Chicken Flavor Market Share, Size, Trends, Industry Analysis Report

By Form (Liquid and Powder); By Nature (Organic, Conventional); By Packaging; By End Users; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM3503

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

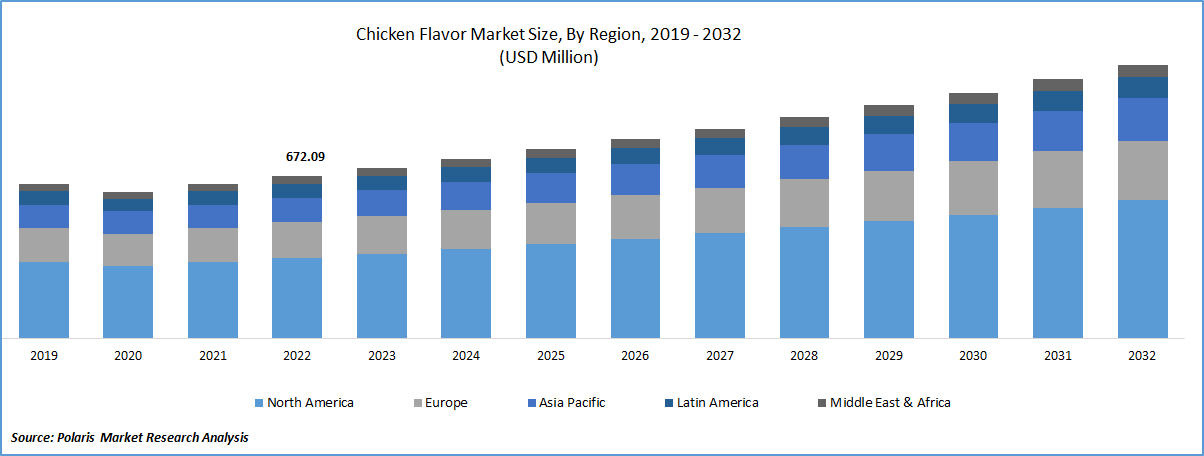

The global chicken flavor market was valued at USD 707.1 million in 2023 and is expected to grow at a CAGR of 5.40% during the forecast period. Plant-based flavor is significantly gaining a huge momentum in the market due to its huge health-beneficial aspects. As many customers are turning to plant-based foods as a healthier alternative to meat-based products. To tap a huge consumer base, large numbers of industry participants are contributing to the market by investing in it. For example, in February 2023, California-based Impossible Food launched a new crispy, juicy chicken line to its portfolio made from plants: Impossible Chicken Tenders, Impossible Spicy Chicken Patties, and Impossible Spicy Chicken Nuggets. Various players are pouring millions of dollars to improve their customer base and enhance business across various regions. This factor is fruitfully intensifying the market’s growth worldwide.

To Understand More About this Research: Request a Free Sample Report

The chicken flavor is a widely used flavor in the food industry due to its versatility and popularity. It can add depth and richness to the flavor of food and make it more appetizing. It can be a cost-effective way to add flavor to food without using actual chicken meat. This can be especially beneficial for manufacturers who want to produce vegetarian or vegan products. Furthermore, the demand for ready-to-eat meals is increasing due to busy lifestyles and the need for convenience. The chicken flavor is widely used in ready-to-eat meals, which is driving the demand for chicken flavor.

Due to the pandemic, people are spending more time at home and are turning to packaged and processed food products, which has led to an increase in demand for chicken flavor. As people avoid going to restaurants and prefer to order food online, there has been a surge in demand for food delivery services, which has led to an increase in demand for chicken flavor. However, the COVID-19 pandemic has disrupted supply chains worldwide, including the production and transportation of chicken flavor. This has led to delays in delivery and increased costs, affecting the market.

Industry Dynamics

Growth Drivers

Increasing demand for processed food among people is one of the key drivers to the growth of the global chicken flavor market. This is attributed to the changing lifestyles, convenience, and availability of a variety of food options. For instance, the American diet is mostly composed of processed foods—nearly 70% of it. Fast food accounts for 10% of Americans' discretionary income. Every day, one in four Americans eats fast food. The consumption of processed food is broadly increasing. Chicken flavor is also widely used in processed food which is further heightening global revenue.

Augmenting business strategies executed by industry participants is another prime factor likely to boost the market with a significant share. Industry participants are investing in research and development to develop new and innovative chicken flavors that can cater to changing consumer preferences, including natural and organic flavors, low-sodium options, and ethnic flavors.

For example, in May 2021, Pringles and Wendy's teamed up to create a single chip that tastes just like the traditional spicy fried chicken. In addition to this, in March 2023, with its new Flavour of the Month, Chick'n & Waffles, Baskin-Robbins has entered the competition for the best-fried chicken with a wonderfully deconstructed brunch staple. Likewise, many other players are contributing to the market by launching various products, acquiring other businesses, and investing in the market. This is significantly escalating the global market’s growth.

Report Segmentation

The market is primarily segmented based on form, nature, packaging, end users, and region.

|

By Form |

By Nature |

By Packaging |

By end user |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Liquid Form Segment Held Largest Share of the Global Market in 2022

This form of flavor is easy to use and can be added directly to food products. This makes them a popular choice for manufacturers who need to produce large quantities of food quickly and efficiently. These are more consistent in terms of taste and aroma compared to other forms like powder or paste. This makes them a preferred choice for manufacturers who want to ensure that their products taste the same every time.

Organic Segment is Dominating the Global Market Through the Forecast Period

In 2022, organic segment held the largest global share. The organic nature of chicken flavor is gaining popularity due to several factors such as health, sustainability, and growth in demand. The demand for organic chicken flavor is increasing due to the growing popularity of organic food products in general. This has led to an increase in the availability and variety of organic chicken flavor products in the market. For example, January 2023, 3 new flavors—Honey Jalapeo Chicken Party Wings, Black Garlic & Skinless Chicken Breast—have been added to Farmer Focus's award-winning pre-seasoned, organic chicken line. Manufacturers are largely contributing to the market by innovating new products in their portfolio. This is broadening the revenue of the organic segment of the global revenue.

Sachets and Pouches Segment is Expected to Expand at the Fastest Cagr

The sachets and pouches segment is growing with the fastest CAGR during the assessment years. These are convenient to use, store, and transport, making them a popular choice among consumers who are looking for on-the-go options or small quantities. Sachets and pouches offer portion control, which helps in reducing wastage and controlling costs for both consumers and manufacturers. Additionally, these offer better protection against moisture, light, and oxygen, which can extend the shelf life of the product.

Business to Business Segment Held the Largest Market Share in 2022

Business to business segment is significantly dominating the market with greater revenue in the fiscal year of 2022. B2B customers typically place larger orders than individual consumers, which makes them a significant source of revenue for the manufacturers. B2B customers often require customized chicken flavor solutions to meet their specific requirements, which can lead to long-term partnerships and repeat business for manufacturers.

North America is Accounting the Largest Share of the Global Market

Expanding fast food consumption is one of the major factors driving the growth of market in North America. For example, fast food is consumed daily by 44.9% of Americans between the ages of 20 and 39, according to the CDC. Consumers who enjoy fast food often develop a taste for the flavors of fried chicken, grilled chicken, and other chicken-based dishes. As a result, they may seek out chicken flavor products to recreate those flavors at home or in other food applications. This is fundamentally booming the growth of chicken flavor market across the region.

Asia Pacific is the fastest-growing region in the global market during the forecast period. The food industry in the Asia Pacific is expanding rapidly, with the growth of fast-food chains and the increasing popularity of ready-to-eat meals. For instance, Japan's food processing sector produced USD 218.3 billion worth of food and drink goods in 2020, a 1.1 percent decrease from USD 220.8 billion in 2019. In addition to this, The China Chain Store & Franchise Association estimates that the country's food and beverage (F&B) market was worth USD 595 billion, in 2019. This is creating opportunities for chicken flavor manufacturers to expand their customer base and increase sales.

Competitive Insight

The global chicken flavor market involves Kerry Group, Koninklijke DSM, Sensient Technologies, Cargill, BASF, International Flavors & Fragrances, Symrise, Givaudan, Innova, and Trailtopia Adventure Food.

Recent Developments

- In October 2022, Chipotle Mexican Grill launched its new flavor of pollo asado at restaurants in the Canada and U.S. Before settling on a national launch strategy for new menu innovations, Chipotle uses its stage-gate approach to test, listen to, learn from, and iterate on customer input.

Chicken Flavor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 744.16 million |

|

Revenue forecast in 2032 |

USD 1131.26 million |

|

CAGR |

5.40% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019– 2022 |

|

Forecast period |

2024– 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Form, By Nature, By Packaging, By End Users, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Kerry Group plc, Koninklijke DSM N.V., Sensient Technologies Corporation, Cargill, BASF, International Flavors & Fragrances Inc., Symrise, Givaudan, Innova, and Trailtopia Adventure Food. |

FAQ's

The global chicken flavor market size is expected to reach USD 1131.26 million by 2032.

Top market players in the Chicken Flavor Market are Kerry Group, Koninklijke DSM, Sensient Technologies, Cargill, BASF, International Flavors & Fragrances.

North America contribute notably towards the global Chicken Flavor Market.

The global chicken flavor market expected to grow at a CAGR of 5.4% during the forecast period.

The Chicken Flavor Market report covering key are form, nature, packaging, end users, and region.