Breast Prosthetic Market Size, Share, Trends, Industry Analysis Report

By Product (Silicone Prosthesis, Foam Prosthesis), By Material, By Usage, By Distribution Channel, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5982

- Base Year: 2024

- Historical Data: 2020-2023

Overview

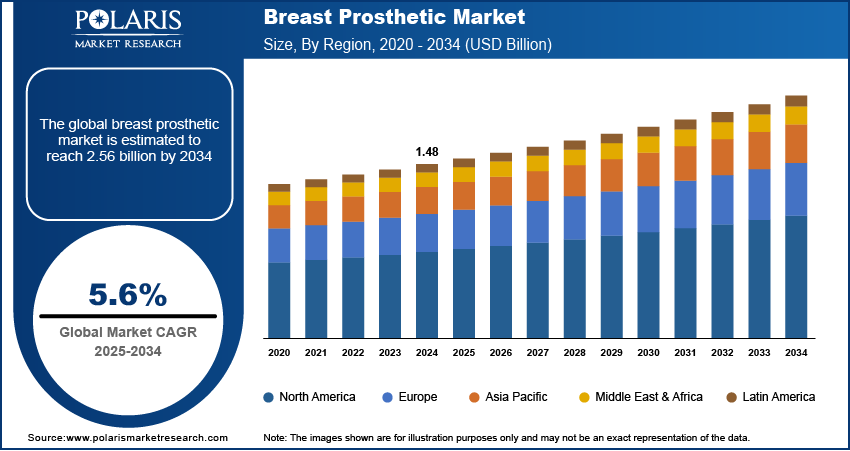

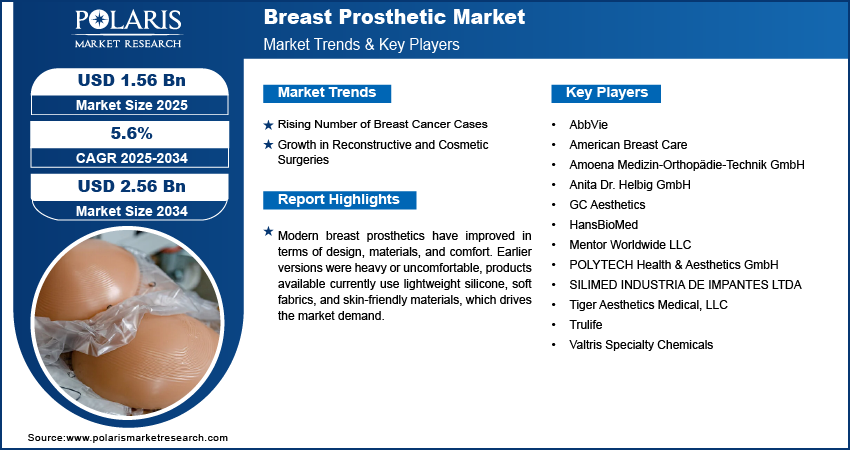

The global breast prosthetic market size was valued at USD 1.48 billion in 2024, growing at a CAGR of 5.6% from 2025 to 2034. The growth is driven by the rise in the number of breast cancer cases and growth in reconstructive and cosmetic surgeries.

Key Insights

- In 2024, the silicone prosthesis segment dominated with the largest share as silicone forms are popular as they look and feel more like natural breast tissue.

- The latex segment is expected to experience significant growth during the forecast period as it offers a more affordable option for many users.

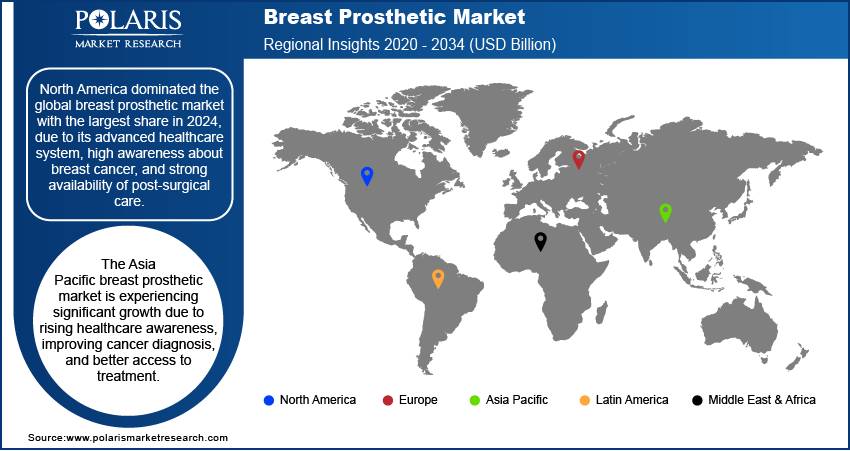

- The market in North America dominated with the largest share in 2024, due to its advanced healthcare system, high awareness about breast cancer, and strong availability of post-surgical care.

- The market in the U.S. is expected to witness significant growth driven by its high breast cancer rates and widespread awareness.

- The breast prosthetic market in Asia Pacific is projected to witness substantial growth during the forecast period due to rising healthcare awareness, improving cancer diagnosis, and better access to treatment.

A breast prosthetic is an artificial breast form used to replace the shape of all or part of a breast that has been removed due to mastectomy or other medical conditions. It can be worn externally inside a bra or surgically implanted as a breast implant. These prosthetics help restore body symmetry, improve self-confidence, and support emotional recovery for individuals after breast surgery.

Women are learning about breast prosthetics due to health awareness campaigns and support groups. Hospitals, NGOs, and health organizations actively promote post-mastectomy care and provide resources for women to access prosthetics. Awareness events such as Breast Cancer Awareness Month help educate patients on their options after surgery. This improved knowledge helps reduce the stigma around mastectomy and encourages more women to seek prosthetic solutions. The demand for breast forms that are both functional and natural-looking increase as awareness grows, pushing manufacturers to innovate and meet these needs, thereby driving the growth.

To Understand More About this Research: Request a Free Sample Report

Modern breast prosthetics have improved in terms of design, materials, and comfort. Earlier versions were heavy or uncomfortable, products available currently use lightweight silicone, soft fabrics, and skin-friendly materials. Some prosthetics even offer temperature control and better movement with the body. These improvements make it easier for users to wear them daily without discomfort. Customer satisfaction increases as manufacturers continue to develop more natural-looking and wearable prosthetics. This positive user experience leads to more acceptance and demand, driving growth as more women feel encouraged to use high-quality breast forms.

Industry Dynamics

- Rising number of breast cancer cases is driving the demand for coating pretreatments.

- Growth in reconstructive and cosmetic surgeries is fueling the industry.

- Advancements in design, materials, and comfort drive the reliability and appeal of product.

- High cost of advanced breast prosthetics, such as adjustable silicone forms, limits accessibility for patients in low-income regions and those without adequate insurance coverage.

Rising Number of Breast Cancer Cases: One of the main reasons the breast prosthetic demand is growing is the increasing number of breast cancer cases worldwide. According to the European Commission, out of all cancer diagnosed cases, breast cancer accounted for 29.4% cases in Europe alone. Many women undergo mastectomy (breast removal surgery) as part of their treatment, which leads to a higher demand for breast prosthetics. More people are diagnosed and treated early, often resulting in surgery, as cancer awareness improves. After recovery, many women choose breast prosthetics to restore their body shape and feel more confident. This growing need for physical healing after surgery is a major factor driving the demand for high-quality, comfortable prosthetic options, thereby driving the growth.

Growth in Reconstructive and Cosmetic Surgeries: More women are choosing reconstructive or cosmetic breast surgeries after mastectomy or for aesthetic reasons. According to the ISAPS, in 2024, Brazil alone accounted for 3.3 million cosmetic surgeries. Breast prosthetics are used before or after these surgeries to provide shape, balance, or temporary support. This trend is especially noticeable in developed countries where cosmetic procedures are more common. The growing popularity of body image enhancement and personalized care further fuels the demand. Patients are more willing to invest in both permanent and temporary breast forms as surgical techniques improve and become more accessible, boosting demand across the medical and aesthetic sectors, thereby driving the growth.

Segmental Insights

Product Analysis

The segmentation, based on product, include silicone prosthesis, foam prosthesis, inflatable prosthesis, custom-fit prosthesis, and partial breast prosthesis. In 2024, the silicone prosthesis segment dominated with the largest share as silicone forms are popular because they look and feel more like natural breast tissue. They are soft, flexible, and durable, making them a preferred choice for daily wear. Many women feel more comfortable using silicone prosthetics after surgery, which has helped drive demand. These prosthetics further come in a wide variety of sizes and shapes to fit individual needs. Silicone prosthetics demand rises as more people seek natural-looking and long-lasting solutions, thereby driving the segment growth.

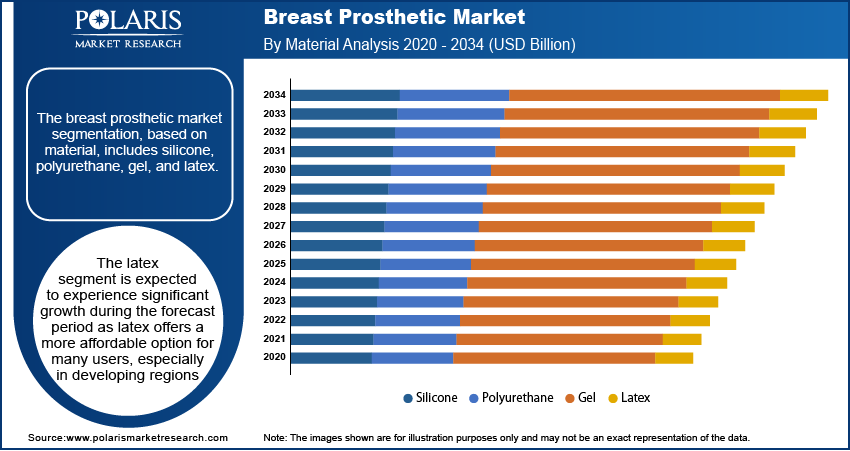

Material Analysis

The segmentation, based on material, includes silicone, polyurethane, gel, and latex. The latex segment is expected to experience significant growth during the forecast period as latex offers a more affordable option for many users, especially in developing regions. New improvements in latex materials are making these prosthetics more skin-friendly and lightweight. More women are becoming open to trying latex-based prosthetics as awareness increases and companies work to reduce allergic reactions. The lower cost and growing availability make them an attractive alternative. This trend is expected to push latex-based products into greater use, especially in cost-sensitive and emerging markets over the coming years, thereby driving the segment growth.

Usage Analysis

The segmentation, based on usage, includes post-mastectomy, post-lumpectomy, reconstructive surgery, and cosmetic improvement. In 2024, the cosmetic improvement segment dominated with the largest share as many women choose prosthetics not just after surgery, but also to improve their appearance or correct natural imbalances. These products help improve body symmetry and boost self-esteem. More women are using prosthetics as part of their daily routine or special occasions, with rising beauty awareness and growing acceptance of body enhancements. Cosmetic use is no longer limited to post-surgical needs; it has become a personal style choice for many, thereby driving the segment growth.

Distribution Channel Analysis

The segmentation, based on distribution channel, includes online retail, specialty stores, hospitals and clinics, and pharmacies. The online retail segment is expected to experience significant growth during the forecast period as more women are choosing to buy prosthetics online due to convenience, privacy, and a wide range of available options. E-commerce platforms enable customers to compare products, read reviews, and find the best fit without visiting a store. Especially for those in remote areas, online retail platforms offer a discreet and simple solution, thereby driving the segment growth.

Regional Analysis

North America Breast Prosthetic Market Trend

The market in North America dominated with the largest share in 2024, due to its advanced healthcare system, high awareness about breast cancer, and strong availability of post-surgical care. Many women in this region opt for breast prosthetics following mastectomy or cosmetic procedures. Insurance coverage and support programs further make these products more accessible. The presence of leading manufacturers and specialized clinics helps drive innovation and adoption. Demand for natural-looking, comfortable prosthetics grows with a strong focus on women’s wellness and body confidence. Moreover, North America’s supportive healthcare environment drives the growth in the region.

U.S. Breast Prosthetic Market Insight

The market in the U.S. is expected to witness significant growth in the coming years, driven by its high breast cancer rates and widespread awareness, which encourages early treatment and post-surgery recovery support, including prosthetic use. The U.S. further benefits from strong insurance systems, advanced hospitals, and the availability of high-end silicone prosthetics. Many women in the country choose external breast forms for both medical and cosmetic reasons. Online sales, specialty stores, and support communities further improve access, thereby driving the growth.

Asia Pacific Breast Prosthetic Market Analysis

The market in Asia Pacific is projected to witness substantial growth during 2025–2034, due to rising healthcare awareness, improving cancer diagnosis, and better access to treatment. Countries such as India, Japan, and South Korea are increasing investments in women’s health, leading to higher demand for post-mastectomy products. Affordability is important in this region, which is encouraging local manufacturers to produce cost-effective and comfortable prosthetics. More women are opting for breast forms to support emotional and physical recovery as awareness campaigns and healthcare infrastructure improve, thereby driving the industry growth.

China Breast Prosthetic Market Outlook

The market in China is expected to experience rapid growth in the coming years, due to the rise in breast cancer cases and better access to healthcare services. Urban women are becoming more open to using prosthetics for both recovery and appearance. Government efforts to expand cancer care and the growth of online retail platforms make it easier for patients to find and purchase prosthetics. Chinese manufacturers are further developing affordable products to meet domestic demand. The social acceptance and medical support are improving in the country, further fueling market growth.

Europe Breast Prosthetic Market Insight

The market in Europe is expected to experience faster growth during the forecast period, due to high awareness of breast cancer and widespread access to advanced healthcare services. Countries across the region have well-developed post-mastectomy care systems and support programs that make prosthetics more accessible. Patients benefit from insurance coverage, hospital recommendations, and a variety of product choices. There is a growing demand for natural-looking and eco-friendly materials. European consumers value quality, comfort, and safety, pushing manufacturers to focus on innovation. The rising health consciousness and supportive healthcare policies further drive the growth of the regional market.

Germany Breast Prosthetic Market Outlook

The Germany market is expected to experience significant growth as the country has a strong healthcare system that covers post-mastectomy products, making them accessible to a wide range of patients. German consumers further place high importance on product quality, safety, and comfort, which drives demand for premium silicone prosthetics. Local manufacturers such as Anita Dr. Helbig GmbH and Amoena are well-known for their innovation and craftsmanship. More women are opting for prosthetics as part of their recovery with rising breast cancer awareness, support groups, and medical guidance, thereby driving the growth.

Key Players and Competitive Analysis

The industry is moderately fragmented, with a mix of established medical device companies and specialized prosthetics manufacturers competing for market share. Major players such as AbbVie, Mentor Worldwide LLC, and GC Aesthetics bring strong brand recognition and global distribution networks, especially in post-mastectomy care and reconstructive solutions. Companies such as Amoena, Anita Dr. Helbig GmbH, and Trulife focus on non-surgical, external breast prostheses and dominate in the post-surgical apparel and orthotic segments. HansBioMed and SILIMED are key players in implantable prosthetics, while POLYTECH Health & Aesthetics GmbH offers a broad portfolio of aesthetic and reconstructive solutions. American Breast Care and Tiger Aesthetics are gaining ground through innovation and tailored patient care. Competitive strategies include product customization, expansion into emerging markets, and partnerships with healthcare providers. The market is further driven by rising mastectomy rates, awareness programs, and demand for improved comfort and natural appearance in prosthetic solutions.

Key Players

- AbbVie

- American Breast Care

- Amoena Medizin-Orthopädie-Technik GmbH

- Anita Dr. Helbig GmbH

- GC Aesthetics

- HansBioMed

- Mentor Worldwide LLC

- POLYTECH Health & Aesthetics GmbH

- SILIMED INDUSTRIA DE IMPANTES LTDA

- Tiger Aesthetics Medical, LLC

- Trulife

- Valtris Specialty Chemicals

Industry Developments

In April 2023, Amoena launches its award-winning Adapt Air breast form, featuring adjustable air chamber technology, lightweight silicone, and Comfort+ for a customizable fit and all-day comfort after mastectomy.

Breast Prosthetic Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Silicone Prosthesis

- Foam Prosthesis

- Inflatable Prosthesis

- Custom-Fit Prosthesis

- Partial Breast Prosthesis

By Material Outlook (Revenue, USD Billion, 2020–2034)

- Silicone

- Polyurethane

- Gel

- Latex

By Usage Outlook (Revenue, USD Billion, 2020–2034)

- Post-Mastectomy

- Post-Lumpectomy

- Reconstructive Surgery

- Cosmetic Improvement

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Online Retail

- Specialty Stores

- Hospitals and Clinics

- Pharmacies

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.48 Billion |

|

Market Size in 2025 |

USD 1.56 Billion |

|

Revenue Forecast by 2034 |

USD 2.56 Billion |

|

CAGR |

5.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.48 billion in 2024 and is projected to grow to USD 2.56 billion by 2034.

The global market is projected to register a CAGR of 5.6% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AbbVie; American Breast Care; Amoena Medizin-Orthopädie-Technik GmbH; Anita Dr. Helbig GmbH; GC Aesthetics; HansBioMed; Mentor Worldwide LLC; POLYTECH Health & Aesthetics GmbH; SILIMED INDUSTRIA DE IMPANTES LTDA; Tiger Aesthetics Medical, LLC; Trulife; and Valtris Specialty Chemicals.

The silicone prosthesis segment dominated the market share in 2024.

The latex segment is expected to witness the significant growth during the forecast period.