Cyclosporine Market Size, Share, & Industry Analysis Report

By Indication (Transplant rejection prophylaxis, Rheumatoid arthritis), By Dosage Form, By Route of Administration, By Distribution Channel, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 125

- Format: PDF

- Report ID: PM6000

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

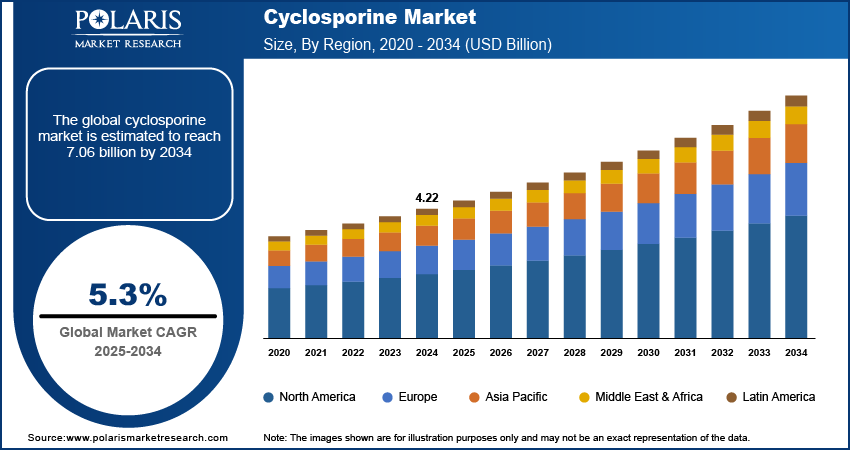

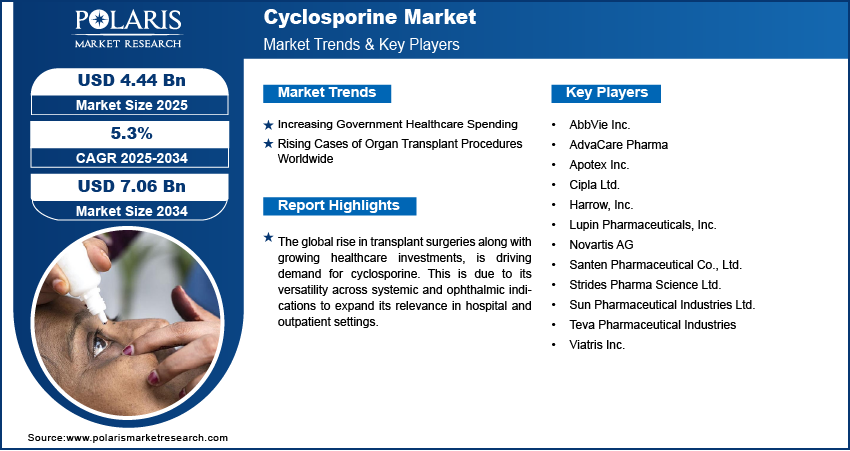

The global cyclosporine market size was valued at USD 4.22 billion in 2024, growing at a CAGR of 5.3% during 2025–2034. Rising government healthcare spending and the increasing volume of organ transplant procedures worldwide are driving demand for cyclosporine.

Key Insights

- The transplant rejection prophylaxis segment accounted for largest revenue share in 2024.

- The topical targeted therapy segment is projected to grow at a rapid pace in the coming years, driven by the increasing incidence of chronic dry eye and broader clinical adoption in ophthalmology.

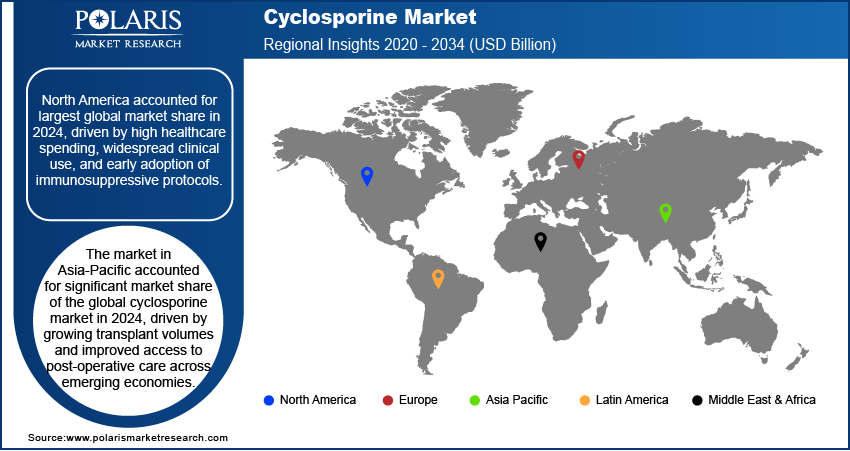

- The North America cyclosporine market accounted for largest global market share in 2024.

- The US cyclosporine market held largest regional share of the North America market share in 2024, due to high healthcare spending and widespread transplant procedures.

- The market in Asia Pacific is projected to grow fastest from 2025-2034, fueled by expanding healthcare access and growing awareness of immunosuppressive therapies.

- Countries such as China and Japan are contributing major role in regional growth, due to rising transplant volumes and increasing investments in healthcare infrastructure.

Cyclosporine is an immunosuppressive medication used to control immune responses in organ transplant recipients and patients with autoimmune disorders. It is commonly prescribed for kidney, liver and heart transplants, as well as conditions such as rheumatoid arthritis, psoriasis and dry eye disease. The drug works by inhibiting T-cell activity to prevent the body from attacking transplanted organs or healthy tissues. Cyclosporine is available in oral and injectable forms and is administered in hospitals, transplant centers and specialty clinics. Its use requires close monitoring to manage dosage and avoid potential toxicity. The market includes conventional and modified formulations designed to improve dosing precision and patient compliance.

The rising prevalence of autoimmune diseases such as psoriasis and dry eye disease is driving growth in the cyclosporine market due to increasing demand for effective immunosuppressive therapies to manage chronic inflammation and prevent disease progression. According to the World Psoriasis Day consortium, total 125 million people or around 2% to 3% of the global population suffer with psoriasis. This growing patient base is pushing healthcare systems to adopt established and well-studied treatments including cyclosporine that offer long-term symptom control and are used in monotherapy and combination regimens.

The rising global geriatric population is fueling demand in the cyclosporine market, due to susceptibility to autoimmune conditions, chronic inflammatory diseases, and organ dysfunction in older adults that require long-term immunosuppressive therapy. According to the United Nations (UN), the number of people aged 65 and older is projected to reach 2.2 billion by the late 2070, while the 80+ age group is anticipated to hit 265 million by the mid-2030. This demographic trend is increasing the prevalence of conditions such as rheumatoid arthritis, dry eye syndrome, and transplant-related complications driving demand for cyclosporine-based treatments with well-established safety and efficacy profiles.

Industry Dynamics

- Increasing government healthcare spending globally is boosting access to immunosuppressive therapies including cyclosporine and fueling innovation in transplant care.

- The rising number of organ transplantation procedures worldwide is driving demand for cyclosporine, given its effectiveness in preventing graft rejection and improving patient outcomes.

- The growing focus on personalized medicine and optimized dosing strategies is creating opportunities for tailored cyclosporine therapies, enhancing safety and efficacy across different patient profiles.

- The emergence of newer immunosuppressive agents with improved safety profiles and efficacy is restricting the adoption of cyclosporine.

Increasing Government Healthcare Spending: Rising government healthcare spending is driving the growth of the cyclosporine market by improving access to immunosuppressive treatments across autoimmune, ophthalmic, and transplant care settings. According to the latest report by World Health Organization (WHO) 2023, global health expenditure reached approximately USD 9 trillion in 2021, with countries increasing allocations for chronic disease management and specialty therapies. Additionally, government health spending in 2023 accounted for 10.1% of GDP in Germany, 9.5% in Japan, and 7.9% in Canada, up from 9.8%, 9.2%, and 7.7% respectively in 2019. This rise in public funding is enabling healthcare providers to expand access to cyclosporine-based therapies used in managing conditions such as rheumatoid arthritis, psoriasis, dry eye disease, and post-transplant care.

Rising Cases of Organ Transplant Procedures Worldwide: The growing number of organ transplant procedures is fueling demand in the cyclosporine market due to its established role in preventing immune rejection following surgery. Rising cases of end-stage organ failure and improved access to donor organs are leading to higher transplant volumes across major healthcare systems. According to the Global Observatory on Donation and Transplantation (GODT), more than 172,409 organ transplants were performed globally in 2023, indicating an increase of 9.5% from 2022. This growth is driving long-term use of immunosuppressive therapies such as cyclosporine across kidney, liver, heart, and lung transplants. Therefore, expanding transplant infrastructure and better post-operative management protocols continue to support consistent demand for cyclosporine across developed and emerging markets.

Segmental Insights

Indication Analysis

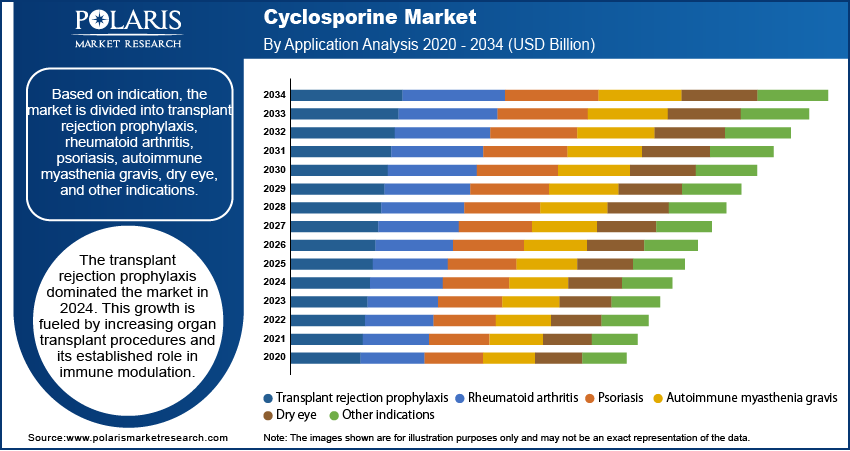

Based indication, the segmentation includes transplant rejection prophylaxis, rheumatoid arthritis, psoriasis, autoimmune myasthenia gravis, dry eye, and other indications. The transplant rejection prophylaxis segment held the largest revenue share in 2024. This is attributed to cyclosporine crucial role as an immunosuppressant in kidney, liver, and heart transplants, where its T-cell inhibition properties are essential for preventing graft rejection. The growing organ transplant volumes worldwide coupled with advancements in immunosuppressive protocols continue to drive demand for cyclosporine to ensure graft survival and patient outcomes. According to the Organ Procurement and Transplantation Network (OPTN), over 27,332 kidney transplants and 10,659 liver transplants were performed in 2023. The segment remains backed by well-established clinical guidelines and long-term treatment regimens that prioritize transplant success and patient survival.

The dry eye segment is projected to expand at a notable pace through 2034, driven by a rising prevalence of chronic dry eye disease and increasing awareness of its long-term impact on visual health and quality of life. Cyclosporine-based ophthalmic formulations are commonly prescribed to manage inflammation and restore tear production in patients with moderate to severe dry eye. The growing incidence of dry eye is linked to an aging global population, prolonged digital screen exposure coupled with widespread use of contact lenses. Advancements in topical delivery systems, including preservative-free and nanoemulsion-based eye drops are enhancing patient comfort and improving treatment adherence.

Dosage Form Analysis

In terms of dosage form, the segmentation includes capsules, eye drops, liquid solutions, and creams and ointments. The capsule segment held the dominant market share in 2024, owing to its widespread use in systemic treatment of autoimmune diseases and transplant rejection. Capsules allow precise dosing and are widely prescribed for chronic conditions requiring long-term immunomodulation. Their established use in hospital and outpatient settings along with generic availability that supports continuous utilization of capsules across global treatment protocols.

The eye drops segment is estimated to hold a significant market share in 2034, fueled by rising prescriptions for ophthalmic indications such as dry eye and vernal keratoconjunctivitis. These formulations enable targeted anti-inflammatory action while minimizing systemic exposure, making it a preferred option for ophthalmologists. The introduction of preservative-free versions and advanced delivery systems is enhancing patient adherence and expanding their role in routine eye care.

Route of Administration Analysis

Based on route of administration, the segmentation includes oral, intravenous, and topical. The oral segment accounted for the largest market share in 2024, due to its widespread use in managing transplant rejection, rheumatoid arthritis, and psoriasis. Oral cyclosporine offers systemic bioavailability and dose flexibility, making it suitable for long-term maintenance therapy in immunologically active conditions. Its inclusion in global treatment guidelines and adaptability across age groups support its continued dominance in clinical settings.

The topical segment is projected to grow at the fastest CAGR during the forecast period. This is due to growing adoption in dermatology and ophthalmology for localized treatment. Cyclosporine creams and ointments are used for conditions such as atopic dermatitis and psoriasis, providing targeted relief without significant systemic exposure. Moreover, topical cyclosporine is helping address chronic dry eye and other surface eye diseases, offering an effective alternative for patients requiring localized treatment approaches.

Distribution Channel Analysis

Based on distribution channel, the segmentation includes hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacy segment held the dominant market share in 2024, driven by the structured dispensing of immunosuppressive therapies within transplant centers and specialized medical institutions. Standardized procurement processes, centralized inventory management and the need for specialist oversight continue to position hospital pharmacies as the primary channel for cyclosporine distribution in acute care and transplant management.

The online pharmacy segment is projected to grow rapidly through 2034, due to increasing consumer adoption of digital health platforms and home-based therapy models. Chronic conditions such as dry eye and rheumatoid arthritis require consistent medication refills, making online pharmacies a convenient alternative. The availability of prescription management tools and doorstep delivery services is expanding access in urban markets with strong internet penetration and regulatory support for e-pharmacy operations.

Regional Analysis

North America cyclosporine industry accounted for largest global market share in 2024, driven by the rising number of organ transplants across the region. The US and Canada maintain high transplant volumes, driven by well-established donor networks and advanced transplant care infrastructure. Also, the cyclosporine industry is growing due to its rapid adoption in clinical protocols to ensure graft survival and minimizing rejection risks across the region. Moreover, strong healthcare spending by the countries further boost the cyclosporine access to post-transplant care and long-term medication management.

US Cyclosporine Market Insight

The US dominated the regional market share in 2024. This is driven by rising healthcare spending that support advanced transplant procedures and the growing use of cyclosporine in post-operative care. According to the Centers for Medicare & Medicaid Services (CMS), the US national health spending rose to approximately USD 4.9 trillion in 2023, up from USD 4.1 trillion in 2020. Thus, higher healthcare funding is improving access to post-transplant care and chronic disease treatments, thereby driving demand for cyclosporine.

Asia Pacific Cyclosporine Market

The Asia Pacific cyclosporine industry is projected to witness fastest growth during the forecast period. This is driven by the growing transplant surgeries and rising awareness of autoimmune disease management. Also, the presence of prominent countries including China, Japan, and South Korea are witnessing increasing uptake of cyclosporine in ophthalmic and dermatologic applications due to improvements in healthcare accessibility. Moreover, regional production of generic formulations and biosimilars is expanding therapeutic reach across public health systems and specialty clinics.

India Cyclosporine Market Insight

Rising volume of organ transplant is driving growth in India cyclosporine market, due to increasing demand for immunosuppressants in post-transplant care and chronic inflammatory disorders. Moreover, the growing kidney diseases and liver transplantation are contributing to the consumption of cyclosporine in hospitals. According to the Indian Ministry of Health and Family Welfare, the total number of organ transplant in the country reached from 4,990 in 2013 to 18,378 in 2023, reflecting a growing focus on long-term graft survival and medication adherence. Additionally, the increasing penetration of ophthalmic cyclosporine formulations for dry eye and corneal conditions is driving demand for cyclosporine products in urban clinics and tertiary care centers.

Europe Cyclosporine Market Overview

The market in Europe accounted for substantial market share of the global cyclosporine market in 2024, driven by rising geriatric population and increasing demand for immunosuppressive treatment post-transplant. The need for long-term transplant care grows with age, with older patients representing a significant consumer base for cyclosporine across renal, hepatic and corneal transplant cases. According to the Eurostat, the population aged 80 and above increased across all EU countries, rising from 3.8% to 6.1% between 2004 and 2024. Additionally, the share of individuals aged 65 and over grew from 16.4% to 21.6% during the same period. This aging trend continues to influence treatment protocols across the region, driving the clinical relevance of the immunosuppressant in Europe’s healthcare systems.

Key Players & Competitive Analysis Report

The cyclosporine market is moderately competitive, with key players such as AbbVie Inc., AdvaCare Pharma, Apotex Inc., Cipla Ltd., Harrow, Inc., Lupin Pharmaceuticals, Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., and Strides Pharma Science Ltd. These companies compete on formulation innovation, bioequivalence, and therapeutic efficacy to enhance their presence in immunosuppressive therapy. Increasing demand for cyclosporine in organ transplantation, autoimmune disorders, and ophthalmic applications continues to drive product development, including modified-release formulations and topical preparations. The competitive environment is further influenced by regional manufacturing capabilities and partnerships aimed at improving global distribution and therapeutic reach.

Key companies in the industry include AbbVie Inc., AdvaCare Pharma, Apotex Inc., Cipla Ltd., Harrow, Inc., Lupin Pharmaceuticals, Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., Strides Pharma Science Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries, and Viatris Inc.

Key Players

- AbbVie Inc.

- AdvaCare Pharma

- Apotex Inc.

- Cipla Ltd.

- Harrow, Inc.

- Lupin Pharmaceuticals, Inc.

- Novartis AG

- Santen Pharmaceutical Co., Ltd.

- Strides Pharma Science Ltd.

- Sun Pharmaceutical Industries Ltd.

- Teva Pharmaceutical Industries

- Viatris Inc.

Industry Developments

March 2025: Harrow partnered with PhilRx and introduced a new initiative called VEVYE Access for All that aims to make cyclosporine ophthalmic solution 0.1% more accessible for patients with dry eye disease. This collaboration is designed to speed up prescription fulfillment by eliminating the need for prior authorization and offering a flat-rate refill program.

July 2024: Lupin partnered with Huons to launch a cyclosporine ophthalmic nanoemulsion. This collaboration aims to bring advanced eye care solutions and treat dry eye disease by offering improved efficacy and patient comfort through its nanoemulsion technology.

Cyclosporine Market Segmentation

By Indication Outlook (Revenue, USD Billion, 2020–2034)

- Transplant rejection prophylaxis

- Rheumatoid arthritis

- Psoriasis

- Autoimmune myasthenia gravis

- Dry eye

- Other indications

By Dosage Form Outlook (Revenue, USD Billion, 2020–2034)

- Capsule

- Eye drops

- Liquid solutions

- Creams and ointments

By Route of Administration (Revenue, USD Billion, 2020–2034)

- Oral

- Intravenous

- Topical

By Distribution Channel (Revenue, USD Billion, 2020–2034)

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Cyclosporine Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.22 Billion |

|

Market Size in 2025 |

USD 4.44 Billion |

|

Revenue Forecast by 2034 |

USD 7.06 Billion |

|

CAGR |

5.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

Cyclosporine Industry Trend Analysis (2024) Company Profiles/Industry participants profiling includes company overview, financial information, product/service benchmarking, and recent developments |

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.22 billion in 2024 and is projected to grow to USD 7.06 billion by 2034.

The global market is projected to register a CAGR of 5.3% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are AbbVie Inc., AdvaCare Pharma, Apotex Inc., Cipla Ltd., Harrow, Inc., Lupin Pharmaceuticals, Inc., Novartis AG, Santen Pharmaceutical Co., Ltd., Strides Pharma Science Ltd., Sun Pharmaceutical Industries Ltd., Teva Pharmaceutical Industries, and Viatris Inc.

The transplant rejection prophylaxis segment dominated the market share in 2024 due to the widespread use of cyclosporine in preventing organ rejection following kidney, liver, and heart transplants.

The eye drops segment is expected to witness the fastest growth during the forecast period, driven by increasing cases of chronic dry eye and expanding ophthalmic applications of cyclosporine for surface eye disorders.