Cardiac Monitoring and Cardiac Rhythm Management Devices Market Size, Share, Trends, & Industry Analysis Report

By Type, By Procedure (Invasive and Non-invasive), By Application, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6283

- Base Year: 2024

- Historical Data: 2020-2023

Overview

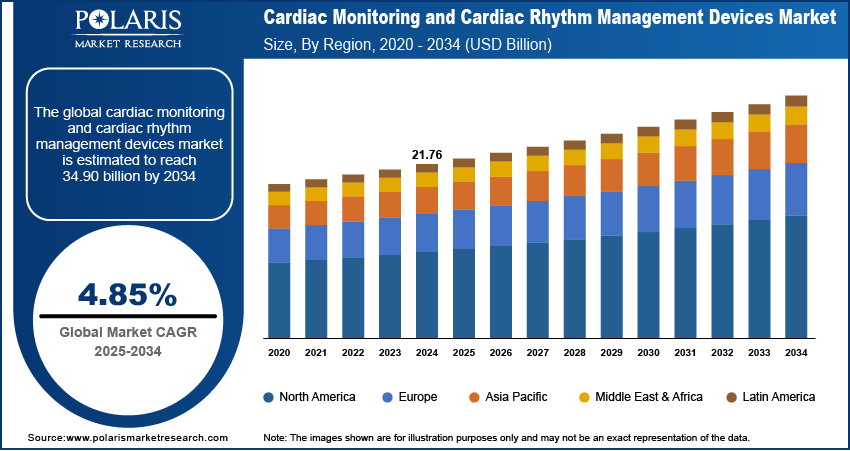

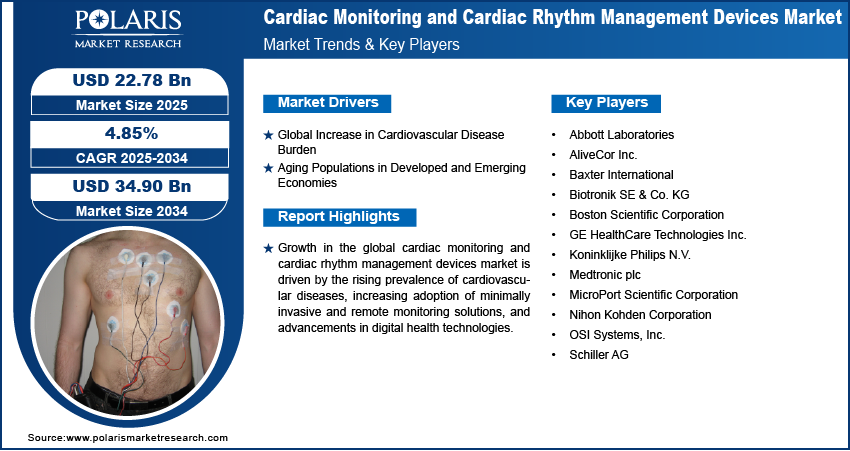

The global cardiac monitoring and cardiac rhythm management devices market size was valued at USD 21.76 billion in 2024, growing at a CAGR of 4.85% from 2025–2034. The global rise in the aging population coupled with the growing prevalence of cardiovascular diseases and arrhythmias is driving demand for cardiac monitoring and rhythm management devices.

Key Insights

- Cardiac monitoring devices dominated in 2024, fueled by increasing CVD incidence and use of wearable and home monitoring.

- Cardiac rhythm management devices to expand fastest, led by growth in implantables and need for minimally invasive treatments.

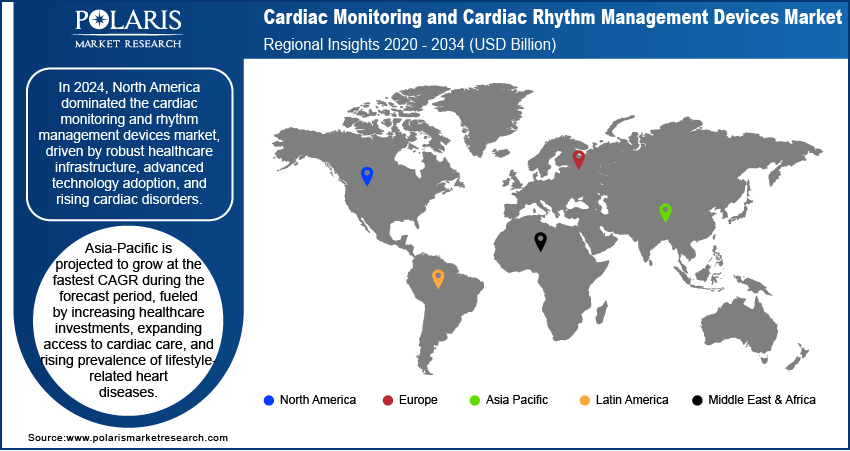

- North America accounted for the largest share in 2024, fueled by sophisticated healthcare infrastructure and high digital health adoption.

- The U.S. had the greatest North America share in 2024, aided by high disease incidence, outpatient expansion, and robust device manufacturers.

- Asia Pacific to expand at the fastest rate, led by increasing healthcare expenditure, growing hospitals, and awareness of early cardiac detection.

- China market is growing very quickly, led by huge patient pool, government programs, and adoption of advanced devices.

Industry Dynamics

- Increasing prevalence of cardiovascular diseases is driving demand for rhythm management and monitoring devices.

- Increase in aging population enhances need for cardiac devices, as age increases arrhythmia and heart-failure prevalence.

- Advancements in miniature implants, wireless and AI monitoring enhance the accuracy of treatment and patient comfort.

- High cost of devices, risks of implantation complications and reduced access to advanced heart care in low- and middle-income nations limit adoption.

Market Statistics

- 2024 Market Size: USD 21.76 Billion

- 2034 Projected Market Size: USD 34.90 Billion

- CAGR (2025–2034): 4.85%

- North America: Largest Market Share

Cardiac monitor and rhythm management products diagnose, monitor, and treat cardiovascular diseases with accuracy. The range consists of pacemakers, ICDs, CRT devices, wearables, and remote monitors. They facilitate accurate detection, real-time monitoring, and timely intervention for arrhythmias and heart failure. Their use in hospitals, clinics, and homecare enhances outcomes and reduces risks of complications.

Implantable devices treat abnormal rhythms and avert sudden cardiac arrest, and external monitors identify early arrhythmias. Remote monitoring provides real-time data transfer, enabling clinicians to modulate therapy and minimize hospital dependency. In April 2025, HeartBeam collaborated with AccurKardia to incorporate FDA-cleared AccurECG software onto its handheld ECG device, extending monitoring outside conventional care. Adoption is increasing as healthcare seeks safety, efficiency, and cost-effective cardiovascular management.

The cardiac monitoring and rhythm management devices market is expanding due to the rising prevalence of cardiovascular disorders, aging populations, and increasing awareness of preventive cardiac care. Rising technological advancements such as miniaturized devices, wireless connectivity and AI-enabled monitoring are driving market growth. Whereas, increasing government policies, rising healthcare infrastructure investments in emerging markets and growing demand for home-based and remote monitoring systems further contribute to the market expansion. In addition, the rising improvements in device safety, battery life and patient comfort are expected to sustain market growth in the coming years.

Drivers & Opportunities

Global Increase in Cardiovascular Disease Burden: Growing prevalence of cardiovascular diseases is driving demand for cardiac rhythm management and monitoring devices. Sedentary lifestyle, obesity, diabetes, and high blood pressure are driving incidence of arrhythmia and heart failure. Statistics by WHO show that cardiovascular diseases cause 17.9 million deaths every year, of which over 80% are due to heart attacks and strokes, and one-third are premature under the age of 70. This indicates the burden is compelling hospitals and clinics to implement ICDs, pacemakers, and wearable monitors for enabling early intervention and better patient outcomes.

Aging Populations in Developed and Emerging Economies: The increase in the world's elderly population is boosting the demand for cardiac monitoring and rhythm management devices. Older persons have a greater risk of arrhythmias and heart failure, generating high demand for constant monitoring and stabilization therapies. The world's population aged 60+ is estimated to increase from 1 billion in 2020 to 2.1 billion by 2050, with 80+ years old growing three times to 426 million. This aging population is compelling healthcare systems to embrace pacemakers, CRT devices, and remote monitoring to treat age-related cardiac complications and drive long-term market expansion.

Segmental Insights

Type Analysis

Segmentation by type covers cardiac monitoring devices and cardiac rhythm management devices. The cardiac monitoring devices segment led the market in 2024, fueled by increasing adoption of wearable ECGs, Holter monitors, and remote systems. The devices facilitate early arrhythmia detection and minimize hospital visits. Increased need for home-based monitoring and wireless connectivity further increases adoption.

The cardiac rhythm management devices segment is expected to register the highest CAGR through the forecast period, due to increased demand for pacemakers, ICDs, and CRT devices. FDA's approval in 2025 of the AI-powered Jewel Patch enhanced patient safety and convenience. Miniaturization, extended battery life, and growing infrastructure in emerging economies drive adoption.

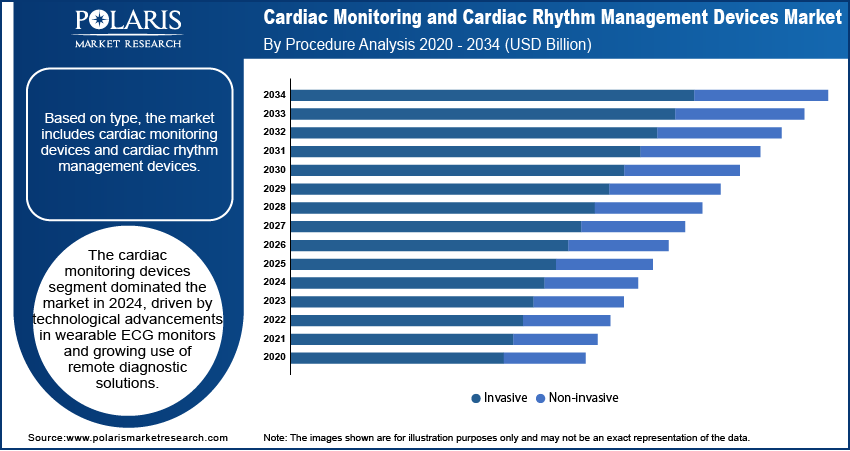

Procedure Analysis

Based on procedure, the segmentation includes invasive and non-invasive. The invasive segment held market control in 2024 due to high utilization of pacemakers, ICDs, and CRT devices involving surgery. These assist in controlling rhythm in extreme situations and aid in favorable outcomes. Increasing incidence of arrhythmia and enhanced surgical procedures maintain dominance.

The non-invasive market is expected to expand at the highest CAGR over the forecast period, driven by external cardiac devices and wearable monitors. The solutions provide convenience, reduced risk, and immediate data. The expansion of telemedicine and cost-effective preventive care enhance adoption across the world.

Application Analysis

On the basis of application, segmentation is arrhythmias, myocardial infarction, heart failure and other applications. Arrhythmias segment led the market in 2024 due to huge prevalence of atrial fibrillation and tachycardia. Implantable and wearable devices facilitate real-time monitoring and early identification. Awareness programs and clinical guidelines also encourage hospital adoption.

The heart failure segment is expected to expand at the highest CAGR over the forecast period, as chronic cases increase among aging populations. CRT devices enhance function and lessen hospitalizations. Increasing adoption of clinical research and remote monitoring enables growth.

End User Analysis

On the basis of end user, the breakdown covers hospitals & clinics, ambulatory surgery centers, and other end users. The segment of hospitals & clinics was the market leader in 2024 due to high inflow of patients, sophisticated facilities, and experienced personnel. This segment were still main centers for implantations and monitoring as well as providing optimum reimbursements in developed markets.

The ambulatory surgery centers segment is likely to expand at the highest CAGR over the forecast period, attributed to the demand for minimally invasive and outpatient care. Lower recovery times and cost advantage are provided by these centers. Cost-containment policies and innovations in implantable devices drive adoption.

Regional Analysis

North America cardiac rhythm management devices and cardiac monitoring devices market captured the largest share in the global market in 2024. This is attributed to high rates of cardiovascular diseases in the U.S., which continue to drive the demand for implantable cardioverter defibrillators, pacemakers, and remote monitoring systems. The region enjoys well-developed healthcare facilities, robust clinical acceptance, and good reimbursement policies that supports the adoption of expensive technologies.

The U.S. Cardiac Monitoring and Cardiac Rhythm Management Devices Market Insight

The U.S. dominated the largest share of the North America cardiac monitoring and cardiac rhythm management devices market in 2024 due to increasing cases of atrial fibrillation, heart failure, and cardiac arrest. Robust R&D, FDA-approved devices, and telemedicine integration enhance the take-up of remote monitoring. Reimbursable and high healthcare expenditure support the U.S. as a prominent global growth center.

Europe Cardiac Monitoring and Cardiac Rhythm Management Devices Market

The European cardiac monitoring and cardiac rhythm management devices market is estimated to have a significant share in 2034. This is due to China, Japan, and India's aging populations. Growing hospital infrastructure, increased healthcare investments, and affordable device innovation drive demand. Government policies and digital health uptake propel wearable and remote monitoring in urban and rural settings.

Asia Pacific Cardiac Monitoring and Cardiac Rhythm Management Devices Market

Asia Pacific is expected to register the highest growth rate of CAGR over the forecast period. It is growing driven by high growth in the geriatric population base in China, Japan, and India, thereby fueling the need for arrhythmia management devices. Increasing hospital infrastructure, growth in healthcare investments, and adoption of digital health technologies are also increasing the demand for wearable and remote monitoring solutions.

China Cardiac Monitoring and Cardiac Rhythm Management Devices Market Overview

The Chinese market is growing owing to increasing cardiovascular disease, urbanization, and aging population. As of 2023, 216.76 million individuals were 65+, representing 15.4% of the population. Upgrades in hospitals, awareness of preventive care, and domestic manufacturing improvements make monitoring devices affordable and locally popular.

Key Players & Competitive Analysis Report

The market for cardiac rhythm management and monitoring devices is moderately competitive with players concentrating on innovative technologies for accuracy, patient safety, and comfort. Strategic partnerships with healthcare providers and research centers are driving innovation, enabling green-friendly and region-specific solutions, and building long-term competitiveness.

Some of the leading companies involved in this market are Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Biotronik SE & Co. KG, Nihon Kohden Corporation, Baxter International, Schiller AG, OSI Systems, Inc., AliveCor Inc., and MicroPort Scientific Corporation.

Key Players

- Abbott Laboratories

- AliveCor Inc.

- Baxter International

- Biotronik SE & Co. KG

- Boston Scientific Corporation

- GE HealthCare Technologies Inc.

- Koninklijke Philips N.V.

- Medtronic plc

- MicroPort Scientific Corporation

- Nihon Kohden Corporation

- OSI Systems, Inc.

- Schiller AG

Industry Developments

- August 2025: Cardiosense’s CardioTag wearable heart monitor received FDA clearance. It is the first device to capture ECG, PPG, and SCG signals together, offering noninvasive insights into heart function and supporting AI-driven tools for heart failure management.

- March 2025: MicroPort CRM received CE Mark approval for its SmartView Connect App Mobile on Android. The app enables Bluetooth pacemakers, ICDs, and CRT-D devices to transmit data securely to clinics through patients’ smartphones, eliminating the need for a bedside monitor.

Cardiac Monitoring and Cardiac Rhythm Management Devices Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Cardiac Monitoring Device

- ECG

- Implantable Cardiac Monitors

- Holter Monitors

- Mobile Cardiac Telemetry

- Cardiac Rhythm Management Devices

- Defibrillators

- Implantable Cardioverter Defibrillators (ICD)

- Single Chamber

- Dual Chamber

- External Defibrillator

- Manual External Defibrillator

- Automatic External Defibrillator

- Wearable Cardioverter Defibrillator Pacemakers

- Implantable Cardioverter Defibrillators (ICD)

- Pacemakers

- Conventional

- Leadless

- Defibrillators

By Procedure Outlook (Revenue, USD Billion, 2020–2034)

- Invasive

- Non-invasive

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Arrhythmias

- Myocardial Infarction

- Heart Failure

- Other Applications

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Hospitals & Clinics

- Ambulatory Surgery Centers

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cardiac Monitoring and Cardiac Rhythm Management Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 21.76 Billion |

|

Market Size in 2025 |

USD 22.78 Billion |

|

Revenue Forecast by 2034 |

USD 34.90 Billion |

|

CAGR |

4.85% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Techniqueat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 21.76 billion in 2024 and is projected to grow to USD 34.90 billion by 2034.

The global market is projected to register a CAGR of 4.85% during the forecast period.

North America dominated the cardiac monitoring and cardiac rhythm management devices market in 2024, driven by a high prevalence of cardiovascular diseases, strong adoption of advanced diagnostic technologies, and increasing healthcare expenditure.

A few of the key players in the market are Medtronic plc, Abbott Laboratories, Boston Scientific Corporation, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Biotronik SE & Co. KG, Nihon Kohden Corporation, Baxter International, Schiller AG, OSI Systems, Inc., AliveCor Inc., and MicroPort Scientific Corporation.

The cardiac monitoring devices segment dominated the market in 2024, driven by increasing adoption of wearable ECG devices, remote patient monitoring systems, and rising demand for early detection of arrhythmias.

The ambulatory surgery centers segment is projected to grow at the fastest CAGR, fueled by rising preference for outpatient procedures and advancements in implantable device technologies.