Tuna Fish Market Size, Share, Trends, Industry Analysis Report

By Species (Skipjack, Albacore, Yellowfin, Bigeye, and Bluefin), Type, Distribution Channel, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 122

- Format: PDF

- Report ID: PM3384

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

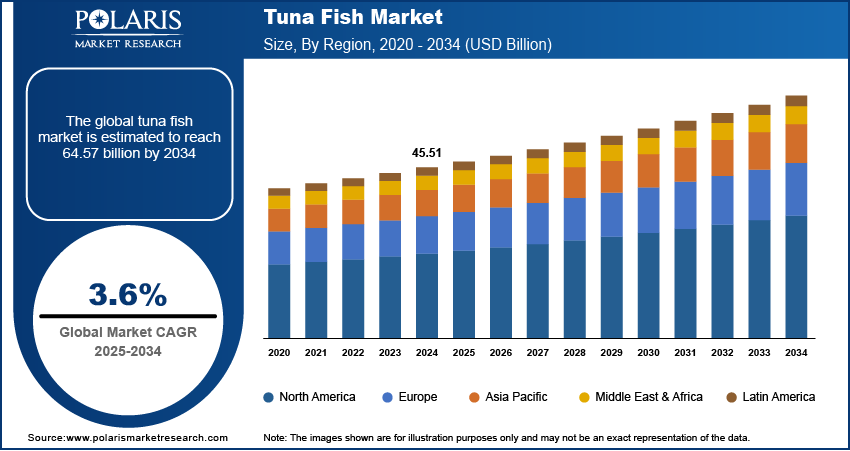

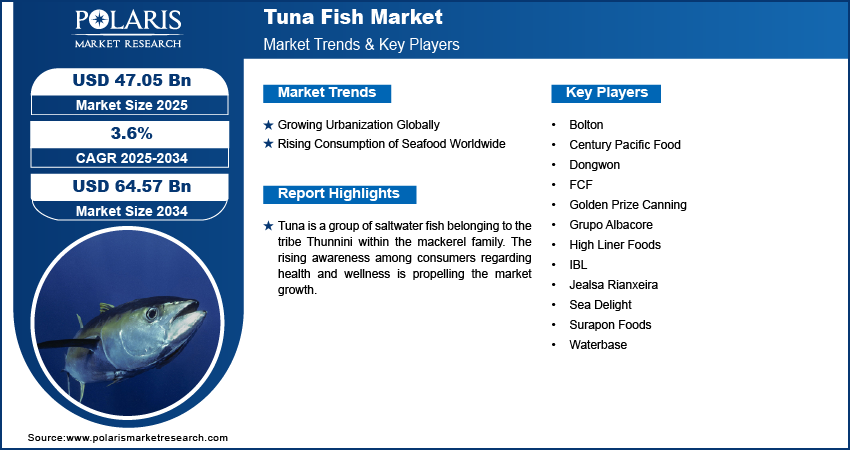

The tuna fish market size was valued at USD 45.51 billion in 2024, exhibiting a CAGR of 3.6% during 2025–2034. The market is driven by rising health consciousness, demand for protein-rich diets, growing urbanization, and increasing global seafood consumption, supported by improved accessibility.

Key Insights

- Skipjack dominated due to abundance, affordability, and lower mercury content, making it ideal for canned products in global retail markets.

- Canned tuna led the market owing to its convenience, long shelf life, and wide use in ready-to-eat meals and aid programs.

- Asia Pacific leads in market share with strong seafood traditions, major exports, and high consumption, especially in Japan and Southeast Asia.

- North America is expanding rapidly with rising health trends, demand for sustainable sourcing, and increasing inclusion of tuna in clean-label diets.

Industry Dynamics

- Increasing health awareness boosts tuna demand due to its high-quality protein, low fat, and essential vitamins supporting overall wellness.

- The rising popularity of high-protein diets like keto and paleo drives regular tuna consumption among fitness-focused and health-conscious consumers.

- Growing demand for convenient, protein-packed snacks encourages product innovation using tuna in salads, wraps, protein kits, and ready-to-eat meals.

- Overfishing, bycatch issues, and unsustainable practices threaten tuna populations, raising regulatory scrutiny and limiting long-term supply availability.

Market Statistics

2024 Market Size: USD 45.51 billion

2034 Projected Market Size: USD 64.57 billion

CAGR (2025–2034): 3.6%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Tuna is a group of saltwater fish belonging to the tribe Thunnini within the mackerel family. There are various species of tuna, varying in size from the small bullet tuna to the large Atlantic bluefin tuna. Tuna are highly adapted for speed, with sleek, streamlined bodies, and are among the fastest-swimming pelagic fish. It is widely valued as a food fish globally. Its flesh ranges from pink to dark red due to high myoglobin content, which supports their active lifestyle.

The rising awareness among people regarding health and wellness is propelling the tuna fish market growth. Tuna is an excellent high-quality protein source; low in fat; and rich in essential nutrients such as vitamin B12, vitamin D, niacin, calcium, and magnesium. The fish also provides beneficial omega-3 fatty acids that support heart, eye, and brain health and help reduce inflammation and cancer risk. These benefits are propelling health-conscious consumers across the world to consume tuna fish. According to a National Fisheries Institute survey, over 1 billion pounds of canned and packed tuna are consumed annually in the US.

The tuna fish market demand is driven by growing preference toward a protein-rich diet across the world. Tuna is known for its an excellent source of high-quality protein, making it ideal for fitness enthusiasts and health-conscious individuals. Many consumers are now shifting toward high-protein diets such as keto, paleo, and athletic meal plans, which encourage them to incorporate tuna for its muscle-building benefits and convenience. Canned tuna, in particular, offers an affordable and shelf-stable protein source, appealing to busy professionals and budget-conscious shoppers. Additionally, the rise in preference for ready-to-eat protein snacks drives tuna fish demand, as manufacturers include it in protein bars, salads, and meal kits. Hence, as more people prioritize a protein-rich diet for weight management and overall wellness, tuna’s nutritional profile ensures its continued demand in global markets.

Market Dynamics

Growing Urbanization Globally

Urban people often seek convenient, protein-rich food options, and canned or processed tuna fits this need perfectly. Supermarkets and restaurants in urban areas stock a large amount of tuna products to meet the rising demand from health-conscious consumers who value its nutritional benefits. Additionally, urbanization usually expands middle-class populations with higher disposable incomes, enabling them to spend more on seafood, such as tuna. The growth of fast-food chains and sushi restaurants in urban areas is also driving tuna consumption, as these establishments frequently feature tuna-based dishes. According to data published by the United Nations Development Programme, in 2024, cities host more than half of the global population and are projected to double by 2050. Global trade networks improve with the expansion of cities, making tuna more accessible and affordable for urban markets, boosting demand even further.

Rising Consumption of Seafood Worldwide

Consumers favor seafood, including tuna fish, for its high protein content, omega-3 fatty acids, and low fat. With the increasing demand for sushi and seafood-based cuisines, particularly in Western markets, tuna remains a key ingredient in dishes such as sashimi and poke bowls. Fast-food chains and restaurants also incorporate tuna into salads, sandwiches, and ready-to-eat meals, catering to busy consumers seeking nutritious options. Additionally, improved global supply chains and sustainable fishing practices are ensuring steady availability of seafood, including tuna fish, to meet the rising consumption demand. According to the World Economic Forum, coastal countries such as Iceland and the Maldives have the highest levels of seafood consumption, averaging more than 80 kg per person per year. As seafood consumption increases, tuna remains a staple, fueling sustained demand across global markets.

Segment Insights

Tuna Fish Market Breakdown by Species

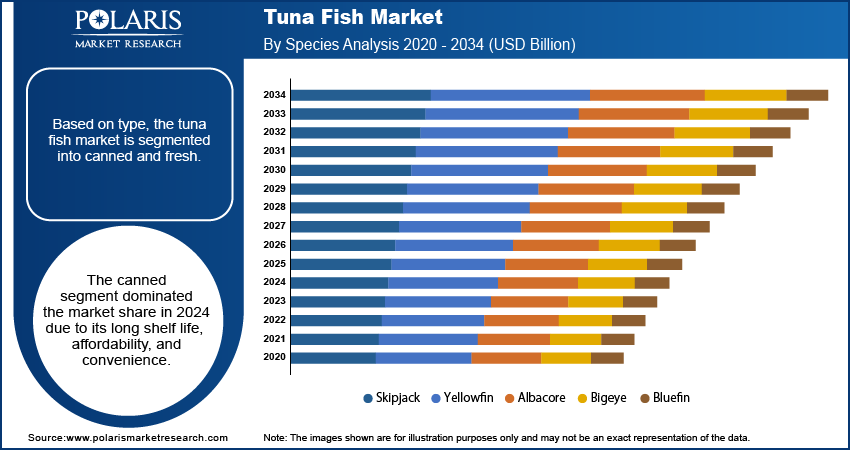

Based on species, the market is segmented into skipjack, albacore, yellowfin, bigeye, and bluefin. The skipjack segment dominated the tuna fish market share in 2024 due to its widespread availability, rapid reproductive cycle, and cost-effectiveness. Fisheries harvested skipjack in large volumes owing to its abundance in tropical and subtropical oceans, making it the most accessible and affordable species for canned products. Major brands relied heavily on skipjack variety to meet global demand for ready-to-eat and shelf-stable food options, particularly in North America, Europe, and Southeast Asia. Additionally, skipjack contains relatively lower levels of mercury compared to other species, which further strengthens its appeal among health-conscious consumers and regulatory bodies.

The yellowfin segment is expected to grow during the forecast period owing to the rising consumer preference for premium quality and sustainably sourced seafood. Yellowfin, often marketed as “ahi,” has high demand in the fresh and frozen segments, especially in foodservice establishments and upscale retail outlets. Its firm texture, mild flavor, and versatility in dishes such as sushi, sashimi, and grilled entrees make it a favorite among chefs and consumers alike. Furthermore, initiatives promoting responsible fishing practices and traceability have improved the sustainability of yellowfin, attracting eco-aware buyers and driving long-term expansion.

Tuna Fish Market Assessment by Type

Based on type, the market is segmented into canned and fresh. The canned segment dominated the market share in 2024 due to its long shelf life, affordability, and convenience. Retailers and foodservice providers stocked canned tuna extensively, especially in regions such as North America, Europe, and parts of Asia Pacific, where demand for ready-to-eat meals continues to rise. Additionally, manufacturers have invested in product innovation, introducing flavored varieties and packaging improvements such as easy-open lids, which have enhanced the appeal of canned options across diverse demographics. Government food aid programs and disaster relief efforts also contributed to canned tuna fish demand, as canned goods serve as essential, non-perishable staples.

Regional Insights

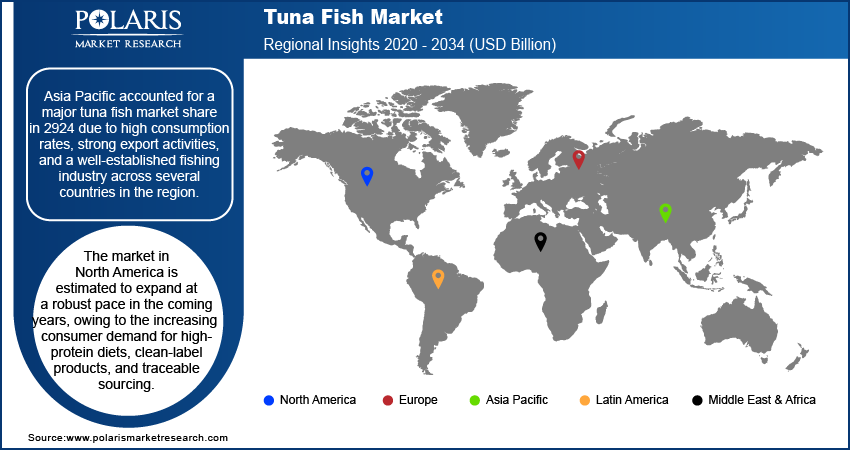

By region, the study provides tuna fish market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific accounted for a major share in 2024 due to high consumption rates, strong export activities, and a well-established fishing industry across several countries in the region. Japan played the most influential role in driving regional growth due to its deep-rooted culinary traditions centered around seafood, especially in dishes such as sushi and sashimi. Japan’s sophisticated distribution networks, advanced preservation technologies, and high demand for both fresh and processed varieties created a robust domestic market while also supporting imports of premium species. Additionally, countries such as Thailand and Indonesia invested heavily in regional supply chains, contributing to market expansion.

The market in North America is estimated to expand at a robust pace in the coming years, owing to the increasing consumer demand for high-protein diets, clean-label products, and traceable sourcing. Health-conscious individuals in the region have begun favoring grilled, baked, and raw seafood over traditional red meats, contributing to rising sales of both fresh and frozen tuna fish. Furthermore, sustainability certifications and eco-labels such as MSC influence purchasing decisions, with American consumers showing strong preferences for environmentally responsible sourcing. Retailers and restaurants in the US are expanding their offerings to include responsibly harvested tuna options, further fueling market growth in the region.

Key Players and Competitive Insights

The global tuna fish market is highly competitive, with key players dominating through strategic partnerships, mergers & acquisitions (M&A), and product diversification. Product innovation remains critical in the market, with major brands expanding into value-added products such as flavored tuna pouches, ready meals, and premium sushi-grade tuna to cater to health-conscious consumers. Private-label tuna products from retailers such as Walmart and Costco further intensify competition, pushing brands to differentiate through quality and sustainability claims.

A few of the major players operating in the global market include High Liner Foods, Surapon Foods, Thai Union, Waterbase, ITOCHU, Dongwon, IBL, Century Pacific Food, Bolton Group, Jealsa Rianxeira, Grupo Albacore, CANNING, Bumble Bee Foods, Golden Prize Canning, Crown Prince, FCF, and Sea Delight.

Bolton Group is one of the world’s leading players in the tuna fish industry, trading over 500,000 metric tonnes of tuna annually. Through its subsidiary Tri Marine, which it acquired in 2019, Bolton benefits from more than 50 years of expertise in fishing, processing, and trading tuna globally. This acquisition significantly expanded Bolton’s reach in the tuna supply chain, making it a dominant force in the seafood market. Bolton Group owns several major European canned tuna brands, including Rio Mare in Italy, Palmera, Isabel in Spain, and Saupiquet in France, which are household names in Europe. Bolton Group’s tuna products are widely consumed across more than 45 countries, offering a range of canned tuna options that cater to consumer demand for healthy, convenient, and sustainable seafood.

Sea Delight is a prominent importer and distributor of high-quality frozen and fresh seafood products in the US, with a strong focus on tuna fish. Founded in 2006 by Eugenio and Margarita Sanchez, Sea Delight has grown to become a major player in the seafood industry, recognized for its commitment to responsible sourcing and sustainability. The company specializes in a variety of tuna products, including yellowfin tuna loins and frozen boneless tuna steaks, which are wild-caught and sourced from regions such as Indonesia and Vietnam. These products are prized for their quality and are widely available through retail and foodservice channels, including convenient delivery options such as Instacart.

List of Key Companies in Tuna Fish Industry

- Bolton Group

- Century Pacific Food

- Dongwon

- FCF

- Golden Prize Canning

- Grupo Albacore

- High Liner Foods

- IBL

- Jealsa Rianxeira

- Sea Delight

- Surapon Foods

- Waterbase

Tuna Fish Industry Developments

December 2024: Echebastar-owned Alakrana brand announced the launch of two new frozen tuna products, nuggets and mini burgers for kids in Spain.

January 2023: Vgarden, Ltd., a foodTech developer and manufacturer of plant-based alternatives, announced the launch of vegan canned tuna to satisfy the appetites of the growing pool of sustainability-driven consumers.

December 2022: Atlanta's Table One brand introduced its line of ready-to-eat smoked tuna. The product line includes smoked tuna in soybean oil, smoked tuna in soybean oil with lemon & oregano, and others.

Tuna Fish Market Segmentation

By Species Outlook (Revenue, USD Billion, 2020–2034)

- Skipjack

- Albacore

- Yellowfin

- Bigeye

- Bluefin

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Canned

- Fresh

By Distribution Channel Outlook (Revenue, USD Billion, 2020–2034)

- Hypermarket & Supermarket

- Specialty Stores

- Online Stores

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Tuna Fish Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 45.51 Billion |

|

Market Size Value in 2025 |

USD 47.05 Billion |

|

Revenue Forecast by 2034 |

USD 64.57 Billion |

|

CAGR |

3.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

.Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 45.51 billion in 2024 and is projected to grow to USD 64.57 billion by 2034.

The global market is projected to register a CAGR of 3.6% during the forecast period.

Asia Pacific accounted for the largest share of the global market in 2024.

A few key players in the market are High Liner Foods, Surapon Foods, Thai Union, Waterbase, ITOCHU, Dongwon, IBL, Century Pacific Food, Bolton, Jealsa Rianxeira, Grupo Albacore, CANNING, Bumble Bee Foods, Golden Prize Canning, Crown Prince, FCF, and Sea Delight.

The yellowfin segment is projected for significant growth in the global market during the forecast period.

The canned segment dominated the market in 2024.