Industrial Hose Market Size, Share, Trend, Industry Analysis Report

By Material Type (Rubber, PVC, Silicone, Teflon, Others), By Application, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM5876

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

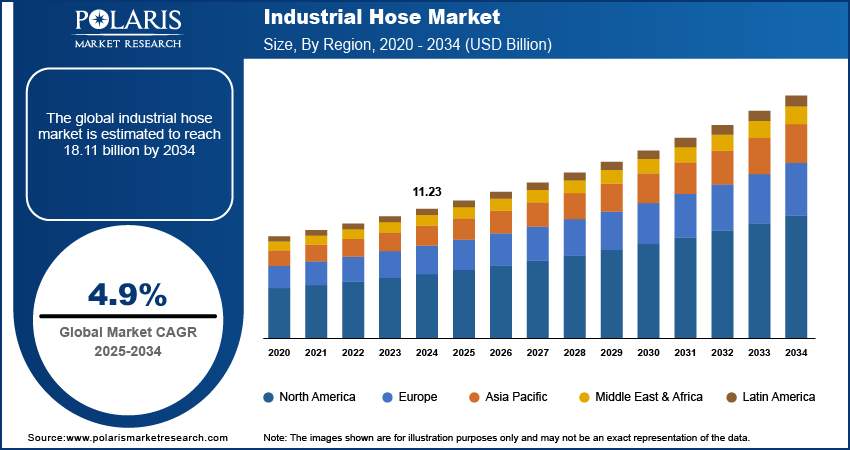

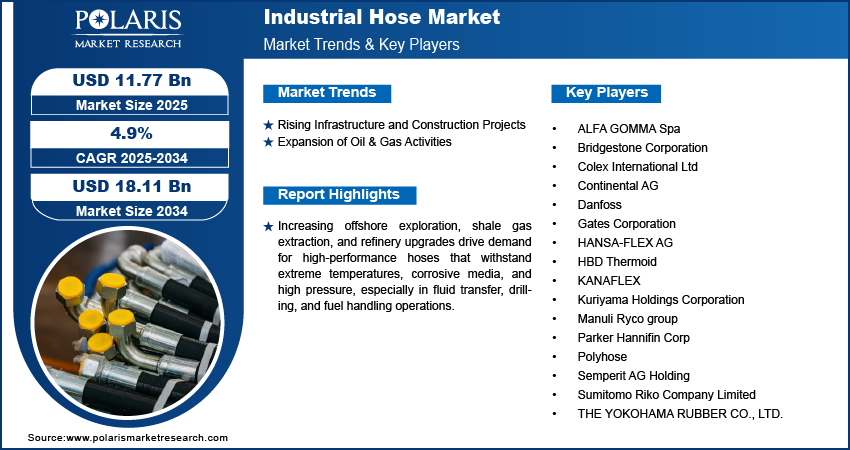

The global industrial hose market size was valued at USD 11.23 billion in 2024 and is projected to register a CAGR of 4.9% from 2025 to 2034. Increasing offshore exploration, shale gas extraction, and refinery upgrades drive demand for high-performance hoses that withstand extreme temperatures, corrosive media, and high pressure, especially in fluid transfer, drilling, and fuel handling operations.

The market encompasses flexible, reinforced tubing systems designed to transport fluids, gases, or solids in various industrial applications. These hoses are essential components in sectors such as oil & gas, agriculture, chemicals, food processing, construction, and water treatment, offering durability, high-pressure resistance, and customization for operational needs. The demand for hygienic and FDA-compliant hoses is growing in the food & beverage industry, where contamination-free fluid transfer is critical. This includes use in dairies, breweries, and processing lines, boosting specialized hose adoption.

Mechanized farming practices, including irrigation systems, pesticide delivery, and slurry transport, rely heavily on industrial hoses, particularly those that offer UV resistance, flexibility, and abrasion tolerance under varying weather conditions. Additionally, innovation in materials such as thermoplastics, polytetrafluoroethylene (PTFE), and reinforced rubber enables longer-lasting, lightweight, and more flexible hose solutions, leading to greater performance in harsh environments and expanding their applicability across sectors.

To Understand More About this Research: Request a Free Sample Report

Market Dynamics

Rising Infrastructure and Construction Projects

Rising infrastructure and construction activities are playing a crucial role in driving the market. According to the U.S. Census Bureau, construction spending in the first four months of 2025 reached USD 660.2 billion, reflecting a 1.4% increase compared to USD 651.3 billion during the same period in 2024. This upward trend highlights the ongoing expansion in infrastructure and construction activities. Urban expansion, transportation upgrades, and public utility development are accelerating the need for reliable and durable hose systems on job sites. Hoses are essential for tasks such as concrete pumping, dewatering flooded areas, transferring cement mixtures, and powering pneumatic tools. Construction environments are often rough and unpredictable, requiring hoses that offer flexibility, abrasion resistance, and the ability to function under heavy mechanical stress. Large-scale projects such as highways, commercial buildings, and metro systems rely on high-capacity hose systems for efficient operations. This steady demand across new and ongoing construction initiatives supports the continued growth of industrial hoses in global markets.

Expansion of Oil & Gas Activities

Expansion in oil and gas operations contributes to the demand for industrial hoses. The Bureau of Ocean Energy Management reported a 22.6% increase in remaining recoverable reserves, reaching a total of 7.04 billion barrels of oil equivalent as of 2025. This includes 5.77 billion barrels of oil and 7.15 trillion cubic feet of natural gas, reflecting expanded exploration and production activities since 2021. This growth highlights the ongoing development and investments in oil and gas resources, supporting continued industry expansion. Exploration in deep-sea and remote areas has increased the need for hoses that can perform reliably under extreme temperatures, corrosive environments, and high-pressure conditions. These hoses are used extensively in offshore rigs, onshore drilling, refinery operations, and petrochemical transport. Fuel transfer, mud circulation, hydraulic fracturing, and chemical injection processes all require specialized hose systems designed to handle aggressive fluids and maintain structural integrity. The rising focus on energy security and increased investments in shale gas and LNG infrastructure are creating long-term demand for high-performance industrial hoses that meet stringent safety and performance standards.

Segment Insights

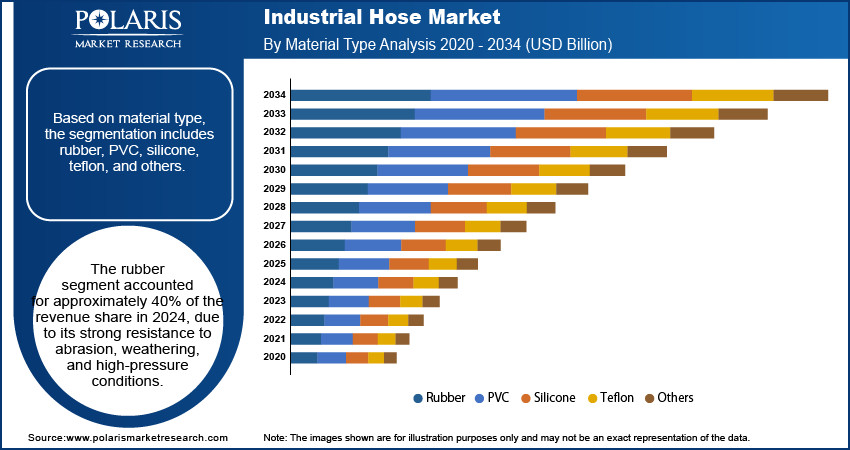

Material Type Analysis

Based on material type, the segmentation includes rubber, PVC, silicone, teflon, and others. The rubber segment accounted for approximately 40% of the revenue share in 2024 due to its strong resistance to abrasion, weathering, and high-pressure conditions. Rubber hoses are widely used across demanding applications such as mining, construction, and oil & gas, where durability and performance are essential. Their ability to handle aggressive fluids and rough terrain makes them ideal for heavy-duty industrial environments. Additionally, advancements in synthetic rubber compounds such as EPDM and nitrile have strengthened their reliability, reinforcing their position as a preferred choice in rugged operations where flexibility and resistance to mechanical stress are critical.

The PVC segment is gaining traction due to its lightweight nature, cost-effectiveness, and suitability for medium- to low-pressure applications. In 2024, demand rose in industries such as agriculture, water supply, and ventilation systems, where frequent hose replacement and ease of handling are important. PVC hoses are non-reactive to many chemicals, making them ideal for light chemical transfer and food-grade applications. Their smooth inner surfaces help reduce friction loss, enhancing efficiency in fluid conveyance. Additionally, color-coded variants and transparent PVC hoses are favored in industrial settings for visual monitoring of fluid flow, adding a layer of operational control and safety.

Application Analysis

Based on application, the segmentation includes automotive, construction & infrastructure, oil & gas, pharmaceuticals, food & beverages, water & wastewater treatment, mining, and other. In 2024, the construction & infrastructure segment accounted for the largest revenue share, driven by rising global infrastructure investments in roads, buildings, and public utilities. This sector demands robust hoses for concrete transfer, dewatering, cement spraying, and dust suppression systems. Large-scale urbanization and smart city projects have intensified the need for heavy-duty hoses that can operate effectively in harsh site conditions and extreme temperatures. Hose products used in this segment must offer both flexibility and high resistance to mechanical stress, which has spurred demand for reinforced and multi-layered hose solutions tailored to construction use.

The pharmaceuticals segment is projected to register the highest CAGR during the forecast period, due to increasing investments in cleanroom manufacturing and biopharmaceutical production. Demand for high-purity hoses that meet strict sanitary and regulatory standards is rising sharply. These hoses must resist contamination, maintain flexibility under autoclaving conditions, and ensure consistent fluid transfer in sterile environments. Silicone and PTFE-based hoses are widely adopted for transferring active pharmaceutical ingredients and solvents. Growth in drug production, vaccine pipelines, and personalized medicine is expanding the operational scale of pharmaceutical manufacturing, creating a sustained need for specialized hose solutions tailored to strict industry protocols.

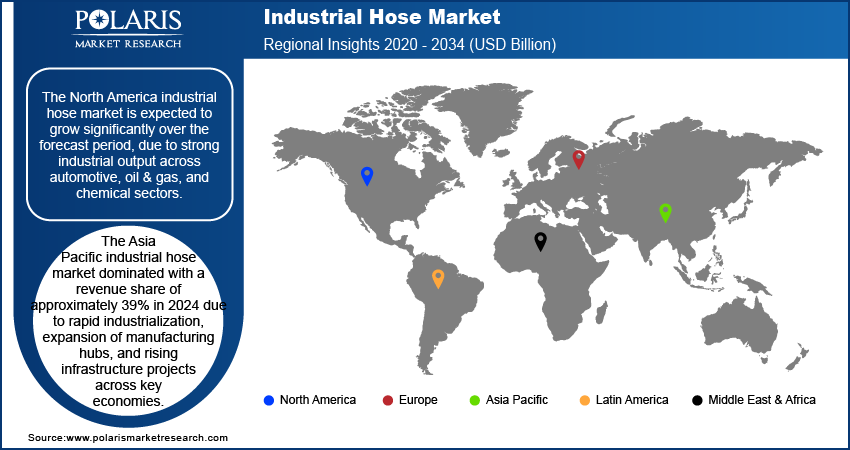

Regional Analysis

The North America industrial hose market is expected to grow significantly over the forecast period due to strong industrial output across the automotive, oil & gas, and chemical sectors. Rising investments in automation, infrastructure development, and shale gas extraction are reinforcing demand for durable hose systems. For instance, in 2023, the Biden government signed the Bipartisan Infrastructure Law (BIL) into effect, allocating USD 1.2 trillion in federal funding for transportation, energy, and climate infrastructure projects. A majority of these funds are channeled through state and local governments to support large-scale development. Additionally, regulatory emphasis on workplace safety and emissions control is encouraging the adoption of certified, leak-proof hoses. Technological advancements in hose design and materials that increase lifecycle and reduce maintenance further support market expansion. Manufacturers in the region are also focusing on localized domestic production, ensuring timely supply and customization for end-use industries.

U.S. Industrial Hose Market Trends

The U.S. market is expected to grow significantly over the forecast period, supported by the country’s large-scale manufacturing and energy production footprint. Increasing upgrades in public infrastructure and transportation networks are creating consistent demand for heavy-duty hoses. The automotive sector, with its evolving shift to electric and hybrid vehicle production, is also contributing to demand for hoses used in thermal management and fluid transfer systems. Moreover, the US food and pharmaceutical industries require FDA- and USP-compliant hose systems, driving growth in specialized hose categories. Strategic procurement practices and strong domestic production capacity further enhance market resilience.

Asia Pacific Industrial Hose Market Overview

The Asia Pacific market dominated with a revenue share of approximately 39% in 2024 due to rapid industrialization, expansion of manufacturing hubs, and rising infrastructure projects across key economies. According to data from the National Bureau of Statistics of China, in 2025, the value added for the processing of food from agricultural and sideline products increased by 2.2% compared to the previous year. The textile industry reported a stronger growth of 5.1%, while the manufacture of raw chemical materials and chemical products rose significantly by 8.9%. This upward trend highlights the continued expansion and resilience of China's manufacturing base, strengthening its position as a leading manufacturing hub in Asia. Moreover, countries such as India, Vietnam, and Indonesia are investing heavily in construction equipment, energy, and transportation, boosting demand for high-performance hoses. The region also benefits from a strong presence of domestic manufacturers offering competitively priced hose solutions tailored to local needs. Increasing adoption of advanced agricultural techniques and the growth of the food processing industry are driving demand for flexible and durable hose systems across various end-use sectors.

China Industrial Hose Market Outlook

The market in China accounted for the largest revenue share in Asia Pacific in 2024, fueled by strong output across the automotive, construction, and chemicals industries. Massive investments in infrastructure, including urban development and high-speed rail projects, continue to drive demand for heavy-duty hose systems. China’s position as a global manufacturing hub supports large-scale production of hoses across material types, offering cost advantages and broad product availability. The country’s growing emphasis on automation and smart factory initiatives also creates opportunities for advanced hose systems compatible with high-efficiency machinery, supporting its leading position in the region.

Europe Industrial Hose Market Insights

The Europe industrial hose market is expected to grow significantly during the forecast period, driven by increasing investments in sustainable manufacturing and stringent regulatory standards. Industries across Germany, France, and the UK are upgrading to environmentally compliant hose systems that minimize leakage and improve efficiency. Demand for specialty hoses in the pharmaceuticals and food processing industries is rising, driven by the imposition of stringent EU hygiene and safety standards. Ongoing transition to renewable energy projects and modernization of water and wastewater treatment infrastructure are further contributing to the rising adoption of durable and chemically resistant hose solutions across the region.

Key Players and Competitive Analysis

The competitive landscape of the industrial hose market is shaped by ongoing technology advancements, robust market expansion strategies, and strategic alliances across key regions. Industry analysis reveals a dynamic environment where players focus on product differentiation through material innovation, performance optimization, and compliance with industrial safety standards. Mergers and acquisitions, along with post-merger integration initiatives, are central to consolidating market presence and expanding global distribution networks. Joint ventures between hose manufacturers and industrial equipment providers are accelerating access to high-growth sectors, including oil & gas, food processing, and pharmaceuticals. Strategic investments in automation-compatible hose solutions and smart fluid conveyance systems are creating new opportunities for differentiation. Companies are also emphasizing sustainable manufacturing and lightweight, high-durability hose designs to align with evolving regulatory and operational needs. Competitive dynamics continue to intensify, driven by rapid industrialization, infrastructure growth, and demand for customized, high-performance fluid transfer solutions across diverse end-use verticals.

List of Key Companies

- ALFA GOMMA Spa

- Bridgestone Corporation

- Colex International Ltd

- Continental AG

- Danfoss

- Gates Corporation

- HANSA-FLEX AG

- HBD Thermoid

- KANAFLEX

- Kuriyama Holdings Corporation

- Manuli Ryco group

- Parker Hannifin Corp

- Polyhose

- Semperit AG Holding

- Sumitomo Riko Company Limited

- THE YOKOHAMA RUBBER CO., LTD.

- Trelleborg Group

Industrial Hose Industry Developments

In April 2025, Danfoss Power Solutions launched the Synflex by Danfoss 3TMH thermoplastic hydraulic hose. It is designed to enhance performance in material handling equipment, such as telehandlers, boom lifts, and scissor lifts. The company claims that the hose offers durability, with abrasion resistance up to 10 times greater than similar products, helping to extend service life, reduce downtime, and lower maintenance costs. It also maintained reliable performance over 1 million impulse cycles, ensuring long-term efficiency.

In February 2024, Gates introduced the Clean Master Plus hose platform, a new addition to its industrial hose range. It is designed to perform in high-pressure applications and challenging industrial environments.

In July 2023, Kurt Manufacturing acquired Bellatex Industries LLC, strengthening its product portfolio and market position in the industrial hose sector. The acquisition supported efforts to address growing market demand and expand its global presence.

Industrial Hose Market Segmentation

By Material Type Outlook (Revenue USD Billion, 2020–2034)

- Rubber

- PVC

- Silicone

- Teflon

- Others

By Application Outlook (Revenue USD Billion, 2020–2034)

- Automotive

- Construction & Infrastructure

- Oil & Gas

- Pharmaceuticals

- Food & Beverages

- Water & Wastewater Treatment

- Mining

- Others

By Regional Outlook (Revenue USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Hose Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 11.23 billion |

|

Market Size in 2025 |

USD 11.77 billion |

|

Revenue Forecast by 2034 |

USD 18.11 billion |

|

CAGR |

4.9% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 11.23 billion in 2024 and is projected to grow to USD 18.11 billion by 2034.

The global market is projected to register a CAGR of 4.9% during the forecast period.

The Asia Pacific industrial hose market dominated with a revenue share of approximately 39% in 2024 due to rapid industrialization, expansion of manufacturing hubs, and rising infrastructure projects across key economies.

A few of the key players are ALFA GOMMA Spa; Bridgestone Corporation; Colex International Ltd; Continental AG; Danfoss; Gates Corporation; HANSA-FLEX AG; HBD Thermoid; KANAFLEX; Kuriyama Holdings Corporation; Manuli Ryco group; Parker Hannifin Corp; Polyhose; Semperit AG Holding; Sumitomo Riko Company Limited; THE YOKOHAMA RUBBER CO., LTD.; and Trelleborg Group.

The rubber segment accounted for approximately 40% of the revenue share in 2024 due to its strong resistance to abrasion, weathering, and high-pressure conditions.

In 2024, the construction & infrastructure segment accounted for the largest revenue share, driven by rising global infrastructure investments in roads, buildings, and public utilities.