Current Sensor Market Size, Share, Trends, Industry Analysis Report

: By Current Sensing Method (Direct Current Sensing and In-Direct Current Sensing), Loop, Technology, Output, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 120

- Format: PDF

- Report ID: PM5558

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

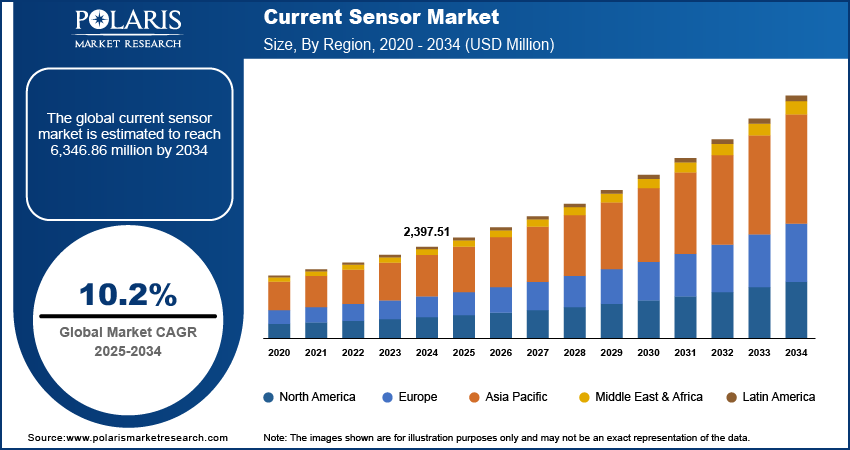

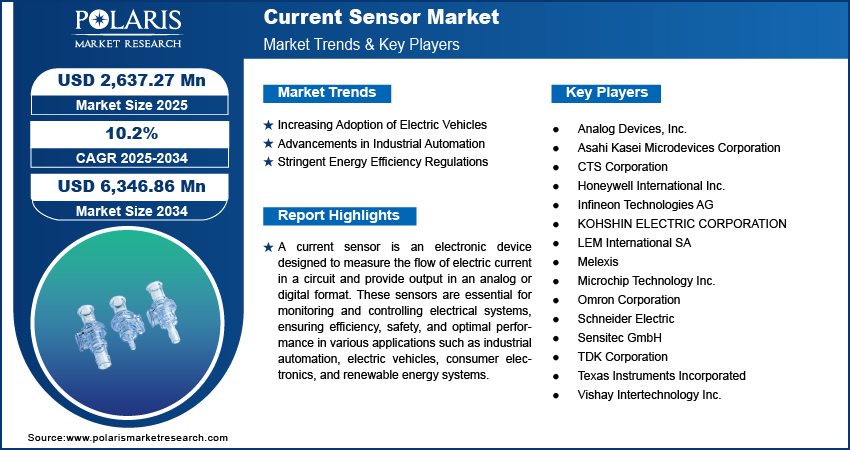

The current sensor market size was valued at USD 2,397.51 million in 2024, growing at a CAGR of 10.2% during 2025–2034. The market growth is primarily driven by the rising industrial automation and the increased need for real-time current monitoring in smart grids.

Key Insights

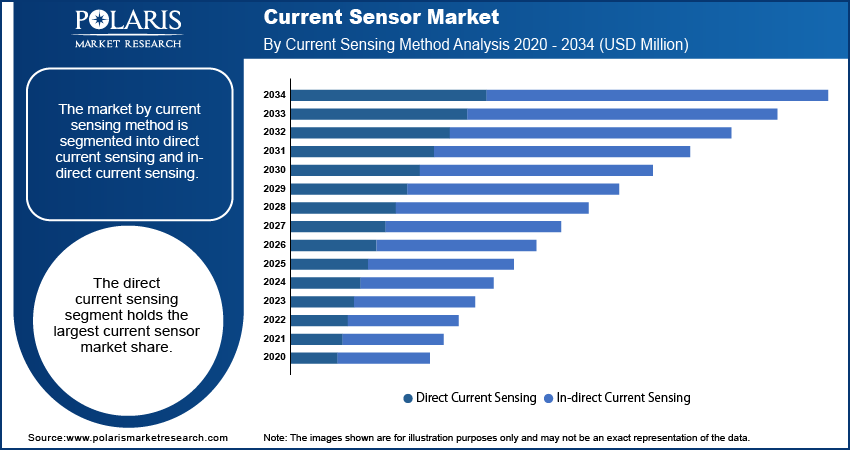

- The direct current sensing segment accounts for the largest market share. The segment’s dominance is primarily driven by its high accuracy and simplicity.

- The open loop segment is witnessing notable growth, owing to its significant price benefit over closed-loop sensors.

- The Hall effect segment accounted for the largest market share. The segment’s dominance is attributed to the ability of these sensors to measure both AC and DC currents.

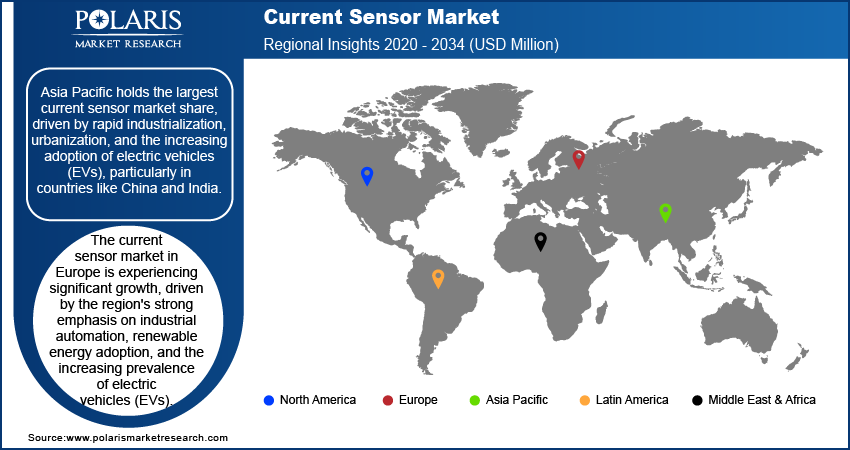

- Asia Pacific accounted for the largest market share in 2024. Rapid urbanization and growing adoption of electric vehicles (EVs) drive the region’s leading market position.

- Europe is projected to witness significant growth. Increased emphasis on industrial automation and rising adoption of renewable energy are fueling the regional market growth.

Industry Dynamics

- The growing adoption of electric vehicles (EVs) has fueled the demand for advanced current sensors for power monitoring and efficient battery management.

- The introduction of stringent energy efficiency regulations by governments globally is shaping the market landscape.

- The rising integration of artificial intelligence for energy efficiency and predictive maintenance is creating several market opportunities.

- Accuracy issues in extreme environmental conditions are hindering market growth.

Market Statistics

2024 Market Size: USD 2,397.51 million

2034 Projected Market Size: USD 6,346.86 million

CAGR (2025-2034): 10.2%

Asia Pacific: Largest Market in 2024

AI Impact on the Current Sensor Market

- AI-driven calibration techniques improve sensor accuracy, reducing errors in current measurement for automotive, industrial, and consumer applications.

- Machine learning models enable self-diagnosis and anomaly detection, allowing sensors to predict faults and enhance reliability.

- AI optimizes signal processing in sensors. This makes them more responsive to dynamic load variations in EVs, renewable grids, and smart devices.

- Integration with AI-powered control systems enhances real-time monitoring and energy efficiency across connected ecosystems.

To Understand More About this Research: Request a Free Sample Report

The current sensor market is driven by the increasing demand for energy-efficient solutions, the rise in industrial automation, and the growing adoption of electric vehicles (EVs). These sensors play a crucial role in monitoring and managing electrical currents in various applications, including consumer electronics, automotive, and industrial equipment. The market is also benefiting from advancements in sensor technology, such as the integration of Hall effect and Rogowski coil sensors, which offer improved accuracy and reliability. Additionally, stringent government regulations on energy consumption and safety standards further drive the adoption of current sensors across industries.

A qualitative analysis of the current sensor market highlights the growing preference for contactless and high-precision sensing technologies. The increasing need for real-time current monitoring in smart grids and renewable energy systems is also accelerating market growth. Moreover, miniaturization and the integration of current sensors into compact electronic devices are fueling demand in the consumer electronics sector. The continuous research and development efforts are expected to enhance sensor performance, making them more cost-effective and efficient for diverse applications.

Market Dynamics

Increasing Adoption of Electric Vehicles

The surge in electric vehicle (EV) adoption significantly propels the market. In China, EVs constituted over 35% of total domestic car sales in 2023, achieving the nation's 2025 target for new energy vehicles ahead of schedule (International Energy Agency, 2023). Similarly, the US witnessed a 40% increase in EV sales in 2023, capturing about 10% of the car market. This rapid transition to electrified transportation necessitates advanced current sensors for efficient battery management and power monitoring, thereby driving current sensor market growth.

Advancements in Industrial Automation

The evolution of industrial automation amplifies the demand for precise current sensing solutions. As industries integrate advanced automation technologies, accurate current monitoring becomes paramount to ensure operational efficiency and equipment safety. Government initiatives promoting smart manufacturing and Industry 4.0 have further boosted this trend, leading to the increased adoption of current sensors in various industrial applications.

Stringent Energy Efficiency Regulations

Governments worldwide are implementing rigorous energy efficiency standards to mitigate environmental impacts, thereby influencing the current sensor market. For instance, India's commitment to achieving net-zero emissions by 2070 includes policies that have elevated EV adoption from 0.7% in 2020 to 6.3% in 2024, resulting in nearly 5 million registered EVs (World Resources Institute, 2025). Such regulatory frameworks necessitate precise current measurement and control, increasing the reliance on advanced current sensors across various sectors.

Segment Insights

Market Assessment by Current Sensing Method

The current sensor market is segmented by current sensing method into direct current sensing and in-direct current sensing. The direct current sensing segment holds the largest current sensor market share. This dominance is attributed to the method's simplicity, dependability, and accuracy. The increasing demand for battery-powered devices, low-power applications, and the growing popularity of renewable energy technologies are driving the growth of the direct current sensing market.

In-direct current sensing segment is experiencing significant growth. Its ability to measure current without direct electrical contact enhances safety and reduces component wear and tear. This feature makes it ideal for applications in electric vehicles, industrial automation, and power distribution systems, where non-invasive and high-precision current monitoring is increasingly in demand.

Market Evaluation by Loop

The current sensor market segmentation, based on loop, includes open loop and closed loop. The closed loop segment holds the largest market share. These sensors are widely utilized to provide an output proportional to the measured current, making them suitable for applications requiring fast response, high linearity, and low-temperature drift. Their extensive use in variable speed drives, ground fault detectors, robotics, and power supplies contribute to their market dominance.

The open loop segment is experiencing notable growth, driven by its significant price advantage over closed-loop sensors. Due to their compact size and lower power consumption, these sensors are ideal for battery-powered circuits. Additionally, open-loop sensors provide cost benefits in high current ranges (over 100 A) while maintaining constant power consumption, regardless of the sensed current.

Market Outlook by Technology

The current sensor market is segmented by technology into Hall effect, shunt, flux gate, and magneto-resistive. In 2024, the Hall effect segment holds the largest market share. This prominence is attributed to the Hall Effect sensors' ability to measure both AC and DC currents without physical contact, ensuring durability and reliability. Their compact size, cost-effectiveness, and resilience in harsh environments, such as high temperatures or areas with significant electromagnetic interference, make them highly versatile across various applications. Advancements in semiconductor technology have further enhanced their sensitivity and integration capabilities, solidifying their position as the preferred choice for current sensing in sectors such as industrial automation, automotive systems, and consumer electronics.

The magneto-resistive segment is experiencing the fastest current sensor market growth. This growth is driven by the superior performance characteristics of magneto-resistive sensors, including high sensitivity, excellent accuracy, and compact form factors. These attributes make them particularly suitable for advanced applications such as wearables, robotics, and drones. The increasing adoption of these sensors in consumer electronics, notably in true wireless stereo (TWS) earbuds, is further propelling market expansion. Ongoing technological innovations, such as the development of tunnel magneto-resistance (TMR) technology, which offers enhanced sensitivity and ultra-low power consumption, are expected to continue driving the growth of this segment.

Market Assessment by Output

The current sensor market segmentation, based on output, includes analog and digital. The analog segment dominated the current sensor market. This dominance is attributed to analog sensors' ability to provide continuous, real-time signals that are crucial for applications requiring immediate and precise current measurements. Industries such as industrial automation and process control rely heavily on these sensors for their high precision and reliability. Furthermore, advancements have led to analog sensors with improved accuracy and reduced power consumption, enhancing their compatibility with advanced control systems and reinforcing their widespread adoption.

The digital segment is experiencing significant current sensor market growth. This expansion is driven by technological advancements and the increasing demand for IoT-enabled devices. Digital sensors offer advantages such as noise immunity and the capability to transmit data over long distances without signal degradation. They are increasingly utilized in applications such as smart grids and battery management systems, where rapid and accurate data acquisition is essential. The seamless integration of digital sensors with advanced data analytics and remote monitoring systems positions them as a vital component in modern electronic infrastructures.

Market Evaluation by Application

The current sensor market is segmented by application into motor drive, converter inverter, battery management, UPS & SMPS, starter & generators, grid infrastructure, and others. The motor drive segment holds the largest market share. This dominance is driven by the widespread use of electric motors across various industries, including automotive, industrial automation, and consumer electronics. Current sensors are integral to monitoring motor performance, ensuring efficient operation, and preventing damage through overload protection. The increasing adoption of electric vehicles (EVs) significantly contributes to this segment's prominence, as precise current measurement is essential for optimal motor control and energy efficiency in EVs. Additionally, the trend toward automation and the integration of smart technologies in manufacturing processes have heightened the demand for current sensors in motor drives, facilitating improved operational efficiency and reduced energy consumption.

The starter & generators segment is experiencing the fastest current sensor market growth. This growth is propelled by a strong focus on enhancing energy efficiency and reducing emissions in automotive and aerospace applications. Current sensors play a crucial role in ensuring the optimal performance and safety of starter motors and generators, which are vital components in these sectors. The global shift toward sustainability and stringent regulatory requirements have further accelerated the adoption of advanced current sensing technologies in this segment, enabling compliance with performance standards while supporting the integration of cleaner and more efficient power systems.

Regional Insights

By region, the study provides current sensor market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, Asia Pacific holds the largest market share, driven by rapid industrialization, urbanization, and the increasing adoption of electric vehicles (EVs), particularly in countries such as China and India. The region's strong manufacturing base and government initiatives promoting renewable energy and smart grid technologies further fuel the demand for efficient current sensing solutions. Additionally, the growing focus on energy management and infrastructure development across the region contributes to the current sensor market expansion in this region.

The current sensor market in Europe is experiencing significant growth, driven by the region's strong emphasis on industrial automation, renewable energy adoption, and the increasing prevalence of electric vehicles (EVs). Germany stands out as a pivotal contributor, leveraging its robust industrial base and leadership in automotive innovation. The country's focus on Industry 4.0 and smart manufacturing has heightened the demand for advanced sensors in robotics and predictive maintenance. Similarly, France is witnessing notable expansion due to substantial investments in renewable energy infrastructure and smart grid technologies, which necessitate precise current measurement solutions. The UK also plays a crucial role, with its strong automotive sector and government initiatives supporting EV infrastructure and carbon emission reductions, further propelling the need for efficient current sensing technologies.

Key Players and Competitive Insights

The competitive landscape of the current sensor market is characterized by rapid technological advancements, strategic collaborations, and regional expansion. Companies are investing heavily in research and development to enhance sensor accuracy, reduce power consumption, and improve miniaturization, catering to industries such as electric vehicles, industrial automation, and renewable energy. The market is witnessing consolidation trends through mergers and acquisitions, allowing firms to expand their technological capabilities and market reach. Asia Pacific leads in market share, driven by rising automotive production and consumer electronics demand, while North America and Europe are experiencing growth due to electric vehicle adoption and renewable energy integration. However, pricing pressures remain a challenge, with intense competition affecting profit margins. Additionally, ensuring sensor accuracy across varying temperatures is a technical hurdle. Opportunities in the sector are expanding with the rise of electric mobility, smart grid applications, and the integration of artificial intelligence for predictive maintenance and energy efficiency.

Honeywell International Inc. is a diversified technology and manufacturing company that offers a wide range of products and services across various sectors, including aerospace, building technologies, performance materials, and safety solutions. In the current sensor market, Honeywell provides advanced sensing technologies for applications in industrial automation, automotive systems, and energy management. Its sensors are designed to deliver accurate and reliable measurements, supporting efficient system performance across these industries.

Texas Instruments Incorporated is a global semiconductor company specializing in the design and manufacture of analog and embedded processing chips. Within the current sensor market, Texas Instruments offers a comprehensive portfolio of current sensing solutions that are integral to power management and control systems. Their products are utilized in various applications, including consumer electronics, automotive systems, and industrial equipment, providing precise measurement capabilities essential for optimal performance.

List of Key Companies

- Analog Devices, Inc.

- Asahi Kasei Microdevices Corporation

- CTS Corporation

- Honeywell International Inc.

- Infineon Technologies AG

- KOHSHIN ELECTRIC CORPORATION

- LEM International SA

- Melexis

- Microchip Technology Inc.

- Omron Corporation

- Schneider Electric

- Sensitec GmbH

- TDK Corporation

- Texas Instruments Incorporated

- Vishay Intertechnology Inc.

Current Sensor Industry Developments

- March 2025: Honeywell International Inc. announced its acquisition of Sundyne LLC for USD 2.2 billion. Based in Arvada, Colorado, Sundyne specializes in manufacturing highly engineered pumps and compressors used in the petrochemical, liquefied natural gas (LNG), and renewable fuel markets. This strategic move aims to enhance Honeywell's Energy and Sustainability business by broadening its product offerings in energy security solutions. The acquisition aligns with Honeywell's ongoing efforts to transform its portfolio and strengthen its presence in the energy sector.

- January 2025: Honeywell and NXP Semiconductors announced an expanded partnership aimed at accelerating the development of next-generation aviation technology. This collaboration focuses on integrating NXP's high-performance computing architecture into Honeywell's Anthem avionics, enabling AI-driven aerospace technology to improve operational efficiency and safety.

Current Sensor Market Segmentation

By Current Sensing Method Outlook (Revenue-USD Million, 2020–2034)

- Direct Current Sensing

- In-Direct Current Sensing

By Loop Outlook (Revenue-USD Million, 2020–2034)

- Open Loop

- Closed Loop

By Technology Outlook (Revenue-USD Million, 2020–2034)

- Hall Effect

- Shunt

- Flux Gate

- Magneto-Resistive

By Output Outlook (Revenue-USD Million, 2020–2034)

- Analog

- Digital

By Application Outlook (Revenue-USD Million, 2020–2034)

- Motor Drive

- Converter Inverter

- Battery Management

- UPS & SMPS

- Starter & Generators

- Grid Infrastructure

- Others

By Regional Outlook (Revenue-USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest f Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest f Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest f Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest f Latin America

Current Sensor Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 2,397.51 million |

|

Market Size Value in 2025 |

USD 2,637.27 million |

|

Revenue Forecast by 2034 |

USD 6,346.86 million |

|

CAGR |

10.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The current sensor market size was valued at USD 2,397.51 million in 2024 and is projected to grow to USD 6,346.86 million by 2034.

The market is projected to register a CAGR of 10.2% during the forecast period, 2024-2034.

Asia Pacific had the largest share of the market.

The key players of the market are Analog Devices, Inc.; Asahi Kasei Microdevices Corporation; CTS Corporation; Honeywell International Inc.; Infineon Technologies AG; KOHSHIN ELECTRIC CORPORATION; LEM International SA; Melexis; Microchip Technology Inc.; Omron Corporation; Schneider Electric; Sensitec GmbH; TDK Corporation; Texas Instruments Incorporated; Vishay Intertechnology Inc.

The direct current sensing segment accounted for the larger share of the market in 2024.

A current sensor is an electronic device used to detect and measure electric current in a circuit and convert it into a readable output signal, which can be analog or digital. These sensors play a crucial role in monitoring, controlling, and protecting electrical and electronic systems by ensuring efficient power management and preventing overcurrent damage. Current sensors are widely used in various applications, including electric vehicles, industrial automation, consumer electronics, and renewable energy systems. They operate using different technologies such as Hall Effect, shunt resistors, flux gate, and magneto-resistive methods to provide accurate current measurements.