Canned Tuna Fish Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Skipjack Tuna, Albacore Tuna, Yellowfin Tuna, and Others), Packaging, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast 2025–2034

- Published Date:Aug-2025

- Pages: 128

- Format: PDF

- Report ID: PM5598

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

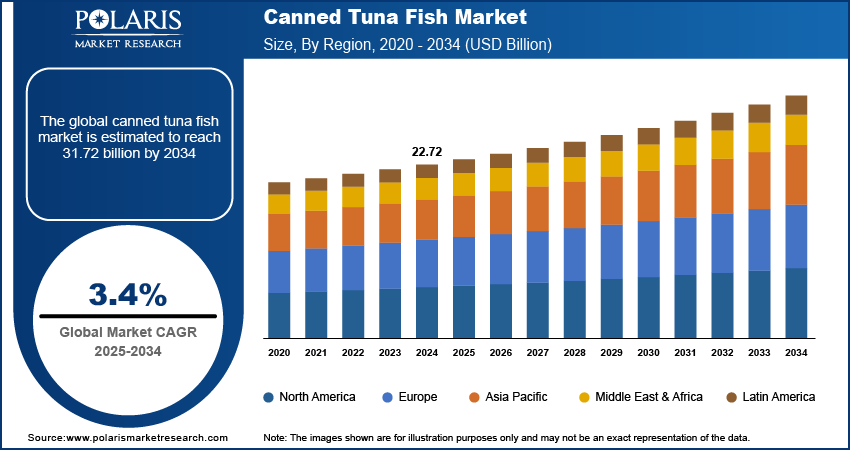

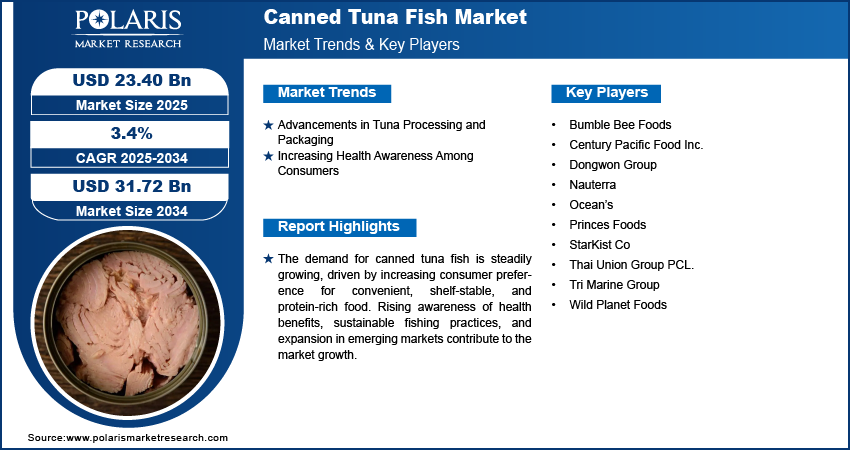

The global canned tuna fish market size was valued at USD 22.72 billion in 2024, growing at a CAGR of 3.4% during 2025–2034. Shifting consumer preferences, increasing health awareness, and rising disposable income in emerging economies are a few of the key factors fueling market growth.

Key Insights

- The skipjack tuna segment is expected to lead the market, owing to its cost-effectiveness and widespread availability.

- The canned in water segment is projected to witness rapid growth, primarily driven by the growing health consciousness among consumers.

- North America accounts for the largest market share. The regional market dominance is attributed to the high demand for convenient and protein-rich food options among consumers in the region.

- Asia Pacific is projected to witness significant growth. Rising disposable income and growing seafood consumption are driving market growth in the region.

Industry Dynamics

- Advancements in tuna processing and packaging, including faster production lines and improved freezing methods, are driving market expansion.

- Rising health awareness among consumers has resulted in increased demand for canned tuna fish.

- The introduction of government initiatives promoting sustainable tuna harvesting is creating market opportunities.

- Stringent regulations increasing production and sourcing costs are hindering market growth.

Market Statistics

2024 Market Size: USD 22.72 billion

2034 Projected Market Size: USD 31.72 billion

CAGR (2025-2034): 3.4%

North America: Largest Market in 2024

To Understand More About this Research: Request a Free Sample Report

Canned tuna is processed and preserved tuna packed in sealed cans to extend its shelf life. It is a popular, protein-rich food recognized for its affordability, convenience, and versatility in various culinary applications. The canned tuna market represents a global industry dedicated to the production, distribution, and sale of processed tuna in sealed containers for convenience and long-lasting freshness. The demand for canned tuna continues to grow due to shifting consumer preferences, health awareness, and sustainability initiatives. The rising demand for protein-rich, low-fat foods has led to increased tuna consumption, as it is a lean source of omega-3 fatty acids and essential nutrients. Health organizations such as the FDA and WHO advocate for fish consumption, further accelerating canned tuna fish market growth.

Sustainability concerns have led to stricter regulations and certifications, such as the Marine Stewardship Council (MSC) label, ensuring responsible sourcing. Government policies, including the European Union’s Common Fisheries Policy (CFP) and NOAA’s measures in the US, promote sustainable tuna harvesting. These initiatives enhance consumer trust, reinforcing canned tuna fish market opportunities.

Trade policies and economic conditions significantly impact supply chains and pricing. Tariffs, import-export regulations, and trade agreements influence canned tuna fish market trends. The United States International Trade Commission (USITC) oversees tuna imports under preference programs, affecting key producing regions such as Southeast Asia and Latin America. The rising disposable incomes in emerging economies have expanded consumer access to canned tuna, boosting demand in Asia Pacific and Africa.

Innovation in product offerings, including flavored and ready-to-eat varieties, further contributes to the canned tuna fish market growth. Manufacturers focusing on sustainability, affordability, and quality maintain a competitive edge, ensuring the industry remains a vital part of the global food sector.

Market Dynamics

Advancements in Tuna Processing and Packaging

Advancements in tuna processing and packaging have significantly contributed to the canned tuna fish market demand. Modern processing techniques, such as improved freezing methods and faster production lines, ensure that tuna retains its freshness and flavor. Innovations in packaging, such as BPA-free cans and eco-friendly materials, have also made canned tuna more appealing to environmentally conscious consumers. These advancements enhance the product’s shelf life, making it more convenient and accessible for a broader range of consumers worldwide. Furthermore, the increasing demand for ready meals and convenient food options has fueled the popularity of canned tuna. This combination of technological innovation and changing consumer preferences is driving the rapid growth of the market expansion.

Increasing Health Awareness Among Consumers

The increasing health awareness among consumers has significantly fueled the canned tuna fish market expansion. People are actively seeking nutritious, protein-rich foods that support overall well-being, making tuna a preferred choice. High omega-3 fatty acid content in tuna fish promotes heart health, reduces inflammation, and supports brain function, aligning with growing health-conscious lifestyles.

Health organizations, including the FDA and WHO, recommend regular fish consumption, reinforcing its role in a balanced diet. Consumers focusing on weight management and fitness prefer canned tuna due to its lean protein and low-fat composition. The shift toward healthier eating habits has also influenced purchasing decisions, driving canned tuna fish market growth. Expanding awareness of these nutritional benefits continues to shape consumer preferences, fueling steady demand for canned tuna.

Segment Analysis

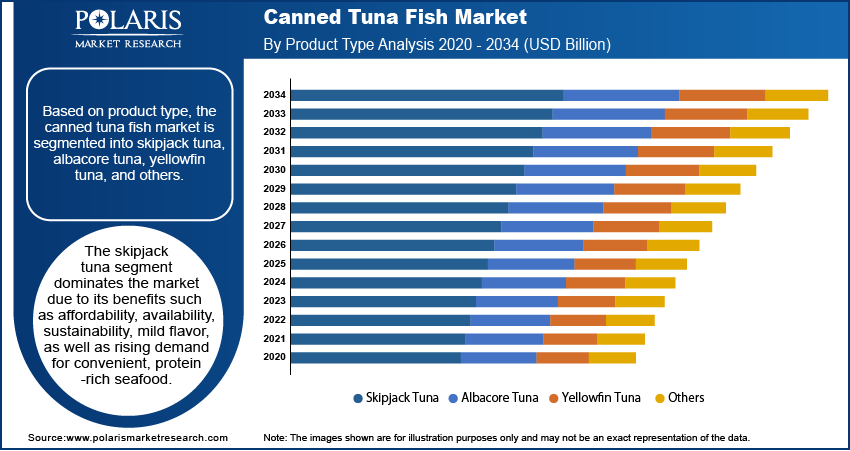

Market Assessment by Product Type Outlook

The global canned tuna fish market segmentation, based on product type, includes skipjack tuna, albacore tuna, yellowfin tuna, and others. The skipjack tuna segment is expected to dominate the canned tuna fish market share during the forecast period due to its widespread availability and cost-effectiveness. Skipjack tuna is more abundant in the oceans compared to other species, making it easier to source and process. The fish's lighter flavor and smaller size make it an ideal choice for canning, appealing to a broader consumer base. Additionally, skipjack tuna is often considered more sustainable due to its faster reproduction rates, which appeals to eco-conscious buyers. The increasing demand for affordable and convenient seafood products further fuels its market growth. Skipjack tuna continues to be a popular choice in the market as consumers increasingly prefer healthier, protein-rich meal options.

Market Evaluation by Packaging Outlook

The global canned tuna fish market segmentation, based on packaging, includes canned in water, canned in oil, and canned in brine. The canned in water segment is expected to grow rapidly in the coming years due to increasing health consciousness among consumers. Many prefer tuna canned in water over oil because it contains lower fat and fewer calories, making it a healthier option. The rising demand for high-protein, low-fat diets has further contributed to this trend. Fitness enthusiasts and individuals following weight management plans often choose water-packed tuna for its nutritional benefits. The growing awareness of heart health and the need to reduce unhealthy fats in daily diets also play a significant role. The canned in water segment continues to drive market expansion across various regions as more consumers seek nutritious and convenient seafood options.

Regional Analysis

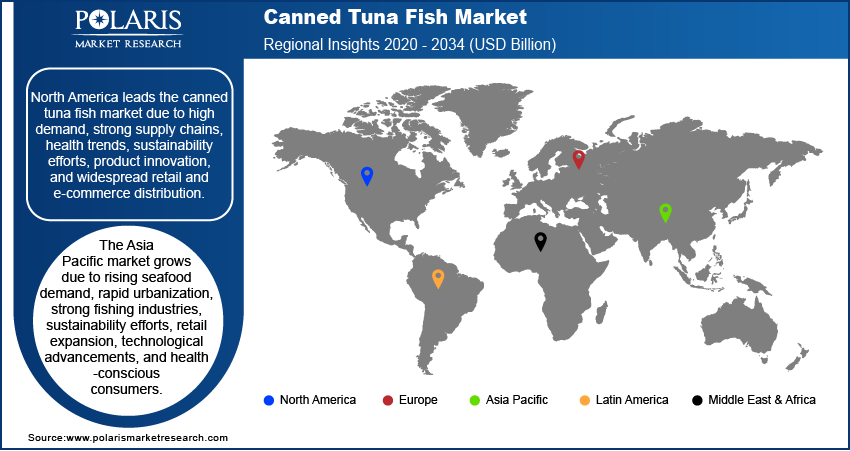

By region, the study provides canned tuna fish market insight into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest canned tuna fish market share due to high consumer demand for convenient and protein-rich food options. The region's strong seafood industry, advanced processing facilities, and well-established supply chains contribute to market dominance. The rising health awareness and preference for ready-to-eat meals further drive sales. The presence of key market players and continuous product innovations, such as flavored and sustainably sourced tuna, boost the regional market growth. Retail giants and e-commerce platforms play a crucial role in distribution, making canned tuna widely accessible. Favorable government regulations and sustainability initiatives also support industry expansion. The increased household consumption, along with the growing popularity of tuna-based recipes, strengthens North America leadership in the market share.

The Asia Pacific canned tuna fish market is experiencing substantial growth due to rising seafood consumption and increasing disposable income. The changing dietary preferences and a growing demand for convenient protein sources contribute to market expansion. Rapid urbanization and a fast-paced lifestyle encourage consumers to opt for ready-to-eat and canned food products. The strong tuna fishing and processing industries in countries such as Thailand, Indonesia, and the Philippines enhance regional supply. Government initiatives promoting sustainable fishing practices and export opportunities further drive growth. The expanding retail networks, including supermarkets and online platforms, improve product accessibility. Technological advancements in packaging and preservation also support industry development. The increasing awareness of health benefits strengthens consumer preference, fueling canned tuna fish market growth in Asia Pacific.

Key Players and Competitive Analysis Report

The canned tuna fish market is highly competitive, driven by factors such as sustainability, pricing strategies, product innovation, and global supply chain dynamics. A few key market players are Bumble Bee Foods, Century Pacific Food Inc., Dongwon Group, Nauterra, Ocean’s, Princes Foods, StarKist Co, Thai Union Group PCL., Tri Marine Group, and Wild Planet Foods, each competing through brand strength, distribution networks, and sustainability commitments. Thai Union Group PCL. and StarKist Co. are among the largest players globally, leveraging their extensive supply chains and product diversification. Dongwon Group and Bumble Bee Foods focus on premium product offerings and sustainable fishing practices to meet consumer demand for ethically sourced seafood. Meanwhile, companies such as Wild Planet Foods emphasize eco-friendly and pole-and-line fishing methods, appealing to environmentally conscious consumers. The industry also sees increasing regulatory pressures and consumer preference shifts toward healthier, traceable, and high-quality seafood products, pushing brands to innovate with value-added tuna offerings such as ready-to-eat meals and flavored options.

Dongwon Group, founded in 1969 and based in Seoul, South Korea, operates in marine, fisheries, distribution, and logistics. The company operates tuna purse seiners, longliners, and trawlers across various oceans. It processes and distributes tuna and salmon fish, and engages in logistics, cold storage, and restaurant operations.

Thai Union Group is a global seafood company. The company operates in the ambient seafood, frozen seafood, pet food, and value-added businesses. It offers tuna, shrimp, salmon, marine ingredients, and pet care products under brands such as Chicken of the Sea, John West, and King Oscar.

List of Key Companies

- Bumble Bee Foods

- Century Pacific Food Inc.

- Dongwon Group

- Nauterra

- Ocean’s

- Princes Foods

- StarKist Co

- Thai Union Group PCL.

- Tri Marine Group

- Wild Planet Foods

Canned Tuna Fish Industry Development

In June 2023, Bumble Bee Seafoods launched 12 new canned, pouched, and kit-based tuna products across the US, including flavored Yellowfin, tuna salad kits, MSC-certified Chunk Light Tuna, Wild-Caught Tuna pouches, and low-sodium Albacore.

In February 2021, SEALECT Tuna partnered with After Yum to launch a canned tuna in special sauce, allowing consumers to create a unique spicy salad.

Canned Tuna Fish Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Skipjack Tuna

- Albacore Tuna

- Yellowfin Tuna

- Others

By Packaging Outlook (Revenue, USD Billion, 2020–2034)

- Canned in Water

- Canned in Oil

- Canned in Brine

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Canned Tuna Fish Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 22.72 Billion |

|

Market Size Value in 2025 |

USD 23.40 Billion |

|

Revenue Forecast by 2034 |

USD 31.72 Billion |

|

CAGR |

3.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 22.72 billion in 2024 and is projected to grow to USD 31.72 billion by 2034.

The global market is projected to register a CAGR of 3.4% during the forecast period.

North America held a substantial market share in 2024.

A few key players in the market are Bumble Bee Foods, Century Pacific Food Inc., Dongwon Group, Nauterra; Ocean’s, Princes Foods, StarKist Co, Thai Union Group PCL., Tri Marine Group, and Wild Planet Foods.

The skipjack tuna segment held a significant market share in 2024.

The canned in water segment is projected to grow significantly in the market during 2025–2034.