Asia Pacific Personal Protective Equipment Market Size, Share, & Industry Analysis Report

: By Product (Hand Protection, Eye & Face Protection, Hearing Protection, Protective Clothing, Respiratory Protection, Protective Footwear, Fall Protection, and Others), By End User, and By Country – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 140

- Format: PDF

- Report ID: PM5604

- Base Year: 2024

- Historical Data: 2020-2023

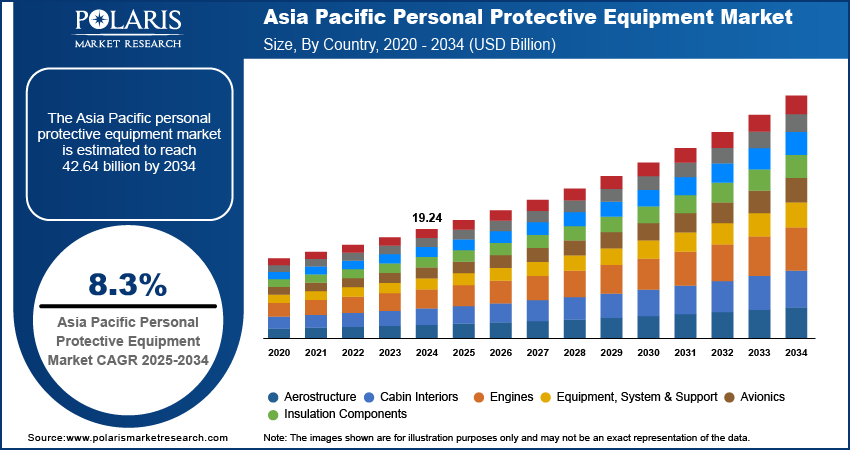

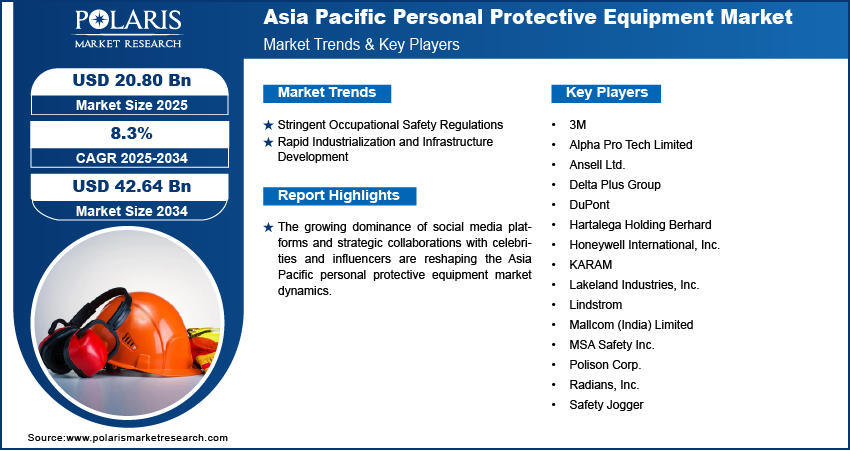

The Asia Pacific personal protective equipment (PPE) market size was valued at USD 19.24 billion in 2024 and is expected to reach USD 20.80 billion by 2025 and USD 42.64 billion by 2034, exhibiting a CAGR of 8.3% during 2025–2034.

Market Overview

The Asia Pacific personal protective equipment (PPE) market focuses on the production, distribution, and sale of protective gear designed to safeguard individuals from injuries, hazards, or exposure to harmful environments. PPE includes a wide range of products such as helmets such as smart helmets, gloves, goggles, face masks, face shields, safety shoes, earplugs, and high-visibility clothing. These products are used across various industries, including healthcare, construction, manufacturing, oil and gas, chemical processing, and transportation, to ensure worker safety and compliance with occupational health and safety regulations.

The Asia Pacific personal protective equipment industry growth is attributed to a combination of regulatory frameworks, industrial expansion, technological advancements, and heightened awareness of workplace safety. The expanding healthcare sector in Asia Pacific is driven by growing geriatric populations requiring regular medical assistance, rising prevalence of chronic diseases, and increasing healthcare spending, which has created a surge in demand for medical-grade PPE kits.

To Understand More About this Research: Request a Free Sample Report

Countries such as China, India, Vietnam, and Indonesia have emerged as significant manufacturing hubs across various sectors, including electronics, textiles, and the automotive. These sectors increasingly incorporate personal protective equipment (PPE) into their operations, thereby driving the Asia Pacific PPE market demand. Additionally, awareness campaigns and training programs conducted by governments and private organizations are educating workers about the importance of using PPE, which fuels the Asia Pacific personal protective equipment market expansion.

Market Dynamics

Stringent Occupational Safety Regulations

Stringent occupational safety regulations implemented across major Asia Pacific economies are significantly contributing to the Asia Pacific PPE industry growth. Governments in countries such as China, India, Japan, and Australia are mandating comprehensive safety compliance protocols to mitigate workplace hazards, particularly in high-risk industries such as construction, chemicals, and manufacturing. For instance, from January to November 2019, the Emergency Management Department of Sichuan province inspected 23,436 companies handling hazardous chemicals, uncovering 26,419 safety violations. Enforcement actions included suspension of operations for 56 companies, temporary cancellation of permits for 3 companies, closure of 8 firms, and liability assessments for 158 entities. The total fines amounted to around USD 1.35 million. These regulatory frameworks are influencing procurement practices, pushing companies to invest in certified PPE solutions that meet international safety standards. Rising awareness among employers regarding legal liabilities and workforce well-being is strengthening the demand for advanced protective gear. This regulatory pressure is accelerating product adoption and also stimulating innovation among manufacturers, driving the APAC personal protective equipment market expansion across diverse industrial verticals in the region.

Rapid Industrialization and Infrastructure Development

Rapid industrialization and large-scale infrastructure development across Asia Pacific are fueling the demand for personal protective equipment across the region. According to the Press Information Bureau, India's infrastructure expenditure has surged significantly, with budget allocations reaching USD 119.76 billion for the fiscal year 2023–2024. Government-led initiatives in smart city development, highway expansion, and railway modernization are fueling construction activity, leading to a surge in workforce deployment in hazardous environments. These dynamics are generating robust demand for protective clothing, safety helmets, gloves, and respiratory protection, particularly in sectors such as mining, oil and gas, and heavy machinery. The increased focus on worker safety during high-risk infrastructure execution is creating strong demand for PPE kits. Additionally, private sector investments in new manufacturing plants and energy projects are supporting long-term industry expansion. The convergence of economic development goals and occupational safety protocols is opening up significant growth opportunities for suppliers offering sector-specific, high-performance solutions.

Segment Insights

Assessment by Product

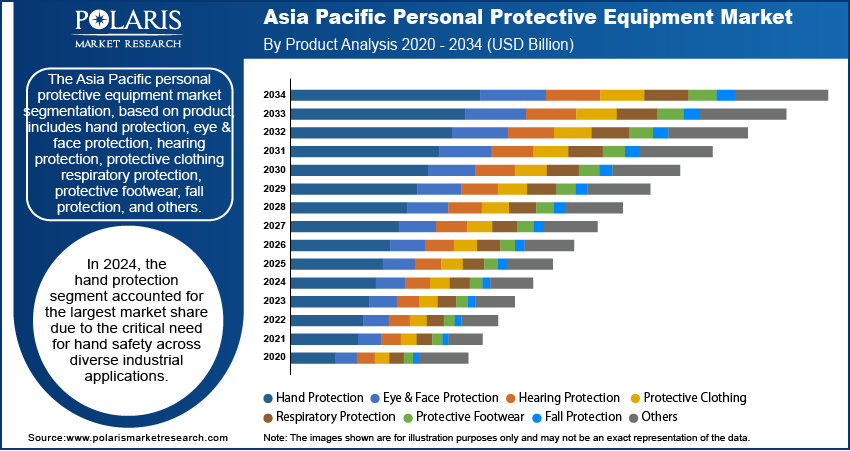

The Asia Pacific personal protective equipment market segmentation, based on product, includes hand protection, eye & face protection, hearing protection, protective clothing, respiratory protection, protective footwear, fall protection, and others. In 2024, the hand protection segment accounted for the largest share due to the critical need for hand safety across diverse industrial applications. Industries such as manufacturing, chemical processing, construction, and automotive frequently expose workers to mechanical hazards, burns, chemical exposure, and cuts. The rising adoption of specialized gloves ranging from nitrile and latex to cut-resistant and heat-resistant variants tailored to specific work environments is significantly contributing to the industry growth. Increasing awareness regarding occupational injuries and regulatory enforcement surrounding workplace safety is prompting large-scale procurement of hand protection products, thereby solidifying this segment’s dominance in the market landscape.

The fall protection segment is projected to register the highest CAGR during the forecast period due to the growing demand in high-risk sectors such as construction, oil & gas, and infrastructure development. Rising investments in large-scale vertical construction projects and industrial maintenance activities necessitate comprehensive fall arrest systems, harnesses, and lifelines. Increased enforcement of workplace safety standards and stricter penalties for non-compliance are encouraging employers to adopt certified fall protection systems. These dynamics are fueling fall protection segment growth, particularly in emerging economies where infrastructure expansion is a key driver of economic activity and the demand for personal protective equipment.

Evaluation by End Use

The Asia Pacific personal protective equipment market segmentation, based on end user, includes manufacturing, construction, automotive, oil & gas, healthcare, food, chemical, transportation, and others. In 2024, the manufacturing segment accounted for the largest revenue share due to the extensive workforce employed in hazardous production environments, including heavy machinery, chemicals, and electronics. The need for comprehensive PPE kits ranging from hand, respiratory, and eye protection to flame-retardant clothing is driven by both regulatory compliance and the necessity to mitigate occupational risks. Ongoing efforts to modernize industrial facilities and the shift toward automation are enhancing operational safety protocols. These factors are significantly contributing to the industry growth, as manufacturers prioritize employee safety and productivity through increased investment in high-performance protective gear.

The healthcare segment is expected to register the highest CAGR over the forecast period, driven by the heightened emphasis on infection control, surgical hygiene, and biohazard protection. The post-pandemic healthcare landscape continues to demand advanced PPE such as disposable gowns, face shields, N95 respirators, and protective gloves. Ongoing government initiatives to upgrade public health infrastructure and the proliferation of private clinics and diagnostic centers are intensifying the demand for medical-grade protective solutions. In addition, a growing focus on pandemic preparedness and infection surveillance in healthcare facilities is supporting the adoption of personal protective equipment in the healthcare segment.

Country Analysis

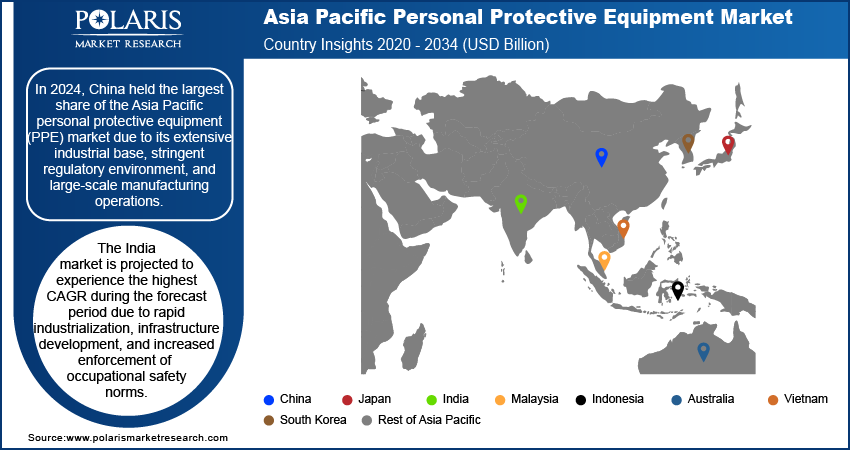

By country, the study provides Asia Pacific PPE market insights into China, Japan, India, Malaysia, South Korea, Indonesia, Australia, Vietnam, and the Rest of Asia Pacific. In 2024, China held the largest share due to its extensive industrial base, stringent regulatory environment, and large-scale manufacturing operations. The presence of a well-established network of factories and production facilities across sectors such as automotive, construction, chemicals, electronics, and mining has significantly elevated the country’s PPE consumption. Government-mandated workplace safety policies, reinforced by national labor laws and inspection frameworks, have further driven institutional procurement of PPE across public and private sectors. Additionally, China’s role as a leading exporter of PPE has led to continuous advancements in material innovation and production scalability, contributing to overall industry expansion. Integration of domestic PPE manufacturing into supply chains is enhancing production efficiency and product quality, while raising awareness about worker safety among enterprises is intensifying demand.

The India personal protective equipment market is projected to experience the highest CAGR during the forecast period due to rapid industrialization, infrastructure development, and increased enforcement of occupational safety norms. Expanding sectors such as construction, oil & gas, and pharmaceuticals are witnessing growing adoption of PPE to mitigate workplace hazards. Government initiatives promoting “Make in India” and investments in smart cities and manufacturing clusters are significantly boosting demand for high-quality protective gear. According to the India Brand Equity Foundation, India's manufacturing sector is set to reach USD 1 trillion by 2025–2026, with Maharashtra, Gujarat, and Tamil Nadu leading the way. This growth is driven by investments in electronics, automotive, and textiles, boosted by government initiatives such as Make in India and Production-Linked Incentive schemes. Additionally, rising awareness among employers regarding employee safety, coupled with stricter compliance requirements from regulatory bodies, is creating strong market dynamics. Technological advancements in domestically produced PPE and an emerging ecosystem of local manufacturers are further accelerating the country's market growth trajectory.

Key Players & Competitive Analysis Report

The competitive landscape of the market is shaped by a dynamic mix of strategic maneuvers and evolving regulatory frameworks. Industry analysis reveals a strong emphasis on market expansion strategies through localized production facilities and capacity enhancements, particularly in emerging economies. Market participants are actively pursuing mergers and acquisitions to consolidate their presence and broaden product portfolios, with post-merger integration efforts focused on optimizing distribution networks and streamlining operations. Joint ventures between regional players and firms are enabling the transfer of technology and expertise, fostering the development of high-performance PPE tailored to the specific safety requirements of industries such as construction, chemicals, and manufacturing.

Strategic alliances are playing a critical role in driving innovation, allowing manufacturers to integrate advanced materials and smart technologies into their offerings. Technology advancements, particularly in breathable fabrics, ergonomic design, and embedded sensors for real-time safety monitoring, are reshaping product development pipelines. New product launches targeting niche industrial applications and pandemic-driven demand are further intensifying competitive dynamics. Customization and certification compliance remain central to gaining market share in an environment where government safety mandates are becoming increasingly stringent. These developments collectively underscore the complex and rapidly evolving nature of the market.

Ansell Limited (Ansell) specializes in manufacturing & marketing a range of gloves, healthcare safety products, and protective clothing. Its product portfolio includes chemical-resistant, examination, and rubber-insulated gloves. Ansell operates manufacturing facilities in Malaysia, Thailand, Brazil, China, Portugal, Vietnam, and India, with its headquarters located in Richmond, Australia. In February 2024, the company launched the new ultra-textured MICROFLEX Mega Texture 93-256 glove.

MSA Safety Inc. (MSA) specializes in the development, manufacturing, and supply of safety products. Their portfolio includes breathing apparatus, fixed gas and flame detection systems, firefighter helmets, industrial head protection, and fall protection devices. It also provides respirators, eye and face protection equipment, ballistic helmets, and gas masks that enhance its core offerings. MSA operates across the Americas, Europe, the Middle East, Africa, and Asia Pacific, with its headquarters located in Cranberry Township, Pennsylvania, US. In December 2023, the company secured a USD 35 million contract from the US Air Force to supply new respiratory protective equipment for its air base fire brigades.

List of Key Companies in Asia Pacific Personal Protective Equipment Market

- 3M

- Alpha Pro Tech Limited

- Ansell Ltd.

- Delta Plus Group

- DuPont

- Hartalega Holding Berhard

- Honeywell International, Inc.

- KARAM

- Lakeland Industries, Inc.

- Lindstrom

- Mallcom (India) Limited

- MSA Safety Inc.

- Polison Corp.

- Radians, Inc.

- Safety Jogger

Major Industry Developments

July 2024: Ansell acquired Kimberly-Clark's Personal Protective Equipment (PPE) division, alongside a concurrent equity raising initiative to support this strategic expansion.

April 2022: Honeywell launched two new NIOSH-certified respiratory devices aimed at healthcare professionals, further enhancing its PPE portfolio and leveraging its extensive expertise in respiratory protection.

Asia Pacific Personal Protective Equipment Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Hand Protection

- Disposable by Type

- General Purpose

- Chemical Handling

- Sterile Gloves

- Surgical

- Others

- Disposable by Type

-

- Disposable by Material

- Natural Rubber

- Nitrile

- Vinyl

- Neoprene

- Polyethylene

- Others

- Durable

- Mechanical Gloves

- Chemical Handling

- Thermal/flame Retardant

- Others

- Disposable by Material

- Eye & Face Protection

- Safety Spectacles

- Safety Goggles

- Welding Shields

- Face Shields

- Headgear

- Hearing Protection

- Ear Plugs

- Cap Mounted Earmuffs

- Hearing Bands

- Protective Clothing

- Chemical Defending Garment

- Flame-Retardant Apparel

- High Visibility Clothing

- Clean Room Clothing

- General Use

- Others

- Respiratory Protection

- Air Purifying Respirators (APR)

- Supplied Air Respirators

- Protective Footwear

- Leather

- Rubber

- Polyvinylchloride (PVC)

- Polyurethane

- Others

- Fall Protection

- Soft Goods

- Hard Goods

- Full Body Harness

- Rescue Kits

- Body Belts

- Head Protection

- Hard Hats

- Bump Caps

- Others

By End User Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- Construction

- Automotive

- Oil & Gas

- Healthcare

- Food

- Chemical

- Transportation

- Others

By Country Outlook (Revenue – USD Billion, 2020–2034)

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

Asia Pacific Personal Protective Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 19.24 billion |

|

Market Size Value in 2025 |

USD 20.80 billion |

|

Revenue Forecast by 2034 |

USD 42.64 billion |

|

CAGR |

8.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The APAC PPE market size was valued at USD 19.24 billion in 2024 and is projected to grow to USD 42.64 billion by 2034.

The market is projected to register a CAGR of 8.3% during the forecast period.

In 2024, China held the largest market share due to its extensive industrial base, stringent regulatory environment, and large-scale manufacturing operations.

A few of the key players in the market are 3M; Alpha Pro Tech Limited; Ansell Ltd.; Delta Plus Group; DuPont; Hartalega Holding Berhard; Honeywell International, Inc.; KARAM; Lakeland Industries, Inc.; Lindstrom; Mallcom (India) Limited; MSA Safety Inc.; Polison Corp.; Radians, Inc.; and Safety Jogger.

In 2024, the hand protection segment accounted for the largest market share due to the critical need for hand safety across diverse industrial applications.

In 2024, the manufacturing segment accounted for the largest market share due to the extensive workforce employed in hazardous production environments, including heavy machinery, chemicals, and electronics.