Battery Management System Market Share, Size, & Industry Analysis Report

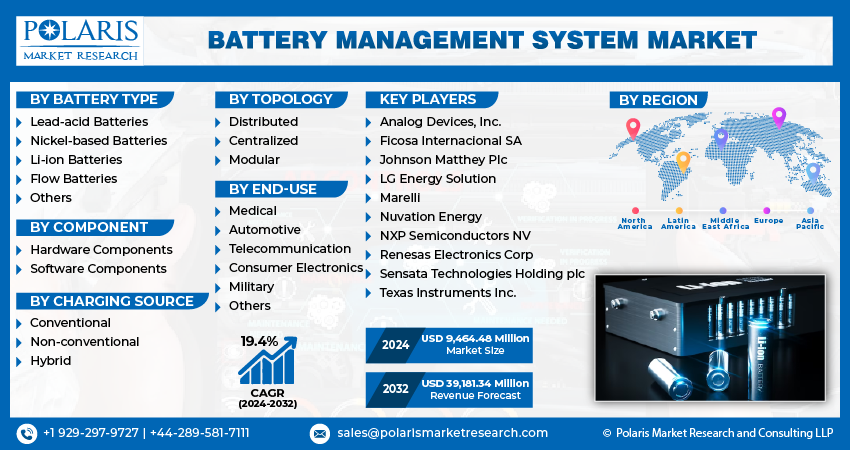

By Battery Type (Lead-Acid, Nickel-Based, Li-ion, Flow, Others); By Component; By Charging Source; By End-Use; By Topology; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 145

- Format: PDF

- Report ID: PM1031

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The battery management system (BMS) market was valued at USD 8.41 billion in 2024 and is expected to register a CAGR of 16.30% from 2025 to 2034. The increasing deployment of renewable energy systems and the growing adoption of electric vehicles drive market growth. The rising need for efficient energy storage solutions is expected to boost the industry expansion.

Key Insights

- The lead-acid segment dominated the market share in 2024, due to its established infrastructure and widespread adoption in various applications.

- The automotive segment is anticipated to register a significant CAGR during the forecast period. BMS solutions for the automotive sector are crucial for ensuring the safe and reliable operation of battery packs powering vehicles.

- North America dominated the industry with over 32% share in 2024. The rising adoption of EVs and increasing investments in renewable energy infrastructure boost the regional industry growth.

- The Asia Pacific battery management systems industry is experiencing rapid growth. Growing urbanization and industrialization and the increasing adoption of EVs propel the industry expansion.

Industry Dynamics

- Rising adoption of electric vehicles fuels the demand for battery management systems.

- Product launches, rising collaborations and mergers & acquisitions boost the industry expansion.

- Growing focus on developing EV charging infrastructure is expected to offer lucrative opportunities for the industry during the forecast period.

- Lack of standards and regulations regarding BMS hinders the market development.

Market Statistics

2024 Market Size: USD 8.41 billion

2034 Projected Market Size: USD 78.72 billion

CAGR (2025–2034): 16.30%

North America: Largest market in 2024

To Understand More About this Research:Request a Free Sample Report

Industry Trends

A Battery Management System (BMS) is a crucial technology used to monitor and manage the performance of rechargeable batteries, ensuring their optimal operation, safety, and longevity. It oversees various functions, such as measuring the battery’s state of charge (SOC), state of health (SOH), and state of power (SOP). A BMS balances the charge among cells, preventing overcharging or deep discharging, which can damage the battery and reduce its lifespan. It also manages thermal management to prevent overheating, a critical safety feature.

The growth in renewable energy integration presents significant opportunities for the market due to the increasing need for efficient energy storage solutions. Renewable energy sources such as solar and wind power are intermittent by nature, leading to fluctuations in power generation that must be balanced with demand. Battery storage systems, coupled with BMS technology, play a crucial role in storing excess energy during periods of high generation and releasing it when demand is high or renewable generation is low. BMS solutions enable the monitoring, control, and optimization of battery performance, ensuring efficient charging, discharging, and storage of energy. They help to maximize the lifespan of batteries, prevent overcharging or over discharging, and maintain optimal operating conditions, thereby enhancing system efficiency and reliability.

Moreover, as renewable energy installations, such as solar farms and wind turbines, continue to proliferate, the demand for grid-scale energy storage solutions grows. BMS technology enables the integration of battery storage systems into microgrids, smart grids, and distributed energy networks, providing grid stability, peak shaving, and backup power capabilities. Furthermore, government incentives, mandates, and environmental regulations aimed at reducing carbon emissions and promoting renewable energy adoption drive investments in energy storage infrastructure, creating opportunities for BMS manufacturers. Overall, the growth in renewable energy integration offers a fertile ground for innovation, investment, and market expansion in the battery management systems market.

What are the Drivers Driving the Demand for Market?

Increasing Adoption of Electric Vehicles (EVs)

The increasing adoption of electric vehicles (EVs) is a major driver of growth in the BMS industry for several reasons. Firstly, as EVs become more prevalent, the demand for high-performance and reliable battery packs rises. BMS plays a crucial role in ensuring the optimal performance, safety, and longevity of these battery packs by monitoring key parameters such as temperature, voltage, and state of charge (SoC), as well as implementing advanced charging and discharging algorithms. Secondly, the complexity of EV battery systems necessitates sophisticated BMS solutions to manage multiple battery cells or modules effectively. BMS helps to balance cell voltages, prevent overcharging or overdischarging, and optimize energy usage to extend driving range and battery life.

Moreover, the growth of EV charging infrastructure further drives the demand for BMS technology. BMS solutions enable fast charging while ensuring battery safety and reliability, enhancing the user experience and accelerating the adoption of electric vehicles. Additionally, stringent regulations and safety standards for EV batteries require robust BMS solutions to comply with industry standards and ensure vehicle and occupant safety. As the EV continues to expand globally, the demand for advanced BMS technology is expected to grow proportionally, driving innovation and investment in the battery management systems market.

Which factor is Restraining the Demand?

Growing Costs is Challenging the Growth

Growing costs pose a significant challenge due to several factors. Firstly, as battery technology advances and energy storage systems become more sophisticated, the complexity and functionality requirements of BMS solutions increase. This necessitates the development of more advanced algorithms, hardware components, and communication protocols, driving up research, development, and manufacturing costs. Additionally, the demand for high-performance BMS solutions in applications such as electric vehicles (EVs), grid-scale energy storage, and renewable energy integration requires robust and reliable components, which may come at a higher price. Moreover, stringent safety regulations and industry standards impose additional costs on BMS manufacturers to ensure compliance and certification.

Report Segmentation

The market is primarily segmented based on battery type, component, charging source, end-use, topology, and region.

|

By Battery Type |

By Component |

By Charging Source |

By End-Use |

By Topology |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Battery Type Insights

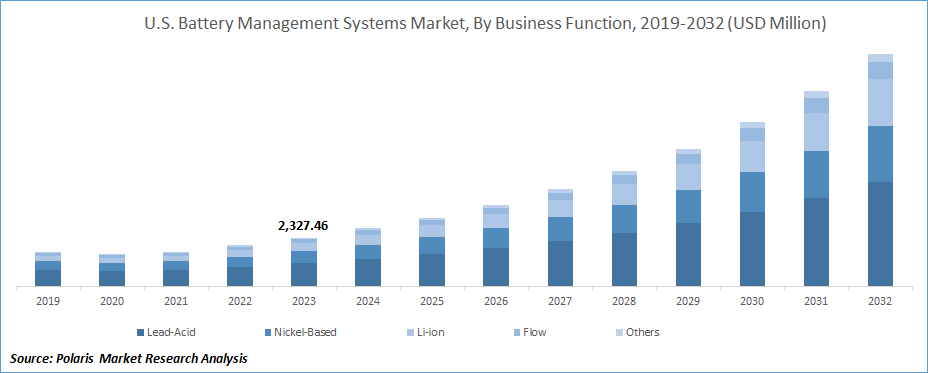

Based on battery type category analysis, the market has been segmented on the basis of lead-acid, nickel-based, li-ion, flow, and others. Lead-acid battery type has captured the largest share in the battery management systems (BMS) market due to its long history of use, established infrastructure, and widespread adoption in various applications. Lead-acid batteries are known for their reliability, cost-effectiveness, and familiarity, making them a preferred choice for many users, especially in automotive, industrial, and stationary power applications. Additionally, the mature technology and extensive industry presence contribute to lead-acid batteries' dominance in the BMS market.

Lead-acid batteries, although one of the oldest rechargeable battery technologies, still play a significant role in various industries and applications, including automotive, industrial, and standby power systems. In the battery management systems (BMS) market, lead-acid battery types require specialized monitoring and management due to their unique characteristics and requirements.

By End-Use Insights

Automotive segment is experiencing the highest CAGR in the battery management system market since BMS solutions for the automotive sector are crucial for ensuring the safe, efficient, and reliable operation of battery packs powering these vehicles. These BMS solutions monitor and control key parameters such as cell voltage, temperature, state of charge (SoC), and state of health (SoH), optimizing battery performance, extending battery life, and preventing overcharging or over discharging. Additionally, automotive BMS solutions incorporate advanced features such as thermal management, cell balancing, and fast-charging algorithms to maximize driving range, enhance energy efficiency, and improve overall vehicle performance.

Regional Insights

North America

North America battery management systems market has captured the largest share due to several factors which include robust technological innovation, widespread adoption of electric vehicles (EVs), and significant investments in renewable energy infrastructure. Additionally, supportive government policies and regulations, coupled with a mature automotive industry and strong presence of key BMS manufacturers, have contributed to North America's dominance. These factors collectively drive demand for BMS solutions, positioning the region as a leader in the industry.

Asia Pacific

The Asia Pacific battery management systems market represents a dynamic and rapid growth for battery management systems (BMS), fueled by factors such as rapid urbanization, industrialization, and the increasing adoption of electric vehicles (EVs) and renewable energy technologies. With countries like China, Japan, and South Korea leading the way in technological innovation and manufacturing capabilities, Asia Pacific is a hub for BMS development, production, and deployment. The region's burgeoning automotive industry, coupled with government incentives and regulations promoting electric mobility, has driven significant demand for BMS solutions in the automotive sector.

Competitive Landscape

The market is competitive, with key players such as Texas Instruments Inc., Ricardo Edition, NXP Semiconductors, Nuvation Engineering, Analog Devices Inc., Sensata Technologies Holding plc, and Marelli vying for dominance. These companies are implementing strategies such as agreements, collaborations, and partnerships and focusing on developing new products with enhanced features to bolster their product lineup and solidify their market position.

Some of the major players operating in the global market include:

- Analog Devices, Inc.

- Ficosa Internacional SA

- Johnson Matthey Plc

- LG Energy Solution

- Marelli

- Nuvation Energy

- NXP Semiconductors NV

- Renesas Electronics Corp

- Sensata Technologies Holding plc

- Texas Instruments Inc.

Recent Developments

- In January 2025, LG Energy Solution launched its advanced SoC-based battery management system (BMS) in partnership with Qualcomm. The BMS was developed to enhance EV battery safety and diagnostics using Snapdragon Digital Chassis for improved performance and data processing.

- In June 2022, Renesas Electronics Corporation introduced an AUTOSAR-compliant complex device driver (CDD) software module for designers of automotive battery management systems (BMS) in electric vehicles (EVs). The new software pairs with Renesas’ ISL78714 Li-Ion battery management IC to speed design and optimize the performance of next-generation systems.

- In November 2021, Renesas Electronics introduced a new family of multi-cell full battery front end (BFE) ICs for battery management systems (BMS). These management systems are intended for larger, high-voltage battery packs that power e-scooters, energy storage, high-voltage power tools, and other high-voltage equipment.

- In May 2022, Marelli expands its range of battery management technologies for electric vehicles with a new state-of-the-art Wireless Distributed Battery Management System (wBMS). This technology eliminates the wired physical connections typically needed in other Battery Management System (BMS) architectures, allowing for greater flexibility, increased efficiency, improved reliability and reduced costs, all crucial aspects in electric vehicles.

- In February 2023, Qnovo, the market leader in e-mobility battery management software, announced a collaboration with NXP Semiconductors. NXP will offer Qnovo's new innovation for electrified mobility, SpectralX, in its e-mobility enablement solutions for electric vehicles (EV) in 2023. SpectralX is intelligent battery management system (BMS) software.

Report Coverage

The battery management system market report emphasizes on key regions across the globe to provide better understanding of the charging source to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, battery type, component, charging source, end-use, topology, and their futuristic growth opportunities.

Battery Management System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 10.52 billion |

|

Revenue forecast in 2034 |

USD 78.72 billion |

|

CAGR |

16.30% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Battery Type, By Component, By Charging Source, By End-Use, By Topology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in battery management system market Analog Devices, Inc., Ficosa Internacional SA, Johnson Matthey Plc, LG Energy Solution

Battery management system market exhibiting the CAGR of 16.30% during the forecast period (2025 to 2034)

The Battery Management System Market report covering key segments are type, component, charging source, topology, end-use, and region.

key driving factors in battery management system market are Increasing Adoption of Electric Vehicles (EVs)

Battery Management System Market Size Worth USD 78.72 billion by 2034