Conformal Coatings Market Size, Share, Trends, & Industry Analysis Report

By Material (Acrylic, Epoxy), By Application, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM1447

- Base Year: 2024

- Historical Data: 2020-2023

Overview

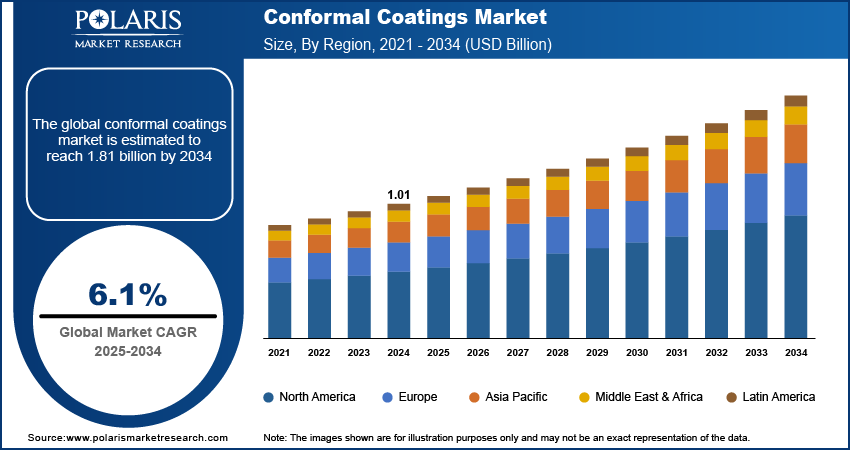

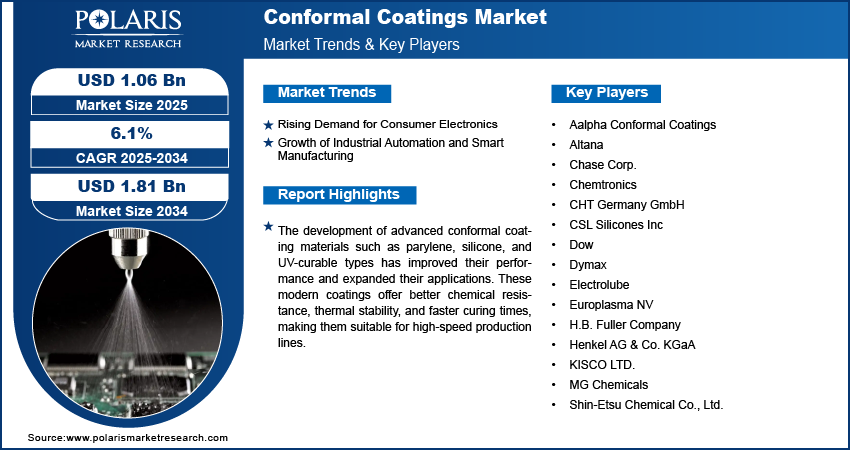

The global conformal coatings market size was valued at USD 1.01 billion in 2024, growing at a CAGR of 6.1% from 2025–2034. Key factors driving demand rising demand for consumer electronics, and growth of industrial automation and smart manufacturing.

Key Insights

- The acrylic segment is expected to grow at a CAGR of 5.7% during the forecast period due to its strong moisture resistance, fast drying time, and easy application and removal.

- The automotive segment held a significant revenue share of 15.30% in 2024, driven by increasing vehicle electrification and digitalization.

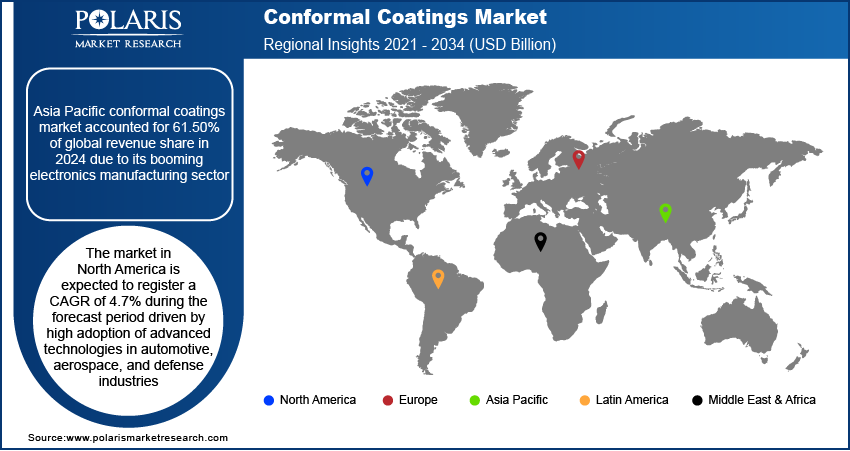

- Asia Pacific accounted for 61.50% of the global conformal coatings market revenue in 2024, supported by its booming electronics manufacturing sector.

- North America is projected to register a CAGR of 4.7% during the forecast period, fueled by the adoption of advanced technologies in automotive, aerospace, and defense industries.

- The U.S. market is experiencing rising demand due to strong R&D activity, a well-established electronics ecosystem, and expanding automotive and aerospace sectors.

Industry Dynamics

- Rising demand for consumer electronics are driving the demand for conformal coatings.

- Growth of industrial automation and smart manufacturing is driving the Conformal Coatings Market

- The development of advanced conformal coating materials such as parylene, silicone, and UV-curable types has improved their performance and expanded their applications.

- Limited availability of skilled labor and high costs of advanced conformal coating materials restrict market growth.

Market Statistics

- 2024 Market Size: USD 1.01 Billion

- 2034 Projected Market Size: USD 1.81 Billion

- CAGR (2025-2034): 6.1%

- Asia Pacific: Largest Market Share

AI Impact on the Conformal Coatings Market

- AI accelerates the development of conformal coatings by analyzing chemical formulations, curing times, and durability to create coatings with improved protection and performance.

- Integration of AI allows predictive modeling for optimizing coating processes, reducing experimental costs, and speeding up product innovation cycles.

- AI-powered analytics provide insights into market demands, customer preferences, and competitor strategies, enabling companies to tailor products more effectively.

- AI-driven automation enhances manufacturing efficiency, quality assurance, and supply chain management, leading to lower defects and operational expenses in conformal coating production.

Conformal coating is a thin protective chemical layer applied to electronic circuit boards to safeguard them from moisture, dust, chemicals, and temperature extremes. It "conforms" to the shape of the components, providing a uniform barrier without affecting performance. Commonly used coatings include acrylic, silicone, epoxy, urethane, and parylene.

Modern vehicles use complex electronics for navigation, entertainment, safety, and control systems. The number of electronic components in cars has grown rapidly with the rise of electric vehicles and smart driving technologies. These electronics has to withstand temperature changes, vibration, and moisture, especially in engines and exterior-mounted systems. Conformal coatings protect these components, preventing corrosion, short circuits, and performance issues. The need for reliable circuit protection increases as automotive technology becomes more advanced and software-driven. This makes conformal coatings a necessary solution for car manufacturers focused on improving product safety, longevity, and functionality in demanding driving conditions.

The development of advanced conformal coating materials such as parylene, silicone, and UV-curable types has improved their performance and expanded their applications. These modern coatings offer better chemical resistance, thermal stability, and faster curing times, making them suitable for high-speed production lines. Technological progress in application methods, including selective coating, robotic spraying, and dip coating, has improved precision and reduced material waste. These innovations make it easier for manufacturers to apply coatings efficiently while maintaining product quality. Consequently, more industries are adopting conformal coatings, for protection and for efficiency, sustainability, and overall improvement of manufacturing processes.

Drivers & Opportunities

Rising Demand for Consumer Electronics: The growing popularity of smartphones, tablets, smartwatches, and other personal devices is driving the need for protective solutions like conformal coatings. According to Apple Annual Report, smartphone sales rose from USD 191,973 million in 2021 to USD 205,489 million in 2022. Electronic device becomes more sensitive to moisture, dust, and other environmental risks as they become more compact and powerful. Conformal coatings provide a thin, invisible layer of protection over circuit boards, ensuring reliable performance and extended lifespan. Manufacturers are prioritizing durability with people using electronics more frequently in harsh or mobile environments. This demand for longevity and product quality continues to increase the use of conformal coatings across various consumer electronics applications, especially in high-humidity or outdoor settings.

Growth of Industrial Automation and Smart Manufacturing: Smart manufacturing and industrial automation are expanding globally, with factories using advanced machinery, sensors, and robotics that rely on electronics. These systems operate in challenging conditions, including heat, chemicals, and moisture. Conformal coatings are crucial to protect internal electronics, ensuring uninterrupted operation and reducing maintenance costs. The reliance on reliable electronics grows as industries digitize and adopt smart technologies. Whether it's in packaging lines, oil refineries, or water treatment facilities, coated electronics perform better and last longer. This shift toward smarter, more connected operations is creating consistent demand for conformal coatings to ensure equipment durability and operational efficiency, thereby fueling the growth.

Segmental Insights

Material Analysis

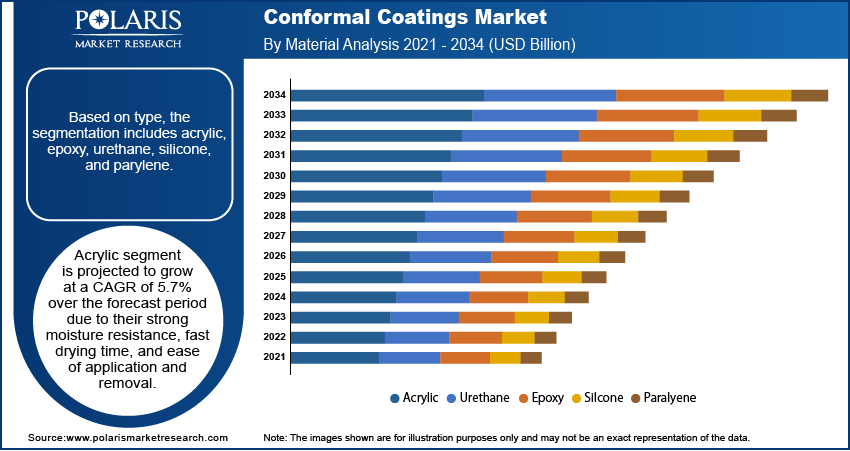

Based on type, the segmentation includes acrylic, epoxy, urethane, silicone, and parylene. Acrylic segment is projected to grow at a CAGR of 5.7% over the forecast period due to their strong moisture resistance, fast drying time, and ease of application and removal. The growing demand for quick-turnaround electronics manufacturing, where speed and cost-effectiveness are essential fuels the demand. Acrylic coatings can be easily reworked or repaired, which makes them ideal for high-volume production lines. Their compatibility with a variety of application methods, such as spraying, dipping, and brushing, further adds to their popularity. The need for affordable yet effective protection drives the acrylic coatings segment as consumer and industrial electronics grow more complex.

Epoxy segment is expected to witness a significant share over the forecast period as epoxy conformal coatings offer excellent chemical and abrasion resistance, making them well-suited for harsh industrial environments. This segment is driven by demand in heavy-duty applications, where electronics must perform reliably under exposure to oils, solvents, and physical wear. Epoxy coatings form a tough, protective barrier that adheres well to circuit boards, making them ideal for long-term performance in rugged conditions. Industries such as defense, aerospace, and automotive rely on epoxy coatings for durable protection. The demand for highly resilient coatings like epoxy rises as equipment and vehicles become more dependent on electronic systems, thereby fueling the segment growth.

Application Analysis

In terms of application, the segmentation includes electronics, aerospace & defense, medical, automotive, marine, industrial, others. The electronics held 38.55% of revenue share in 2024 driven by rapid growth in smartphones, wearables, computers, and other smart devices. These devices require protection from moisture, dust, and contaminants to ensure reliable operation, especially as they are used in increasingly mobile and outdoor environments. The miniaturization of electronics further makes them more sensitive to failure, increasing the demand for protective coatings. Additionally, the growing use of conformal coatings in printed circuit boards (PCBs), sensors, and IoT devices supports this segment’s expansion. Moreover, consumer demand for high-performance electronics rising further driving the need for effective coating solutions.

The automotive segment held significant revenue share in 2024, holding 15.30% due to the increasing electrification and digitalization of vehicles. Modern cars rely on electronics for engine control, infotainment, driver assistance, lighting, and safety features. These systems are exposed to temperature fluctuations, vibration, humidity, and corrosive elements. Conformal coatings provide essential protection to ensure the performance and durability of automotive electronics. The complexity and volume of onboard electronics increase as electric vehicles (EVs) and autonomous driving technologies expand. This trend directly fuels the demand for conformal coatings that withstand challenging road and weather conditions, supporting this segment’s growth.

Regional Analysis

Asia Pacific Conformal Coatings Market accounted for 61.50% of global revenue share in 2024 due to its booming electronics manufacturing sector. Countries like China, Japan, South Korea, and Taiwan are major hubs for consumer electronics, semiconductors, and automotive production. The region's strong presence of contract manufacturers and OEMs creates high demand for protective coatings to improve reliability and product lifespan. Rapid industrialization, urbanization, and increasing adoption of smart devices across emerging economies also drive growth. Moreover, government support for electronics production and rising demand for electric vehicles further fuel the need for conformal coatings in both consumer and industrial applications across Asia Pacific.

China Conformal Coatings Market Insight

The China held 30.64% of the revenue share within Asia Pacific in 2024, due to its dominant position in global electronics manufacturing. The country houses a vast number of PCB producers, component manufacturers, and assembly plants for smartphones, computers, and automotive electronics. Rising domestic consumption of electronic devices and the government's push for high-tech industries through initiatives like "Made in China 2025" are key growth drivers. Additionally, China’s growing EV industry and increasing focus on advanced driver-assistance systems in vehicles create further demand for protective coatings to ensure durability and performance under harsh conditions.

North America Conformal Coatings Market

The market in North America is expected to register a CAGR of 4.7% during the forecast period driven by high adoption of advanced technologies in automotive, aerospace, and defense industries. There is strong demand for coatings that provide protection against moisture, vibration, and chemical exposure. The rise of electric and autonomous vehicles, especially in the U.S., is expanding the use of circuit boards and sensors that require conformal coatings. Moreover, investments in defense electronics and medical devices support sustained demand. The region also benefits from a strong focus on innovation, with manufacturers developing high-performance coatings tailored for next-generation electronic applications.

U.S. Conformal Coatings Market Overview

The demand for conformal coatings in U.S. is rising as The U.S. market benefits from strong R&D activity, a well-established electronics ecosystem, and expanding automotive and aerospace sectors. The growing use of conformal coatings in military and defense applications is a major driver, where performance and reliability are non-negotiable. Additionally, the U.S. is witnessing rising demand for electric vehicles, smart medical devices, and wearable technologies all of which require compact, durable electronics protected by conformal coatings. Government funding in high-tech sectors and increasing awareness of product quality and safety further support growth.

Europe Conformal Coatings Market

The industry in the Asia Pacific is projected to grow at a CAGR of 4.1% from 2025 to 2034, driven by the region’s strong industrial base, particularly in automotive, aerospace, and medical device manufacturing. Countries like Germany, France, and the UK are at the forefront of developing sophisticated electronic systems that require advanced protection against moisture, temperature, and chemical exposure. The automotive sector's transition toward electric vehicles (EVs) and increasing integration of electronics in both safety and infotainment systems are major growth contributors. Additionally, strict regulatory standards for reliability and environmental safety push manufacturers to adopt high-quality coating materials. Europe's focus on sustainability and innovation further encourages the use of eco-friendly, low-VOC conformal coatings.

Key Players & Competitive Analysis

The conformal coatings market is characterized by strong competition among global and regional players, each striving to innovate and expand their footprint across industries such as electronics, automotive, aerospace, and medical. Key companies like Dow, Henkel AG & Co. KGaA, H.B. Fuller Company, and Shin-Etsu Chemical Co., Ltd. dominate through extensive R&D, broad product portfolios, and strong distribution networks. Mid-sized firms such as Chase Corp., Altana, and Dymax are also investing in advanced formulations and sustainable coatings to gain market share. Specialized players like Electrolube, Chemtronics, and Europlasma NV focus on niche segments, including eco-friendly and Parylene coatings. Strategic collaborations, mergers, and acquisitions are frequent, aimed at accessing new technologies and expanding geographically. Moreover, increasing demand for miniaturized electronics and growing regulatory emphasis on VOC-free solutions are pushing companies to develop innovative, high-performance coatings. As competition intensifies, differentiation through performance, reliability, and sustainability is becoming crucial for long-term success.

Key Players

- Aalpha Conformal Coatings

- Altana

- Chase Corp.

- Chemtronics

- CHT Germany GmbH

- CSL Silicones Inc

- Dow

- Dymax

- Electrolube

- Europlasma NV

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- KISCO LTD.

- MG Chemicals

- Shin-Etsu Chemical Co., Ltd.

Industry Developments

July 2024, Dow introduced the DOWSIL CC‑8000 Series a solventless UV and dual moisture cure conformal coating. It enabled rapid, energy-efficient curing via UV/LED light, delivered superior protection in harsh conditions, and promoted sustainability by improving safety and operational efficiency.

October 2024, Curtiss-Wright launched parylene conformal coating capabilities at its Evesham, UK facility. This expansion enabled localized service for UK medical and electronics manufacturers, enhancing efficiency and unlocking new business opportunities with advanced, ultra-thin protective coating technology.

Conformal Coatings Market Segmentation

By Material Outlook (Volume, Kilo Tons, Revenue, USD Billion, 2021–2034)

- Acrylic

- Urethane

- Epoxy

- Silcone

- Paralyene

By Application Outlook (Volume, Kilo Tons, Revenue, USD Billion, 2021–2034)

- Electronics

- Aerospace & Defense

- Medical

- Automotive

- Marine

- Industrial

- Others

By Regional Outlook (Volume, Kilo Tons, Revenue, USD Billion, 2021–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Conformal Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.01 Billion |

|

Market Size in 2025 |

USD 1.06 Billion |

|

Revenue Forecast by 2034 |

USD 1.81 Billion |

|

CAGR |

6.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilo Tons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.01 billion in 2024 and is projected to grow to USD 1.81 billion by 2034.

The global market is projected to register a CAGR of 6.1% during the forecast period.

Asia Pacific dominated the market in 2024

A few of the key players in the market are Aalpha Conformal Coatings; Altana; Chase Corp.; Chemtronics; CHT Germany GmbH; CSL Silicones Inc; Dow; Dymax; Electrolube; Europlasma NV; H.B. Fuller Company; Henkel AG & Co. KGaA; KISCO LTD.; MG Chemicals; Shin-Etsu Chemical Co., Ltd.

The acrylic segment dominated the market revenue share in 2024.

The automotive segment is projected to witness the fastest growth during the forecast period.

The automotive segment is projected to witness the fastest growth during the forecast period.