Content Disarm and Reconstruction Market Share, Size, Trends, Industry Analysis Report

By Services (Solution and Services); By Deployment Mode; By End-Use; By Organization Size; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 117

- Format: PDF

- Report ID: PM2925

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

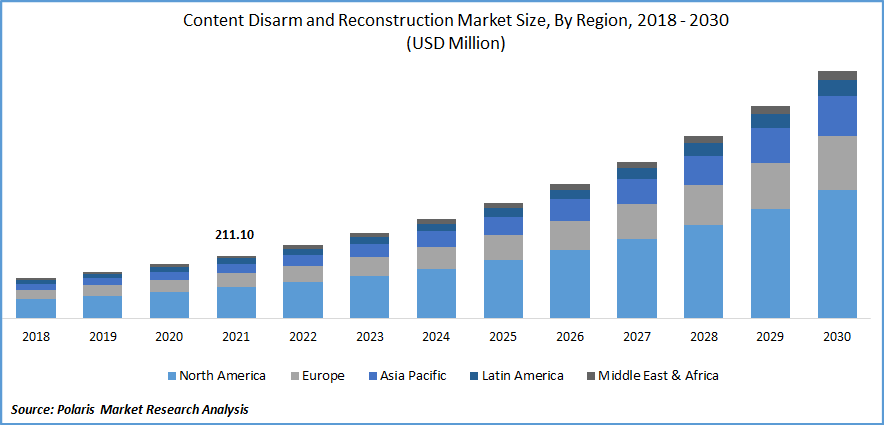

The global content disarm and reconstruction market was valued at USD 211.10 million in 2021 and is expected to grow at a CAGR of 16.4% during the forecast period.

Increasing numbers of file-based and malware attacks & growing need to safe data from persistent threats & ransomware, zero-day assaults & automation for optimizing the cost & scale of their experiences by various business industries around the world are significant factors driving the growth. Moreover, a rise in the acceptance of cloud solutions and high development in cybersecurity solutions among connected Internet of Things (IoT) devices are further projected to boost the demand.

Know more about this report: Request for sample pages

For instance, in August 2022, Incorta, an analytics platform provider, announced the launch of its new data analysis applications. This is a development toolkit & an online marketplace where they can easily create & sell their analytical content. The company also said that they are working on getting its connector and component software developer kits with a goal of providing access to build custom data applications and other types of analytical content.

However, lack of security professionals and relevant skills across the globe is a major factor expected to hinder the growth of the global content disarm and reconstruction market during the projected period and as it requires latest know-how, trained and skilled in analytics and cloud computing knowledge to tackle the rising security threats and malware attacks worldwide.

The outbreak of the COVID-19 pandemic has positively impacted the growth of the content disarm and reconstruction market. With the rapid emergence of deadly coronavirus across the globe, remote working has been boosted. Due to this, the need for content disarm and reconstruction solutions is increased to respond to the escalating threat. Cyber-attacks and various types of security threats were more common during the pandemic as people use technology to stay informed and operate their businesses more efficiently, which has fueled the adoption of these solutions extensively.

Industry Dynamics

Growth Drivers

The growing demand for content disarm and reconstruction services/solutions across the globe, owing to increasing cost of data breaches, is a key factor expected to drive the global market. With the rapid surge in file-sharing between co-workers working remotely and partners, vendors, and customers, enterprises face highly elevated risks and vulnerabilities. With the help of effective CDR solutions, companies can reduce the cost of data breaches and manage their data more safely.

Furthermore, due to its flexible and powerful infrastructure, a rapid increase in demand for cloud-based security solutions among small and medium enterprises is expected to boost the adoption of CDR solutions among SMEs in the coming years.

Moreover, through implementing a cloud-based model, enterprises get access to manage all their applications, which is likely to fuel the adoption of these solutions among SMEs. For instance, in September 2022, Zscaler, a publicly traded cloud-security company, acquired a Silicon Valley-based startup called ShiftRight with a value of USD 25.6 million. With this acquisition, ShiftRight’s technology will help the company strengthen its offerings and tackle various security challenges.

Report Segmentation

The market is primarily segmented based on component, deployment mode, end-use, organization size, and region.

|

By Component |

By Deployment Mode |

By End-Use |

By Organization Size |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Services segment is expected to witness the fastest growth

The services segment is expected to grow significantly over the projected period due to rising popularity among various industries for different purposes, including consulting, implementation, training, education, integration, and support, which are required at several stages, starting from the pre-sales requirement to execution and product deployment of post-sales. Services play a crucial role in effectively implementing solutions, such as providing training, managing, and sustaining the software solution, which is likely to propel the growth of the segment market in the next coming years.

Cloud-based segment expected to hold a significant market share

The cloud-based deployment mode is expected to hold substantial market revenue share in 2021 owing to increasing migration from an on-premises deployment to cloud deployment as it offers reduced cost of operations, making the technology easily accessible to the organizations and providing good infrastructure support.

In addition, cloud services dost not require any upfront costs or can pay according to the user’s requirements. It offers several types of benefits to the businesses, such as scalability, faster deployment, and access from anywhere and anytime, fueling the growth of the segment market in recent years and expected to do so during the forecast period.

Furthermore, there is a growing trend of the PaaS & IaaS among SMBs for several cloud services, CRM, email, internal communication, and file sharing. SMBs across the globe are more willing to deploy cloud-based infrastructure in their network as they are adopting new & innovative technologies.

Manufacturing sector is likely to expand faster during the anticipated period

The manufacturing industry is anticipated to register at a high CAGR on account of the increasing efforts by government organizations to deploy advanced and innovative technologies in the industry for higher infrastructure development. In the last few years, various manufacturing companies across the world are highly relying on software applications for the automation of their processes, facilitating R&D, and effective management of supply chains.

In addition, the rising prevalence of digitalization of manufacturing processes and products has paved the way for vulnerable networks and endpoints to various types of advanced threats and data-related issues. These factors are further expected to drive the adoption and growth of the segment market in the coming years.

Large enterprises segment accounted for the highest market share in 2021

The large enterprise segment accounted for a significant revenue share and is projected to retain its position throughout the forecast period. The growth of the segment market is mainly attributable to the high adoption rate of advanced technologies among these enterprises due to large funding capacity and global reach.

Moreover, with rising penetration of content disarm and reconstruction solutions worldwide to reduce the spread of cyber-attacks involving APTs and ransomware, the integration of these solutions in large enterprises has gained high growth and positively contributed to the segment market.

North America dominated the global market in 2021

North America dominated the market and accounted for a healthy market revenue share in 2021 and is expected to maintain its dominance during the projected period. The market’s growth is mainly driven by increasing instances of sophisticated cyber-attacks and a rapid surge in cost-effective cloud-based cybersecurity solutions. In the region, the United States is the most significant contributor to the market growth as the adoption of advanced IT solutions in the country is higher as compared to other.

Moreover, Asia Pacific region is witnessing a significant growth rate over the next coming years owing to increasing spending on the security sector and a large number of established SMEs to cater to the large consumer base and growing demand for these solutions. Various regional organizations are shifting towards cloud-based services/solutions to speed up and improve their business performance, which is augmenting the market's growth in the region.

Competitive Insight

Some of the major players operating in the global market include Check Point Software Technologies, Broadcom, Deep Secure, ReSec Technologies, Glasswall Solutions, Sasa Software, Votiro, Peraton, Jiran Security, Fortinet, OPSWAT, CybACE Solutions, Gatefy, Solebit, Symantec, and Yazamtech.

Recent Developments

In March 2022, Glasswall Solutions, announced the availability of its desktop CDR tool in a freemium version named Glasswall Desktop Freedom. This technology has mainly developed to assist in safeguarding organizations in both private and public sectors from various types of hazards of file-based attacks, including malware and ransomware.

Furthermore, in June 2021, Check Point Software Technologies announced the launch of its new product, Check Point CloudGuard Workload Protection, an automated cloud workload advanced security solution that empowers the security teams with tools to efficiently automate the security among various applications, programming interfaces, and microservices.

Content Disarm and Reconstruction Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 245.25 million |

|

Revenue forecast in 2030 |

USD 826.77 million |

|

CAGR |

16.4% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Deployment Mode, By End-Use, By Organization Size, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Check Point Software Technologies, Broadcom, Deep Secure, Resec Technologies, Glasswall Solutions, Sasa Software, Votiro, Peraton, Jiran Security, Fortinet Inc., OPSWAT Inc., CybACE Solutions, Gatefy, Solebit, Symantec, and Yazamtech. |