Biogas Market Share, Size, Trends & Industry Analysis Report

By Source (Agricultural Waste, Industrial Waste, Municipal Waste, Others); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 117

- Format: PDF

- Report ID: PM4195

- Base Year: 2024

- Historical Data: 2020-2023

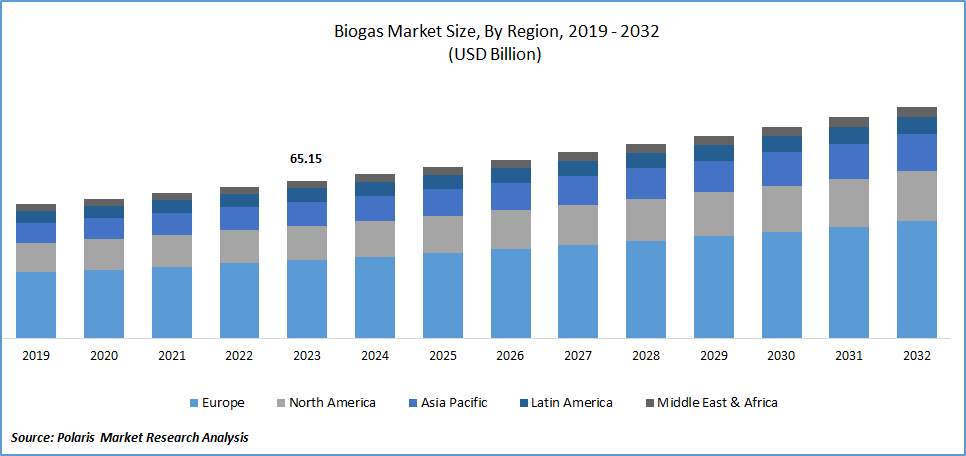

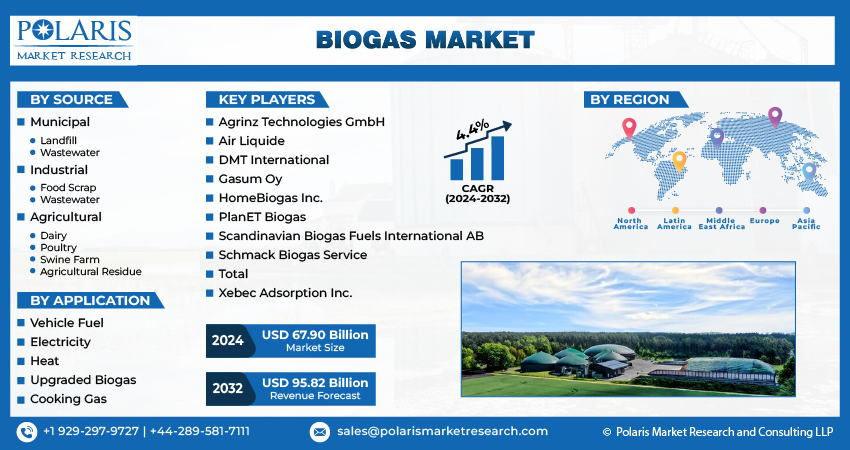

The global Biogas Market was valued at USD 71.63 billion in 2024 and is expected to grow at a CAGR of 4.65% from 2025 to 2034. Supportive renewable energy policies, waste-to-energy initiatives, and the push for decentralized power generation are key growth enablers.

The sector is poised for growth as there is an increasing demand for the product across various application segments such as heat, electricity, upgraded biogas, vehicle fuel, and cooking gas. Additionally, a notable shift towards the utilization of renewable energy, particularly in the electric power sector, has played a significant role in driving the demand for biogas in electricity applications. Furthermore, the escalating need to decrease reliance on fossil fuels is creating favorable opportunities for biogas in vehicle fuel applications.

To Understand More About this Research: Request a Free Sample Report

According to the International Renewable Energy Agency (IRENA), adopting biogas as a vehicle fuel can result in substantial reductions in greenhouse gas emissions, ranging from 60-80%, compared to traditional fossil fuels. In response to climate change concerns and growing environmental awareness, many governments have established targets to cut emissions, leading to significant investments in renewable energy and alternative fuels.

For instance, Clean Energy Fuels Corp. entered into an agreement with the Los Angeles County Metropolitan Transportation Authority in February 2021, supplying around 47.5 Mn gallons of renewable natural gas to fuel the transit bus fleet in the U.S. This agreement marked the achievement of Metro's 5-year goal to shift from its diesel-based fleet to the cleaner, with 2,400 buses powered by the RNG. The increasing preference for environmentally friendly products to mitigate emissions is anticipated to drive the demand for biogas in the coming years.

Nevertheless, the anticipated impediment to market growth lies in the substantial initial investment required for establishing a biogas plant. The construction cost of a biogas facility encompasses expenses related to land, materials, equipment, and labor. The development and expansion of biogas facilities necessitate financial support. The procurement and storage of raw materials are both time-consuming and costly processes. Effective regulation and financial assistance are imperative for activities such as collecting, sorting, processing, supplying, and distributing feedstock, as well as plant construction, operation, and biogas sale and distribution. Additionally, the plant's output must be both sufficient and consistent to offset the installation and operating costs.

Growth Drivers

Rising Biogas Demand Driving Force in Sustainable Energy Transition

Biogas demand is experiencing significant growth, driven by the increasing demand across various applications such as cooking gas, electricity, fuel, & heat. This growth is anticipated to have a positive impact on the sector over the study period. Several factors contribute to the robust performance of the regional market, including a high demand for green fuels, stringent environmental regulations that prioritize sustainable energy sources, and increased investment in the development of refineries. These factors collectively contribute to the upward trajectory of biogas demand.

Report Segmentation

The market is primarily segmented based on source, application, and region.

|

By Source |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Source Analysis

Municipal Segment Held the Largest Share of the Market in 2024

The municipal segment held the largest share. This dominance can be attributed to the increasing utilization of municipal solid waste (MSW) in the production of biogas. The growing trend of using MSW for biogas production serves the dual purpose of reducing the volume of waste sent to landfills and curbing greenhouse gas emissions. As a sustainable waste management solution, the conversion of municipal solid waste into biogas aligns with environmental goals, making it a favorable option for waste disposal and energy production.

The industrial segment is projected to grow at the fastest rate. This growth is driven by a rising interest in discovering efficient methods to extract bio-products and biofuel from industrial food waste. Industries are increasingly exploring sustainable solutions to manage their waste and extract value from by-products. Utilizing industrial food waste for biogas production aligns with the principles of circular economy and resource efficiency. Additionally, the need for wastewater treatment in the industrial sector further contributes to the demand for biogas. This dual benefit of waste-to-energy conversion and wastewater treatment positions biogas as an attractive and environmentally friendly solution for industrial waste management.

By Product Analysis

Electricity Segment Registered the Largest Market Share in 2024

Electricity segment accounted for the largest share. This dominance can be attributed to the heightened focus on renewable energy adoption, especially within the electric power sector. Biogas has gained prominence as a sustainable and eco-friendly source of electricity generation. The utilization of biogas for electricity aligns with global efforts to transition towards cleaner and more sustainable energy sources, contributing to the reduction of greenhouse gas emissions and promoting environmental sustainability. This increased emphasis on renewable energy, coupled with the versatile applicability of biogas in electricity generation.

In 2022, around 220 million kilowatt-hours (kWh) of electricity were generated from biogas sourced from 24 livestock and dairy operations in the United States. Additionally, industrial and sewage wastewater treatment facilities contributed to the production of approximately 1 billion kWh of electricity. Biogas is recognized as a renewable energy fuel in the country, aligning with state renewable electricity standards (RES) to meet the criteria for electricity generation.

The upgraded biogas segment will grow at a substantial pace. This is primarily driven by increasing demand for biofuels across various sectors, particularly in the automotive industry. Upgrade biogas refers to the process of converting biogas into biomethane, achieved by eliminating hydrogen sulfide, water, carbon dioxide, and contaminants from the original biogas. This upgraded form of biogas, known as biomethane, holds promise as a cleaner and more refined biofuel, making it suitable for various applications, including fueling vehicles.

Regional Insights

Europe Region Held the Largest Share of the Global Market in 2024

Europe region dominated the market. The growth of the biogas sector in Europe is attributed to advancements in technology and substantial investments in the refinery industry. Companies operating in Europe are making significant capital investments in research and development focused on biogas production from existing sources. Additionally, these companies are strategically planning to augment their share of feedstock in the coming years. This concerted effort is expected to drive growth in the regional biogas market as it reflects a commitment to innovation, efficiency, and sustainability within the industry.

The expansion of Italy's biogas market is propelled by governmental initiatives aimed at achieving decarbonization. An illustration of this commitment is Eni SpA's agreement, made in March 2021, to acquire an Italian biogas company from the FRI-EL Greenpower. This acquisition is currently pending approval from relevant antitrust authorities.

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- Agrinz Technologies GmbH

- Air Liquide

- DMT International

- Gasum Oy

- HomeBiogas Inc.

- PlanET Biogas

- Scandinavian Biogas Fuels International AB

- Schmack Biogas Service

- Total

- Xebec Adsorption Inc.

Recent Developments

- In May 2022, Enertech Fuel Solutions declared intentions to invest INR 600 crore in venturing into the compressed biogas (CBG) sector. The project's development is envisioned to unfold in multiple phases. Initially, four CBG plants are planned to be established in Gujarat, Uttar Pradesh, Punjab, and Haryana as part of the first phase. Subsequently, in the second phase, an additional plant will be invested in each of these states, accompanied by the addition of two more plants in Madhya Pradesh.

- In January 2022, BioConstruct disclosed the signing of a power purchase agreement (PPA) with the Next Kraftwerke. According to the agreement, Next Kraftwerke will be responsible for marketing 40,000 MWh of biogas electricity during the initial quarter of 2022.

Biogas Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 74.96 billion |

|

Revenue forecast in 2034 |

USD 113.23 billion |

|

CAGR |

4.65% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Power Source, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Browse Our More Top Selling Reports:

Drug Discovery Services Market Size & Share

Feed Phosphates Market Size & Share

Bicycle Chain Lubricant Market Size & Share

FAQ's

The global biogas market size is expected to reach USD 113.23 billion by 2034

Top market players in the market are Agrinz Technologies, DMT International, Gasum, HomeBiogas

Europe region contribute notably towards the global Biogas Market

The global biogas market is expected to grow at a CAGR of 4.65% during the forecast period

source, application, and region are the key segments in the Biogas Market