Automotive OEM Coatings Market Size, Share, Trend, Industry Analysis Report

By Product (Clear Coat, Base Coat, Primer, E-Coat, Others), By Resin, By Technology, By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5970

- Base Year: 2024

- Historical Data: 2020-2023

Overview

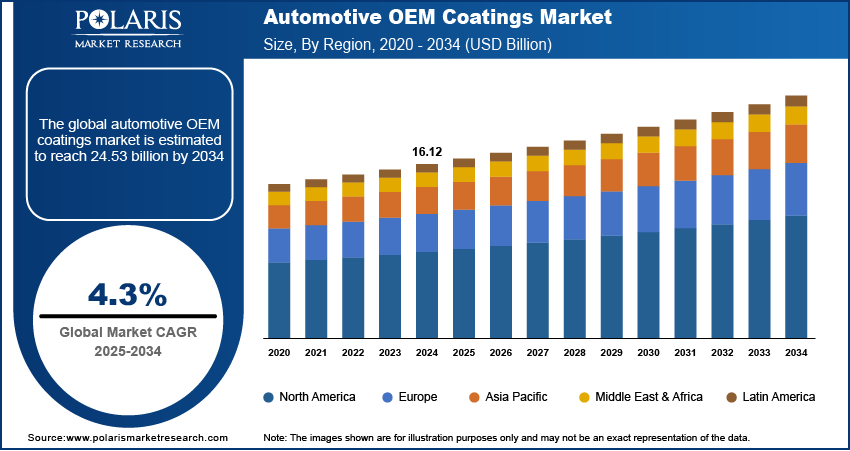

The global automotive OEM coatings market size was valued at USD 16.12 billion in 2024, growing at a CAGR of 4.3% from 2025 to 2034. Increased global vehicle manufacturing boosts demand for high-performance OEM coatings that meet durability and aesthetic standards across passenger and commercial vehicles.

Key Insights

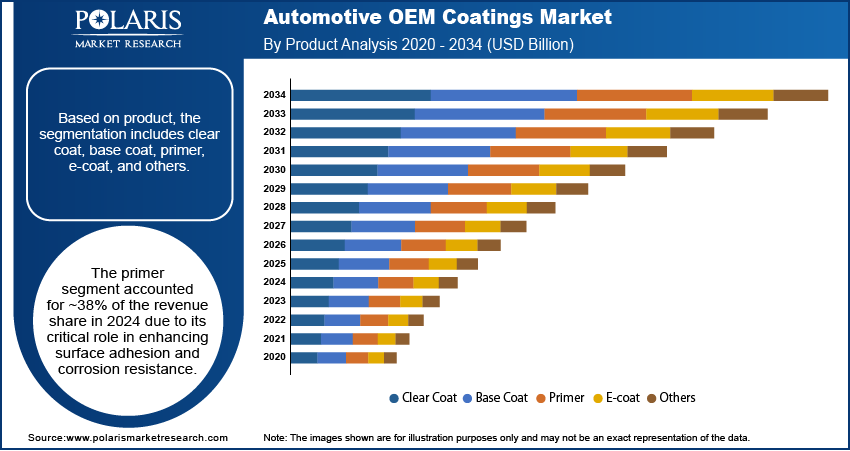

- The primer segment accounted for ~38% of the revenue share in 2024

- The epoxy segment held the largest revenue share in 2024.

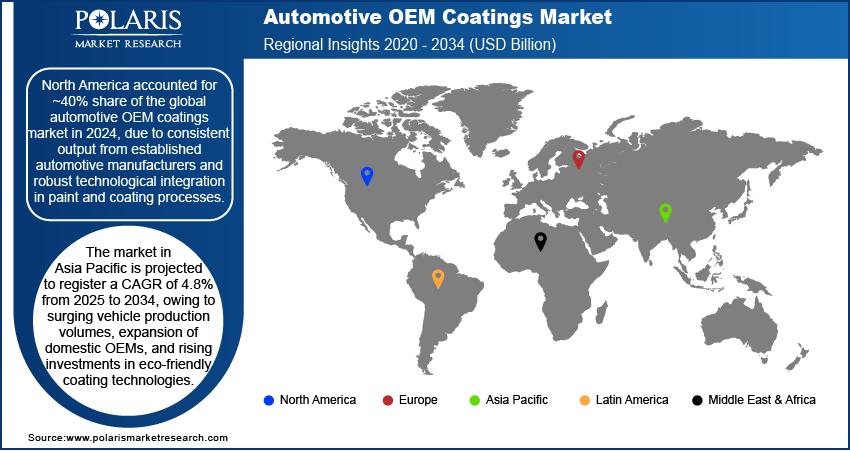

- North America accounted for ~40% of the revenue share of the global automotive OEM coatings market in 2024.

- The U.S. held the dominant share in North America automotive OEM coatings landscape in 2024.

- The market in Asia Pacific is projected to register a CAGR of 4.8% from 2025 to 2034.

- The market in China is expanding due to high vehicle production rates, rapid EV adoption, and strong demand for locally produced and exported automobiles.

The automotive OEM coatings industry involves the production and supply of coatings applied to vehicles during original manufacturing by automakers. Coatings such as primers, basecoats, and clearcoats enhance durability, corrosion resistance, and aesthetics, while also meeting environmental and regulatory standards. OEM coatings are applied in factory-controlled environments, ensuring uniform finish and long-term protection. Innovation in waterborne, UV-cured, and powder coatings is driving overall growth, offering faster curing times, energy efficiency, and reduced environmental impact.

Growing consumer preference for vibrant colors, metallic finishes, and matte effects is pushing automakers to adopt advanced paint solutions during OEM production. Additionally, stricter VOC emission norms are encouraging manufacturers to shift toward eco-friendly coating formulations, fueling demand for water-based and low-VOC OEM coatings.

To Understand More About this Research: Request a Free Sample Report

Focus on lightweight materials such as plastics and composites in vehicle bodies requires specialized coatings for adhesion and durability, driving innovation and demand in the OEM coatings market. Moreover, automation in vehicle coating processes enhances efficiency, consistency, and quality, leading OEMs to invest in coatings compatible with robotic application systems.

Industry Dynamics

- Electric vehicle manufacturing is expanding rapidly, leading to changing requirements for automotive coatings.

- Increased global vehicle manufacturing is boosting demand for high-performance OEM coatings.

- Expansion of automotive production in emerging markets drives demand for advanced, cost-effective coating solutions tailored to local manufacturing needs.

- Stricter environmental regulations limit the use of high-VOC coatings, increasing compliance costs for manufacturers.

Increased Adoption of Electric Vehicles (EVs): Electric vehicle (EV) manufacturing is expanding rapidly, leading to changing requirements for automotive coatings. According to the U.S. Department of Energy (DOE), electric vehicle (EV) sales in the U.S. reached 1.2 million units in 2023, representing a 50% increase compared to 2022. Unlike traditional internal combustion engine vehicles, EVs often incorporate lightweight materials such as aluminum and composites, which require specialized coatings for proper adhesion and long-term durability.

The unique design structures and underbody layouts of EVs demand custom formulations that can protect sensitive electrical components from corrosion and thermal stress. This shift is prompting coating manufacturers to innovate and tailor solutions specifically for EVs. Automakers are aligning their supply chains with coating technologies that deliver energy efficiency, consistent appearance, and compatibility with the latest production techniques.

Strict Environmental Regulations: Regulatory bodies are imposing stricter limits on volatile organic compound (VOC) emissions in response to environmental and public health concerns. According to the U.S. Environmental Protection Agency (EPA), in April 2024, new amendments to the National Emission Standards for Hazardous Air Pollutants (NESHAP) for automotive coatings significantly tightened limits on VOC emissions from vehicle manufacturing facilities. The updated rule requires auto OEMs and paint suppliers to adopt low-VOC or water-based coating systems by 2027, accelerating the industry's shift toward environmentally friendly alternatives.

These regulations are pushing OEMs and suppliers to transition from solvent-based to water-based and low-VOC coatings. Eco-friendly coating technologies reduce air pollution and also improve working conditions within manufacturing facilities. In response, coating developers are investing in advanced formulations that maintain high performance and finish quality while meeting stringent environmental standards. This shift supports both regulatory compliance and sustainability goals, encouraging broader adoption of greener alternatives in OEM production lines across the automotive sector.

Segmental Insights

Product Analysis

Based on product, the segmentation includes clear coat, base coat, primer, e-coat, and others. The primer segment accounted for ~38% of the revenue share in 2024 due to its critical role in enhancing surface adhesion and corrosion resistance. Primers act as the foundational coating layer, preparing the metal or composite body for the application of base and clear coats. Their ability to improve durability and extend the life of a vehicle’s paint system makes them indispensable in automotive manufacturing. Increasing demand for improved chip resistance, smoother finishes, and eco-friendly primer technologies has led OEMs to invest in advanced primer systems. Manufacturers are adopting low-VOC and water-based primers to meet environmental guidelines without compromising performance.

The base coat segment is expected to register a CAGR of 4.6% during the forecast period due to rising demand for aesthetically appealing vehicle finishes. Consumers are increasingly seeking vehicles with vibrant colors, metallic effects, and custom finishes, which base coats provide. Growing vehicle personalization trends are prompting OEMs to expand their color palette offerings and adopt more complex pigment technologies. Advances in base coat chemistry are also improving coverage, reducing coating layers, and enhancing environmental performance. This segment’s growth is supported by continued innovation in color consistency and compatibility with robotic spray application systems.

Resin Analysis

In terms of resin, the segmentation includes polyurethane, acrylic, epoxy, and others. The epoxy resin segment accounted for the largest revenue share in 2024 due to its strong adhesion properties, chemical resistance, and structural durability. Epoxy resins are commonly used in e-coat primers to provide superior protection against corrosion and wear, particularly in areas prone to moisture exposure. Their ability to form a hard, protective film makes them ideal for underbody and engine components. Automakers prefer epoxy-based systems in high-performance applications where mechanical strength and environmental resistance are crucial. Growth in commercial vehicle manufacturing and heightened corrosion protection standards in OEM assembly lines have strengthened demand for epoxy coatings.

The polyurethane segment is projected to witness significant growth during the forecast period due to its excellent weatherability, gloss retention, and flexibility. Polyurethane resins are widely used in topcoat formulations, particularly clear coats, due to their UV resistance and ability to maintain finish quality over time. Vehicle manufacturers are increasingly favoring polyurethane coatings due to their smooth appearance, resilience to scratches, and compatibility with rapid-cure technologies. This segment’s expansion is also supported by growing applications in waterborne and high-solid systems aimed at reducing emissions. Advancements in resin synthesis are further boosting polyurethane adoption in both premium and mass-market vehicle production.

Technology Analysis

In terms of technology, the segmentation includes solvent-based, water-based, powder-based, and others. The water-based segment led in 2024 due to its low VOC emissions, regulatory compliance, and improved workplace safety. Growing environmental concerns and tightening emission norms have prompted OEMs to transition away from traditional solvent-based coatings. Water-based systems provide high-quality finishes with reduced environmental impact, making them suitable for eco-conscious manufacturers. Investment in modern paint shops equipped to handle waterborne coatings is accelerating this shift. Technological advancements have improved drying times, color accuracy, and corrosion protection, enabling water-based coatings to match the performance of solvent-based alternatives while offering sustainability benefits.

The solvent-based segment is projected to grow rapidly during the forecast period, especially in regions where emission regulations are less stringent. These coatings offer advantages in drying speed, adhesion, and film formation, particularly in high-humidity or low-temperature environments. Solvent-based technologies are often preferred in commercial and industrial vehicle production, where durability and performance outweigh regulatory constraints. Ongoing developments in low-VOC solvent formulations are also helping to balance environmental requirements with performance needs. Increased production of heavy-duty and off-road vehicles is supporting growth in this segment, particularly for primer and base coat applications.

Application Analysis

In terms of application, the segmentation includes passenger cars and commercial vehicles. The passenger cars segment accounted for the largest revenue share in 2024, driven by the high volume of vehicles produced and the growing emphasis on design, aesthetics, and surface protection. Consumers are increasingly valuing finish quality and vehicle customization, prompting OEMs to invest in diverse coating systems for enhanced appearance and durability. This segment benefits from continual innovation in base coat and clear coat technologies, enabling smoother finishes, longer life, and resistance to UV degradation. The rising demand for electric and premium passenger vehicles is further driving investments in advanced coating materials that meet both aesthetic and functional requirements.

The commercial vehicles segment is projected to grow significantly from 2025 to 2034, due to increasing demand for heavy-duty trucks, buses, and logistics fleets. These vehicles operate under harsh environmental and mechanical conditions, requiring coatings that offer superior corrosion resistance, impact durability, and extended maintenance intervals. Regulatory pressure to reduce vehicle downtime and maintenance costs is pushing OEMs to adopt high-performance coating solutions. Additionally, fleet operators are investing in visually appealing finishes to enhance brand visibility, contributing to the adoption of durable, easy-to-clean coatings. Growth in last-mile delivery, public transport infrastructure, and commercial mobility solutions is driving sustained demand.

Regional Analysis

The North America automotive OEM coatings market accounted for ~40% of revenue share in 2024 due to consistent output from established automotive manufacturers and robust technological integration in paint and coating processes. Increasing adoption of advanced coating technologies such as waterborne and UV-cured systems is reshaping production environments. OEMs are prioritizing durable and environmentally compliant coatings that align with evolving emission regulations. High consumer expectations for vehicle aesthetics, along with a preference for premium finishes in passenger cars and light trucks, is contributing to greater spending on high-performance coating systems across original equipment assembly lines.

U.S. Automotive OEM Coatings Market Insight

The U.S. held the dominant share of the North America automotive OEM coatings landscape in 2024 due to strong domestic vehicle production, rising sales of light trucks and SUVs, and sustained investments in advanced manufacturing technologies. According to the U.S. Bureau of Economic Analysis, in May 2024, domestic motor vehicle production in the U.S. increased by 9.3% year-over-year, with light truck and SUV output accounting for over 65% of total production in Q1 2024. Increasing demand for custom color finishes and scratch-resistant coatings is also boosting market growth.

Asia Pacific Automotive OEM Coatings Market Trends

The market in Asia Pacific is projected to register a CAGR of 4.8% from 2025 to 2034, owing to surging vehicle production volumes, expansion of domestic OEMs, and rising investments in eco-friendly coating technologies. According to India’s Ministry of Heavy Industries, in July 2024, domestic passenger vehicle production reached a record high of 4.8 million units in FY 2023–2024, showing a growth of 14% compared to the previous fiscal year. Local automakers are scaling up production capacity to meet growing regional demand, particularly in passenger cars and electric vehicles. Paint system upgrades in new plants are focused on energy efficiency and water conservation. Increasing urbanization and disposable income levels are supporting the need for improved automotive aesthetics, driving adoption of high-gloss and weather-resistant coatings across regional markets.

China Automotive OEM Coatings Market Overview

The market in China is expanding due to high vehicle production rates, rapid EV adoption, and strong demand for locally produced and exported automobiles. OEMs are investing in automation and sustainable coating processes to meet both domestic environmental standards and global compliance. Growth in luxury and premium vehicle segments further fuels demand for advanced coating solutions.

Europe Automotive OEM Coatings Market Outlook

The automotive OEM coatings landscape in Europe is projected to grow significantly from 2025 to 2034 due to ongoing innovation in eco-friendly technologies and a strong focus on reducing carbon emissions in automotive manufacturing. Automotive OEMs are upgrading existing facilities with waterborne and low-VOC coating systems to comply with environmental regulations. European manufacturers emphasize precision and finish quality, driving demand for multi-layer coating processes that enhance both durability and visual appeal. The rise of electric vehicle production and supportive government policies are also encouraging investments in high-performance and sustainable coating technologies, particularly in Germany, France, and Nordic countries.

Key Players and Competitive Analysis

The competitive landscape of the automotive OEM coatings market is defined by a mix of strategic initiatives and technology-led advancements. Industry analysis highlights a shift toward sustainable and low-VOC coating solutions, prompting key players to align their product portfolios with evolving regulatory frameworks and OEM performance specifications.

Market expansion strategies often involve joint ventures with regional automotive manufacturers to localize production, optimize supply chains, and meet specific coating requirements. Mergers and acquisitions are increasingly focused on gaining access to specialized technologies such as waterborne, powder-based, or UV-cured systems. Post-merger integration efforts concentrate on combining R&D capabilities and streamlining distribution networks.

Strategic alliances between coating manufacturers and automotive OEMs are also growing, enabling co-development of advanced formulations that improve weather resistance, scratch durability, and visual aesthetics. Technological advancements such as nanocoatings, self-healing surfaces, and AI-integrated quality control systems are gaining traction, enhancing productivity across painting lines. Competitors are further differentiating through digital paint matching, robotics-assisted application processes, and modular coating systems.

Key Players

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd

- BASF SE

- Berger Paints India Ltd

- Covestro AG.

- Kansai Paint Co. Ltd

- KCC Corporation

- Nippon Paints Holdings Co. Ltd

- PPG Industries Inc.

- The Sherwin-Williams Company

Industry Developments

March 2025: NIO and BASF Coatings partnered to develop advanced exterior coatings for NIO's electric vehicles, aiming to enhance performance, durability, and sustainability by combining BASF's expertise with NIO's EV leadership.

March 2025: Nippon Paint and Uchihamakasei Corp. developed an innovative next-generation in-mold coating (IMC) technology to promote carbon neutrality in automotive manufacturing.

Automotive OEM Coatings Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Clear Coat

- Base Coat

- Primer

- E-coat

- Others

By Resin Outlook (Revenue, USD Billion, 2020–2034)

- Polyurethane

- Acrylic

- Epoxy

- Others

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Solvent-Based

- Water-Based

- Powder-Based

- Others

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Passenger Cars

- Commercial Vehicles

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Automotive OEM Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 16.12 billion |

|

Market Size in 2025 |

USD 16.80 billion |

|

Revenue Forecast by 2034 |

USD 24.53 billion |

|

CAGR |

4.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 16.12 billion in 2024 and is projected to grow to USD 24.53 billion by 2034.

The global market is projected to register a CAGR of 4.3% during the forecast period.

North America accounted for ~40% share of the global automotive OEM coatings market in 2024 due to consistent output from established automotive manufacturers and robust technological integration in paint and coating processes.

A few of the key players in the market are BASF SE, PPG Industries Inc., Nippon Paints Holdings Co. Ltd, Akzo Nobel N.V., Axalta Coating Systems Ltd, Berger Paints India Ltd, Kansai Paint Co. Ltd, The Sherwin-Williams Company, KCC Corporation, and Covestro AG.

The primer segment accounted for ~38% of the revenue share in 2024 due to its critical role in enhancing surface adhesion and corrosion resistance

The epoxy segment accounted for the largest revenue share in 2024 due to its strong adhesion properties, chemical resistance, and structural durability.