U.S. Mobile Value-Added Services Market Size, Share, Trends, & Industry Analysis Report

By Solutions (SMS, MMS, Location-Based Services), By Organization Type, By Application, By Industry Vertical– Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 128

- Format: PDF

- Report ID: PM6055

- Base Year: 2024

- Historical Data: 2020-2023

Overview

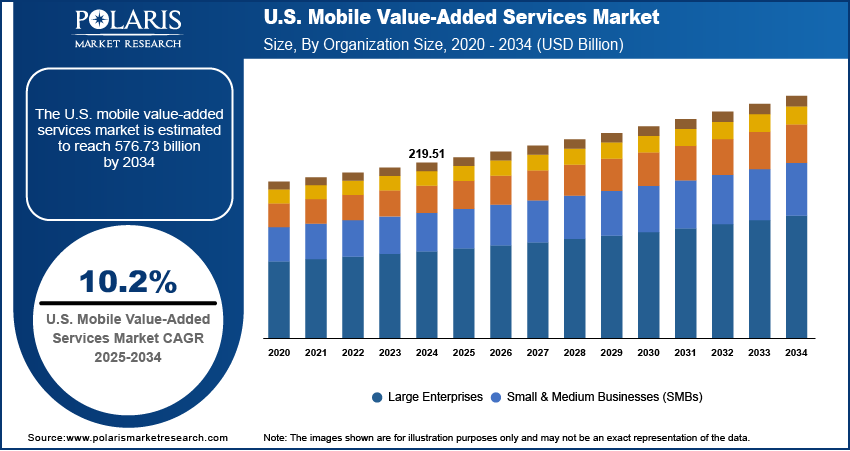

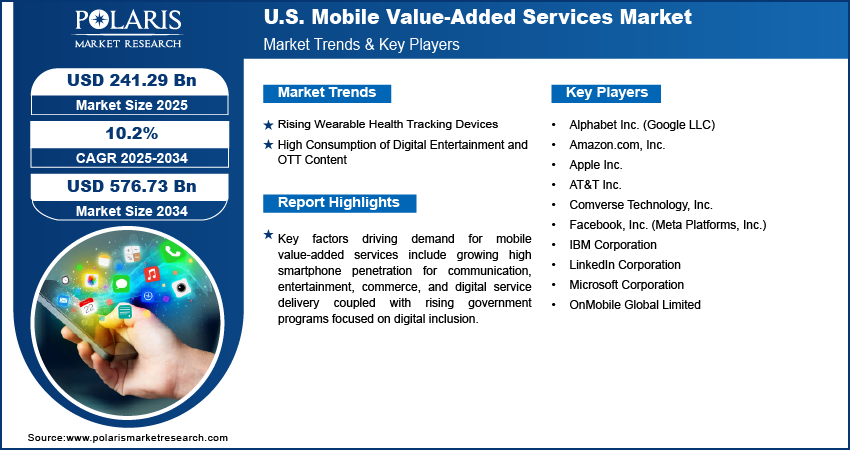

The US mobile value-added services (MVAS) market size was valued at USD 219.51 billion in 2024, growing at a CAGR of 10.2% from 2025–2034. The increasing use of wearable health devices and the growing consumption of digital entertainment are contributing to the rising demand for mobile value-added services in the US.

Key Insights

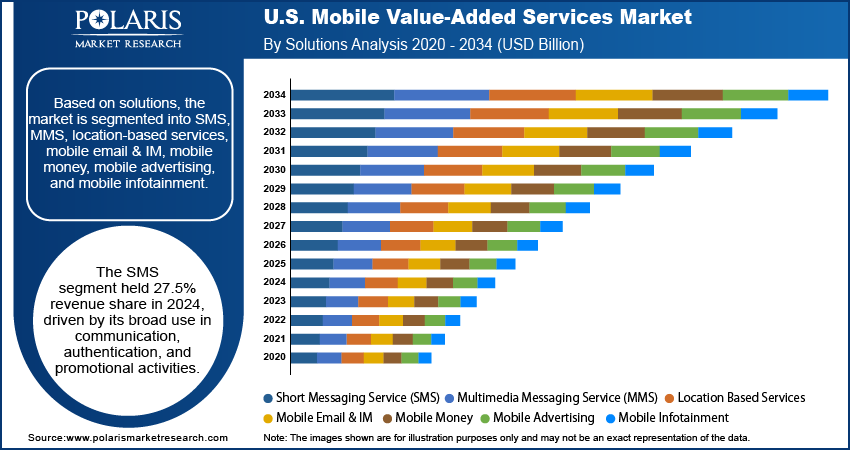

- The short messaging service (SMS) segment accounted for 27.5 % market share in 2024.

- The SMBs segment is projected to grow at the fastest rate over the forecast period, driven by increasing digital transformation efforts and the affordability of MVAS solutions.

Industry Dynamics

- Rising adoption of healthcare mobility solutions is accelerating the use of MVAS for virtual consultations, e-prescriptions, appointment scheduling, and remote health monitoring, enhancing mobile-driven patient engagement.

- High consumption of digital entertainment and OTT content is boosting demand for MVAS in streaming, gaming, and mobile media, with smartphones emerging as primary entertainment platforms.

- Fragmented regulatory frameworks around data privacy and digital advertising are restricting seamless MVAS delivery, increasing compliance complexity for service providers.

- Emerging technologies such as AI, AR/VR, and voice assistants are opening new opportunities to personalize services and improve user interaction through next-gen MVAS applications.

Market Statistics

- 2024 Market Size: 219.51 billion

- 2034 Projected Market Size: 241.29 billion

- CAGR (2024-2034): 10.2%

The US mobile value-added services market is growing significantly due to the highly developed digital ecosystem and widespread access to mobile broadband in the country. MVAS in the US includes a wide spectrum of offerings such as mobile entertainment, digital content subscriptions, real-time notifications, financial services, and location-based applications. These services are integrated into mobile platforms across sectors, including telecom, retail, healthcare, media, and finance to enhance customer interaction and service accessibility.

The US mobile value-added services (MVAS) market is growing steadily due to high smartphone penetration for communication, entertainment, e-commerce, and digital service delivery. According to Pew Research Center, 98% of Americans now own a cellphone, while approximately 91% own a smartphone. Mobile value-added services such as mobile banking, e-commerce platforms, healthcare apps, navigation tools, entertainment content, and mobile learning modules are integrated into daily routines to improve user experience and strengthen engagement. Rising smartphone accessibility, and the continued expansion of mobile internet coverage are increasing the adoption of MVAS across diverse demographics and geographies in the country.

Additionally, increasing government programs focused on digital inclusion are improving broadband access and digital infrastructure, thus fueling the market growth. This is enabling service providers to extend mobile-based offerings to broader user segments. Initiatives such as public Wi-Fi schemes, rural connectivity projects, and subsidized mobile access programs are bridging the digital divide. These initiatives are driving public-private partnerships, further accelerating mobile service penetration across underserved and remote areas of the country.

Drivers & Opportunities/Trends

Rising Wearable Health Tracking Devices

The growing adoption of wearable health tracking devices such as smartwatches, fitness bands, and smart rings is significantly boosting the US mobile value-added services (MVAS) market. According to the 2023 Digital Health Consumer Adoption Survey by Rock Health, 44% of Americans use wearable health tracking devices such as smartwatches and smart rings to monitor key health indicators such as sleep quality and heart rate. These devices are increasingly used to monitor vital health metrics such as heart rate, sleep quality, and physical activity, creating demand for real-time mobile health applications that sync data seamlessly with healthcare platforms. The demand for remote healthcare and personalized wellness solutions is encouraging MVAS providers to integrate health analytics, notifications, and reminders into mobile platforms. This is further fueled by the broader push toward digital health solutions and lifestyle-focused technology usage across the country.

High Consumption of Digital Entertainment and OTT Content

The rising demand for on-demand streaming and mobile-based content consumption, is propelling the entertainment-based MVAS market in the country. The growing preference for mobile devices as primary entertainment platforms is prompting telecom operators and content providers to offer services such as subscription management and real-time streaming updates. According to the Marketing & Advertising Global Network, more than 51 million US households actively stream content from OTT platforms, and 46% subscribe to two or more services, averaging 3.4 subscriptions per household. This widespread adoption of mobile streaming services is propelling providers to expand and diversify MVAS offerings in digital entertainment, driving growth in user engagement and revenue.

Segmental Insights

Solutions Analysis

Based on solution, the segmentation includes short messaging service (SMS), multimedia messaging service (MMS), location-based services, mobile email & IM, mobile money, mobile advertising, and mobile infotainment. The short messaging service (SMS) segment accounted for 27.5% revenue share in 2024, due to its widespread use in communication, authentication, customer engagement, and promotional campaigns across industries. SMS remains a reliable and low-cost channel for reaching a large user base in areas with limited internet access or basic mobile devices. Enterprises and government agencies are actively using SMS for alerts, service updates, and two-factor authentication, thereby driving a steady demand of MVAS.

The mobile money segment is projected to grow at the fastest rate during the forecast period, fueled by increasing adoption of digital payments, peer-to-peer transfers, and financial inclusion initiatives. Telecom operators, fintech companies, and banks are collaborating to expand mobile wallet services, in developing economies where access to formal banking remains limited. The growing emphasis on secure, real-time financial transactions is accelerating the integration of mobile money solutions into MVAS platforms.

Organization Size Analysis

By organization size, the market includes SMBs and enterprise. The large enterprise segment held the largest revenue share in 2024, owing to growing adoption of MVAS across industries. Businesses are leveraging mobile value-added services to enhance customer engagement, streamline communication, and offer tools such as mobile advertising, push notifications, and real-time support. Enterprises are leveraging MVAS to improve marketing strategies, enable remote workforces, and offer mobile-based loyalty programs that improve retention and personalization.

The SMBs segment is expected to witness the fastest growth over the forecast period, driven by increasing digital transformation efforts and the affordability of MVAS solutions. Small and medium businesses are increasingly using mobile platforms to access broader audiences, conduct transactions, and deliver content without requiring extensive infrastructure. As a result, cloud-enabled MVAS tools are gaining traction among businesses seeking scalable and cost-effective digital engagement solutions.

Application Analysis

By application, the market includes residential, commercial & institutional, and industrial. The commercial & institutional segment accounted for the largest share of the MVAS market in 2024. Enterprises, educational institutions, and public sector organizations are leveraging mobile value-added services to enhance digital communication, customer engagement, and operational efficiency. Services such as bulk messaging, mobile banking, location-based advertising, and enterprise mobility solutions are integrated into organizational workflows.

The residential segment is projected to grow at the fastest rate over the forecast period. Rising smartphone penetration and mobile internet usage in households across developing economies is increasing demand for personalized services such as mobile entertainment, cloud gaming, OTT content, and digital learning. Growth in digital literacy, mobile payments, and multilingual content is further accelerating the adoption of MVAS within residential applications.

Industry Vertical Analysis

By industry vertical, the market includes BFSI, media and entertainment, healthcare, education, retail, government, telecom & it, and others. The BFSI segment held the largest revenue share in 2024, due to high usage of mobile banking, account alerts, payment reminders, and fraud detection services. Banks and financial service providers are deploying MVAS to expand digital outreach, improve transaction security, and offer real-time customer service. The integration of mobile channels with banking systems is enhancing customer convenience and helping institutions scale services more efficiently.

The healthcare segment is anticipated to grow at the fastest pace during the forecast period, as hospitals, insurers, and telehealth providers increase the use of MVAS for appointment scheduling, medical alerts, patient education, and remote monitoring. The shift toward digital health platforms is pushing service providers to use SMS, mobile apps, and push notifications to engage patients and improve healthcare access, in remote or underserved regions across the country.

Key Players & Competitive Analysis Report

The US mobile value-added services (MVAS) market is moderately consolidated, with competition centered around service personalization, technological integration, and platform scalability. Major players are leveraging advancements in cloud computing, AI, and 5G infrastructure to expand MVAS offerings across entertainment, digital payments, mobile advertising, social media, and enterprise communication. Companies are heavily investing in app ecosystems and connected services that deliver high user engagement and seamless cross-platform functionality. Strategic collaborations between telecom operators, fintech companies, content creators, and technology platforms are further enhancing service innovation and market penetration. Players are focusing on delivering real-time services such as mobile commerce, streaming, location-based applications, and enterprise messaging to capture evolving consumer and business needs. Monetization strategies include freemium models, subscription plans, in-app transactions, and targeted digital advertising, aimed at increasing user retention and revenue streams. The growing digital transformation across healthcare, education, e-commerce, and enterprise communication sectors is fueling demand for intelligent and secure MVAS tools in the US.

Prominent companies operating in the US MVAS market include Alphabet Inc. (Google LLC), Amazon.com, Inc., Apple Inc., AT&T Inc., Comverse Technology, Inc., Facebook, Inc. (Meta Platforms, Inc.), IBM Corporation, LinkedIn Corporation, Microsoft Corporation, and OnMobile Global Limited.

Key Players

- Alphabet Inc. (Google LLC)

- Amazon.com, Inc.

- Apple Inc.

- AT&T Inc.

- Comverse Technology, Inc.

- Facebook, Inc. (Meta Platforms, Inc.)

- IBM Corporation

- LinkedIn Corporation

- Microsoft Corporation

- OnMobile Global Limited

Industry Developments

- November 2024: NUWAVE Communications, a leading provider of advanced communication solutions, launched its Business Text Messaging service in partnership with Clerk Chat. The service integrates SMS, MMS, and WhatsApp messaging into popular platforms like Webex, Microsoft Teams, and Zoom, transforming how businesses engage with customers across multiple channels.

- September 2024: Mastercard introduced its Payment Passkey Service, a new biometric-based authentication solution aimed at enhancing transaction speed and fraud prevention. The service leverages tokenization and biometric credentials to authorize payments without sharing sensitive information with merchants or third parties.

US Mobile Value-Added Services Market Segmentation

By Solutions Outlook (Revenue, USD Billion, 2020–2034)

- Short Messaging Service (SMS)

- Multimedia Messaging Service (MMS)

- Location Based Services

- Mobile Email & IM

- Mobile Money

- Mobile Advertising

- Mobile Infotainment

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Small & Medium Businesses (SMBs)

- Large Enterprises

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Residential

- Commercial & Institutional

- Industrial

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Media and Entertainment

- Healthcare

- Education

- Retail

- Government

- Telecom & IT

- Others

US Mobile Value-Added Services Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 219.51 Billion |

|

Market Size in 2025 |

USD 241.29 Billion |

|

Revenue Forecast by 2034 |

USD 576.73 Billion |

|

CAGR |

10.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, countrys, and segmentation. |

FAQ's

The US market size was valued at USD 219.51 billion in 2024 and is projected to grow to USD 576.73 billion by 2034.

The US market is projected to register a CAGR of 10.2% during the forecast period.

A few of the key players in the market are Alphabet Inc. (Google LLC), Amazon.com, Inc., Apple Inc., AT&T Inc., Comverse Technology, Inc., Facebook, Inc. (Meta Platforms, Inc.), IBM Corporation, LinkedIn Corporation, Microsoft Corporation, and OnMobile Global Limited.

The short messaging service (SMS) segment dominated the market in 2024, holding 27.5% share.

The large enterprise segment is expected to witness the fastest growth during the forecast period.