.06% strengths, aiming to strengthen its complex generics portfolio and expand respiratory product offerings.

In February 2022, Glenmark launched nitric oxide nasal spray, FabiSpray, in India for adult COVID-19 patients at high risk of disease progression. The product was developed in partnership with SaNOtize and received accelerated approval from the Drugs Controller General of India.

Anti-pollution Nasal Spray Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Pollution Defense Products

- Symptomatic Relief Nasal Sprays

- Cleansing Nasal Sprays

- Hydrating Nasal Sprays

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online Channels

- Retail Pharmacies

- Supermarkets/General Retail Stores

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Anti-pollution Nasal Spray Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 8.06 Billion |

|

Market Size in 2025 |

USD 8.51 Billion |

|

Revenue Forecast by 2034 |

USD 14.06 Billion |

|

CAGR |

5.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 8.06 billion in 2024 and is projected to grow to USD 14.06 billion by 2034.

The global market is projected to register a CAGR of 5.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Altamira Therapeutics; Aurena Laboratories AB; Church & Dwight Co., Inc.; GSK plc; Haleon plc; Himalaya Wellness Company; Jadran-galenski laboratorij d.d. (JGL d.d.); Merck & Co., Inc.; NeilMed Pharmaceuticals, Inc.; Sandoz International GmbH; and Xlear, Inc.

The pollution defense products segment dominated the market share in 2024.

The online segment is expected to witness the significant growth during the forecast period.