Busbar Trunking Market Size, Share, Trend, & Industry Analysis Report

By Conductor (Copper and Aluminum), By Insulation, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5980

- Base Year: 2024

- Historical Data: 2020-2023

Overview

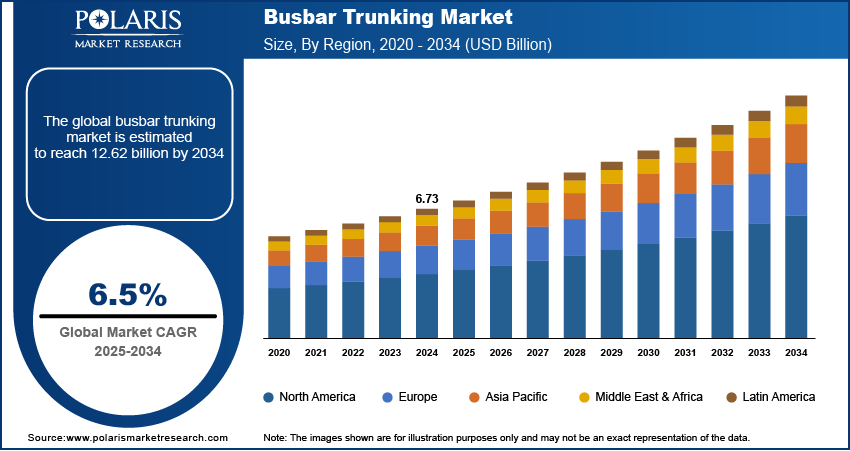

The global busbar trunking market size was valued at USD 6.73 billion in 2024, growing at a CAGR of 6.5% from 2025 to 2034. Rising demand for high-density power distribution in smart buildings, metros, and commercial complexes is accelerating the adoption of busbar trunking systems due to their space efficiency, scalability, and ease of installation.

Key Insights

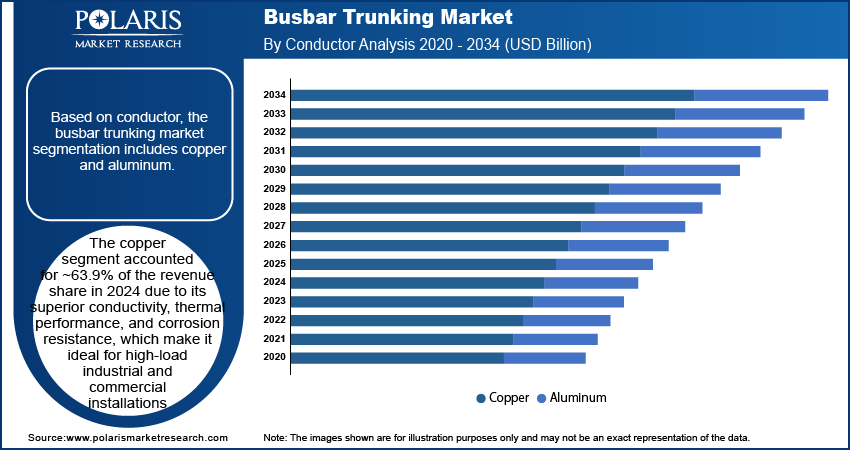

- The copper segment accounted for ~63.9% of the revenue share in 2024.

- The sandwich insulated segment accounted for ~68% of the revenue share in 2024.

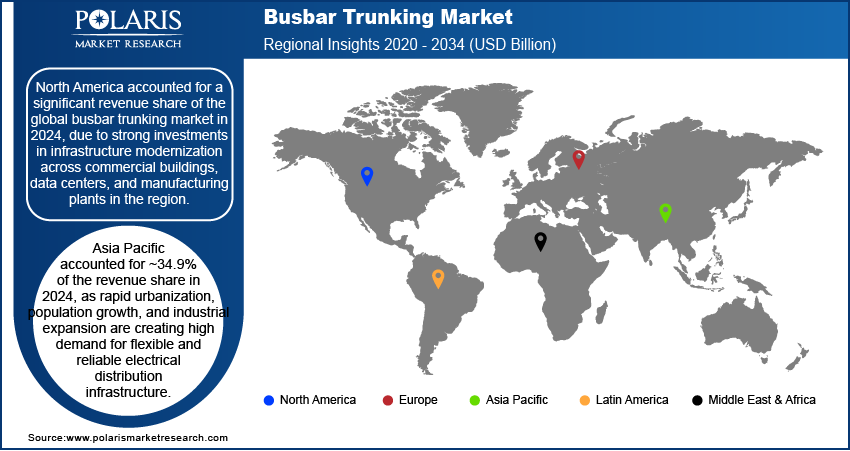

- North America accounted for the significant revenue share in 2024.

- The U.S. held significant revenue share in North America busbar trunking landscape in 2024.

- Asia Pacific accounted for ~34.9% of the revenue share in 2024.

- China accounted for the dominant share in 2024.

The busbar trunking market encompasses the design, manufacturing, and installation of prefabricated electrical distribution systems that utilize insulated conductors enclosed in a protective casing. These systems replace traditional cabling in buildings and industrial setups, offering modular, efficient, and safe power distribution across a wide range of voltage and current ratings. Busbar trunking systems reduce power losses and improve thermal management compared to conventional cable systems. This aligns with increasing emphasis on energy-efficient building standards and green certifications.

To Understand More About this Research: Request a Free Sample Report

Expansion of automated manufacturing plants and data centers requires robust and flexible power distribution solutions, supporting overall demand for busbar trunking systems that offer modular upgrades and minimal downtime. Moreover, busbar systems provide enhanced fire safety and lower risk of electrical faults, making them ideal for hospitals, airports, and high-rise buildings where compliance with strict safety standards is mandatory.

Industry Dynamics

- Expansion of cloud services and hyperscale data centers is significantly driving the demand for efficient and compact power distribution solutions.

- The shift toward smart cities and modern urban infrastructure is fueling the adoption of advanced electrical distribution systems such as busbar trunking.

- Growing renewable energy installations drive demand for efficient power distribution solutions in solar and wind farms.

- High initial costs and complex installation processes limit adoption in price-sensitive markets.

Rapid Growth in Data Centers: The ongoing expansion of cloud services and hyperscale data centers is significantly driving the demand for efficient and compact power distribution solutions. For instance, Microsoft invested USD 4.52 billion in Italy to boost AI infrastructure and cloud capacity. Busbar trunking systems offer a modular design that simplifies installation and ensures seamless integration into high-load environments. Data centers require continuous, uninterrupted power delivery, and busbars provide a reliable alternative to traditional cabling, minimizing voltage drops and improving fault tolerance. The systems also support high current capacities, which is critical in dense server environments. Increasing energy consumption and the need for efficient cooling further support the use of busbar systems due to their superior heat dissipation capabilities. As data centers continue to scale, the flexibility to reconfigure or expand the power distribution infrastructure without extended downtime adds to the appeal of these solutions.

Urbanization and Smart Infrastructure Development: The shift toward smart cities and modern urban infrastructure is fueling the adoption of advanced electrical distribution systems such as busbar trunking. In August 2024, India approved 12 new industrial smart cities and infrastructure projects to boost manufacturing. The smart city initiatives under NICDP attracted USD 3.41 billion in investment, while three railway projects improved logistics across four states. A hydropower project also upgraded Northeast India's power infrastructure. As building designs evolve to accommodate higher energy needs and space optimization, busbar systems offer a more compact and organized alternative to traditional cable setups. These systems enable efficient high-density power distribution while allowing for simplified maintenance and future scalability. Their modularity supports design flexibility, which is essential for large commercial buildings, metros, and smart residential complexes.

Growing emphasis on sustainability and green building standards is also encouraging the use of energy-efficient solutions like busbar trunking. Construction of intelligent infrastructure, including airports, hospitals, and business parks, is accelerating the need for reliable, safe, and easily reconfigurable power systems. This trend continues to drive widespread deployment of busbar trunking in the urban construction ecosystem.

Segmental Insights

Conductor Analysis

Based on conductor, the segmentation includes copper and aluminum. The copper segment accounted for ~63.9% of the revenue share in 2024 due to its superior conductivity, thermal performance, and corrosion resistance, which make it ideal for high-load industrial and commercial installations. Copper conductors support efficient current transmission, reducing power losses and enhancing system reliability. The durability and longer service life of copper in harsh environments drive preference in mission-critical infrastructure such as factories, refineries, and power generation plants. Its compatibility with compact trunking systems also supports its use in space-constrained environments. Despite higher raw material costs, the overall lifecycle value proposition and lower maintenance needs make copper the favored choice for long-term power distribution solutions.

The aluminum segment is expected to register a CAGR of 7.0% during the forecast period due to its cost-effectiveness, light weight, and improved mechanical flexibility. Aluminum’s lower density reduces the overall weight of trunking systems, making installation easier in vertical and suspended applications. Cost-sensitive projects in large-scale commercial buildings and renewable energy installations are increasingly opting for aluminum conductors due to their affordability. Innovations in aluminum alloy formulations have also enhanced conductivity and corrosion resistance, making the material more viable in applications that were previously dominated by copper. These advantages are contributing to its rising demand, particularly in infrastructure developments that prioritize both performance and budget control.

Insulation Analysis

In terms of insulation, the segmentation includes air insulated and sandwich insulated. The sandwich insulated segment accounted for ~68% of the revenue share in 2024 due to its compact structure, enhanced safety, and high mechanical protection. This type of insulation provides better containment of electromagnetic interference, reduces heat dissipation, and allows high current density in minimal space. It is widely used in industrial facilities, commercial complexes, and data centers that require uninterrupted and secure power distribution. Its sealed construction minimizes dust accumulation and offers superior fire resistance, making it suitable for environments demanding strict safety compliance. The pre-engineered nature of sandwich insulated systems also enables faster project completion and easier integration into modern building designs.

The air insulated segment is projected to witness significant growth during the forecast period due to its lower upfront cost, ease of customization, and suitability for low to medium voltage applications. These systems are often chosen in residential buildings, warehouses, and medium-sized commercial projects where load variability is manageable and space constraints are less stringent. Maintenance access is easier, and component-level modifications can be made without system overhauls. The air gap as an insulating medium supports simpler designs and faster installations. Continued demand for affordable and scalable power infrastructure in developing construction markets is expected to drive consistent adoption of this segment.

End Use Analysis

In terms of end use, the segmentation includes residential, commercial, industrial, and others. The industrial segment accounted for ~50% of the revenue share in 2024, due to the high power requirements and continuous operations in manufacturing, processing plants, mining operations, and heavy engineering units. These environments prioritize durability, fault tolerance, and energy efficiency, where busbar trunking systems offer better performance than traditional cabling. The modular design of these systems supports future expansion and reconfiguration, which is critical in dynamic industrial environments. Additionally, industries implementing smart factory automation and energy monitoring systems benefit from the integration capabilities offered by modern busbar systems. High reliability, thermal stability, and ease of troubleshooting further solidify their preference across industrial users.

The commercial segment is projected to grow significantly from 2025 to 2034, due to increasing investments in real estate development, smart buildings, and high-rise construction projects. Commercial establishments such as shopping malls, hospitals, office towers, and airports are emphasizing flexible power infrastructure capable of adapting to changing load patterns. Busbar trunking systems provide compact and aesthetic power distribution that aligns with architectural requirements while ensuring operational reliability. The push for LEED-certified buildings and energy-efficient installations also contributes to this segment’s expansion. Retrofitting aging electrical infrastructure in existing buildings is another contributing factor to the segment’s anticipated growth.

Regional Analysis

The North America busbar trunking market accounted for a significant revenue share in 2024 due to strong investments in infrastructure modernization across commercial buildings, data centers, and manufacturing plants in the region. For instance, the U.S. Department of Energy reported that data centers consumed about 4.4% of total U.S. electricity in 2023, with projections suggesting to rise between 6.7% and 12% by 2028. Thus, adoption of energy-efficient systems in response to regulatory policies and ESG goals is accelerating the shift away from traditional cable-based systems toward busbar trunking. Growing emphasis on safety, fire resistance, and space optimization in high-density environments also supports this trend. Major urban development projects and facility upgrades in both private and public sectors continue to stimulate the deployment of compact and scalable electrical distribution systems across the region.

U.S. Busbar Trunking Market Insight

The U.S. held a significant revenue share in North America in 2024 due to its mature construction sector, high penetration of smart buildings, and rising integration of automation across industrial and commercial facilities. Investments in hyperscale data centers and clean energy infrastructure are further increasing the need for efficient and low-maintenance power distribution systems. Preference for pre-engineered, modular trunking solutions in large-scale developments helps reduce project lead times and labor costs, supporting faster deployment. Advanced safety codes and energy regulations also drive the replacement of aging wiring networks with more secure, future-ready busbar systems tailored for next-gen infrastructure environments.

Asia Pacific Busbar Trunking Market Trends

Asia Pacific accounted for ~34.9% of the revenue share in 2024, as rapid urbanization, population growth, and industrial expansion across Asia Pacific are creating high demand for flexible and reliable electrical distribution infrastructure. Governments are investing heavily in transportation networks, special economic zones, and urban renewal initiatives, all of which require efficient power systems. Busbar trunking systems meet these demands by offering higher load capacity, ease of installation, and fire safety, especially in high-rise structures. Energy-intensive industries and technology hubs across countries such as India, South Korea, and Southeast Asia are also boosting adoption. Focus on sustainability and grid modernization further enhances market prospects across the region.

China Busbar Trunking Market Overview

China accounted for the dominant share in 2024 due to huge infrastructure development across urban and industrial sectors has fueled the demand for high-performance, space-efficient power distribution solutions in China. The country’s rapid construction of smart cities, transportation hubs, and commercial complexes necessitates systems that support high electrical loads while minimizing installation time and footprint. The rise of electric vehicle production and renewable energy facilities also contributes to the growing demand for durable, low-loss distribution networks tailored for modern energy systems. According to the International Energy Agency, China produced 70% of the electric cars in 2024. Moreover, government initiatives promoting energy efficiency and advanced manufacturing practices have led to wider acceptance of modular busbar trunking in both new and retrofitted buildings.

Europe Busbar Trunking Market Outlook

The market in Europe is projected to grow significantly during 2025–2034 due to strong focus on energy efficiency, decarbonization, and sustainable building design across the region. Policies such as the European Green Deal and rising retrofitting activity in aging infrastructure support the transition to low-emission, space-optimized power systems. Busbar trunking is increasingly integrated into smart building projects, where it enables modular layouts and advanced energy monitoring. Increased demand from rail, airport, and commercial real estate sectors is also accelerating adoption. Emphasis on fire safety compliance and clean energy integration further strengthens the region’s preference for standardized, durable, and low-maintenance power distribution frameworks.

Key Players and Competitive Analysis

The competitive landscape of the busbar trunking market is shaped by a combination of advanced engineering capabilities, global expansion strategies, and evolving customer demands across infrastructure and industrial sectors. Industry analysis highlights increasing competition around low-voltage and medium-voltage solutions as players pursue market expansion strategies focused on high-growth regions. Strategic alliances and joint ventures are facilitating entry into emerging economies and enabling localized production. Mergers and acquisitions are consolidating technological know-how, allowing for the integration of smart monitoring features and digital diagnostics within busbar systems.

Post-merger integration efforts are improving supply chain efficiencies and accelerating product development cycles. Continuous investment in technology advancements, such as compact insulation, fire-rated enclosures, and plug-and-play modularity, is creating product differentiation. Players are also focusing on power efficiency, load balancing, and flexible deployment in commercial and data center applications. Customized solutions targeting smart infrastructure and renewable energy facilities are strengthening competitive positioning and expanding addressable market segments.

Key Players

- ABB

- DBTS Industries Sdn Bhd

- Eaton

- General Electric Company

- GODREJ & BOYCE MANUFACTURING COMPANY LIMITED (Godrej Enterprises)

- LARSEN & TOUBRO

- Legrand North and Central America, LLC

- LEGRAND SA

- Schneider Electric

- Siemens AG

Industry Developments

May 2025: Schneider Electric launched the Canalis for EV, an advanced and adaptable busbar solution tailored for electric vehicle (EV) charging infrastructure. This innovative system is designed to accommodate the evolving demands of EV charging, ensuring scalability and flexibility for future energy distribution needs.

Busbar Trunking Market Segmentation

By Conductor Outlook (Revenue, USD Billion, 2020–2034)

- Copper

- Aluminum

By Insulation Outlook (Revenue, USD Billion, 2020–2034)

- Air Insulated

- Sandwich Insulated

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial

- Industrial

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Busbar Trunking Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 6.73 billion |

|

Market Size in 2025 |

USD 7.16 billion |

|

Revenue Forecast by 2034 |

USD 12.62 billion |

|

CAGR |

6.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 6.73 billion in 2024 and is projected to grow to USD 12.62 billion by 2034.

The global market is projected to register a CAGR of 6.5% during the forecast period.

Asia Pacific accounted for ~34.9% of the revenue share in 2024 as rapid urbanization, population growth, and industrial expansion are creating high demand for flexible and reliable electrical distribution infrastructure.

A few of the key players in the market are ABB; DBTS Industries Sdn Bhd; Eaton; General Electric Company; GODREJ & BOYCE MANUFACTURING COMPANY LIMITED (Godrej Enterprises); LARSEN & TOUBRO; Legrand North and Central America, LLC; LEGRAND SA; Schneider Electric; and Siemens AG.

The copper segment accounted for ~63.9% of the revenue share in 2024 due to its superior conductivity, thermal performance, and corrosion resistance, which make it ideal for high-load industrial and commercial installations.

The sandwich insulated segment accounted for ~68% of the revenue share in 2024 due to its compact structure, enhanced safety, and high mechanical protection.