Autonomous Forklift Market Size, Share, Trends & Industry Analysis Report

: By Type, By Navigation Technology, By Tonnage Capacity (Below 5 Tons, 5-10 Tons, and Above 10 Tons), By Application, Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 130

- Format: PDF

- Report ID: PM2456

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview:

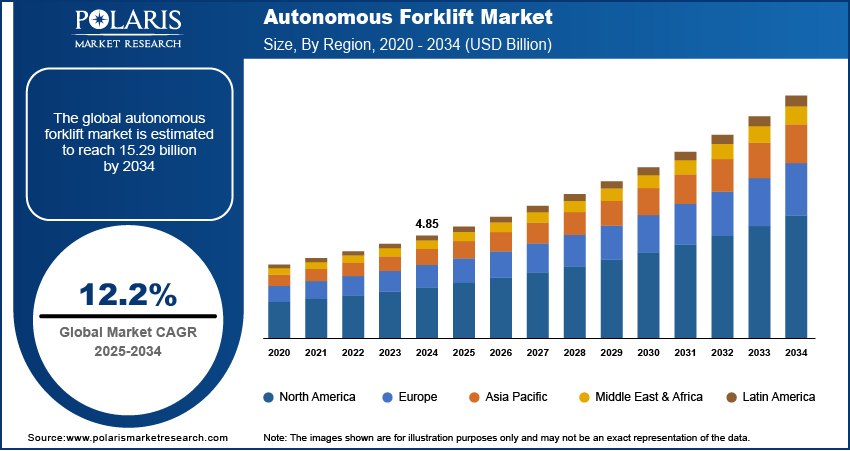

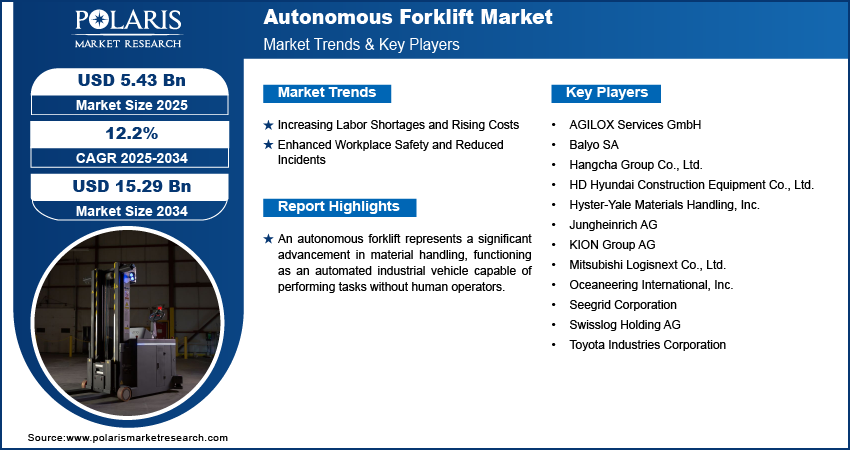

The autonomous forklift market size was valued at USD 4.85 billion in 2024, growing at a CAGR of 12.2% during 2025–2034. Key factors driving demand for autonomous forklifts include increasing labor shortages and rising costs, enhanced workplace safety and reduced incidents, and e-commerce growth.

Automated forklifts drive themselves using integrated cameras, advanced sensor technology, and control systems. No humans are needed to sit behind the driver’s seat. They heighten material flow and lower damage to the equipment. Such vehicles are referred to as automated guided vehicles or AGVs.

To Understand More About this Research: Request a Free Sample Report

Industry Dynamics:

Increasing Labor Shortages and Rising Costs

The escalating challenges of labor availability and the associated rising costs within the logistics and manufacturing sectors are significant drivers for autonomous forklift adoption. Businesses globally are grappling with difficulties in recruiting and retaining skilled workers for material handling roles, leading to operational inefficiencies and increased expenditure. This persistent shortage compels companies to seek automated solutions to maintain productivity and reduce reliance on a volatile labor pool. Furthermore, the rising wages of skilled forklift operators contribute to higher operational overheads, making the investment in autonomous systems increasingly economically viable.

Enhanced Workplace Safety and Reduced Incidents

The paramount importance of workplace safety and the continuous efforts to reduce occupational injuries and fatalities are key drivers for the adoption of autonomous forklifts. Traditional forklift operations pose inherent risks, leading to a substantial number of accidents, including collisions, tip-overs, and workers being struck by equipment. Autonomous forklifts, equipped with advanced navigation, obstacle detection, and safety protocols, significantly minimize human error, which is a major contributor to these incidents. Their predictable and consistent operation reduces the potential for accidents, thereby improving overall warehouse safety and lowering associated costs like workers' compensation claims and lost productivity. This enhanced safety potential is a critical growth factor for the autonomous forklift market.

E-commerce Growth

The exponential growth of the e-commerce sector and the high demand for faster, more efficient logistics operations are strong drivers for the autonomous forklift. The rapid increase in online sales necessitates quicker order fulfillment, higher throughput in warehouses, and optimized inventory management. This surge in e-commerce directly translates into increased package volumes and a need for highly automated distribution centers. Autonomous forklifts offer the scalability, precision, and continuous operational capabilities required to meet these stringent e-commerce demands, ensuring goods are moved efficiently and accurately.

Segmental Insights:

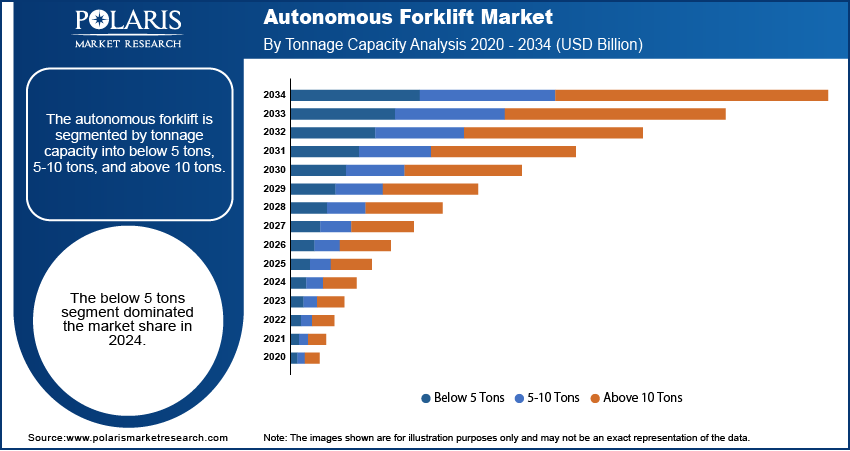

Assessment By Tonnage Capacity

By tonnage capacity, the segmentation includes below 5 tons, 5-10 tons, and above 10 tons. The below 5 tons segment accounted for a major market share in 2024. This is mainly attributed to the widespread use of lower-level material handling equipment in e-commerce fulfillment centers, retail warehouses, and general distribution centers. These types of environments usually emphasize agility, speed, docking, and space-efficient design. The construction and implementation of autonomous systems for these lighter loads have been straightforward, thus leading to greater adoption and more installed systems. These smaller, highly automated vehicles are incredibly versatile, which makes them crucial to modern logistics systems operations.

The 5-10 tons segment is projected to grow at a robust pace in the coming years, owing to the growing automation needs in the manufacturing, automotive, and industrial sectors that deal with moderately heavy raw materials or components. Companies in these industries are realizing the efficiency and safety benefits of automating medium-duty material transport and minimizing manual labor for physically strenuous tasks. This move towards automating more robust material flows is a primary contributor to the greater market penetration within this capacity range.

Evaluation By Application

In terms of application, the segmentation includes manufacturing, warehousing, material handling, logistics & freight, and others. The warehousing segment held the largest market share in 2024 due to the growing importance of automation in distribution and storage centers, e-commerce fulfillment hubs, and storage facilities. Warehousing operations perform monotonous activities such as picking, putting away, and the transportation of goods, thus greatly allowing for automation. The need to maximize throughput in these environments, coupled with lower labor costs and improved safety, has increased the use of autonomous forklifts, thus making warehousing the primary area for their widespread application and establishing its dominion.

Evaluation By Industry

Based on industry, the segmentation includes 3rd party logistics, food & beverages, automotive, paper & pulp, metals & heavy machinery, e-commerce, aviation, semiconductors & electronics, healthcare, and others. The e-commerce industry dominated the revenue market share in 2024. E-commerce businesses handle immense volumes of diverse products, which require rapid order fulfillment, precise forecasting, and a continuous flow of materials within large distribution centers. These demanding tasks are automated through the use of autonomous forklifts that operate around the clock, improving throughput and accuracy in the system.

The adoption rate of autonomous forklifts is growing quickly within the semiconductors & electronics sector. This growth is due to the demanding containment control, precision handling, and traceability requirements in the manufacturing process of sensitive and high-value electronic components. There is always an ever-increasing need for electronic devices, which fuels the need for fully automated, error-free, and material transport, especially within cleanroom environments, and highly automated production lines. Forklifts that are autonomous provide the needed dependability, gentle handling, and accuracy required for these delicate materials to avoid damage, and refine complex cargo handling supply chain processes within this specialized sector.

Regional Analysis

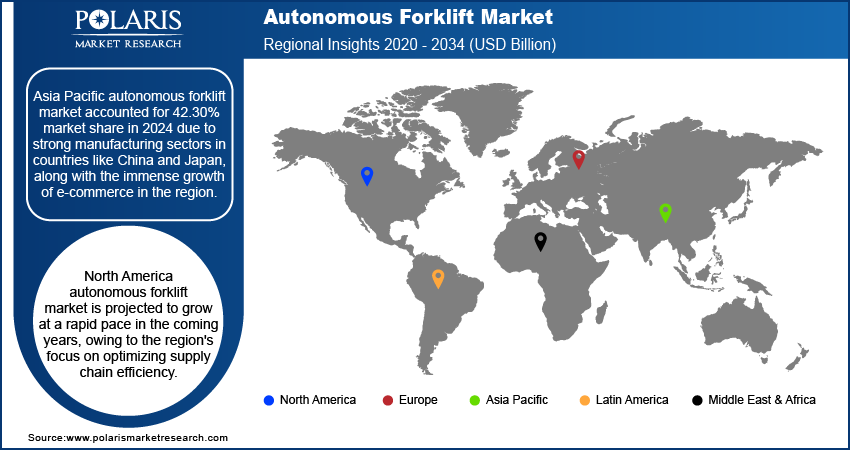

Asia Pacific autonomous forklift market accounted for 42.30% market share in 2024 due to strong manufacturing sectors in countries like China and Japan, along with the immense growth of e-commerce in the region. Rapid industrialization, investments in smart warehouses, and the growing need to tackle labor shortages also contributed to market expansion in the region. Moreover, expanding urbanization is further fueling the demand for autonomous forklifts as urban warehouses and distribution centers often face significant space limitations.

North America autonomous forklift market is projected to grow at a rapid pace in the coming years, owing to the region's focus on optimizing supply chain efficiency. The increasing shortage of labor in countries such as the US is also driving the market expansion in the region. High spending power in the US is further contributing to the US autonomous forklift market growth. The presence of large economic distribution networks and e-commerce fulfillment centers is also driving major corporations in the region to invest in warehouse automation, therefore boosting demand for autonomous forklifts.

Key Players and Competitive Insights

Some major key players include Toyota Industries Corporation, KION Group AG, Mitsubishi Logisnext Co., Ltd., Jungheinrich AG, Hyster-Yale Materials Handling, Inc., Hangcha Group Co., Ltd., AGILOX Services GmbH, Oceaneering International, Inc., Swisslog Holding AG, Balyo SA, HD Hyundai Construction Equipment Co., Ltd., and Seegrid Corporation. Each of these companies provides relevant products and services, ranging from autonomous pallet movers to counterbalanced forklifts, catering to diverse requirements and operational scales.

The ecosystem pertaining to autonomous forklifts is diverse and hybrid in nature, featuring both traditional material handling equipment OEMs and robotics firms as competitors. The competition focuses on primary technologies like navigation and AI for task integration, as well as interfacing with existing systems within warehouse management system and software. Key players continue to improve the safety and dependability of the systems, reliability, and the flexibility of the offerings. Collaboration initiatives are common between conventional forklift builders and robotics engineers in a merger attempt of vast knowledge from the market and innovative skills in automation technologies. The market for responsive, adaptable, and precise integrated systems is forcing all stakeholders to continuously evolve products, adding more features and distinguishing them from other players.

List of Key Companies:

- AGILOX Services GmbH

- Balyo SA

- Hangcha Group Co., Ltd.

- HD Hyundai Construction Equipment Co., Ltd.

- Hyster-Yale Materials Handling, Inc.

- Jungheinrich AG

- KION Group AG

- Mitsubishi Logisnext Co., Ltd.

- Oceaneering International, Inc.

- Seegrid Corporation

- Swisslog Holding AG

- Toyota Industries Corporation

Industry Developments

- March 2025: KION Group AG unveiled its first physical AI-powered Omniverse solution at LogiMAT 2025 in Stuttgart, Germany. This initiative stems from a collaboration with NVIDIA and Accenture, aiming to reinvent industrial automation.

- March 2025: AGILOX Services GmbH, a technology company specializing in Autonomous Mobile Robots (AMRs), introduced its latest product innovation, the AGILOX OFL (Omnidirectional Free Lifter), at LogiMAT 2025.

Autonomous Forklift Market Segmentation

By Type Capacity Outlook (Revenue – USD Billion, 2020–2034)

- Pallet Jacks

- Counterbalance Forklifts

- Reach Trucks

- Order Pickers

- Stacker Forklifts

By Navigation Technology Capacity Outlook (Revenue – USD Billion, 2020–2034)

- LiDAR

- Vision-guided

- SLAM (Simultaneous Localization and Mapping)

- Magnetic-guided

- Geofencing-based

- Other

By Tonnage Capacity Outlook (Revenue – USD Billion, 2020–2034)

- Below 5 Tons

- 5-10 Tons

- Above 10 Tons

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Manufacturing

- Warehousing

- Material handling

- Logistics & Freight

- Others

By Industry Outlook (Revenue – USD Billion, 2020–2034)

- 3rd Party Logistic

- Food & Beverages

- Automotive

- Paper & Pulp

- Metals & Heavy Machinery

- E-commerce

- Aviation

- Semiconductors & Electronics

- Healthcare

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Autonomous Forklift Market Report Scope:

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.85 billion |

|

Market Size in 2025 |

USD 5.43 billion |

|

Revenue Forecast by 2034 |

USD 15.29 billion |

|

CAGR |

12.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

? The global market size was valued at USD 4.85 billion in 2024 and is projected to grow to USD 15.29 billion by 2034.

The market is projected to register a CAGR of 12.2% during the forecast period, 2024-2034.

Asia Pacific had the largest share of the market.

Some key players include Toyota Industries Corporation, KION Group AG, Mitsubishi Logisnext Co., Ltd., Jungheinrich AG, Hyster-Yale Materials Handling, Inc., Hangcha Group Co., Ltd., AGILOX Services GmbH, Oceaneering International, Inc. (Oceaneering Mobile Robotics), Swisslog Holding AG (KUKA AG), Balyo SA, HD Hyundai Construction Equipment Co., Ltd., and Seegrid Corporation.

The below 5 tons segment accounted for the largest share of the market in 2024.

The following are some of the market trends: ? Appeal of Artificial Intelligence technologies and Machine Learning Applications: There is an increased application of AI and ML-powered frameworks for enhanced autonomous systems decision making, navigation, and predictive maintenance. ? Enhancement of Exploitative Sensor Methods: There are notable improvements in multiple working conditions sensors such as LiDAR, Vision Guidance, and 3D cameras, which are increasing precision, multifunctional reliability, and multifaceted safety in the autonomous forklift operating environments.

An autonomous forklift is a self-operating industrial forklift that undertakes material handling activities without human help. Such a vehicle is outfitted with sensors, cameras, and AI, allowing it to automatically navigate surroundings, recognize obstacles, and perform actions such as lifting, transporting, and stacking materials. Autonomous forklifts, which are frequently considered a subset of automated guided vehicles (AGV) or autonomous mobile robots (AMR), help warehouses, manufacturing plants, and distribution centres by taking over repetitive labor tasks, enhancing productivity, safety, and reducing costs.