Aquaponics Market Share, Size, Trends, & Industry Analysis Report

By Product (Fish, Herbs, Fruits, Vegetables, Others); By Component; By Methods; By End-User; By Region, Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM1537

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

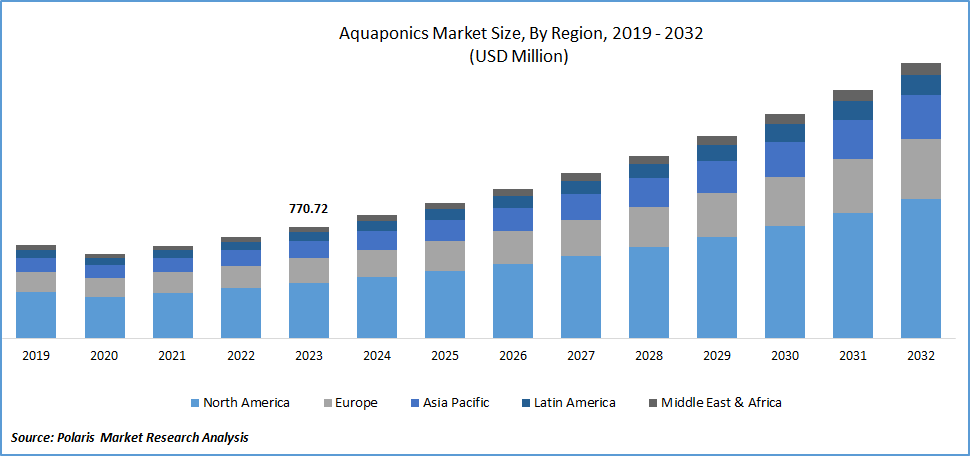

The global aquaponics market was valued at USD 770.72 million in 2023 and is anticipated to grow at a CAGR of 10.6% during the forecast period.

Aquaponics is a system that combines hydroponics and aquaculture to grow plants and fish together in a single integrated system. Growing fish and other aquatic animals are known as aquaculture, while growing plants without soil are known as hydroponics. The plants use the waste from the fish as an organic food source, and the plants also act as a natural water filter for the fish. Aquaponics recycles nutrient-rich water while removing weeds, back strain, and small animal access. Compared to soil-based farming, aquaponics uses only 10% of the water and eliminates toxic runoff. Media-based aquaponics, deep water culture, nutrient film technique, and vertical aquaponics are a few aquaponics techniques.

To Understand More About this Research: Request a Free Sample Report

The need for high-quality food and the growing global population are two factors driving the aquaponics market. Global demand for organic fruits and vegetables has increased significantly, which has fueled the aquaponics industry's expansion. The aquaponics market is growing due to factors like increasing urbanization and the availability of fruits and vegetables off-season. The aquaponics market is growing at a faster rate owing to improvements in farming techniques, reduced transportation and storage costs, and rising consumer awareness. The market for aquaponics has expanded as a result of the growing population's increased demand for food, the decline in arable land, and the use of less water for crop cultivation. There would be plenty of room for growth in the aquaponics market because of reduced reliance on weather and year-round crop production.

The relatively high cost of the initial system setup is the primary constraint on the aquaponics market. The Aquaponics market, while holding considerable promise for sustainable and efficient food production, faces several restraining factors that impact its widespread adoption. At first, the initial setup costs for aquaponics systems can be prohibitive for small-scale farmers or new entrants, hindering their ability to invest in the technology. Also, the complexity of system management and the need for technical expertise pose challenges for individuals without a background in aquaculture or hydroponics. Regulatory challenges and a lack of standardized guidelines for aquaponics operations also affect market growth, as different regions have varying rules governing water quality, fish stocking density, and other critical factors.

Industry Dynamics

Growth Drivers

Reduced susceptibility to pathogens and increased need for food safety and traceability

Traditional farming methods often face challenges related to the spread of diseases among crops, leading to significant economic losses and compromising food safety. In contrast to this, aquaponics, which integrates aquaculture and hydroponics, operates in a closed-loop system where the symbiotic relationship between fish and plants creates a self-sustaining ecosystem. This closed system inherently minimizes the risk of pathogen transmission, as the recirculating water efficiently filters out potential contaminants.

Also, the growing global concern for food safety and the demand for traceability in the supply chain have become important factors driving the adoption of Aquaponics. Aquaponics, by its nature, offers a transparent and traceable approach, as the controlled environment allows for rigorous monitoring of water quality, fish health, and plant growth. This not only addresses concern about the use of pesticides and chemicals but also provides a reliable and traceable source of fresh produce and fish.

Essentially, the reduced susceptibility to pathogens and the heightened focus on food safety and traceability position aquaponics as a compelling solution for a sustainable and secure food production system, aligning with the evolving preferences of both producers and consumers in the modern agricultural landscape.

Report Segmentation

The market is primarily segmented based on product, component, method, end-user, and region.

|

By Product |

By Component |

By Method |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

The fish segment is estimated to hold the largest revenue share in 2022.

The fish segment in aquaponics serves a dual purpose by not only providing a sustainable source of protein but also acting as a vital nutrient source for plants. The cultivation of fish, often species such as tilapia, trout, or catfish, generates revenue through the sale of the fish themselves. This dual-product approach enhances the overall profitability of aquaponic operations, contributing significantly to the greater revenue share held by the fish segment.

Also, fish farming in aquaponics has proven to be highly productive and resource-efficient. The nutrient-rich wastewater from the fish tanks serves as an organic fertilizer for the plants, creating a closed-loop ecosystem that maximizes resource utilization. This efficiency results in accelerated plant growth and yields, enhancing the overall productivity of the aquaponic system.

By End-User Analysis

The commercial segment dominated the market in 2023

The commercial segment dominated the market in 2023 and is expected to continue its dominance in the forecast period. Commercial enterprises, including farms and agribusinesses, have increasingly incorporated aquaponics due to its potential for high-volume, year-round production of both fish and crops. One significant factor driving the commercial segment's dominance is the ability of aquaponics to meet the demands of a growing population for sustainable and locally sourced produce. Large-scale aquaponic operations can produce a variety of vegetables and fish in a controlled environment, offering a consistent and reliable supply of fresh, high-quality food. This fits well with the preferences of consumers and businesses.

Also, the commercial segment benefits from economies of scale, enabling cost-effective production and distribution. The investment costs are often more justifiable for commercial enterprises with the capacity to capitalize on the revenue potential of aquaponic systems. This scalability factor enhanced the profitability of commercial aquaponics operations and contributed to the segment's dominance in the market.

Regional Insights

North America region dominated the Aquaponics Market in 2023

There is a growing awareness and emphasis on sustainable agriculture and locally sourced food production in North America. Aquaponics, with its ability to produce both fish and vegetables in a controlled and resource-efficient manner, aligns well with the region's increasing demand for environmentally friendly and socially responsible farming practices. The robust and mature agriculture and aquaculture industries in North America provide a solid foundation for the adoption of aquaponics. The region's well-established infrastructure, including advanced farming techniques, research institutions, and a supportive regulatory environment, facilitates the integration of aquaponics into existing agricultural practices. This ease of adoption contributes to the dominance of the North American region in the Aquaponics Market.

The Asia-Pacific region is poised to emerge as the fastest-growing segment in the aquaponics market during the forecast period, owing to the combination of factors that underscore the region's increasing investment in sustainable agriculture practices. The rising population and urbanization in Asia-Pacific have intensified the demand for efficient and high-yield farming methods to ensure food security. Aquaponics, with its dual production of fish and crops in a controlled environment, aligns well with the region's need for sustainable and resource-efficient agriculture.

Key Market Players & Competitive Insights

Key players in the market conduct awareness campaigns and provide services like design, consulting, and training programs. As consumer demand for aquaponics grows, industry leaders are responding with cutting-edge products. International companies are branching out into developing markets in order to grow their clientele, fortify their position in the industry, and take a larger share of the aquaponics market.

Some of the major players operating in the global Aquaponics market include:

- Aponic Ltd

- Aquaponic Lynx LLC

- Aquaponics

- Aquaponik Manufactory GmbH

- Backyard Aquaponics Pty Ltd

- Hapa Farms

- Hydrofarm Holdings Group, Inc.

- LivinGreen

- My Aquaponics

- Nelson and Pade Aquaponics

- Pentair Aquatic Eco-System, Inc. (PAES)

- Portable Farms Aquaponics Systems

- Practical Aquaponics (Pty)Ltd

- The Aquaponic Source

- Ultrasonics Canada Corp.

Recent Developments

- In 2020, a pioneering project was initiated by the Ministry of Agriculture (MoA) and the Food and Agriculture Organization of the United Nations (FAO) to offer technical assistance and capacity-building to Jordan's Integrated Agri-Aquaculture (IAA) farming systems.

- In 2021, Global humanitarian development organization INMED Partnerships for Children announced the opening of its first INMED Aquaponics® Social Enterprise (INMED ASE) in Vanderbijlpark, Gauteng.

- In 2022, The Sikkim government announced the introduction of hydroponic, aquaponic, and rooftop farming as modern farming techniques in the state to help increase productivity even on small private landholdings and guarantee financial gains for the farmers.

Aquaponics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 848.79 million |

|

Revenue Forecast in 2032 |

USD 1,903.78 million |

|

CAGR |

10.6% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments Covered |

By Product, By Component, By Method, By End-user, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements concerning countries, regions, and segmentation. |

Explore the market dynamics of the 2024 Aquaponics Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports. The analysis of Aquaponics Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Bestselling Reports:

Kaolin Market Size, Share Research Report

Home Solar System Market Size, Share Research Report

Tissue Diagnostics Market Size, Share Research Report

Tissue Engineering Market Size, Share Research Report

Cloud-Radio Access Network (C-RAN) Market Size, Share Research Report

FAQ's

The global aquaponics market size is expected to reach USD 1,903.78 million by 2032

Aponic Ltd, Ultrasonics Canada Corp., Hydrofarm Holdings Group, Inc., Pentair Aquatic Eco-System are the top market player in the market.

North America region contribute notably towards the global Aquaponics Market.

The global aquaponics market is anticipated to grow at a CAGR of 10.6% during the forecast period.

The Aquaponics Market report covering key segments are product, component, method, end-user, and region.