Cryptocurrency Payment Solutions Market Size, Share, Trends, Industry Analysis Report

: By Cryptocurrency Type (Bitcoin, Ethereum, Stablecoins, and Others), Payment Gateways, Deployment Mode, Industry Vertical, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025– 2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM5610

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

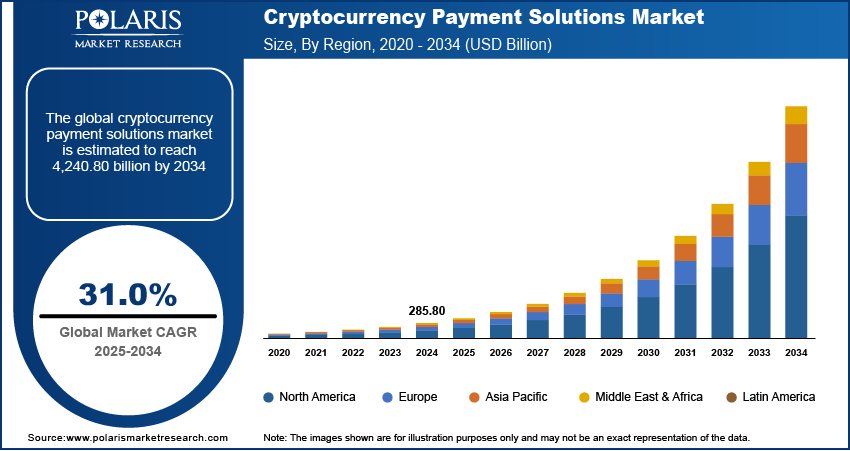

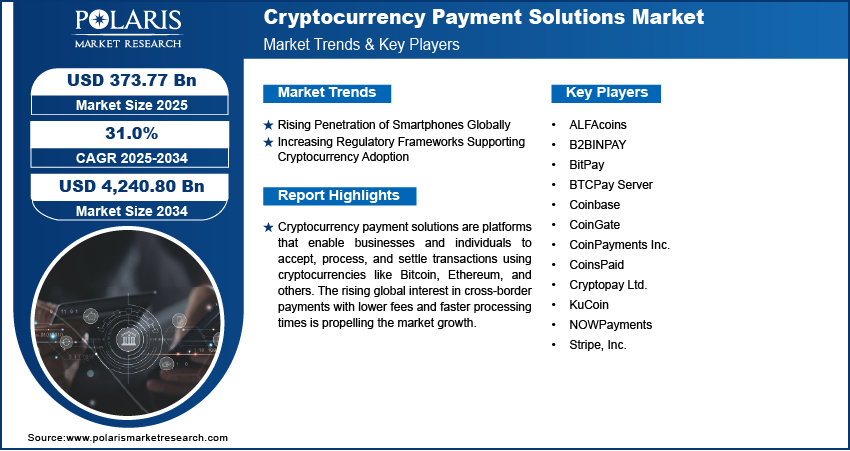

The cryptocurrency payment solutions market size was valued at USD 285.80 billion in 2024 and is expected to register a CAGR of 31.0% from 2025 to 2034. The increasing interest in cross-border payments with lower fees and faster processing times propels market growth. Further, the expansion of web-based cryptocurrency payment gateways boosts the demand for cryptocurrency payment solutions.

Key Insights

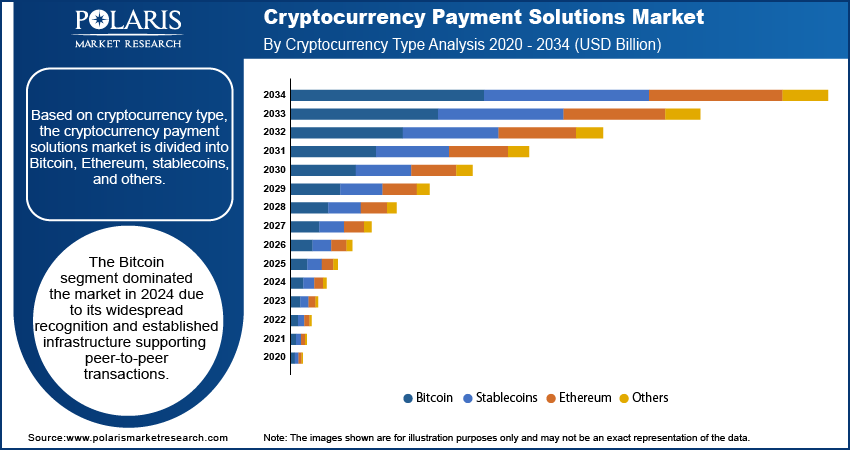

- The Bitcoin segment dominated the market in 2024. It is due to its widespread recognition and established infrastructure supporting peer-to-peer transactions.

- The online payment processors segment accounted for a major share in 2024. The dominance is attributed to the increasing adoption of e-commerce platforms and surging cross-border digital transactions.

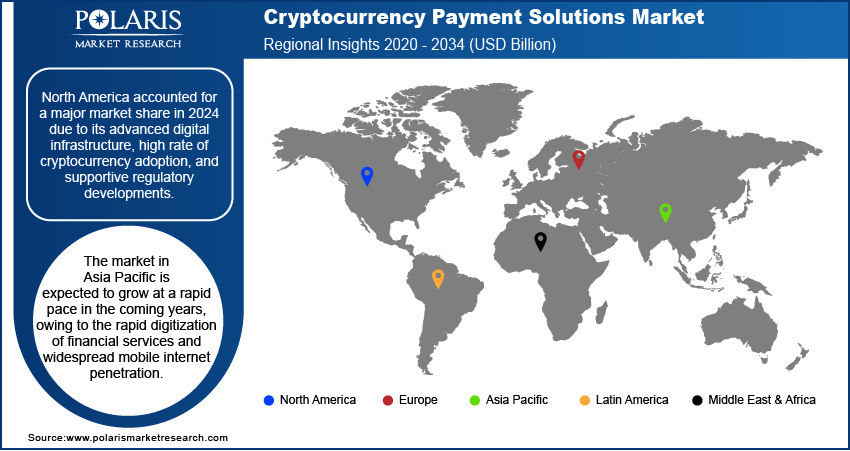

- North America accounted for a major market share in 2024. Its advanced digital infrastructure and high rate of cryptocurrency adoption fuel the dominance of the regional industry.

- The market in Asia Pacific is expected to grow at a rapid pace in the coming years. The growth is driven by the rapid digitization of financial services and widespread mobile internet penetration.

Industry Dynamics

- The rising penetration of smartphones and 5G networks is boosting the demand for cryptocurrency payment solutions.

- The increasing introduction of regulatory frameworks supporting cryptocurrency adoption fuels the adoption of cryptocurrency payment solutions.

- Lack of awareness of cryptocurrency, especially in developing countries, hinders the industry growth.

- Growing DeFi and Web3 ecosystems are playing a key role in the advancement of cryptocurrency payment apps. This factor is expected to offer lucrative opportunities in the coming years.

Market Statistics

2024 Market Size: USD 285.80 billion

2034 Projected Market Size: USD 4,240.80 billion

CAGR (2025–2034): 31.0%

North America: Largest market in 2024

AI Impact on Cryptocurrency Payment Solutions Market

- Artificial intelligence (AI) algorithms analyze behavioral patterns and anomalies. It helps detect and prevent fraudulent transactions.

- AI-enabled biometric and document verification tools enhance Know Your Customer (KYC) processes. These tools reduce the risks of identity theft.

- The technology minimizes manual intervention and errors by streamlining the reconciliation and settlement processes.

- AI offers customization in crypto payment experiences as it analyzes spending patterns, offering personalized recommendations and reminders.

To Understand More About this Research: Request a Free Sample Report

Cryptocurrency payment solutions are platforms that enable businesses and individuals to accept, process, and settle transactions using cryptocurrencies like Bitcoin, Ethereum, and others. These solutions leverage blockchain technology to provide secure, fast, and cost-effective payment processing without relying on traditional financial institutions. Cryptocurrency payment solutions are widely used across industries such as healthcare, education, and retail. These solutions allow businesses to expand their customer base by accepting alternative payment methods, reduce transaction fees compared to traditional systems, and protect against fraud and chargebacks. Additionally, cryptocurrency payment solutions such as crypto wallets facilitate cross-border transactions without currency conversion fees.

The rising global interest in cross-border payments with lower fees and faster processing times is propelling the cryptocurrency payment solutions market growth. For instance, the Payments Association estimates that the value of cross-border payments will increase from almost USD 150 trillion in 2017 to over USD 250 trillion by 2027. Businesses and individuals are increasingly seeking alternatives to traditional banking systems for cross-border payments, as they involve high transaction fees, long processing delays, and currency conversion complications. Cryptocurrency offers a compelling solution to these issues. It allows for fast settlement and significantly reduces transaction costs by eliminating intermediaries. Moreover, cryptocurrency platforms operate 24/7, giving users the freedom to initiate and complete transactions without the constraints of banking hours or regional holidays. This accessibility enhances their appeal to businesses with global operations and customers who are involved in cross-border payments. Therefore, the rising cross-border payments are fueling the need for cryptocurrency payment solutions.

The cryptocurrency payment solutions market demand is driven by the expansion of web-based cryptocurrency payment gateways. Businesses globally are integrating cryptocurrency payment gateways into their websites and e-commerce platforms to create seamless payment experiences for customers who prefer using digital currencies or cryptocurrencies. These gateways simplify the technical process of accepting crypto payments, allowing merchants to receive funds quickly and securely without needing in-depth blockchain knowledge. Web-based gateways also support a wide range of cryptocurrencies, giving users more flexibility. This variety attracts a broader customer base, including tech-savvy consumers and those in regions with limited access to traditional banking. Moreover, web-based cryptocurrency payment gateways include features like real-time exchange rate conversion, fraud protection, and instant settlement, which further strengthen their appeal among businesses and encourage them to use other cryptocurrency payment solutions such as crypto wallets and crypto ATM.

Market Dynamics

Rising Penetration of Smartphones Globally

The rising penetration of smartphones, including 5G smartphones globally, is boosting the demand for cryptocurrency payment solutions. For instance, according to the Groupe Spéciale Mobile Association (GSMA’s) annual State of Mobile Internet Connectivity Report 2023, over 54% of the global population owns a smartphone, and the number is expected to increase in the coming years. Smartphones provide an accessible and convenient platform for users to manage digital assets such as cryptocurrencies, execute transactions, and interact with blockchain-based services. They have become essential tools for users who want to send, receive, and spend cryptocurrencies on the go. Smartphone apps such as Trust Wallet, MetaMask, and Binance Pay allow seamless crypto transactions with just a few taps, eliminating the need for traditional banking infrastructure. This ease of use encourages more consumers and merchants to adopt cryptocurrency payments, particularly in regions where banking services are limited or expensive. Additionally, smartphones enable real-time access to decentralized finance (DeFi) platforms, peer-to-peer (P2P) exchanges, and crypto payment gateways, which encourages smartphone users to invest in cryptocurrencies through cryptocurrency payment solutions.

Increasing Regulatory Frameworks Supporting Cryptocurrency Adoption

Governments globally are introducing clear guidelines for the use of digital assets such as cryptocurrencies to boost confidence among businesses and consumers in crypto payment systems. These frameworks are also encouraging more institutions and service providers to enter the market. Banks, payment processors, and fintech companies are now more willing to offer crypto-related services. This involvement of banks and fintech companies is expanding the infrastructure needed to support the widespread adoption of cryptocurrency payment solutions among businesses and individuals.

Segment Insights

Market Evaluation by Cryptocurrency Type

Based on cryptocurrency type, the market is divided into Bitcoin, Ethereum, stablecoins, and others. The Bitcoin segment dominated the market in 2024 due to its widespread recognition and established infrastructure supporting peer-to-peer transactions. Merchants and payment processors have prioritized Bitcoin integration into their existing transaction systems due to its strong brand presence and high liquidity. Consumers also trust it as a store of value and a medium of exchange, particularly for cross-border transactions. Major companies, including some in the travel, retail, and tech sectors, accept Bitcoin payments, further boosting its transactional use. Its decentralized nature and security features have given users additional confidence, especially in regions with unstable local currencies or limited access to traditional banking services, contributing to its dominance.

The stablecoins segment is expected to grow at a rapid pace in the coming years, owing to its value stability. Regulatory developments are also estimated to favor stablecoins, as they often align more closely with compliance requirements and risk management standards. Financial institutions and fintech platforms have begun integrating stablecoin payment, increasing their reach and usability. Stablecoins are positioned to become the preferred digital asset for day-to-day transactions with growing institutional interest and improved scalability.

Market Insight by Payment Gateways

In terms of payment gateways, the market is segregated into online payment processors, mobile payment solutions, and point-of-sale (POS) systems. The online payment processors segment accounted for a major share of the market in 2024 due to the increasing adoption of e-commerce platforms and the surge in cross-border digital transactions. Businesses have prioritized integrating crypto-compatible payment gateways that enable seamless and fast settlement, reducing transaction costs and minimizing reliance on traditional financial intermediaries. The ability of online processors to support a wide range of cryptocurrencies, coupled with improved security features such as multi-signature wallets and decentralized identity verification, has significantly boosted user trust and adoption. Moreover, partnerships between major e-commerce platforms and crypto payment service providers have further expanded the reach of these solutions, particularly in regions with high digital penetration and limited banking infrastructure.

Regional Analysis

By region, the cryptocurrency payment solutions market report provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for a major market share in 2024 due to its advanced digital infrastructure, high rate of cryptocurrency adoption, and supportive regulatory developments. US-based companies such as Coinbase, BitPay, and Strike have fueled innovation by offering scalable and secure payment platforms that support both retail and enterprise-level crypto transactions. Institutional interest in digital assets has further supported the region’s dominance as major financial players and tech firms have integrated crypto payment solutions into their operations. People in the region have also contributed to its leading market position by increasingly favoring decentralized payment options, including cryptocurrency payment solutions that offer faster settlements and lower fees compared to traditional banking systems.

Asia Pacific is expected to grow at a rapid pace in the coming years, owing to the rapid digitization of financial services and widespread mobile internet penetration. India is expected to play a crucial role in driving regional growth due to its booming fintech sector, massive smartphone user base, and increasing interest in digital currencies for both domestic and cross-border transactions. For instance, according to data published by the World Economic Forum, India had over 700 million smartphone users in January 2023.

Local startups and global exchanges have expanded their presence in India, developing crypto payment solutions tailored to small businesses and unbanked populations. The region’s growing participation in decentralized finance and Web3 ecosystems also reflects a shift toward cryptocurrencies that prioritize accessibility, security, and speed, contributing to the region’s growth.

Key Players and Competitive Insights

The cryptocurrency payment solutions market is highly competitive, with key players leveraging strategic mergers, acquisitions, partnerships, and collaborations to expand their market presence and enhance their product portfolios. Major companies such as BitPay and Coinbase are aggressively pursuing M&A activities to integrate blockchain technology and broaden their service offerings. Partnerships and collaborations are also shaping the competitive landscape, as fintech companies and traditional financial institutions collaborate with crypto payment providers to facilitate seamless transactions.

The cryptocurrency payment solutions market is fragmented, with the presence of numerous global and regional market players. Major players in the market include ALFAcoins; B2BINPAY; BitPay; BTCPay Server; Coinbase; CoinGate; CoinPayments Inc.; CoinsPaid; Cryptopay Ltd.; KuCoin; NOWPayments; and Stripe, Inc.

BitPay is a major cryptocurrency payment service provider based in Atlanta, Georgia. Founded in 2011, it offers comprehensive solutions for businesses and individuals to process cryptocurrency transactions seamlessly. BitPay enables merchants to accept payments in Bitcoin, Ethereum, Dogecoin, Litecoin, and over 100 other cryptocurrencies, attracting crypto-savvy customers who typically spend more than traditional credit card users. Businesses benefit from BitPay's ability to shield them from cryptocurrency price volatility by ensuring payouts in strong currencies such as dollars or euros. This feature has made BitPay a trusted partner for enterprises seeking to adopt blockchain-based payment systems. BitPay also facilitates global commerce by offering payment buttons, hosted checkout solutions, embeddable invoices for websites, and integrations with e-commerce platforms.

ALFAcoins, established in 2013, is a secure and versatile cryptocurrency payment gateway designed to facilitate seamless transactions for merchants and individuals worldwide. Based in Seychelles, the platform supports a wide range of cryptocurrencies, including Bitcoin, Bitcoin Cash, Ethereum, Litecoin, Dash, XRP, and ERC-20 Tether. ALFAcoins enables businesses to accept cryptocurrency payments with ease through its API, widgets, and e-commerce plugins, making it an ideal solution for industries such as e-commerce, gaming, online shopping, betting, and fashion. ALFAcoins emphasizes user convenience with its streamlined interface and robust integration options for online businesses. Merchants can easily incorporate cryptocurrency payments into their existing systems while enjoying the benefits of fraud protection and reduced chargebacks. Additionally, the platform records all transactions on blockchain technology, ensuring transparency and security for both buyers and sellers.

List of Key Companies:

- ALFAcoins

- B2BINPAY

- BitPay

- BTCPay Server

- Coinbase

- CoinGate

- CoinPayments Inc.

- CoinsPaid

- Cryptopay Ltd.

- KuCoin

- NOWPayments

- Stripe, Inc.

Cryptocurrency Payment Solutions Industry Developments

April 2025: AEON announced AEON Pay's expansion into the Philippines with QR Ph Integration, bringing seamless crypto payments to local consumers.

January 2025: KuCoin announced the launch of KuCoin Pay, a new payment platform designed to help merchants accept cryptocurrency transactions.

Cryptocurrency Payment Solutions Market Segmentation

By Cryptocurrency Type Outlook (Revenue, USD Billion, 2020–2034)

- Bitcoin

- Ethereum

- Stablecoins

- Others

By Payment Gateways Outlook (Revenue, USD Billion, 2020–2034)

- Online Payment Processors

- Mobile Payment Solutions

- Point-of-Sale (POS) Systems

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Cloud-Based

- On-Premises

- Hybrid

By Industry Vertical Outlook (Revenue, USD Billion, 2020–2034)

- Retail & E-Commerce

- Hospitality

- Gaming & Entertainment

- BFSI

- Healthcare

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 285.80 billion |

|

Market Size Value in 2025 |

USD 373.77 billion |

|

Revenue Forecast by 2034 |

USD 4,240.80 billion |

|

CAGR |

31.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 285.80 billion in 2024 and is projected to grow to USD 4,240.80 billion by 2034.

The global market is projected to register a CAGR of 31.0% during the forecast period.

North America held a major market share in 2024.

Some of the key players in the market are ALFAcoins; B2BINPAY; BitPay; BTCPay Server; Coinbase; CoinGate; CoinPayments Inc.; CoinsPaid; Cryptopay Ltd.; KuCoin; NOWPayments; and Stripe, Inc.

The online payment processors segment dominated the market in 2024.

The stablecoins segment is expected to grow at the fastest pace in the coming years.