Engine Bearings Market Share, Size, Trends, Industry Analysis Report

By Type (Main Bearing, Connected Rod Bearing, and Others); By Vehicle Type; By Distribution Channel; By Region; Segment Forecast, 2024 – 2032

- Published Date:Jan-2024

- Pages: 119

- Format: PDF

- Report ID: PM4194

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

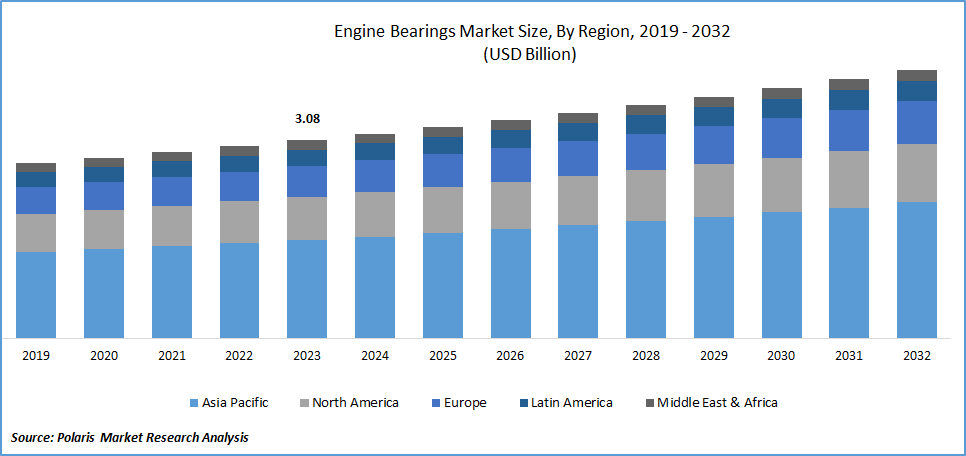

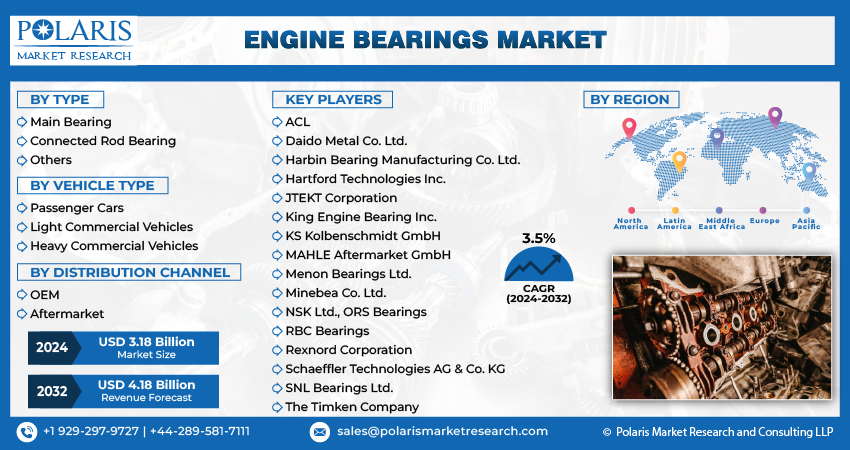

The global engine bearings market was valued at USD 3.08 billion in 2023 and is expected to grow at a CAGR of 3.5% during the forecast period.

The rapidly increasing and widespread use of engine bearings in different kinds of machinery or equipment, including automobiles, defense & aerospace, and farm equipment, among others, along with the growing proliferation of bearings with several advantageous characteristics, including longer lifespan, greater efficiency, and lower maintenance charges or requirements, are among the prominent factors fostering global market growth significantly.

To Understand More About this Research: Request a Free Sample Report

Moreover, the continuous surge in the need and demand for high-performance bearings has significantly encouraged product manufacturers to integrate advanced and innovative sensor units into the products that assist in digital monitoring of axial movement, rotation speed, deceleration, acceleration, and load capacity. Apart from this, the growing focus of companies on developing equipment solutions that make engine bearings more efficient and smoother to operate and lead to higher efficacy is further influencing its market growth.

- For instance, in November 2021, FinnSonic introduced its fully automated FinnSonic TEMPO AEROMATIC Aircraft Engine Bearing Cleaning Line equipment. It includes a 5-stage cleaning process with an Ultrasonic Bearing Line specially designed to clean bearing components.

As companies in the automotive market are facing significant challenges in the development and improvisation of engine performance, they are focusing on reducing the overall weight and size of different engine components. As a result, there has been huge traction for the adoption of aluminum alloys worldwide because of their beneficial characteristics such as durability, high strength, corrosion resistance, and lightweight, which, in turn, positively impact the global market growth.

However, the continuous fluctuations and volatility in the cost of raw materials used in the production of engine bearings that led to high production costs for manufacturers are among the factors likely to restrain the growth of the global market over the coming years.

Industry Dynamics

Growth Drivers

Expansion of automotive production and several favorable trends are driving global market growth

The substantial increase in the rate of urbanization and industrialization, infrastructure development, and continuous increase in consumer disposable income, particularly in emerging economies, has resulted in increased demand for automobiles coupled with the drastic growth in the production of vehicles over the last decade, are primary factors fostering the global market growth.

For instance, according to the European Automobile Manufacturers Association, the number of motor vehicles produced in 2022 stood at around 85.4 million, with an increase of almost 5.7% as compared to 2021.

Additionally, according to a report by the United Nations, approx. 55% of the world’s total population was estimated to live in urban areas in 2018, and the number is expected to reach 68% by 2050, which means the world’s urban population could add another 2.5 billion people by 2050.

Report Segmentation

The market is primarily segmented based on type, vehicle type, distribution channel, and region.

|

By Type |

By Vehicle Type |

By Distribution Channel |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Main bearing segment accounted for the largest market share in 2023

The main bearing segment accounted for the largest share. This is due to its ability to tackle various types of forces along with supporting the crankshaft rotating at very high speeds. Along with this, main bearings are widely known due to their numerous advantageous capabilities and nature, including anti-corrosiveness, frictional resistance, good grinding-in ability, and excellent load-bearing capacity, which, in turn, generates huge growth opportunities for the segment market.

The connected rod bearing segment is also projected to gain a significant growth rate during the anticipated period, mainly driven by its rapid emergence as an essential component of internal combustion engines by helping them to easily transfer the power from the piston to the crankshaft.

By Vehicle Type Analysis

Passenger cars segment expected to hold significant market share over forecast period

The passenger cars segment is expected to hold a substantial market share in terms of revenue over the forecast period, owing to a surge in the production and sales of passenger vehicles all over the world and the growing adoption of automobiles among the middle-class population due to their rising spending capacity and inclination towards luxury and better lifestyle standards. Besides this, the number of bearings used in a conventional vehicle engine also increases, and almost 100 to 150 bearings on average are used in a vehicle’s engine.

For instance, according to the Society of Indian Automobile Manufacturers, the total sales of passenger vehicles substantially increased from 30,69,523 to 38,90,114 units. Also, the sales of passenger cars have surged from 14,67,039 to 17,47,376 between FY22-23 as compared to the previous year.

By Distribution Channel Analysis

OEM segment is expected to witness highest growth throughout forecast period

The OEM segment is expected to register the highest growth rate during the projected period, which is majorly driven by emerging favorable automotive production trends globally and operational characteristics along with the rising focus on research & development activities that led to advancement in product capabilities in lubrication, mechatronics, and many others. Apart from this, several new and innovative technologies are being adopted by leading companies as well as researchers, which helps them make more reliable and highly durable materials that could easily hold heavy holds.

Regional Insights

Asia Pacific region dominated the global market in 2023

The Asia Pacific region dominated the global market. The regional market growth is mainly attributable to the robust presence of the world’s leading automobile-producing countries and companies and the constant increase in investments in aerospace & defense sector development. In addition, rising investments in R&D activities towards developing lightweight and durable materials for vehicles so that more bearings can be incorporated into the vehicles is further boosting the region’s growth over the years.

For instance, according to a recent report published by OICA, China was the leading producer of vehicles in 2021, with a total production of over 26 million vehicles, including 21.4 million cars and approx. 4.6 million commercial vehicles. 4 out of the top 5 car-producing countries are from Asia Pacific, which makes the region the largest market for automobiles.

The Europe region will grow significantly on account of the availability of various mature automotive markets in the region that create substantial demand for automobiles along with the region’s sustainable economic growth that led to greater investments across various sectors and industries.

Key Market Players & Competitive Insights

The engine bearings market is highly fragmented with the presence of numerous large rivals in the market. Some of the leading market companies are extensively focusing on business expansion and development strategies that basically include mergers and acquisitions, alliances, collaborations, partnerships, and new product launches in order to meet surging consumer demand and boost their client base all over the world.

Some of the major players operating in the global market include:

- ACL

- Daido Metal Co. Ltd.

- Harbin Bearing Manufacturing Co. Ltd.

- Hartford Technologies Inc.

- JTEKT Corporation

- King Engine Bearing Inc.

- KS Kolbenschmidt GmbH

- MAHLE Aftermarket GmbH

- Menon Bearings Ltd.

- Minebea Co. Ltd.

- NSK Ltd.

- ORS Bearings

- RBC Bearings

- Rexnord Corporation

- Schaeffler Technologies AG & Co. KG

- SNL Bearings Ltd.

- The Timken Company

Recent Developments

- In February 2022, Schaeffler Group announced that they have strengthened their bearings business and also developed new innovative bearings for electromobility that bring high efficiency and sustainable mobility. The new ball bearing with a centrifugal disc also offers exceptional efficiency and greater service life for almost all types of powertrains.

- In December 2021, NSK announced the launch of its new lineup of bearings with the world’s first 100% bioplastic heat-resistant cage. The company continues to expand the use of bioplastics in its products with the aim to reduce carbon emissions and contribute towards a carbon-neutral society.

Engine Bearings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.18 billion |

|

Revenue forecast in 2032 |

USD 4.18 billion |

|

CAGR |

3.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By Vehicle Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Browse Our More Top Selling Reports:

Portable Dishwasher Market Size & Share

Heated Jacket Market Size & Share

Automotive Hypervisors Market Size & Share

FAQ's

key companies in Engine Bearings Market are Hartford Technologies, Menon Bearings, Rexnord Corporation

The global engine bearings market and is expected to grow at a CAGR of 3.5% during the forecast period

Key segments covered type, vehicle type, distribution channel, and region.

Key driving factors in Engine Bearings Market • Expansion of automotive production and several favorable trends are driving global market growth

The global engine bearings market size is expected to reach USD 4.18 billion by 2032