Cephalosporin Drugs Market Share, Size, Trends, Industry Analysis Report

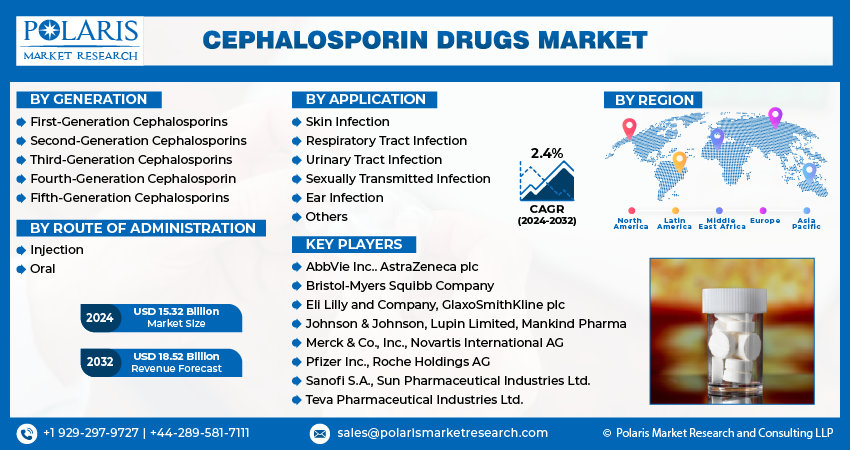

By Generation; By Route of Administration; By Application (Skin Infection, Respiratory Tract Infection, Urinary Tract Infection, Sexually Transmitted Infection, Ear Infection, Others); By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 118

- Format: PDF

- Report ID: PM4412

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

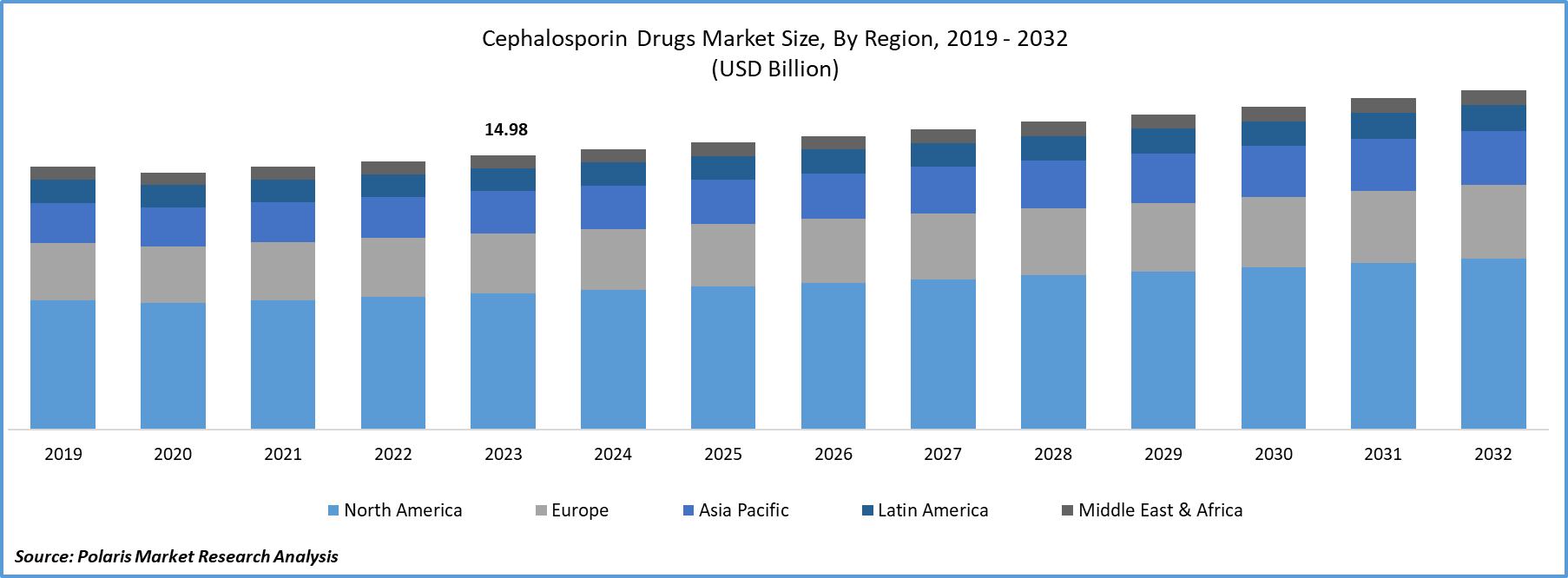

Cephalosporin Drugs Market size was valued at USD 14.98 billion in 2023.

The market is anticipated to grow from USD 15.32 billion in 2024 to USD 18.52 billion by 2032, exhibiting the CAGR of 2.4% during the forecast period.

Market Introduction

Government Initiatives are instrumental in advancing the cephalosporin drugs market share. Supportive policies, subsidies, and incentives create a favorable environment for research, development, and market accessibility. Investments in antibiotic research, along with initiatives targeting antibiotic resistance, drive pharmaceutical innovation. Streamlined approval processes for new cephalosporin formulations enhance market dynamics. Governments, by encouraging pharmaceutical investment, contribute to the sustained growth of the cephalosporin drugs market industry, reinforcing the critical role of these drugs in addressing global health challenges.

In addition, companies operating in the market are concentrating on developing new solutions to cater to the growing market demand.

For instance, September 2023, the Global Antibiotic Research & Development Partnership (GARDP) and Orchid Pharma Ltd from India entered a sublicense agreement for the production of cefiderocol, an antibiotic designed to address specific Gram-negative infections.

Digital health integration emerges as a transformative force propelling the market. Incorporating advanced technologies enhances medication management, treatment adherence, and overall patient outcomes. Smart solutions for monitoring dosages, coupled with digital platforms facilitating real-time patient data analysis, optimize the therapeutic impact of Cephalosporin drugs. As the healthcare landscape embraces digital innovations, pharmaceutical companies leveraging these technologies create a distinct market advantage.

To Understand More About this Research: Request a Free Sample Report

Industry Growth Drivers

Research and Development is Projected to Spur the Product Demand

Research and Development serve as the driving force propelling the cephalosporin drugs market industry forecast. Continuous investment in innovative formulations, addressing bacterial resistance, and expanding therapeutic applications fuels market growth. Advancements in drug delivery systems, improved safety profiles, and enhanced efficacy contribute to the market's dynamic landscape. Collaborations between academia, research institutions, and industry players amplify R&D capabilities, ensuring a robust pipeline of cephalosporin drugs.

Prevalence of Bacterial Infections is Expected to Drive Market Growth

The prevalence of bacterial infections is a pivotal force propelling the cephalosporin drug market. With a persistent global impact, these infections drive the demand for effective antimicrobial solutions like cephalosporins. Addressing a broad spectrum of bacterial ailments, from common respiratory issues to severe surgical complications, cephalosporins play a vital role in modern healthcare. The surge in bacterial infections, often complicated by multidrug resistance, emphasizes the crucial and ongoing role of cephalosporins in pharmaceutical research, ensuring their significance in contemporary medical therapeutics.

Industry Challenges

Regulatory Challenges are Likely to Impede the Market Growth

Regulatory challenges pose significant hurdles for the cephalosporin drugs market, hindering timely market entry of new formulations. Stringent regulatory requirements, including rigorous approval processes and compliance standards, elongate the development timeline and escalate costs for pharmaceutical companies. The intricate nature of regulatory submissions, coupled with evolving guidelines, demands meticulous documentation and extensive clinical data, potentially delaying market authorization. Navigating through diverse global regulatory landscapes further amplifies complexities. These challenges not only impede innovation and limit the introduction of novel cephalosporin drugs but also contribute to an environment where established market players face heightened barriers against new entrants, affecting overall market dynamics.

Report Segmentation

The cephalosporin drugs market analysis is primarily segmented based on generation, route of administration, application, and region.

|

By Generation |

By Route of Administration |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Generation Analysis

Second-Generation Cephalosporin Segment Accounted for Significant Market Share in 2023

The second-generation cephalosporin segment accounted for a significant market share in 2023. Second-generation cephalosporins, a subset of beta-lactam antibiotics, mark an evolutionary step in the cephalosporin family, succeeding first-generation counterparts. Examples like cefuroxime, cefaclor, cefprozil, and cefoxitin showcase this progress. Renowned for their expanded spectrum, these antibiotics exhibit efficacy against diverse bacteria, both Gram-positive and Gram-negative. Widely used for respiratory tract infections, otitis media, urinary tract infections, and skin issues, second-generation cephalosporins offer heightened coverage, especially against Gram-negative pathogens, enhancing their clinical versatility.

By Route of Administration Analysis

Oral Segment Accounted for Significant Market Share in 2023

The oral segment accounted for a significant market share in 2023. Oral Cephalosporin medications are a group of antibiotics designed for oral administration, offering a convenient treatment option for a range of bacterial infections. Functioning by impeding bacterial cell wall synthesis, oral cephalosporins disrupt the growth and proliferation of bacteria. This class of antibiotics is effective against a diverse spectrum of bacteria, commonly prescribed for infections affecting the respiratory system, urinary tract, skin, and soft tissues. The selection of a particular oral cephalosporin, its prescribed dosage, and the duration of treatment are tailored based on the specific bacterial infection and individual patient considerations.

By Application Analysis

Skin Infection Segment Held Significant Market Revenue Share in 2023

The skin infection segment held a significant revenue share in 2023. Owing to their broad-spectrum antibacterial qualities, cephalosporin medications are essential for treating skin infections brought on by bacterial susceptibilities. These antibiotics, which effectively prevent the production of bacterial cell walls, are frequently administered for dermatological disorders such as impetigo and cellulitis. Healthcare providers carefully choose the right cephalosporin by considering the infection severity and particular bacterial strain. The growing need for cephalosporin medications in dermatology emphasizes how well they work to treat bacterial skin infections that recur, highlighting the need to use antibiotics responsibly to promote the best possible patient outcomes.

Regional Insights

North America Region Dominated the Global Market in 2023

In 2023, the North American region dominated the global market. The North American market is shaped by robust healthcare infrastructure and a focus on research and development. With a high prevalence of bacterial infections in diverse settings, the demand for advanced cephalosporin drugs remains resilient. Established pharmaceutical players strategically navigate the market through innovative product development and collaborative partnerships. Stringent regulatory standards underscore the region's commitment to drug safety and efficacy. Addressing the challenge of antibiotic resistance fuels continuous innovation, prompting the development of potent cephalosporin formulations. Substantial healthcare expenditure supports the integration of these pharmaceuticals into infection management strategies, while collaborative efforts enhance research, development, and distribution capabilities.

Over the projected period, the Asia-Pacific region is likely to experience significant growth. The region grapples with a substantial burden of infectious diseases, fueling demand for cephalosporin drugs. Market dynamics encompass a diverse array of established and emerging players, fostering competition and innovation. Economic considerations, such as affordability and accessibility, significantly influence drug availability. Governments actively drive healthcare initiatives to fortify infrastructure and enhance access to cephalosporin drugs. Asia's prominence in medical tourism elevates demand for high-quality pharmaceuticals, including cephalosporin drugs, underscoring the industry's commitment to international healthcare standards.

Key Market Players & Competitive Insights

The market exhibits a diverse landscape, and the arrival of numerous new participants is expected to escalate competition. Established market frontrunners consistently enhance their technologies to maintain a competitive advantage, emphasizing efficiency, integrity, and safety. These entities prioritize strategic endeavors such as partnerships, advancements in products, and collaborative ventures, with the goal of surpassing their counterparts. Their primary objective is to secure a substantial cephalosporin drugs market share.

Some of the major players operating in the global market include:

- AbbVie Inc.

- AstraZeneca plc

- Bristol-Myers Squibb Company

- Eli Lilly and Company

- GlaxoSmithKline plc

- Johnson & Johnson

- Lupin Limited

- Mankind Pharma

- Merck & Co., Inc.

- Novartis International AG

- Pfizer Inc.

- Roche Holdings AG

- Sanofi S.A.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries Ltd.

Recent Developments

- In November 2023, Shionogi & Co., Ltd declared that the Ministry of Health, Labour and Welfare granted manufacturing and marketing approval for Fetroja (cefiderocol) intravenous infusion 1g vial. Fetroja is a pharmaceutical that adeptly permeates the external membrane of gram-negative bacteria, encompassing multidrug-resistant strains, showcasing notable antimicrobial efficacy.

- In September 2021, Lincoln Pharma announced investment for the expansion of its Cephalosporin product range. The facility is set to serve the production needs of various Cephalosporin items, including tablets and capsules.

- In February 2021, GSK disclosed a deal with Sandoz, confirming an agreement to divest its business related to Cephalosporin antibiotics.

Report Coverage

The cephalosporin drugs market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, generations, routes of administration, applications and their futuristic growth opportunities.

Cephalosporin Drugs Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 15.32 billion |

|

Revenue forecast in 2032 |

USD 18.52 billion |

|

CAGR |

2.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the landscape of Cephalosporin Drugs in 2024 through detailed market share, size, and revenue growth rate statistics meticulously organized by Polaris Market Research Industry Reports. This expansive analysis goes beyond the present, offering a forward-looking market forecast till 2032, coupled with a perceptive historical overview. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Feed Mixer Market Size, Share 2024 Research Report

Engine Bearings Market Size, Share 2024 Research Report

Biogas Market Size, Share 2024 Research Report

Microgrid Market Size, Share 2024 Research Report

Ergonomic Chair Market Size, Share 2024 Research Report

FAQ's

The global Cephalosporin Drugs market size is expected to reach USD 18.52 billion by 2032

Key players in the market are AbbVie Inc., AstraZeneca plc, Bristol-Myers Squibb Company, Eli Lilly and Company

North America contribute notably towards the global Cephalosporin Drugs Market

Cephalosporin Drugs Market exhibiting the CAGR of 2.4% during the forecast period.

The Cephalosporin Drugs Market report covering key segments are generation, route of administration, application, and region.