Clinical Decision Support Systems Market Size, Share, Trend, Industry Analysis Report

By Component (Hardware, Software, Services), By Product, By Application, By Delivery Mode, By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 129

- Format: PDF

- Report ID: PM6076

- Base Year: 2024

- Historical Data: 2020-2023

Overview

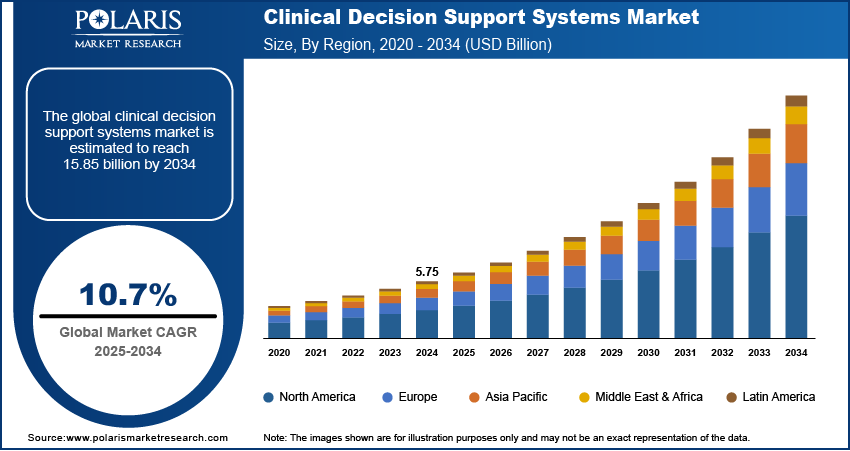

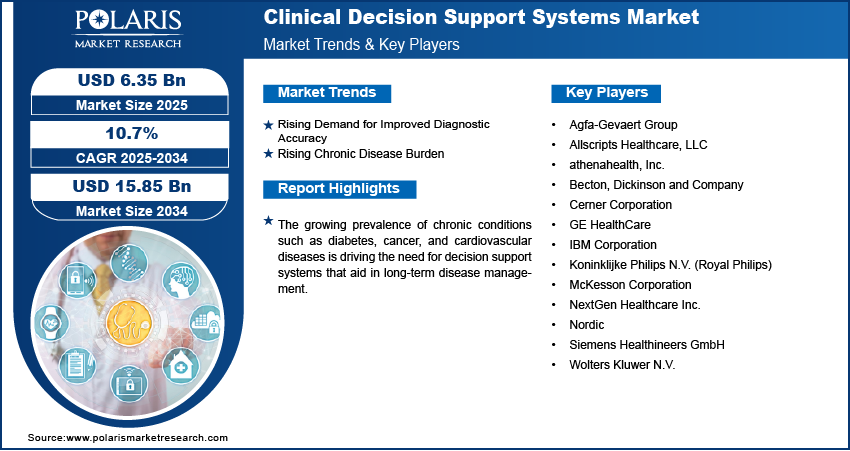

The global clinical decision support systems market size was valued at USD 5.75 billion in 2024, growing at a CAGR of 10.7% from 2025 to 2034. The growing prevalence of chronic conditions such as diabetes, cancer, and cardiovascular diseases is driving the need for decision support systems that aid in long-term disease management.

Key Insights

- The standalone CDSS segment accounted for ~31% of the revenue share in 2024 due to its popularity among healthcare institutions that prefer modular solutions capable of functioning independently.

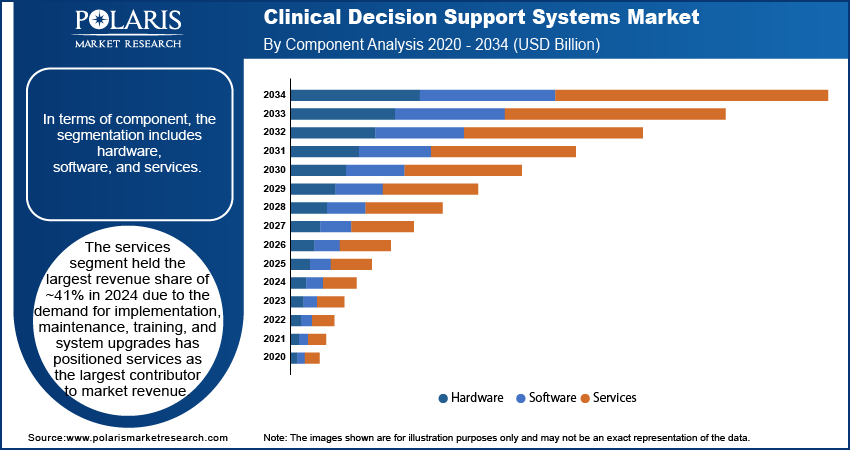

- The services segment held the largest revenue share of ~41% in 2024 due to the demand for implementation, maintenance, training, and system upgrades.

- The drug allergy alerts segment accounted for the largest revenue share of ~26% in 2024. Drug allergy alerts are essential to prevent life-threatening reactions during medication administration.

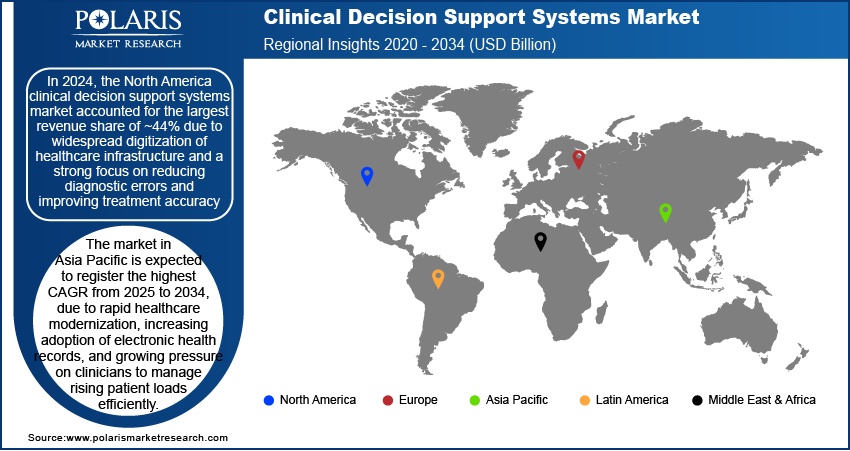

- In 2024, North America accounted for the largest revenue share of ~44% due to widespread digitization of healthcare infrastructure.

- In 2024, the U.S. held the largest revenue share due to the presence of a mature healthcare IT ecosystem and a high level of clinical data digitization.

- The Asia Pacific clinical decision support systems market is expected to register the highest CAGR from 2025 to 2034 due to rapid healthcare modernization.

- The market in China is showing strong growth due to rising investments in hospital digitization and increasing government emphasis on smart healthcare systems.

- The market in Europe is expanding steadily due to the growing focus on harmonized health IT infrastructure and rising demand for patient safety solutions

Industry Dynamics

- Rising adoption of AI and big data in healthcare to improve diagnosis and treatment planning boosts the market development.

- Growing demand for personalized medicine and integrated digital health records in clinical settings propels the demand for clinical decision support systems.

- Expansion of AI-driven CDSS in telemedicine and remote patient monitoring offers new growth avenues.

- Data privacy concerns and high implementation costs limit CDSS adoption in smaller healthcare facilities.

Market Statistics

- 2024 Market Size: USD 5.75 billion

- 2034 Projected Market Size: USD 15.85 billion

- CAGR (2025–2034): 10.7%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

The clinical decision support systems (CDSS) market refers to software solutions integrated within healthcare IT systems that analyze clinical data and provide evidence-based recommendations to assist healthcare professionals in making accurate diagnostic, treatment, and care decisions. Integration of artificial intelligence is enhancing the predictive capabilities of CDSS, enabling more personalized recommendations and proactive clinical interventions.

Healthcare providers are increasingly relying on CDSS tools to minimize diagnostic errors, reduce treatment variability, and enhance clinical outcomes by offering real-time, data-driven decision support. Moreover, the current regulatory emphasis on value-based care is driving healthcare systems to embrace tools that enable cost-effective and high-quality service delivery. Clinical decision support systems play a crucial role in aligning with these policy objectives, enhancing clinical efficiency and improving patient outcomes.

Drivers and Opportunities

Rising Demand for Improved Diagnostic Accuracy: Healthcare professionals are under growing pressure to deliver faster, more accurate diagnoses amid increasingly complex patient conditions. Clinical decision support systems help bridge gaps in clinical knowledge by providing timely, evidence-based insights at the point of care. These tools analyze patient data and clinical guidelines to suggest appropriate diagnostic steps or flag inconsistencies. Doctors benefit from alerts about rare conditions or potential misdiagnoses, especially in high-pressure environments. This reduces variability in treatment decisions and supports consistency in patient care. The reliability of CDSS improves trust among clinicians and enhances patient safety by minimizing the likelihood of costly medical errors. Hence, the rising demand for improved diagnostic accuracy propels the use of CDSS.

Rising Chronic Disease Burden: The sharp increase in lifestyle and age-related illnesses has created a sustained need for long-term disease management tools. Chronic conditions such as diabetes, cardiovascular disease, and cancer require continuous monitoring, frequent interventions, and data-driven treatment adjustments. In 2023, the Centers for Disease Control and Prevention (CDC) reported that cancer was responsible for 613,349 deaths in the US. Clinical decision support systems are becoming essential for tracking patient histories, suggesting personalized therapies, and detecting early signs of deterioration. These systems enable clinicians to tailor care plans while staying aligned with evolving treatment guidelines. In multi-morbidity scenarios, CDSS helps manage drug interactions and clinical risks more effectively. Their integration into daily care routines supports improved patient outcomes and optimizes resource allocation in overburdened health systems. Therefore, the increasing burden of chronic diseases across the world boosts the demand for CDSS.

Segmental Insights

Product Analysis

Based on product, the segmentation includes standalone CDSS, integrated CPOE with CDSS, integrated EHR with CDSS, and integrated CDSS with CPOE & HER. The standalone CDSS segment accounted for ~31% of the revenue share in 2024 due to its popularity among healthcare institutions that prefer modular solutions capable of functioning independently from broader electronic health record ecosystems. These systems are often adopted by specialty clinics, diagnostic centers, or mid-sized facilities seeking focused clinical support without full-scale EHR integration. Their flexibility in deployment, lower upfront investments, and ease of customization have sustained adoption. In fast-paced clinical environments, standalone tools can provide alerts and suggestions without slowing workflows. Their ability to interface with other clinical systems while operating autonomously ensures reliable performance and enhances diagnostic accuracy, which has continued to drive demand among cost-conscious providers.

The integrated EHR with CDSS segment is expected to register the highest CAGR during the forecast period. Integrated EHR with CDSS is becoming the preferred model for providers aiming to streamline clinical workflows and improve patient safety. The direct link between patient records and decision-support algorithms ensures that recommendations are contextually relevant and updated in real time. Physicians benefit from seamless access to alerts, treatment guidelines, and diagnostic suggestions within a single interface. This integration reduces documentation burden, enhances data consistency, and minimizes disruptions during patient interactions. Hospitals are increasingly investing in comprehensive health IT systems, making integrated EHR-CDSS solutions attractive for long-term digital infrastructure. The rising push for interoperability and coordinated care models continues to accelerate this trend.

Component Analysis

In terms of component, the segmentation includes hardware, software, and services. The services segment held the largest revenue share of ~41% in 2024, due to the demand for implementation, maintenance, training, and system upgrades has positioned services as the largest contributor to market revenue. Healthcare providers require expert support to ensure optimal configuration of CDSS platforms, regular system updates, and compliance with regulatory standards. In many cases, in-house IT teams rely on external vendors for technical guidance, security assurance, and performance optimization. Additionally, the need for user training and change management during CDSS adoption boosts the reliance on service providers. These value-added services reduce downtime and help facilities derive maximum clinical and financial benefits from the systems, sustaining their leading position in the market.

The software segment is projected to register the highest CAGR from 2025 to 2034, as advancements in artificial intelligence, machine learning, and natural language processing are transforming the CDSS landscape. Developers are introducing smarter, adaptive solutions capable of real-time data analysis, predictive modeling, and tailored clinical recommendations. The growing demand for cloud-native, interoperable, and user-friendly platforms continues to boost investments in software innovation. Healthcare organizations are shifting toward modular and scalable solutions that can integrate across diverse EHR systems and clinical networks. Increasing preference for customizable interfaces and analytics dashboards further strengthens demand. Frequent software updates that incorporate the latest medical guidelines and patient safety protocols also support long-term value creation in clinical workflows.

Application Analysis

In terms of application, the segmentation includes drug-drug interactions, drug allergy alerts, clinical reminders, clinical guidelines, drug dosing support, and others. The drug allergy alerts segment accounted for the largest revenue share of ~26% in 2024. Drug allergy alerts are essential to preventing life-threatening reactions during medication administration, making them a vital component of clinical decision-making. Hospitals and clinics rely on these alerts to avoid contraindications based on a patient’s allergy history, reducing adverse drug events and liability risks. CDSS solutions are widely used to flag potential allergic responses at the prescription stage, ensuring that providers receive timely warnings. Growing awareness about patient safety protocols and compliance with clinical best practices increased the integration of allergy alert functionalities. This use case remains a primary driver of CDSS adoption, particularly in high-volume healthcare settings.

The clinical guidelines segment is expected to witness the highest CAGR during 2025–2034, as the need to ensure evidence-based care is driving adoption of CDSS features that align clinical decisions with updated treatment protocols. Clinical guidelines support consistency in diagnosis and therapy across providers, helping reduce variation in care delivery. Dynamic updates and automation of new medical research into these guidelines make them highly valuable in improving patient outcomes. These tools assist healthcare professionals in staying current with evolving medical standards without added manual research. Institutions aiming to standardize care pathways and optimize resource use are increasingly prioritizing guideline-driven CDSS platforms. Their ability to embed clinical expertise directly into physician workflows is fueling rapid growth.

Delivery Mode Analysis

In terms of delivery mode, the segmentation includes web-based systems, cloud-based systems, and on-premise systems. The on-premise systems segment accounted for the largest revenue share of ~42% in 2024. On-premise deployment offers healthcare institutions greater control over data security, customization, and system performance. Many large hospitals and academic medical centers prefer these solutions for their ability to handle large volumes of sensitive patient data without relying on external networks. On-premise CDSS platforms provide faster response times and minimize risks related to internet outages. Institutions subject to strict regulatory environments also find on-site infrastructure more compliant with data governance policies. Although initial investment costs are higher, long-term benefits such as reduced latency, internal IT control, and system stability have made on-premise solutions a trusted choice for mission-critical applications.

The cloud-based systems segment is expected to register the highest CAGR from 2025 to 2034. since healthcare providers are increasingly shifting toward cloud-based CDSS platforms to benefit from lower infrastructure costs, enhanced scalability, and remote access capabilities. These systems enable continuous updates, real-time collaboration, and seamless integration with other cloud-based health IT tools. Smaller clinics and rural hospitals particularly benefit from cloud deployments due to reduced maintenance needs and better accessibility. Growing focus on telehealth and distributed care models is also boosting cloud adoption. Vendors are enhancing cloud platforms with advanced security, AI features and interoperability tools are making them suitable for enterprise-scale deployment. Flexible pricing and scalability further support their growing appeal across the sector.

Regional Analysis

In 2024, the North America clinical decision support systems market accounted for the largest revenue share of ~44% due to the widespread digitization of healthcare infrastructure and a strong focus on reducing diagnostic errors and improving treatment accuracy. Major health systems are adopting advanced CDSS platforms integrated with EHRs to streamline clinical workflows and comply with value-based care models. Strong regulatory initiatives, such as the meaningful use of health IT and interoperability mandates, have also supported adoption across hospitals and ambulatory centers. Continued investments in AI-driven healthcare technologies, robust IT infrastructure, and a high concentration of specialized care providers strengthen market leadership in the region. In May 2025, Rad AI announced strategic investments from four health systems to advance enterprise AI in the healthcare sector.

U.S. Clinical Decision Support Systems Market Insights

In 2024, the U.S. held the largest revenue share due to the presence of a mature healthcare IT ecosystem and a high level of clinical data digitization. Hospitals and integrated delivery networks are deploying CDSS tools to reduce unnecessary tests, minimize medication errors, and improve patient outcomes. A favorable reimbursement framework and government incentives for digital health adoption have accelerated implementation in both public and private facilities. Collaboration between healthcare institutions and technology companies is fostering innovation in clinical software tools. The growing demand for predictive analytics in chronic disease management and personalized medicine continues to boost the integration of CDSS into routine care practices.

Asia Pacific Clinical Decision Support Systems Market

The Asia Pacific industry is expected to register highest CAGR from 2025 to 2034 due to rapid healthcare modernization, increasing adoption of electronic health records (HER), and growing pressure on clinicians to manage rising patient loads efficiently. Governments across the region are prioritizing digital health investments to expand access, especially in underserved areas. Countries are launching national health information platforms and e-health initiatives that encourage CDSS deployment. The rising prevalence of chronic illnesses and aging populations push hospitals to adopt tools that support evidence-based care. For instance, the Asian Development Bank projected that by 2050, around 25% of the population in Asia and the Pacific will be over 60 years old. Emerging economies are also witnessing a rise in partnerships between health systems and technology vendors, making advanced clinical decision tools more accessible and scalable.

China Clinical Decision Support Systems Market Overview

China is showing strong growth due to rising investments in hospital digitization and increasing government emphasis on smart healthcare systems. The expanding middle class and healthcare reforms aimed at boosting quality and efficiency are accelerating the adoption of advanced clinical tools. Hospitals are integrating AI-powered CDSS platforms into their clinical workflows to improve diagnostic accuracy and optimize resource allocation. Startups and domestic tech companies are playing a key role by developing localized solutions that align with national healthcare standards. The integration of CDSS into large-scale public health databases and hospital information systems is further fueling the market’s momentum across urban and provincial regions.

Europe Clinical Decision Support Systems Market

The Europe CDSS market is expanding steadily due to the growing focus on harmonized health IT infrastructure and rising demand for patient safety solutions. Efforts to reduce clinical variation and improve guideline adherence have led to increased CDSS deployment across primary care and specialty hospitals. National digital health strategies and EU-level initiatives supporting interoperability and cross-border healthcare data sharing are creating a favorable environment for adoption. Healthcare providers are incorporating decision support tools into electronic prescribing and diagnostics to reduce medication-related errors and improve chronic disease management. The presence of established academic institutions and collaborative research programs also drives the continuous development and refinement of CDSS capabilities.

Key Players and Competitive Analysis

The competitive landscape of the clinical decision support systems (CDSS) market is shaped by continuous innovation, strategic collaborations, and growing demand for real-time data-driven solutions across healthcare ecosystems. Industry analysis reveals a strong focus on developing AI-powered platforms and integrating advanced analytics for predictive care delivery. Companies are adopting market expansion strategies through joint ventures with healthcare providers and IT vendors to co-develop customized solutions. Mergers and acquisitions are being pursued to enhance software capabilities, access proprietary datasets, and improve geographic reach.

Post-merger integration efforts are targeting interoperability improvements and seamless incorporation into existing electronic health records. Strategic alliances between clinical informatics firms and academic institutions are fostering technology advancements and real-world validation of CDSS tools. The market is also witnessing a rise in partnerships that combine clinical expertise with cloud computing infrastructure, enabling scalable and secure deployment models.

Vendors are investing in machine learning and natural language processing to improve accuracy, context awareness, and adaptability of decision algorithms. Regulatory compliance, usability design, and clinician training remain core areas of competitive differentiation. Stakeholders are also emphasizing workflow integration and user experience as key priorities, driving greater adoption in acute care, chronic disease management, and population health applications.

Key Players

- Agfa-Gevaert Group

- Allscripts Healthcare, LLC

- athenahealth, Inc.

- Becton, Dickinson and Company

- Cerner Corporation

- GE HealthCare

- IBM Corporation

- Koninklijke Philips N.V. (Royal Philips)

- McKesson Corporation

- NextGen Healthcare Inc.

- Nordic

- Siemens Healthineers GmbH

- Wolters Kluwer N.V.

Industry Developments

April 2025: Becton, Dickinson and Company introduced the HemoSphere Advanced Monitoring Platform, an AI-powered system designed to improve real-time hemodynamic monitoring and support clinical decision-making in critical care settings.

December 2023: EBSCO Information Services opened the Dyna Innovation Center in the U.S., aimed at advancing clinical decision tools through AI integration and digital health innovation.

Clinical Decision Support Systems Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Standalone CDSS

- Integrated CPOE with CDSS

- Integrated EHR with CDSS

- Integrated CDSS with CPOE & EHR

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Hardware

- Software

- Services

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Drug-Drug Interactions

- Drug Allergy Alerts

- Clinical Reminders

- Clinical Guidelines

- Drug Dosing Support

- Others

By Delivery Mode Outlook (Revenue, USD Billion, 2020–2034)

- Web-Based Systems

- Cloud-Based Systems

- On-Premise Systems

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Clinical Decision Support Systems Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.75 billion |

|

Market Size in 2025 |

USD 6.35 billion |

|

Revenue Forecast by 2034 |

USD 15.85 billion |

|

CAGR |

10.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.75 billion in 2024 and is projected to grow to USD 15.85 billion by 2034.

The global market is projected to register a CAGR of 10.7% during the forecast period.

In 2024, the North America clinical decision support systems market accounted for the largest revenue share of ~44% due to widespread digitization of healthcare infrastructure and a strong focus on reducing diagnostic errors and improving treatment accuracy.

A few of the key players in the market are Agfa-Gevaert Group; Allscripts Healthcare, LLC; athenahealth, Inc.; Becton, Dickinson and Company; Cerner Corporation; GE HealthCare; IBM Corporation; Koninklijke Philips N.V. (Royal Philips); McKesson Corporation; NextGen Healthcare Inc.; Nordic; Siemens Healthineers GmbH; and Wolters Kluwer N.V.

The standalone CDSS segment accounted for ~31% of the revenue share in 2024 due to its popularity among healthcare institutions that prefer modular solutions capable of functioning independently from broader electronic health record ecosystems.

The services segment held the largest revenue share of ~41% in 2024. The rising demand for implementation, maintenance, training, and system upgrades has positioned services as the largest contributor to market revenue.