Buy Now Pay Later Market Share, Size, Trends, & Industry Analysis Report

By Channel (Online, POS), By End-use (Retail, Automotive), By Enterprise Size, By Region, Segment Forecasts, 2025 - 2034

- Published Date:Aug-2025

- Pages: 125

- Format: PDF

- Report ID: PM3910

- Base Year: 2024

- Historical Data: 2020-2023

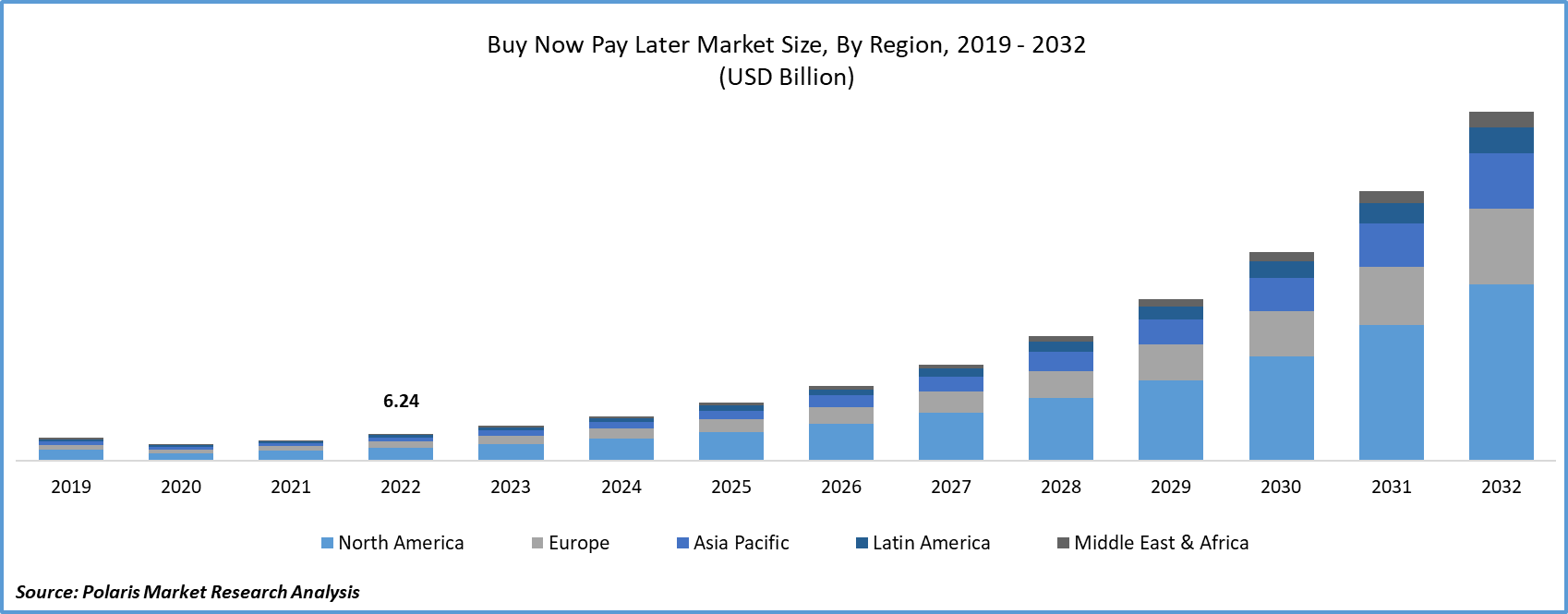

The global buy now pay later (BNPL) market size was valued at USD 10.40 billion in 2024, exhibiting a CAGR of 26.50% during 2025–2034. The market is driven by growing demand for flexible consumer financing, the rapid rise of e-commerce, and increased millennial and Gen Z adoption.

Key Insights

- The online segment holds the largest market share due to the surge in digital shopping and the convenience BNPL offers during online checkout.

- Large enterprises generate the highest revenue, leveraging BNPL to enhance customer purchasing power and increase sales volumes.

- The retail segment dominates the market, driven by strong consumer demand for flexible payment options in both online and offline stores.

- Europe leads the BNPL market, accounting for 35–40% of global transaction value, supported by advanced digital payment infrastructure and widespread consumer acceptance.

Industry Dynamics

- The increasing adoption of e-commerce and consumer preference for flexible payment options are driving the growth of the Buy Now Pay Later (BNPL) market.

- Rising smartphone penetration and the development of digital payment infrastructure are further accelerating BNPL usage worldwide.

- Regulatory scrutiny and concerns over consumer debt limit market expansion.

- Partnerships with traditional financial institutions offer opportunities to expand the reach and credibility of BNPL services.

Market Statistics

- 2024 Market Size: USD 10.40 billion

- 2034 Projected Market Size: USD 111.74 billion

- CAGR (2025-2034): 26.50%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Growth can be attributed to consumers' strong preference for flexible payment choices. BNPL services offer the advantage of deferred payment, granting customers greater financial flexibility and relieving them of the immediate burden of upfront expenses. The rise of online shopping has also played a pivotal role in propelling the BNPL sector. As online retail gains prominence, consumers are in search of seamless and effective payment methods. BNPL services seamlessly integrate into online checkout procedures, ensuring a smooth and convenient payment experience. Given the expansion of online marketplaces and the widespread adoption of digital wallets, BNPL solutions have emerged as an appealing choice for both consumers and merchants, catering to their mutual needs.

Buy now, pay later (BNPL) is a type of short-term financing that allows customers to buy products or services and pay for them over time. In doing so, consumers have the ability to immediately finance their purchases and pay them back in installments over a stipulated time. When compared to personal loans, BNPL services are fairly easy for consumers to get approved of and don’t charge any interest. BNPL has end uses in several sectors, including retail, healthcare, leisure & entertainment, and the automotive industry.

The way BNPL services work is simple. After purchasing at a participating retailer, consumers need to opt for the Buy Now, Pay Later option. Then, they have to make a small down payment of the overall purchase amount. The remaining amount is then deducted in a series of easy monthly installments (EMIs). There are several benefits associated with using BNPL services, including increased affordability, instant access to credit, and safe and secure transactions. Also, BNPL is a simple and transparent process where consumers can choose the repayment tenure. With rising demand from consumers and the presence of a supportive regulatory environment, the Buy Now Pay Later market is projected to witness rapid growth in the upcoming years.

Buy now pay later (BNPL) services effectively tackle the issue of affordability encountered by customers. By enabling the division of payments into interest-free installments, BNPL providers empower consumers to engage in larger purchases without experiencing financial stress. As a result, merchants witness a rise in average order values and repeat business as customers find it more convenient to make substantial transactions. Furthermore, the accessibility and simplicity of enrolling in BNPL services have significantly contributed to their widespread appeal. Many BNPL platforms offer swift and uncomplicated registration procedures, often with minimal credit assessments. This inclusive approach resonates with a wider spectrum of consumers, encompassing those with limited credit history or lower credit scores, who might encounter difficulties when seeking conventional credit options.

The buy now pay later market experienced a favorable outcome due to the COVID-19 pandemic. Numerous individuals encountered financial difficulties and uncertainties in the wake of the pandemic, prompting them to explore adaptable payment alternatives for managing their expenditures. In this scenario, BNPL services emerged as an appealing solution, enabling consumers to distribute their payments across a period, thereby alleviating financial pressure. Additionally, as physical stores shuttered and in-person shopping faced restrictions, there was a notable upswing in online commerce. Consumers shifted towards online platforms for both essential and non-essential purchases, and BNPL services seamlessly melded into these digital transactions, presenting a convenient and uncomplicated method of payment.

Drivers & Opportunities

- Rising demands for BNPL among consumers

BNPL providers extend appealing collaborations and incentives to merchants. Through affiliations with BNPL platforms, retailers can draw in fresh clientele, elevate customer loyalty, and amplify conversion rates. These services additionally aid merchants in curbing instances of abandoned shopping carts by furnishing an alternative payment avenue that motivates customers to finalize their purchases.

Furthermore, the supportive regulatory environment and the ongoing evolution of payment regulations have exerted a positive impact on the buy now pay later market. Governments and financial oversight bodies in diverse countries have acknowledged the legitimacy of BNPL services as a valid payment mechanism, which in turn augments their credibility and fosters consumer trust. This regulatory endorsement has emboldened BNPL providers to broaden their service scope and venture into new markets, thereby fostering the expansion of the industry.

Report Segmentation

The market is primarily segmented based on channel, enterprise size, end use, and region.

|

By Channel |

By Enterprise Size |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Channel Analysis

- Online segment accounted for the largest market share in 2024

The online segment accounted for the largest market share. Businesses across the globe are actively forging partnerships to emphasize the integration of various online payment avenues, including BNPL, as an integral facet of their strategies for post-pandemic recovery. To illustrate, in August 2021, Uplift, Inc., a provider of BNPL solutions, established a collaboration with Tripster, an encompassing travel booking platform.

POS segment will grow at a steady pace. With a growing number of consumers showing a preference for both physical and online shopping experiences, the attractiveness of utilizing BNPL services directly at the point of sale is heightened. The POS approach grants consumers the advantage of making on-the-spot purchasing choices, obviating the necessity for pre-authorization or credit evaluations. This expedites transactions, ensuring a smooth and expeditious process.

By Enterprise Size Analysis

- Large enterprises held the largest share in 2024

Large enterprises garnered the largest revenue share. Large enterprises have embraced these solutions to furnish their customers with an affordable and adaptable payment avenue, particularly beneficial for acquiring high-value items. The utilization of BNPL often results in an increased number of products being acquired by shoppers due to the streamlined purchasing process, consequently propelling sales expansion. Hence, BNPL contributes substantially to the enhancement of the overall customer experience, a benefit particularly significant for large enterprises.

SMEs will grow at a substantial pace. (SMEs) are directing their attention toward the implementation of BNPL solutions to bolster merchants' sales conversion rates. For instance, Dukaan is a startup enterprise facilitating the establishment of online stores for SMEs. Dukaan recently unveiled a collaboration with Simpl, a provider of BNPL solutions. This partnership enables Dukaan to extend BNPL services to its network of merchants.

By Distribution Channel Analysis

- Retail segment held the largest share in 2024

The retail segment dominated the market. Within this industry, there is a noticeable uptick in the acceptance of BNPL solutions. These solutions are gaining traction due to their capacity to facilitate customers in effortlessly spreading the expense of their acquisitions across a predetermined timeline characterized by interest-free payments.

The healthcare segment will grow at the fastest rate. Within this industry, there is a growing reception of BNPL payment mechanisms, primarily due to their provision of a low-resistance alternative to credit cards. Additionally, customers exhibit a preference for BNPL payment avenues over credit cards, largely to steer clear of the accumulation of costly compounded interest and concealed charges. Furthermore, the escalating expenses linked to the management of various ailments, including cancer, chronic heart conditions, and cardiovascular diseases, are poised to act as driving forces for the demand surge in BNPL services during the forecast period.

Regional Insights

The Buy Now Pay Later (BNPL) market is experiencing dynamic growth globally, with Europe leading due to its mature e-commerce environment, strong consumer adoption, and evolving regulatory frameworks that promote responsible lending. European consumers appreciate the flexibility and transparency of BNPL, with providers like Klarna and Afterpay innovating to meet demand across both online and brick-and-mortar retail. Regulatory oversight in countries such as the UK and Germany ensures consumer protection, increasing market trust and encouraging wider acceptance.

In North America, the BNPL market is also expanding rapidly, driven by the United States and Canada. The rising adoption of digital payments, high credit card debt among consumers, and a growing preference for alternative financing options fuel the growth here. However, the region’s regulatory environment is still evolving, with increased scrutiny expected to strike a balance between innovation and consumer safeguards. Major BNPL players in this market focus on partnerships with large retailers and integration with popular payment gateways to expand reach.

The Asia Pacific BNPL market is emerging as one of the fastest-growing globally, propelled by increasing smartphone penetration, expanding e-commerce platforms, and a young, tech-savvy population. Countries like India, China, Australia, and Southeast Asian nations are witnessing rapid uptake, often in markets with underdeveloped traditional credit systems, where BNPL offers accessible credit alternatives. The regulatory landscape varies significantly, but the growing government focus on digital finance and consumer protection is expected to shape market growth positively.

Key Market Players & Competitive Insights

The buy now pay later (BNPL) payment approach is witnessing a rapid surge in favor among consumers, facilitating purchases both in brick-and-mortar establishments and across online platforms. A multitude of retailers are directing their attention towards integrating the BNPL solution into their operations, aiming to empower their patrons with the ability to access interest-free installment plans.

Some of the major players operating in the global market include:

- Affirm, Inc.

- Klarna Inc.

- Splitit Payments, Ltd.

- Sezzle

- Perpay Inc.

- Zip Co, Ltd

- PayPal Holdings, Inc.

- AfterPay Limited

- Openpay

- LatitudePay Financial Services

- HSBC Group

Recent Developments

-

In June 2025, Klarna launched a pilot debit card in the U.S. with Visa and WebBank, offering instant payments or interest-free installments for both online and in-store purchases. Available in three colors, the card includes tiered perks and will expand across the U.S. and Europe later in the year.

-

In May 2025, Costco revealed that U.S. online customers can now split purchases over US$500 into extended monthly installments. To roll out this financing option, the company partnered with Affirm Holdings, Inc.

-

In March 2025, DoorDash added Klarna’s BNPL options to its app, letting users pay upfront, split into four interest-free payments, or defer charges. With a 62% market share in U.S. food delivery, DoorDash’s move marks a key step in Klarna’s push to make BNPL common for everyday spending.

-

In January 2025, Amazon announced the acquisition of Indian BNPL fintech Axio in a deal reportedly exceeding USD 150 million, leveraging a six-year prior investment to significantly deepen its embedded credit offerings across India's e‑commerce ecosystem

-

In March 2023, Apple has unveiled a novel feature named Apple Pay Later, which bolsters the functionalities of its digital wallet by presenting customers with the choice to settle payments for online acquisitions through instalment plans.

Buy Now Pay Later Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 13.16 billion |

|

Revenue forecast in 2034 |

USD 111.74 billion |

|

CAGR |

26.50% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Channel, By Enterprise Size, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

In today’s hyper-connected world, running a business around the clock is no longer an option. And at Polaris Market Research, we get that. Our sales & analyst team is available 24x5 to assist you. Get all your queries and questions answered about the Buy Now Pay Later Market report with a phone call or email, as and when needed.

Browse Our Top Selling Reports

Bioanalytical Testing Services Market Size, Share 2024 Research Report

Ecotoxicological Studies Market Size, Share 2024 Research Report

Anti-Acne Cosmetics Market Size, Share 2024 Research Report

Buttock Augmentation Market Size, Share 2024 Research Report

Surgical Instrument Tracking Systems Market Size, Share 2024 Research Report

FAQ's

The global market size was valued at USD 10.40 billion in 2024 and is projected to grow to USD 111.74 billion by 2034.

The global market is projected to register a CAGR of 26.50% during the forecast period.

Europe leads the BNPL market, accounting for 35–40% of global transaction value, supported by advanced digital payment infrastructure and widespread consumer acceptance.

A few of the key players in the market are Affirm, Inc.; Klarna Inc.; Splitit Payments, Ltd.; Sezzle; Perpay Inc.; Zip Co, Ltd; PayPal Holdings, Inc.; AfterPay Limited; Openpay; LatitudePay Financial Services; HSBC Group.

The online segment holds the largest market share due to the surge in digital shopping and the convenience BNPL offers during online checkout.

Large enterprises generate the highest revenue, leveraging BNPL to enhance customer purchasing power and increase sales volumes.