Epoxy Resins Market Size, Share, Trends, & Industry Analysis Report

By Type (DGBEA, DGBEF), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 128

- Format: PDF

- Report ID: PM1503

- Base Year: 2024

- Historical Data: 2020-2023

Overview

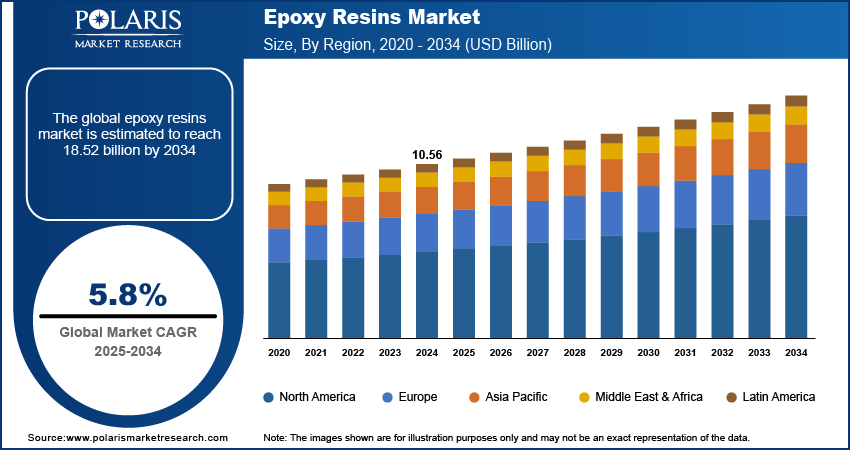

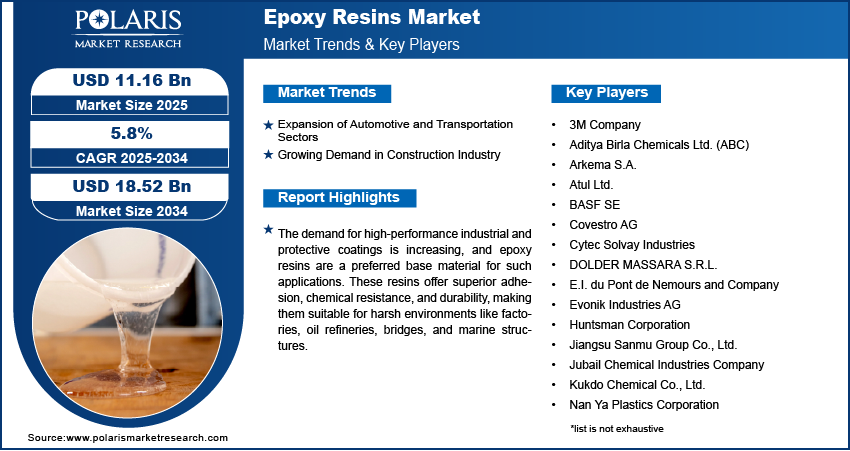

The global epoxy resins market size was valued at USD 10.56 billion in 2024, growing at a CAGR of 5.8% from 2025–2034. Key factors driving demand is expansion of automotive and transportation sectors, and growing demand in construction industry.

Key Insights

- The DGBEA segment is anticipated to grow at a CAGR of 5.4% during the forecast period, driven by its adaptability and broad spectrum of applications.

- In 2024, the construction segment captured a notable 7.42% share of total revenue, fueled by increasing demand for epoxy resins in flooring, adhesives, sealants, and protective coatings.

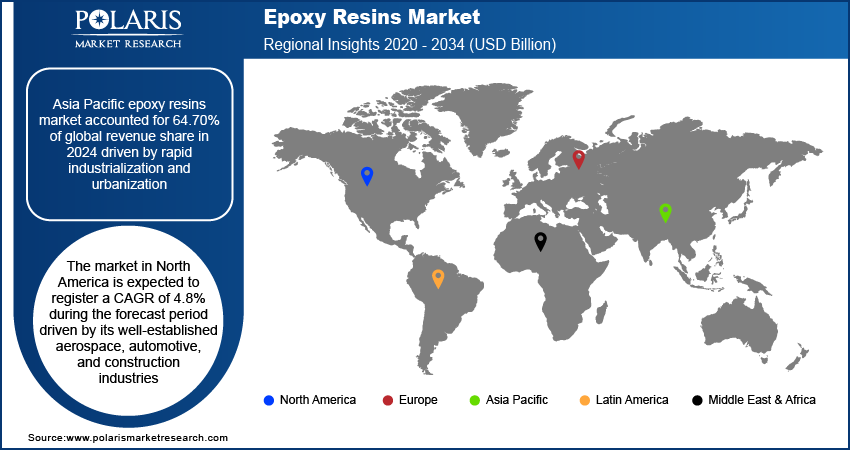

- The Asia Pacific epoxy resins market dominated globally in 2024, contributing 64.70% of the revenue share, primarily due to rapid industrial growth and ongoing urban development.

- North America’s epoxy resins market is projected to grow at a CAGR of 4.8% throughout the forecast period, supported by its robust aerospace, automotive, and construction sectors.

Industry Dynamics

- Expansion of automotive and transportation sectors are driving the demand for epoxy resins.

- Growing demand in construction industry is driving the epoxy resins market

- The demand for high-performance industrial and protective coatings is increasing, and epoxy resins are a preferred base material for such applications.

- Fluctuating raw material prices and the growing popularity of alternative resins limits the growth.

Market Statistics

- 2024 Market Size: USD 10.56 Billion

- 2034 Projected Market Size: USD 18.52 Billion

- CAGR (2025-2034): 5.8%

- Asia Pacific: Largest Market Share

AI Impact on the Industry

- AI accelerates epoxy resin formulation by analyzing chemical properties, curing behaviors, and performance metrics to design resins with enhanced strength, flexibility, and thermal resistance.

- Integration of AI enables predictive modeling to optimize resin compositions and curing processes, reducing trial-and-error in R&D and shortening time-to-market.

- AI-powered market intelligence tools track industry trends, customer demands, and competitive landscapes, helping manufacturers align product offerings with evolving market needs.

- AI-driven automation improves supply chain and production workflows, enhancing quality control, minimizing defects, and reducing operational costs across epoxy resin manufacturing plants.

Epoxy resin is a type of thermosetting polymer known for its strong adhesive properties, chemical resistance, and durability. It is formed through the reaction of epoxide compounds with hardeners, creating a rigid, high-performance material. Commonly used in coatings, electronics, construction, and composites, epoxy resin provides excellent mechanical strength and environmental protection.

Increasing usage in electrical and electronics industry is fueling the demand for this resin. Epoxy resins are extensively used in the electrical and electronics industry for insulating and protecting components. They are ideal for encapsulating circuits, coating semiconductors, and manufacturing printed circuit boards (PCBs) due to their excellent electrical insulation, heat resistance, and chemical stability. Reliable insulation and heat protection are critical as technology advances and devices become more compact and powerful. The booming demand for smartphones, computers, electric vehicles, and 5G infrastructure is driving growth in this sector. Moreover, epoxy resins ensure longer life and higher safety in these devices, making them essential materials in modern electronics manufacturing, thereby fueling the growth.

The demand for high-performance industrial and protective coatings is increasing, and epoxy resins are a preferred base material for such applications. These resins offer superior adhesion, chemical resistance, and durability, making them suitable for harsh environments like factories, oil refineries, bridges, and marine structures. Industries are seeking coatings that last longer and require fewer reapplications with stricter environmental regulations and a focus on sustainability. Epoxy-based coatings meet these needs, reducing maintenance costs and downtime. Their growing use in both industrial and commercial sectors drive demand, particularly in regions experiencing rapid urbanization and infrastructure growth, thereby fueling the growth.

Drivers & Opportunities

Expansion of Automotive and Transportation Sectors: The epoxy resin demand is being driven by the steady growth in the automotive and transportation industries. According to the Organization of Motor Vehicle Organization, in 2024 24,829,593 commercial vehicle were manufactured globally. Epoxy resins are used in lightweight composite materials that help reduce vehicle weight and improve fuel efficiency. They are further essential in coatings for protecting vehicle surfaces from corrosion, wear, and chemicals. Automakers are turning to advanced materials like epoxy composites with the rising global demand for electric vehicles (EVs) and the push for fuel-efficient and environmentally friendly transport solutions. Their ability to provide high strength-to-weight ratios makes them ideal for use in automotive structural parts, panels, and bonding components, thereby boosting the growth.

Growing Demand in Construction Industry: The construction industry is growing worldwide. According to the Government of Mexico, 8.42 million people are employed in construction industry in Mexico alone. Epoxy resins are widely used in flooring, coatings, sealants, and adhesives due to their durability, chemical resistance, and strong bonding properties. There’s a rising need for high-performance materials that withstand heavy loads, moisture, and temperature changes as infrastructure development increases around the world, especially in developing regions. Epoxy resins meet these requirements effectively. Additionally, the trend toward green buildings and energy-efficient structures has led to increased use of epoxy-based materials, which offer longer life and reduced maintenance, boosting their demand in construction applications.

Segmental Insights

Type Analysis

Based on type, the segmentation includes DGBEA, DGBEF, novolac, aliphatic, glycidylamine, and hardener. DGBEA segment is projected to grow at a CAGR of 5.4% over the forecast period driven by its versatility and wide-ranging applications. DGBEA-based epoxy resins offer excellent mechanical strength, chemical resistance, and adhesive properties, making them ideal for coatings, adhesives, electronics, and composites. Its relatively low cost and ease of processing further boost demand. DGBEA continues to gain popularity as industries seek high-performance yet economical materials for protective coatings and insulation systems. Moreover, the push for durable and long-lasting materials in construction and electronics further drives the segment growth.

DGBEF segment is expected to witness a significant share over the forecast period due to its superior performance characteristics. DGBEF epoxy resins offer better chemical resistance, lower viscosity, and improved mechanical strength compared to DGBEA, making them suitable for advanced applications in electronics, aerospace, and high-performance coatings. Their lower viscosity enables better flow and processing, which is especially useful in precision electronics and structural adhesives. DGBEF resins are experiencing rising adoption as demand increases for lightweight, high-strength materials in automotive and electronics industries, thereby boosting the segment growth.

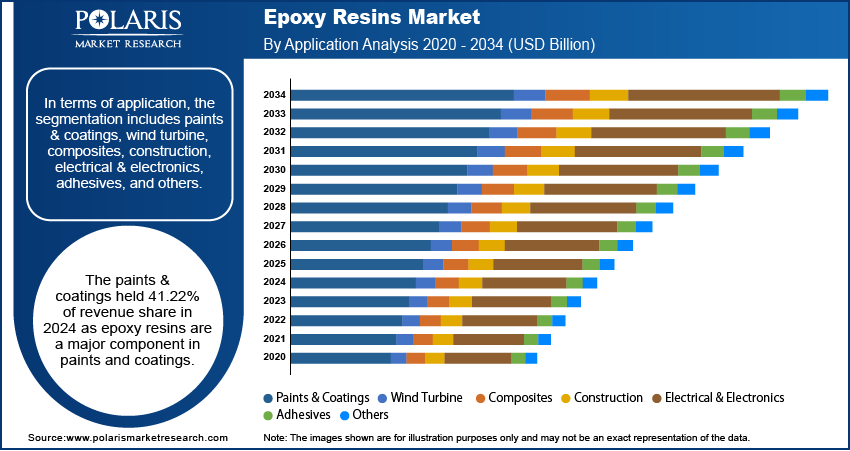

Application Analysis

In terms of application, the segmentation includes paints & coatings, wind turbine, composites, construction, electrical & electronics, adhesives, and others. The paints & coatings held 41.22% of revenue share in 2024 as epoxy resins are a major component in paints and coatings. Their excellent adhesion, corrosion resistance, and durability make them perfect for industrial, marine, and automotive coatings. Epoxy coatings are widely used to protect surfaces from moisture, chemicals, and physical wear. The need for long-lasting, high-performance coatings is rising as infrastructure and manufacturing sectors expand. Additionally, stricter environmental regulations are pushing industries to adopt epoxy-based low-VOC and high-solids coatings. Moreover, the growing focus on protective and decorative finishes in industrial and commercial sectors further fuel this segment’s growth.

The construction segment held significant revenue share in 2024, holding 7.42% driven by rising demand of resins for flooring, adhesives, sealants, and protective coatings. Epoxy resins offer high strength, resistance to chemicals and water, and excellent bonding ability. The use of epoxy-based materials is increasing as global infrastructure investment grows, particularly in Asia-Pacific and the Middle East. Moreover, the rise in demand for sustainable and low-maintenance construction materials has boosted the appeal of epoxy systems. Their use in structural bonding, crack repair, and durable coatings further drive the segment growth.

Regional Analysis

Asia Pacific epoxy resins market accounted for 64.70% of global revenue share in 2024 driven by rapid industrialization and urbanization. Countries like India, South Korea, and Southeast Asian nations are investing heavily in infrastructure, construction, and manufacturing, which significantly boosts demand for epoxy-based paints, coatings, and adhesives. Additionally, the region’s growing automotive, electronics, and wind energy sectors further fuel consumption. Government initiatives promoting renewable energy and electric vehicles (EVs) have increased the need for lightweight, high-performance materials like epoxy composites. The availability of low-cost labor and raw materials further supports local production, thereby fueling the growth in the region.

China Epoxy Resins Market Insight

The China held 68.81% of the revenue share within Asia Pacific in 2024, driven by its strong electronics, construction, and automotive manufacturing. The country is home to one of the largest electronics production bases globally, where epoxy resins are essential for insulation and component protection. Additionally, China’s aggressive infrastructure expansion including smart cities, highways, and energy projects, boost demand for durable, chemical-resistant materials like epoxy flooring and adhesives. Additionally, the government’s focus on renewable energy, particularly wind turbines and EVs, is further driving the use of epoxy composites, thereby driving the growth in the country.

North America Epoxy Resins Market

The market in North America is expected to register a CAGR of 4.8% during the forecast period driven by its well-established aerospace, automotive, and construction industries. Epoxy resins are widely used for advanced composites, high-performance coatings, and adhesives in these sectors. The region’s push toward sustainable building materials and energy-efficient infrastructure is increasing the use of epoxy-based products. Moreover, growing investments in wind energy and EV manufacturing, support epoxy demand in lightweight and durable component applications. Regulatory emphasis on low-VOC and eco-friendly materials is further leading to greater adoption of epoxy resins. Moreover, technological advancements and product innovation boost regional consumption.

U.S. Epoxy Resins Market Overview

The demand for epoxy resin in U.S. is rising driven by infrastructure renovation, defense, and electronics industries growth. The Bipartisan Infrastructure Law and federal investment in clean energy are boosting construction and renewable energy projects, where epoxy resins play a major role in coatings, adhesives, and composites. Additionally, the growth of 5G networks, electric vehicles, and semiconductor manufacturing is expanding the use of epoxy materials in high-performance electrical insulation and thermal management. Moreover, stringent environmental regulations are encouraging industries to adopt safer, more sustainable epoxy formulations, further accelerating the growth in U.S.

Europe Epoxy Resins Market

The industry in the Asia Pacific is projected to grow at a CAGR of 4.3% from 2025 to 2034, driven by its advanced automotive, aerospace, and wind energy sectors. Countries like Germany, France, and the UK are emphasizing lightweight, high-strength materials for vehicles and aircraft, where epoxy composites are essential. The European Union’s strong environmental regulations are encouraging the adoption of low-VOC, durable epoxy coatings in construction and industrial applications. Additionally, Europe is a leader in renewable energy, especially offshore wind power, which requires large quantities of epoxy resin for turbine blades and protective coatings. Growing renovation and energy efficiency programs are further supporting epoxy resin demand in building materials, driving the industry growth in Europe.

Key Players & Competitive Analysis

The epoxy resin market is highly competitive, with global and regional players striving for market share through innovation, strategic partnerships, and expansion. Major companies such as 3M, BASF SE, Huntsman Corporation, Covestro AG, and Solvay SA dominate due to their strong R&D capabilities, diverse product portfolios, and global distribution networks. Emerging players like Atul Ltd., Aditya Birla Chemicals, and Jiangsu Sanmu Group focus on cost competitiveness and regional growth. Companies such as Momentive, Evonik, and Arkema emphasize specialty resins for niche applications, including wind energy and electronics. Competitive strategies include mergers, capacity expansions, and product innovations to meet increasing demand in industries such as construction, automotive, and electronics. Additionally, sustainability is becoming a key differentiator, pushing firms to develop bio-based or low-VOC formulations. Overall, the market shows moderate to high competition, driven by technological advancements and evolving end-user needs across global regions.

Key Players

- 3M Company

- Aditya Birla Chemicals Ltd. (ABC)

- Arkema S.A.

- Atul Ltd.

- BASF SE

- Covestro AG

- Cytec Solvay Industries

- DOLDER MASSARA S.R.L.

- E.I. du Pont de Nemours and Company

- Evonik Industries AG

- Huntsman Corporation

- Jiangsu Sanmu Group Co., Ltd.

- Jubail Chemical Industries Company

- Kukdo Chemical Co., Ltd.

- Momentive Performance Material (MPM) Holding LLC

- Nan Ya Plastics Corporation

- Olin Corporation

- Sika AG

- Sinopec Bailing Petrochemical Company, Ltd.

- SIR INDUSTRIALE S.p.A

- Solvay SA

Industry Developments

March 2025, BASF and Sika launched a new epoxy hardener, Baxxodur EC 151, designed for flooring coatings. The product delivered high gloss, fast curing, low VOC emissions, and enhanced durability, supporting sustainability and performance in industrial and commercial flooring applications.

August 2025, DIC Corporation announced the construction of a new epoxy resins facility at its Chiba Plant to meet rising semiconductor demand. Approved by METI, the project secured up to billions in subsidies and aimed to boost production by 59%.

Epoxy Resins Market Segmentation

By Type Outlook (Volume, Kilo Tons, Revenue, USD Billion, 2021–2034)

- DGBEA

- DGBEF

- Novolac

- Aliphatic

- Glycidylamine

- Hardener

By Application Outlook (Volume, Kilo Tons, Revenue, USD Billion, 2021–2034)

- Paints & Coatings

- Wind Turbine

- Composites

- Construction

- Electrical & Electronics

- Adhesives

- Others

By Regional Outlook (Volume, Kilo Tons, Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Epoxy Resins Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 10.56 Billion |

|

Market Size in 2025 |

USD 11.16 Billion |

|

Revenue Forecast by 2034 |

USD 18.52 Billion |

|

CAGR |

5.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilo Tons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 10.56 billion in 2024 and is projected to grow to USD 18.52 billion by 2034.

The global market is projected to register a CAGR of 5.8% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are 3M Company; Aditya Birla Chemicals Ltd. (ABC); Arkema S.A.; Atul Ltd.; BASF SE; Covestro AG; Cytec Solvay Industries; DOLDER MASSARA S.R.L.; E.I. du Pont de Nemours and Company; Evonik Industries AG; Huntsman Corporation; Jiangsu Sanmu Group Co., Ltd.; Jubail Chemical Industries Company; Kukdo Chemical Co., Ltd.; Momentive Performance Material (MPM) Holding LLC; Nan Ya Plastics Corporation; Olin Corporation; Sika AG; Sinopec Bailing Petrochemical Company, Ltd.; SIR INDUSTRIALE S.p.A; Solvay SA.

The DGBEA segment dominated the market revenue share in 2024.

The construction segment is projected to witness the fastest growth during the forecast period.