Self-driving Cars Market Size, Share, Trends, & Industry Analysis Report

By Component, By Electric Vehicle, By System, By Mobility Type (Shared Mobility, Personal Mobility), By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2418

- Base Year: 2024

- Historical Data: 2020 - 2023

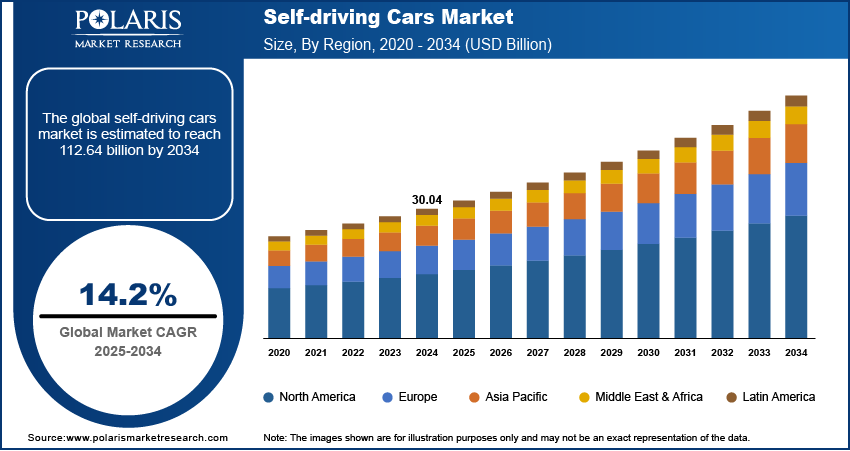

The global self-driving cars market was valued at USD 30.04 billion in 2024 and is expected to grow at a CAGR of 14.2% during the forecast period. The self-driving cars market is reasonably centralized, as automotive sector respondents ranging from hardware to software have begun to focus on having access to the positive trend of autonomous driving technology.

Key Insights

- The personal mobility segment is expected to record significant growth during the forecast period driven by growing demand for convenient, safe, and autonomous personal transportation.

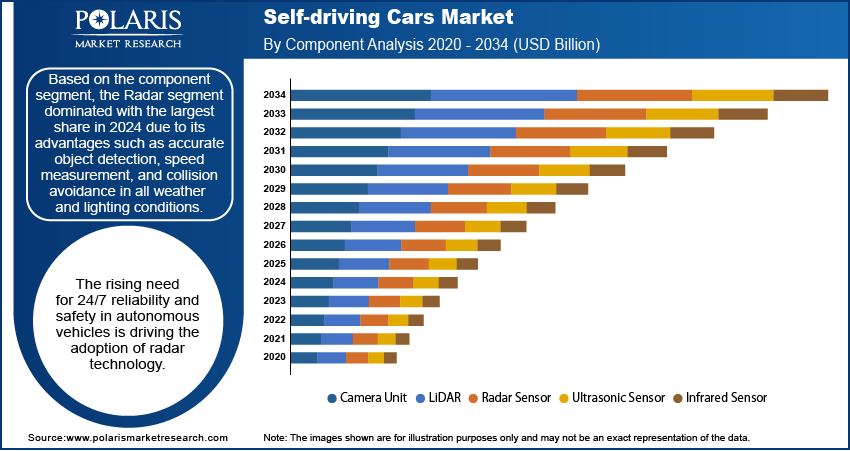

- The Radar segment dominated with the largest share in 2024 due to its advantages and operational reliability.

- The North America is accounted for largest share in 2024 due to robust and established automotive company groupings.

- Asia Pacific is expected to witness fastest growth during the forecast period driven by increasing market demand for secure, effective, and convenient driving dynamics.

Industry Dynamics

- Rising adoption of artificial intelligence fuels the expansion of the industry.

- Rising number of strategic mergers and acquisition among the major players fuels the market growth.

- Advancement in technology is fueling the industry expansion.

- High development and implementation costs combined with stringent regulatory policies are limiting the growth.

Market Statistics

- 2024 Market Size: USD 30.04 Billion

- 2034 Projected Market Size: USD 112.64 Billion

- CAGR (2025-2034): 14.2%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Impact of AI on Industry

- Adoption of AI helps to enable advanced perception, decision-making, and real-time processing to improve safety.

- Machine learning and computer vision is expected to fuel the production output.

- Algorithmic biases, cybersecurity vulnerabilities, and system failures that could lead to accidents is expected to hamper the adoption of final product.

As a result, the number of partnerships, collaborative partnerships, and capital investments in creating a self-vehicle has grown considerably in recent years in the self-driving cars market. Due to high government and private sector guidance in several countries for automated driving vehicle technology, they are forecast to expand even more during the forecast period.

In April 2021, Toyota Motor introduced new editions of the Lexus LS and Mirai in Japan; both installed with the Advanced Drive options, a Tier 2 autonomous program that enables keep the car in its line and maintains a respectable distance from adjacent vehicles. In February 2021, Aurora signed a strategic cooperation with Toyota and Denso to develop and deploy automatic cars on a massive scale.

Industry Dynamics

Growth Drivers

Introduction of AI-based cameras such as SWIR for self-driving cars. The Autonomous Vehicle (AV) market has experienced unprecedented technological development. Global regulators have been tasked with developing policy and legislative frameworks for this fast-paced market. In response to the difficulties in commercializing Mobility as a Service (MaaS), companies have begun to shift their development and resource efforts toward delivery vehicles and automated trucks. Due to self-driving cars market demand and technological challenges, the perception of go-anywhere robo-taxis has proven more difficult than anticipated.

Further, many tier-1 providers and automatic car designers focus on developing and implementing AI-based cameras. They provide safety features such as navigation systems, responsive headlamp control, driver assistance, forward collision warning, pedestrian detection, and automated detection braking. AI camera systems have many advantages, including cost savings, combining various complementary technologies for dependable safety, and an extremely compact form factor.

For instance, in December 2021, Autonomous Intelligence Motors Private Ltd. announced plans to develop an autonomous car driven by Artificial Intelligence of Things (AIoT). The driverless gasoline and diesel variants will be available in March 2022. The fully autonomous vehicles will have integrated custom sensors, cameras, and radar systems, and their perception system will use data from multiple sensors and algorithms installed in the car. The system will record road curves, potholes, routes, and lanes. The development of self-driving vehicles will accelerate the growth of ride-sharing. Overhead costs, such as vehicle maintenance, navigation, and payment solutions, would be included. Self-driving cars will also resolve the first and last short-distance issue.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on components, electric vehicles, systems, mobility types, and regions.

|

By Component |

By Electric Vehicle |

By System |

By Mobility Type |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Component

Based on the component segment, the Radar segment dominated with the largest share in 2024 due to its advantages such as accurate object detection, speed measurement, and collision avoidance in all weather and lighting conditions. The rising need for 24/7 reliability and safety in autonomous vehicles is driving the adoption of radar technology. Moreover, advancement in technology is making radar sensor more appealing in wider applications such as blind-spot detection, lane-change assistance, and adaptive cruise control. This advancement in technology is fueling its adoption by automotive manufacturers. This technological advancement is further making radar cheaper which further fuels the demand, thereby fueling the segment growth.

Insight by Mobility Type

Based on the mobility type segment, the personal mobility segment is expected to record significant growth during the forecast period due to rising demand for convenient, safe, and autonomous personal transportation. This demand is driven by rising urbanization, traffic congestion, and increasing consumer interest in advance driver-assistance features. Moreover, rising disposable income is supporting general population to spend on advance equipment such as autonomous vehicle, which in turn fuels the demand for personal mobility. Additionally, aging populations and mobility-impaired individuals are looking for independent transportation solutions, making self-driving technology especially appealing for personal use, thereby fueling the segment growth.

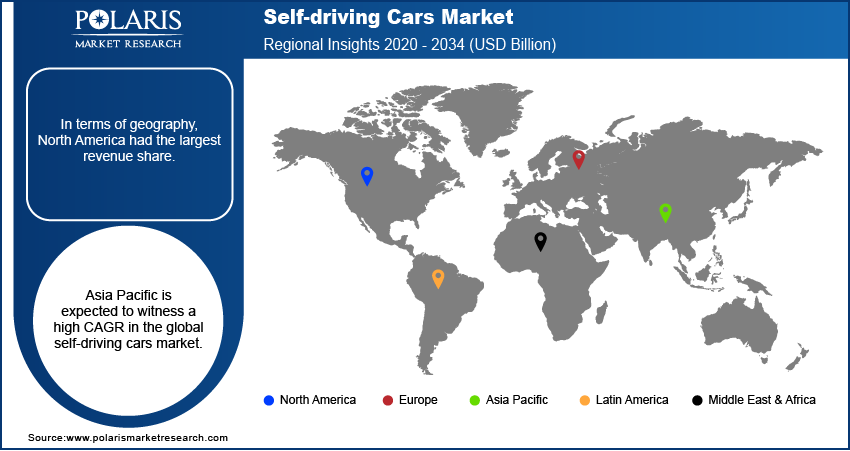

Geographic Overview

In terms of geography, North America had the largest revenue share. Due to robust and established automotive company groupings and being home to the world's largest technology companies such as Google, Microsoft, Apple, and others, the nation has been a pioneer in automated driving. In the U.S., these cars have already been in use in several states. Their mobility is currently limited to specific areas and driving conditions.

Asia Pacific is expected to witness a high CAGR in the global self-driving cars market. The market for self-driving cars is being driven by increasing market demand for secure, effective, and convenient driving dynamics, rising expendable income in emerging economies, and strict safety regulations worldwide. Due to higher partnerships adopted by self-driving car technology vendors in this region, the market in the Asia Pacific is expected to grow at the fastest rate during the forecast period. In China, for example, Baidu is a significant provider of self-driving technical support. It is collaborating with Ford and NVIDIA to increase the rate of self-driving cars in China.

Competitive Insight

Some of the major players operating in the global self-driving cars market include Argo Ai and Ford, Audi, Aurora Innovation Inc., Cadillac, Daimler AG, Einride, General Motors Company, Honda, Lexus, Nissan Motor Co. Ltd, Tesla Inc., Toyota Motor Corp., Uber Technologies Inc., Volvo Car Group, and Waymo LLC (Google Inc.)

Industry Developments

September 2025, Qualcomm and BMW launched the Snapdragon Ride Pilot Automated Driving System, debuting on the BMW iX3. The hands-free driving technology was made available for licensing to other automakers, aiming to spark widespread adoption across global markets by 2026.

Self-driving Cars Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 30.04 Billion |

| Market size value in 2025 | USD 34.19 Billion |

|

Revenue forecast in 2034 |

USD 112.64 Billion |

|

CAGR |

14.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Components, By Electric Vehicle, By System, By Mobility Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Argo Ai and Ford, Audi, Aurora Innovation Inc., Cadillac, Daimler AG, Einride, General Motors Company, Honda, Lexus, Nissan Motor Co. Ltd, Tesla Inc., Toyota Motor Corp., Uber Technologies Inc., Volvo Car Group, and Waymo LLC (Google Inc.) |

FAQ's

• The market size was valued at USD 30.04 billion in 2024 and is projected to grow to USD 112.64 billion by 2034

• The market is projected to register a CAGR of 14.2% during the forecast period.

• A few of the key players in the market are Argo Ai and Ford, Audi, Aurora Innovation Inc., Cadillac, Daimler AG, Einride, General Motors Company, Honda, Lexus, Nissan Motor Co. Ltd, Tesla Inc., Toyota Motor Corp., Uber Technologies Inc., Volvo Car Group, and Waymo LLC (Google Inc.)

• The radar segment dominated the market revenue share in 2024.

• The personal mobility segment is projected to witness the significant growth during the forecast period.