Aspherical Lens Market Size, Share, & Trends Analysis Report

: By Shape, By Material (Glass, Polymer, and Crystal), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5940

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

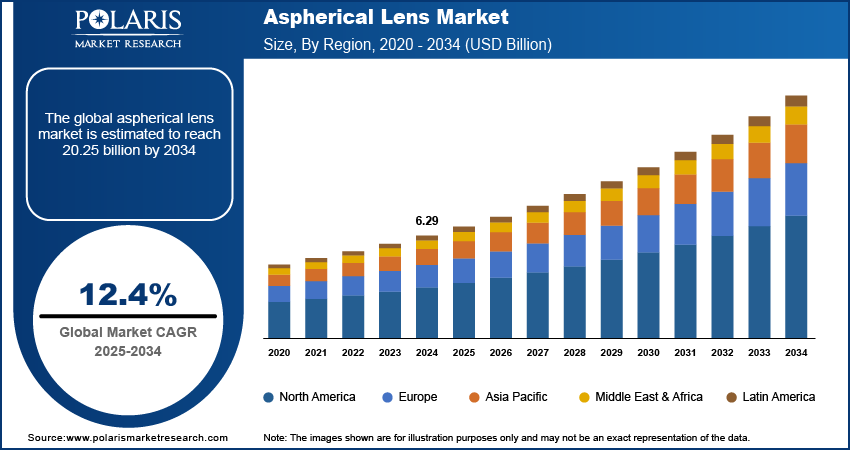

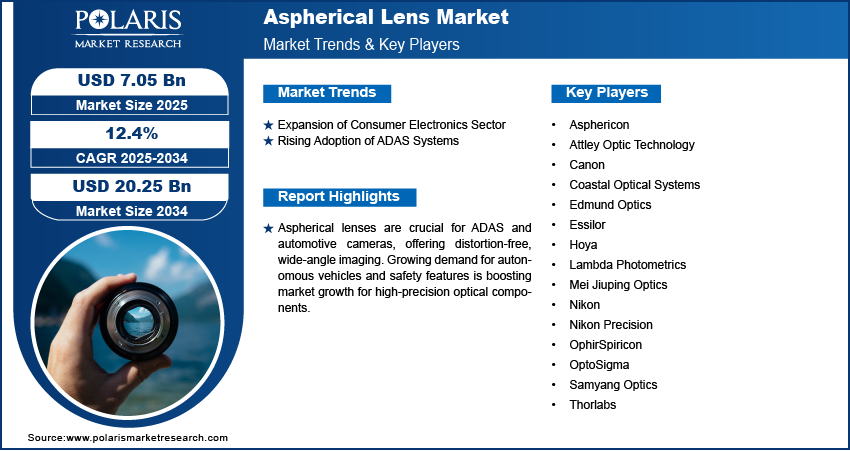

The global aspherical lens market size was valued at USD 6.29 billion in 2024, growing at a CAGR of 12.4% during 2025–2034. The growth is driven by rising demand for consumer electronics and rising adoption of ADAS systems.

An aspherical lens has a nonspherical surface profile designed to reduce optical aberrations such as distortion and spherical aberration. This allows it to provide sharper images and better performance compared to traditional spherical lenses, especially in compact optical systems.

Aspherical lenses help produce clearer and sharper images by reducing distortions and aberrations found in traditional lenses. This makes them essential in cameras, smartphones, and other imaging devices where picture quality is critical. Manufacturers are increasingly adopting aspherical lenses as consumers and professionals are demanding better image clarity. The rise of social media and content creation further fuels this demand, pushing companies to integrate advanced lens technology for superior photo and video quality. As a result, the need for aspherical lenses in photography and video equipment is driving the market growth for aspherical lenses.

To Understand More About this Research: Request a Free Sample Report

Improvements in manufacturing processes, such as precision molding and grinding, have made producing aspherical lenses more cost-effective and efficient. Advanced technology allows for greater precision in shaping the lens surfaces, resulting in better optical performance. These advancements lower production costs and increase availability, making aspherical lenses accessible for various applications beyond high-end optics. This technological progress encourages more industries to adopt aspherical lenses, expanding their presence in sectors, including medical devices, automotive sensors, and industrial inspection systems.

Industry Dynamics

Expansion of Consumer Electronics Sector

The rapid expansion of the consumer electronics sector, especially smartphones and digital cameras, has increased the demand for compact, lightweight, and high-performance lenses. According to Apple's Annual Report, smartphone sales rose from USD 191,973 million in 2021 to USD 205,489 million in 2022, showcasing the growing demand for consumer electronics. Aspherical lenses are perfect for these devices due to their ability to maintain optical quality in smaller sizes. Manufacturers seek to improve camera modules without increasing device bulk. This trend is particularly strong in smartphones, where multiple lens systems require precise, small lenses with high image quality. The continuous innovation in consumer electronics is boosting the demand for these lenses.

Rising Adoption of ADAS Systems

Aspherical lenses play a vital role in automotive cameras and Advanced Driver Assistance Systems (ADAS), which require accurate image capture for safety features such as lane departure warnings and collision avoidance. These systems rely on high-quality lenses that can handle wide-angle views and reduce distortions. The demand for ADAS systems is driven by rising safety precautions by regulatory bodies due to the rising number of car accidents. According to a study by the Partnership for Analytics Research in Traffic Safety, 2.1 million car accidents between 2015 and 2023 out of 7.7 million could have been prevented by ADAS systems. Additionally, the demand for precise optical components increases as the automotive industry shifts towards autonomous and semi-autonomous vehicles, thereby driving the demand for these lenses.

Segmental Insights

By Shape Analysis

The aspherical lenses segment held the largest share in 2024 due to their ability to correct multiple optical aberrations while maintaining a compact form. Unlike simple spherical lenses, aspherical designs offer better image quality, sharper focus, and less distortion, especially at the edges. These lenses are widely used across industries, making them the preferred choice for high-performance optical applications. Growing demand for devices that are both compact and high-resolution is driving the popularity of aspherical lenses.

The convex lenses segment is experiencing significant growth. These lenses are known for their ability to converge light and are commonly used in basic optical systems such as magnifiers, eyeglasses, and projectors. Convex lenses are easier and cheaper to manufacture, making them ideal for applications that don’t require the advanced correction capabilities of aspherical lenses. Their continued use in educational tools, entry-level cameras, and optical instruments contributes to their importance in the overall lens market, even as more complex lens types become widespread.

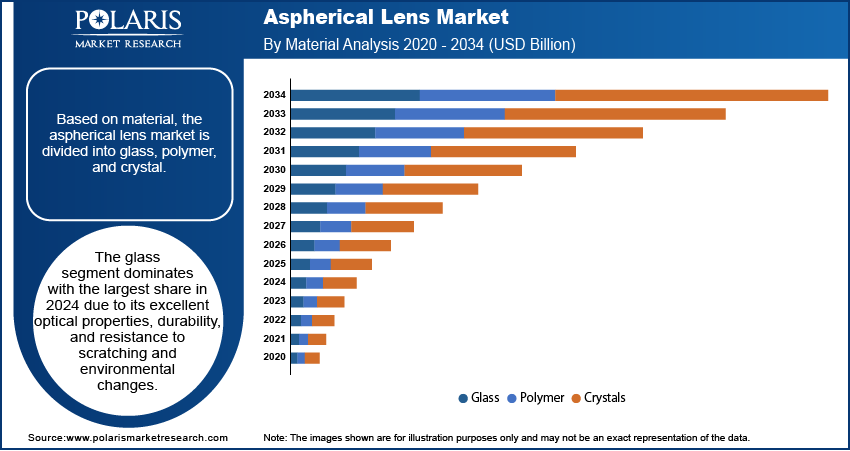

By Material Analysis

The glass segment dominates with the largest share in 2024 due to its excellent optical properties, durability, and resistance to scratching and environmental changes. Glass lenses provide superior clarity and can withstand high temperatures and pressures, making them ideal for precision applications in cameras, microscopes, telescopes, and automotive sensors. Although plastic lenses are lighter and cheaper, glass is preferred when high image quality and long-term reliability are essential. As demand for advanced optics increases in professional-grade devices, glass continues to be the leading material choice in this market.

By Application Analysis

The cameras segment is experiencing significant growth, driven by the growing demand for high-resolution photography and videography. Aspherical lenses are essential in modern camera systems, including DSLRs, mirrorless cameras, and smartphone cameras, as they reduce distortion and produce sharper images, especially in wide-angle and zoom settings. The rise of social media, digital content creation, and mobile photography has fueled the need for better optical performance. The integration of aspherical lenses continues to be a key factor in enhancing image quality across devices as camera technology advances and becomes more compact.

Regional Analysis

The North America aspherical lens market dominated with the largest share in 2024 due to high demand for advanced imaging technologies in consumer electronics, defense, and medical sectors. The region is home to major optical manufacturers and tech companies that invest heavily in R&D. The growing adoption of AR/VR devices, autonomous vehicles, and high-resolution cameras also contributes to market expansion. Additionally, the healthcare industry’s demand for precision imaging in diagnostics and surgery further supports lens consumption and thereby drives the growth of the industry in the region.

The Asia Pacific aspherical lens market is expected to witness significant growth during the forecast period, driven by the massive consumer electronics manufacturing base in countries such as China, Japan, and South Korea. The region benefits from cost-effective production, strong export capabilities, and the presence of key players such as Canon, Nikon, Sony, and Hoya. Rising smartphone penetration, increasing demand for high-end cameras, and growth in automotive safety technologies further fuel the market. In addition, expanding healthcare infrastructure and industrial automation contribute to the adoption of precision optical components. Asia Pacific’s rapid technological advancement and economic growth make it the most dynamic and fastest-growing region in the market.

The India aspherical lens market is driven by increasing demand for smartphones, surveillance systems, and diagnostic imaging equipment. The country’s expanding middle class and rising interest in photography and content creation are pushing manufacturers to improve camera technology. Government initiatives in healthcare, defense, and smart cities are also encouraging the adoption of high-precision optics. Though domestic lens production is still developing, partnerships with global optics brands and local assembly are helping bridge the gap between demand and supply, thereby driving the industry growth in the region.

.webp)

The Europe aspherical lens market is expected to grow significantly during the forecast period due to strong presence in automotive, medical, and industrial sectors. Countries such as Germany, France, and the UK lead in precision engineering and optical research, supporting innovation in lens technology. The region’s emphasis on vehicle safety standards and adoption of ADAS systems boost demand for advanced lenses in the automotive industry. Moreover, Europe’s robust healthcare system drives the need for high-quality lenses in imaging and diagnostic devices, thereby driving the industry growth.

Key Players and Competitive Analysis

The field of aspherical lenses is highly competitive, with key players including Canon, Nikon, and Sony leveraging proprietary technology and integrated camera systems. Edmund Optics, Thorlabs, and OptoSigma serve industrial, scientific, and custom optics segments, while Hoya and Essilor focus on ophthalmic applications. Fujifilm, Coastal Optical, and OphirSpiricon cater to high-precision imaging and metrology needs. Companies such as Asphericon and Attley Optic Technology specialize in custom, high-precision aspheres for research and aerospace. Lambda Photometrics and Mei Jiuping Optics support niche and regional demands. Innovation, quality, and application-specific performance define competition, with growing demand across photography, medical imaging, AR/VR, and industrial automation.

Asphericon was established in 2001 in Jena, Germany, with a focus on the production of aspheric optical components. The company developed a digital manufacturing process based on proprietary CNC control software, enabling precise and flexible production of optical elements. Asphericon employs around 200 people and operates from a production facility covering ∼2,700 square meters in Jena. It also has subsidiaries in the US (Florida) and the Czech Republic, which support its operations and customer base across different regions. The company’s product range includes custom aspheres, spherical lenses, mirrors, freeform optics, and miniaturized optical systems. In addition to manufacturing, asphericon provides services such as optical and mechanical design, coating, metrology, assembly, and optical characterization. Its manufacturing capabilities cover a variety of materials and wavelengths, with a focus on achieving high dimensional accuracy and surface quality. The products are used in various fields, including aerospace, laser technology, medical devices, metrology, automotive, and industrial applications. Asphericon has been involved in projects requiring strict optical tolerances, such as components for space missions. Its main operations are based in Jena, Germany, which serves as its headquarters and primary research and development center. The company’s subsidiary in Chrastava, Czech Republic, focuses on production, while its office in Las Vegas, USA, handles sales and customer support for the North American market.

Canon Inc., a Japanese multinational corporation headquartered in Ohta-ku, Tokyo, specializes in the manufacture of optical, imaging, and industrial products. Founded in 1933, the company has expanded its operations globally and is organized into four main business segments. The Office Business Unit produces copying machines, digital production printers, large-format inkjet printers, laser printers, and multifunction devices. The Imaging System Business Unit includes products such as broadcasting equipment, calculators, digital cameras, camcorders, scanners, and inkjet printers. The Medical System Business Unit focuses on medical imaging equipment, including MRI, CT Scanner, ultrasound devices, and ophthalmic devices. The Industry and Others Business Unit manufactures computers, magnetic heads, micromotors, lithography equipment used in semiconductor production, and network cameras. Canon’s products are used across various sectors, including office environments, healthcare, photography, industrial manufacturing, and semiconductor fabrication. The company operates manufacturing facilities in several countries, including the US, Canada, China, Germany, France, the Netherlands, and the UK. It also maintains sales and marketing subsidiaries across the Americas, Asia Pacific, Europe, and Africa. The company has more than 330 consolidated subsidiaries. Canon’s regional operations are divided mainly into Japan, the Americas, Europe, and Asia & Oceania. Canon Europe, headquartered in London and Amstelveen, manages sales and marketing activities across Europe, the Middle East, and Africa. Canon’s advanced lens technologies include fluorite, aspherical, ultra-low dispersion (UD), and Blue Spectrum Refractive (BR) elements, which are engineered to reduce aberrations, enhance sharpness, and improve image quality across a range of professional and consumer lenses.

Key Players

- Asphericon

- Attley Optic Technology

- Canon

- Coastal Optical Systems

- Edmund Optics

- Essilor

- Hoya

- Lambda Photometrics

- Mei Jiuping Optics

- Nikon

- Nikon Precision

- OphirSpiricon

- OptoSigma

- Samyang Optics

- Thorlabs

Industry Developments

In April 2025, Sony India launched the FE 16mm F1.8 G lens, delivering ultra-wide full-frame resolution, stunning bokeh, fast autofocus, and compact design ideal for photography and video enthusiasts seeking premium performance and creative versatility.

In October 2024, Fujifilm launched the FUJINON XF16-55mmF2.8 R LM WR II lens globally, offering improved optics, a 37% lighter build, smooth aperture control for video, and enhanced autofocus for both still photography and professional video recording.

Aspherical Lens Market Segmentation

By Shape Outlook (Revenue, USD Billion, 2020–2034)

- Convex

- Concave

- Aspherical

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Glass

- Polymer

- Crystals

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Cameras

- Smartphones

- Medical Devices

- Automotive Headlamps

- Laser Systems

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Aspherical Lens Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.29 Billion |

|

Market Size Value in 2025 |

USD 7.05 Billion |

|

Revenue Forecast by 2034 |

USD 20.25 Billion |

|

CAGR |

12.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.29 billion in 2024 and is projected to grow to USD 20.25 billion by 2034

The global market is projected to register a CAGR of 12.4% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Asphericon, Attley Optic Technology, Canon, Coastal Optical Systems, Edmund Optics, Essilor, Hoya, Lambda Photometrics, Mei Jiuping Optics, Nikon, Nikon Precision, OphirSpiricon, OptoSigma, Samyang Optics, and Thorlabs.

The aspherical segment dominated the market share in 2024.

The camera segment is expected to witness the significant growth during the forecast period.