Architectural Coatings Market Size, Share, Trends, Industry Analysis Report

: By Resin Type, Technology (Solventborne and Waterborne), Application, End User, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:Jan-2025

- Pages: 129

- Format: PDF

- Report ID: PM1761

- Base Year: 2024

- Historical Data: 2020-2023

Architectural Coatings Market Overview

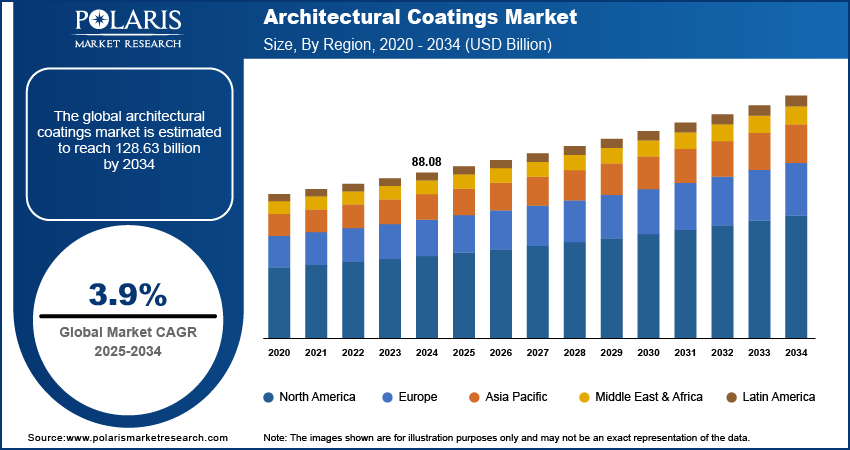

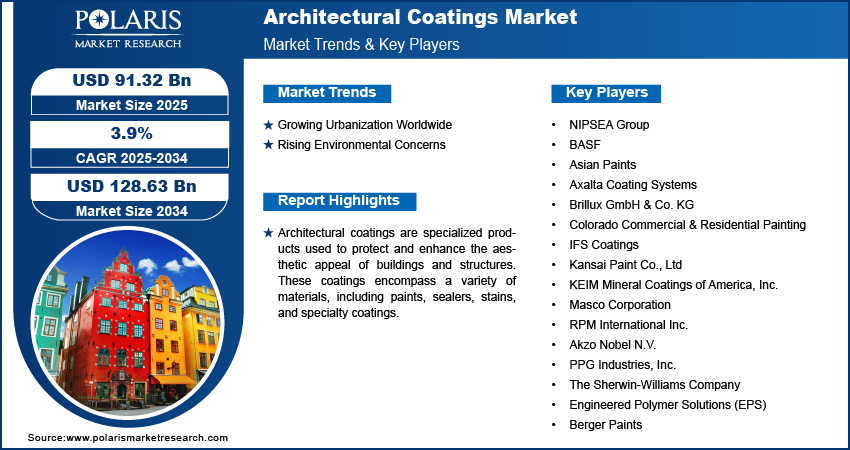

Architectural coatings market size was valued at USD 88.08 billion in 2024 and is projected to grow at a CAGR of 3.9 % during the forecast period. Architectural coatings, including paints, varnishes, and finishes, play a crucial role in home décor by transforming interiors and exteriors, allowing homeowners to align their homes with current design trends or express individual styles. Therefore, as the focus or the demand for home décor increases, the market revenue also spurs.

Architectural coatings are specialized products used to protect and enhance the aesthetic appeal of buildings and structures. These coatings encompass a variety of materials, including paints, sealers, stains, and specialty coatings, which are applied to both interior and exterior surfaces. The primary functions of architectural coatings are to provide a decorative finish while offering protection against environmental factors such as moisture, UV radiation, and mechanical wear.

To Understand More About this Research: Request a Free Sample Report

The market demand is driven by the rising popularity of DIY projects. DIY enthusiasts often undertake tasks such as painting walls, refinishing furniture, or creating accent features, all of which require high-quality coatings, including paints, primers, and finishes. The accessibility of online tutorials, social media inspiration, and a growing preference for cost-effective solutions have further encouraged homeowners to tackle such projects themselves. This trend drives demand for easy-to-use, versatile, and innovative architectural coatings designed to deliver professional results without requiring advanced skills. Moreover, the sense of accomplishment and creative satisfaction associated with DIY projects motivates repeat purchases, contributing to the overall expansion.

Market Driver Analysis

Growing Urbanization Worldwide

The growing urbanization worldwide is projected to propel the global architectural coatings market. According to a report published by the United Nations Habitat, urban areas are already home to 55 percent of the world's population, and that figure is expected to grow to 68 percent by 2050. Urbanization leads to an increase in construction activities to accommodate the rising population in cities, creating a need for paints, varnishes, and protective coatings for both interior and exterior applications. Additionally, urban dwellers often prioritize modern, aesthetically appealing, and durable living and working spaces, further fueling the demand for high-quality architectural coatings.

Rising Environmental Concerns

The rising environmental concerns have significantly boosted the demand for eco-friendly architectural coatings as consumers and regulatory bodies prioritize sustainable building practices. Architectural coatings now often incorporate advanced formulations designed to reduce environmental impact, such as low or zero VOC (volatile organic compound) products, which minimize air pollution and health hazards. Green building certifications and environmental regulations worldwide encourage the use of architectural coatings that contribute to energy efficiency, such as reflective coatings for temperature regulation and longer-lasting finishes that reduce waste. Additionally, increased awareness of climate change has spurred innovation in bio-based and recyclable coating materials, creating an opportunity for eco-friendly architectural coatings.

Market Segment Analysis

Market Assessment by Resin Type Outlook

Based on resin type, the architectural coatings market is categorized into acrylic, vinyl acetate-ethylene (VAE), alkyds, polyurethane, epoxy, polyesters, and others. The acrylic segment held the largest share in 2024 due to its superior performance characteristics and versatility. Acrylic-based coatings offer excellent durability, resistance to UV radiation, and weathering, making them a preferred choice for both interior and exterior applications. The fast-drying nature and compatibility with a wide range of substrates, including concrete, wood, and metal, enhance acrylic usability across diverse construction projects. Additionally, the rise in green building initiatives has fueled the demand for low-VOC and waterborne acrylic coatings, which align with environmental regulations and sustainable construction practices. The growing urbanization and the increasing frequency of renovation activities in developed regions further boost the adoption of acrylic.

The polyurethane segment is expected to witness significant growth over the forecast period due to its superior performance attributes, including high abrasion resistance, excellent chemical stability, and long-term durability under varying climatic conditions. Demand is being driven by increased adoption in high-traffic and high-wear architectural settings, where long-lasting finishes and mechanical strength are critical. In addition, advances in waterborne polyurethane formulations are addressing environmental compliance standards and reducing VOC emissions, making them attractive for sustainable construction projects. The segment’s versatility in offering both aesthetic appeal and functional protection is contributing to overall expansion, particularly in premium interior and exterior applications.

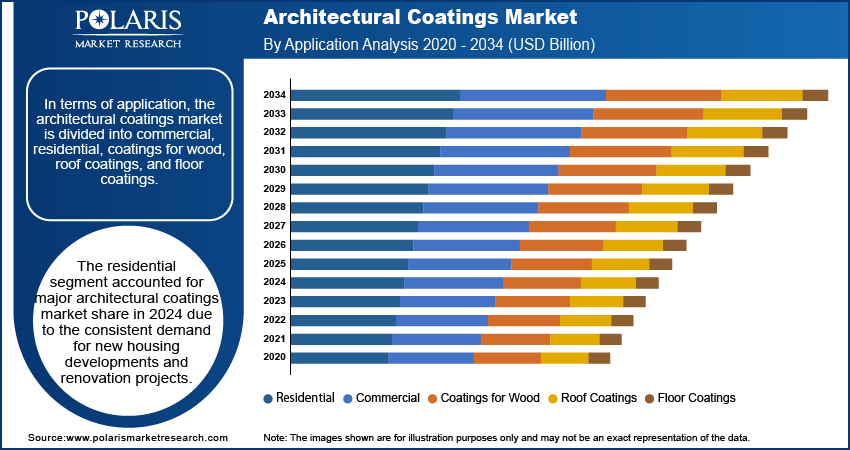

Market Evaluation by Application Outlook

In terms of application, it is divided into commercial, residential, coatings for wood, roof coatings, and floor coatings. The residential segment accounted for the largest share in 2024 due to the consistent demand for new housing developments and renovation projects. The surge in urbanization and population growth in emerging economies has driven the construction of single-family homes and multifamily housing units, creating a steady need for decorative and protective coatings. Homeowners increasingly seek durable, aesthetically pleasing finishes that enhance property value while providing protection against weathering and wear. The trend towards DIY home improvement projects, particularly in developed areas, has further boosted sales of easy-to-apply and low-maintenance coatings. Additionally, growing environmental awareness has fueled the adoption of eco-friendly, low-VOC coatings products in the residential sector.

The floor coatings segment is expected to witness significant growth over the forecast period due to the rising demand for durable, low-maintenance surfaces in both residential and commercial infrastructures. Growing emphasis on functional flooring solutions that resist chemicals, moisture, and abrasion especially in healthcare facilities, manufacturing environments, and retail spaces is driving the adoption of high-performance architectural coatings. Innovations in slip-resistant and decorative epoxy-based floor systems are also gaining traction, aligning with safety and aesthetic requirements. The convergence of durability, regulatory compliance, and enhanced lifecycle cost-efficiency is reinforcing the segment’s role in driving overall growth across diverse built environments.

Market Evaluation by End User Outlook

In terms of end user, it is divided into DIY, and professional. The professional segment accounted for the largest share in 2024 due to the rising demand for high-quality finishes, consistent application, and time-efficient project completion across commercial and residential sectors. Increasing construction activity and stringent specifications in large-scale infrastructure and real estate developments have elevated the reliance on skilled applicators who ensure material performance and compliance with regulatory standards. Demand for advanced coating technologies such as low-VOC, anti-microbial, and high-durability finishes is further reinforcing the preference for professional application. This segment continues to shape dynamics through its critical role in delivering performance-driven results and maximizing product lifecycle efficiency.

The DIY segment is expected to witness significant growth over the forecast period due to increasing consumer inclination toward home improvement, aesthetic personalization, and cost-effective renovation solutions. Surge in online tutorials, easy-to-apply formulations, and the availability of user-friendly, pre-mixed coatings are empowering end users to undertake interior and exterior upgrades without professional assistance. Manufacturers are capitalizing on this trend by offering compact packaging, integrated tools, and instructional content tailored for non-specialists. This evolving consumer behavior is unlocking new opportunities, particularly in urban households and small-scale renovation projects where convenience, affordability, and creative control are driving purchase decisions.

Regional Insights

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest share in 2024 due to rapid urbanization, population growth, and increasing investments in construction activities. China dominated the region, supported by its large-scale urban development initiatives, smart city projects, and robust real estate sector. Government policies promoting affordable housing and infrastructure development further amplified growth in the region. For instance, according to the Asia Pacific forum, the government has launched several initiatives in India, including the Pradhan Mantri Awas Yojana (PMAY), which aims to provide affordable housing to all. This initiative offers financial assistance to eligible beneficiaries for constructing or purchasing homes, successfully enabling millions, especially in rural areas, to secure housing. Additionally, the rising middle-class population and increasing disposable incomes spurred demand for aesthetically appealing and high-performance coatings in residential construction. The region's expanding industrial base and the shift towards sustainable construction practices also propelled the region’s growth.

The Europe is expected to witness steady growth over the forecast period due to the rising focus on urban regeneration projects, infrastructure upgrades, and energy-efficient construction practices in countries such as Germany, France, and the United Kingdom. The expansion of the commercial sector in the region, including offices, retail spaces, and hospitality facilities, further propels the demand for coatings offering durability, aesthetic appeal, and low environmental impact.

Key Market Players & Competitive Analysis Report

The competitive landscape is characterized by accelerated innovation cycles, strategic partnerships, and robust expansion strategies aimed at capturing demand across both mature and emerging economies. Industry analysis highlights a sharp focus on low-VOC formulations, nano-enhanced coatings, and smart finishes as manufacturers align with evolving environmental regulations and performance expectations. Mergers and acquisitions are reshaping the competitive dynamics, enabling firms to integrate vertically, diversify product portfolios, and gain access to high-growth construction and remodeling sectors. Post-merger integration efforts are increasingly directed toward harmonizing manufacturing capabilities, optimizing supply chains, and expanding digital distribution networks. Technology advancements in resin chemistry, self-healing surfaces, and bio-based coatings are unlocking new value propositions, particularly for sustainability-conscious consumers and commercial clients. Joint ventures and strategic alliances with material science firms, design consultants, and applicator networks are also gaining momentum, reinforcing brand equity and positioning. Frequent launches of premium-grade interior and exterior paints designed for high-durability, UV resistance, and stain-blocking properties are bolstering competitive differentiation. The market continues to evolve through a convergence of aesthetic innovation, functional performance, and environmental stewardship, with data-driven decision-making and customer-centric formulations increasingly guiding long-term strategic development.

The market is fragmented, with the presence of numerous global and regional players. Major players include NIPSEA Group; BASF; Asian Paints; Axalta Coating Systems; Brillux GmbH & Co. KG; Colorado Commercial & Residential Painting; IFS Coatings; Kansai Paint Co., Ltd; KEIM Mineral Coatings of America, Inc.; Masco Corporation; RPM International Inc.; Akzo Nobel N.V.; PPG Industries, Inc.; The Sherwin-Williams Company; Engineered Polymer Solutions (EPS), and Berger Paints.

Asian Paints is an Indian multinational company that specializes in the manufacturing, selling, and distribution of paints and coatings. Founded in 1942 by four visionary friends, Champaklal Choksey, Chimanlal Choksi, Suryakant Dani, and Arvind Vakil. The company operates 27 manufacturing facilities across 15 countries, servicing consumers in over 60 countries, with its headquarters located in Mumbai. The company has established a strong reputation for innovation and quality, maintaining its position as a leader in decorative paints since 1967. Asian Paints offers a diverse range of products, including interior and exterior wall finishes, enamels, wood finishes, waterproofing solutions, adhesives, and wall coverings. This extensive portfolio caters to both decorative and industrial applications, making it a versatile choice for various consumer needs.

Kansai Paint Co., Ltd., established in 1918, is one of Japan's largest manufacturers of paints and coatings, with a significant presence in the global market. Headquartered in Osaka, the company has grown to become a key player in the coatings industry, employing around 16,844 people worldwide. Kansai Paint operates 93 production facilities across 34 countries, reflecting its extensive reach and commitment to serving diverse markets. The company’s product portfolio includes automotive coatings, industrial coatings, decorative coatings, protective coatings, and marine coatings, catering to various sectors such as automotive, construction, and consumer goods.

Key Companies

- NIPSEA Group

- BASF

- Asian Paints

- Axalta Coating Systems

- Brillux GmbH & Co. KG

- Colorado Commercial & Residential Painting

- IFS Coatings

- Kansai Paint Co., Ltd

- KEIM Mineral Coatings of America, Inc.

- Masco Corporation

- RPM International Inc.

- Akzo Nobel N.V.

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Engineered Polymer Solutions (EPS)

- Berger Paints

Architectural Coatings Industry Developments

December 2024: PPG announced that it had completed the sale of 100% of its architectural coatings business in the US and Canada to American Industrial Partners (AIP) for USD 550 million.

September 2024: Engineered Polymer Solutions (EPS), a company that manufactures resins and colorants for the architectural, construction, industrial, and adhesive industries, launched a new acrylic resin for architectural coatings.

March 2023: Axalta Coating Systems, a major supplier of coatings solutions to the architectural and design segment, launched a new ICONICA collection in the US for the architectural and construction sector.

Architectural Coatings Market Segmentation

By Resin Type Outlook (Revenue, USD Billion, 2020 - 2034)

- Acrylic

- Vinyl Acetate-Ethylene (VAE)

- Alkyds

- Polyurethane

- Epoxy

- Polyesters

- Others

By Technology Outlook (Revenue, USD Billion, 2020 - 2034)

- Solventborne

- Waterborne

- Others

By Application Outlook (Revenue, USD Billion, 2020 - 2034)

- Commercial

- Residential

- Coatings for Wood

- Roof Coatings

- Floor Coatings

By End User Outlook (Revenue, USD Billion, 2020 - 2034)

- DIY

- Professional

By Regional Outlook (Revenue, USD Billion, 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Architectural Coatings Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 88.08 billion |

|

Market Size Value in 2025 |

USD 91.32 billion |

|

Revenue Forecast in 2034 |

USD 128.63 billion |

|

CAGR |

3.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global architectural coatings market size was valued at USD 88.08 billion in 2024 and is projected to grow to USD 128.63 billion by 2034.

The global market is projected to grow at a CAGR of 3.9% during the forecast period.

Asia Pacific had the largest share of the global market in 2024.

Some of the key players in the market are NIPSEA Group; BASF; Asian Paints; Axalta Coating Systems; Brillux GmbH & Co. KG; Colorado Commercial & Residential Painting; IFS Coatings; Kansai Paint Co., Ltd; KEIM Mineral Coatings of America, Inc.; Masco Corporation; RPM International Inc.; Akzo Nobel N.V.; PPG Industries, Inc.; The Sherwin-Williams Company; Engineered Polymer Solutions (EPS), and Berger Paints.

The acrylic segment is projected for significant growth in the global market.

The residential segment dominated the architectural coatings market in 2024.