B2B2C Insurance Market Size, Share, Trends, & Industry Analysis Report

By Insurance (Life Insurance and Non-life Insurance), By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 122

- Format: PDF

- Report ID: PM2283

- Base Year: 2024

- Historical Data: 2020-2023

What is the B2B2C insurance market size?

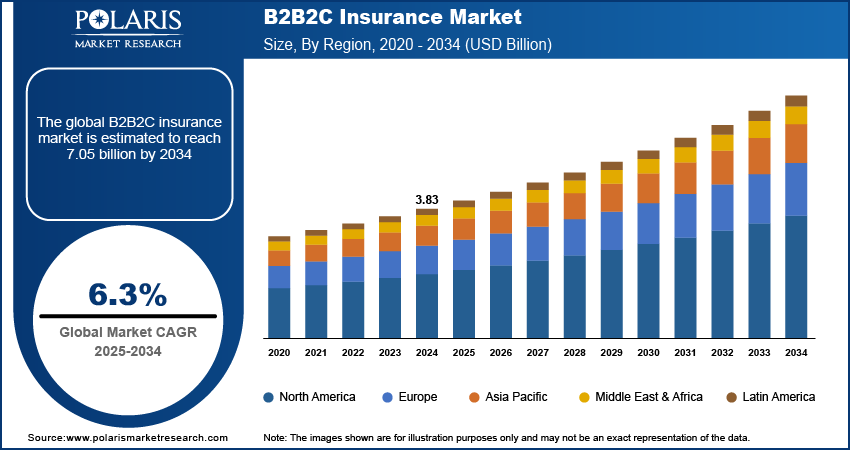

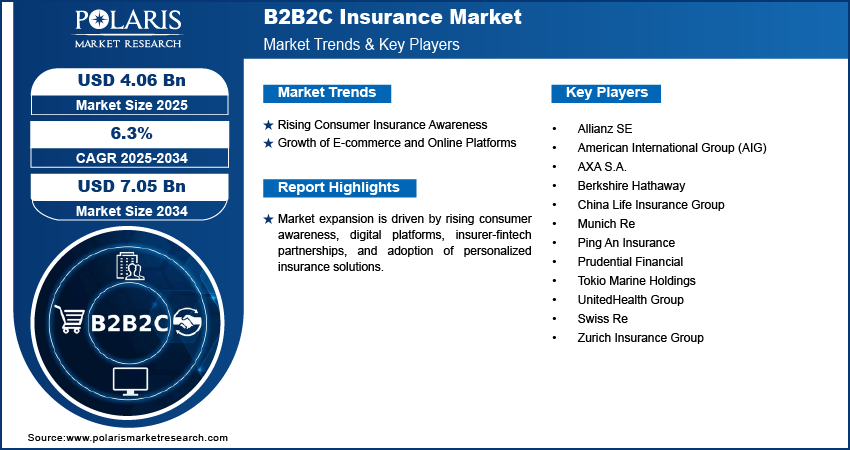

The global B2B2C insurance market size was valued at USD 3.83 Billion in 2024, growing at a CAGR of 6.3% from 2025–2034. Increasing consumer insurance knowledge with the expansion of e-commerce and online channels is pushing demand for B2B2C insurance services.

Key Insights

- Life insurance led 2024 market share owing to increased demand for long-term protection through digital platforms.

- Non-life insurance expected to grow fastest as demand for health, property, and motor cover increases.

- Asia Pacific dominated 2024 market with high digital uptake and government initiatives.

- China recorded the largest regional share through consumer consciousness and financial protection schemes.

- North America is expected to register the highest CAGR through tech uptake and online policy development.

- The U.S. is expanding through insurer collaborations and fintech partnerships.

Industry Dynamics

- Increased consumer insurance consciousness is driving B2B2C insurance solution demand.

- Expansion of e-commerce and digital platforms is boosting broader use of digital insurance distribution.

- Regulatory complexity and cyber security issues are limiting market growth.

- Convergence of AI, analytics and mobile-first platforms offers excellent growth prospects for the industry.

Market Statistics

- 2024 Market Size: USD 3.83 billion

- 2034 Projected Market Size: USD 7.05 billion

- CAGR (2025–2034): 6.3%

- Asia Pacific: Largest Market Share

B2B2C insurance solutions offer effective insurance distribution through collaborations among insurers, intermediaries, and digital platforms. Advanced digital technologies and analytics allow for quicker policy issuance, customized offerings, and simplified claims management. Uses include online policy sales, mobile platforms, and partner-integrated solutions that enable insurers to acquire broader customer bases and enhance customer experience.

Government efforts, financial inclusion initiatives, and regulatory backing for digital insurance are driving B2B2C insurance solution uptake. Financial protection and risk management awareness campaigns are enhancing consumer knowledge, tipping adoption in urban and emerging markets.

Increased digital uptake, platform infrastructure investments, and insurer-fintech collaboration are propelling market growth. Nations with robust digital ecosystems are driving platform efficiency, enhancing policy management, and providing financial and operational advantages. Arch, in July 2025, introduced new supplemental health insurance products to assist individuals in managing medical charges outside primary plan coverage. The products are portable and involve no medical underwriting.

Drivers & Opportunities

Which are the major driving factor for B2B2C insurance market growth?

Rising Consumer Insurance Awareness: Growing financial protection and risk management awareness is fueling B2B2C insurance solutions demand. Individuals are looking for bespoke policies and customized coverage, prompting insurers to increase digital and partner-based distribution channels. For instance, during July 2025, Arlo raised USD 4 million in seed funding to enable small businesses to offer affordable health insurance. The platform applies AI to make it easier to choose plans and reduce coverage costs. This trend bolsters wider adoption of insurance solutions in both urban and emerging markets.

Growth of E-commerce and Online Platforms: Expansion of E-commerce and Online Platforms: Growth in e-commerce and online platforms is facilitating insurers to reach customers more efficiently. Digital distribution channels enable frictionless purchase of policies, renewals, and claims handling. This transition is driving increased adoption of B2B2C insurance models and promoting collaborations between insurers and technology platforms.

Segmental Insights

Insurance Analysis

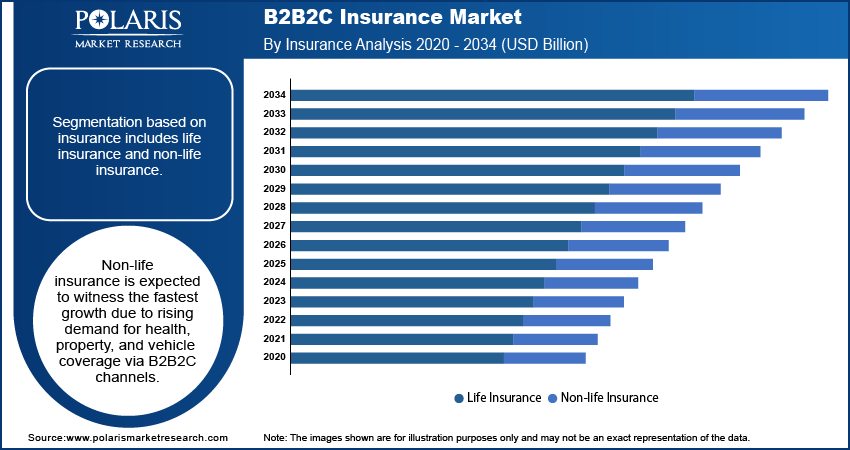

Based on insurance, segmentation consists of life insurance and non-life insurance. The life insurance segment was the market leader in 2024, led by increasing consumer knowledge about financial protection and long-term savings. Additionally, increasing use of digital and partner-based distribution platforms is also aiding strong revenue growth throughout the forecast years.

The non-life insurance segment is expected to expand at the highest CAGR between 2025–2034, fueled by increasing demand for covering property, health, and autos. Furthermore, the growth of web-based platforms and collaborations with fintech suppliers is also boosting market uptake. In September 2025, BHSI has introduced Group Personal Accident and Business Travel insurance in the UK, which includes real-time risk notifications, tracking of employees, emergency services, and virtual care assistance.

Distribution Channel Analysis

On the basis of distribution channel, the market is segmented into online and offline. The offline distribution channel dominated in 2024 due to growing partnerships among insurer with banks, agents, and retail networks. In addition, increased customer confidence in conventional channels and hybrid service strategies is also driving quicker uptake.

Online distribution channel is expected to expand at the highest rate through the forecast period due to convenience, real-time policy management, and effortless customer interaction. Additionally, increasing e-commerce integration and digitalization in urban and semi-urban areas are also contributing to tremendous revenue growth in the market.

Regional Analysis

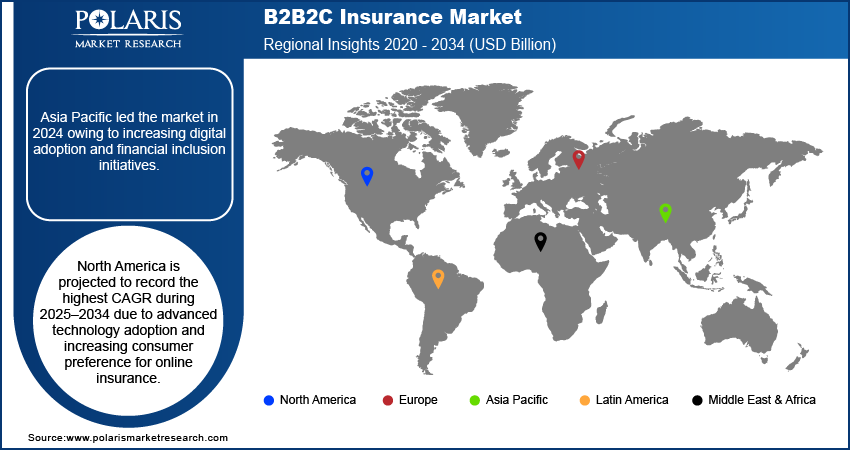

Asia Pacific led the B2B2C insurance industry in 2024, fueled by fast digital penetration and increased financial inclusion programs in emerging economies. Also, increasing consumer consciousness regarding financial security and savings over the long term is further driving market growth. Furthermore, initiatives by the government for increased insurance accessibility are also driving adoption.

China B2B2C Insurance Market Insight

China dominated the regional market on the account of growing e-commerce platforms and robust insurer collaborations with fintech players. Furthermore, rising urbanization and digital literacy also fuel adoption. Besides, government initiatives promoting insurance penetration by middle-class consumers also support growth.

Europe B2B2C Insurance Market

Europe has a large market share owing to stringent regulatory environments fostering consumer protection and insurance transparency. Further, high insurance penetration in mature economies is also aiding adoption. Additionally, collaborations between banks and insurers are paving the way for effective B2B2C distribution models.

North America B2B2C Insurance Market

North America is anticipated to expand at the highest CAGR from 2025–2034, owing to integration of innovative technology into insurance platforms and robust investment in digital infrastructure. Further, increasing demand for online management of policies is also driving adoption. Additionally, favorable regulatory environments boost market growth.

The U.S. B2B2C Insurance Market Overview

The U.S. market is growing as a result of high digital penetration and insurer partnerships with tech and e-commerce platforms. Additionally, increased financial protection and risk management awareness is also fueling adoption. For example, in July 2025, QBE North America launched a Life Sciences insurance product providing liability coverage for medical device, pharmaceutical, and clinical trial firms. Additionally, encouraging government policies for digital insurance further contribute to growth.

Key Players & Competitive Analysis Report

The B2B2C insurance industry is relatively competitive, with businesses ramping up capabilities on digital channels, partner ecosystems, and customized insurance products. Further, investments in big data analytics, mobile-first applications, and strategic collaboration with fintechs, banks, and online platforms improve customer experience, policy management, and market coverage.

Who are the major key players in B2B2C insurance market?

Some of the key market leaders include UnitedHealth Group, Allianz SE, Berkshire Hathaway, AXA S.A., Ping An Insurance, China Life Insurance Group, Zurich Insurance Group, Prudential Financial, Munich Re, Swiss Re, American International Group (AIG), and Tokio Marine Holdings.

Key Players

- Allianz SE

- American International Group (AIG)

- AXA S.A.

- Berkshire Hathaway

- China Life Insurance Group

- Munich Re

- Ping An Insurance

- Prudential Financial

- Tokio Marine Holdings

- UnitedHealth Group

- Swiss Re

- Zurich Insurance Group

Industry Developments

- August 2025: International Airlines Group (IAG) introduced a new travel insurance product, "Wanda by Avios," with flexible cancellation, rapid delay payments, and Avios points protection/restoration of loyalty.

- July 2025: HCSC debuted HealthSpring as a national brand to increase access to Medicare products and high-quality healthcare after its acquisition of Cigna's Medicare businesses.

- June 2025: Washington National launched an Individual Term Life Insurance product offering flexible, affordable coverage with built-in and optional riders for underserved individuals and families.

B2B2C Insurance Market Segmentation

By Insurance Outlook (Revenue, USD Billion, 2020–2034)

- Life Insurance

- Non-life Insurance

- Health Insurance

- Property & Casualty Insurance

- Travel Insurance

- Motor Insurance

- Specialty Insurance

- Others

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online

- Offline

- Insurance Companies

- Banks

- Airlines

- Insurance Aggregators and Comparison Websites

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

B2B2C Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.83 Billion |

|

Market Size in 2025 |

USD 4.06 Billion |

|

Revenue Forecast by 2034 |

USD 7.05 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 3.83 billion in 2024 and is projected to grow to USD 7.05 billion by 2034.

The global market is projected to register a CAGR of 6.3% during the forecast period.

Asia Pacific led the market due to rapid digital adoption and rising consumer awareness of insurance products.

A few of the key players in the market are UnitedHealth Group, Allianz SE, Berkshire Hathaway, AXA S.A., Ping An Insurance, China Life Insurance Group, Zurich Insurance Group, Prudential Financial, Munich Re, Swiss Re, American International Group (AIG), and Tokio Marine Holdings.

Life insurance dominated due to high demand for long-term protection and savings products offered through digital and partner-based channels.

Online distribution is expected to grow fastest due to rising digital adoption and increasing partnerships with fintechs and e-commerce platforms.