Diet and Nutrition Apps Market Share, Size, Trends, Industry Analysis Report

By Service (Free, Paid); By Platform; By Device Type; By Region; Segment Forecast, 2024- 2032

- Published Date:Feb-2024

- Pages: 115

- Format: PDF

- Report ID: PM4615

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

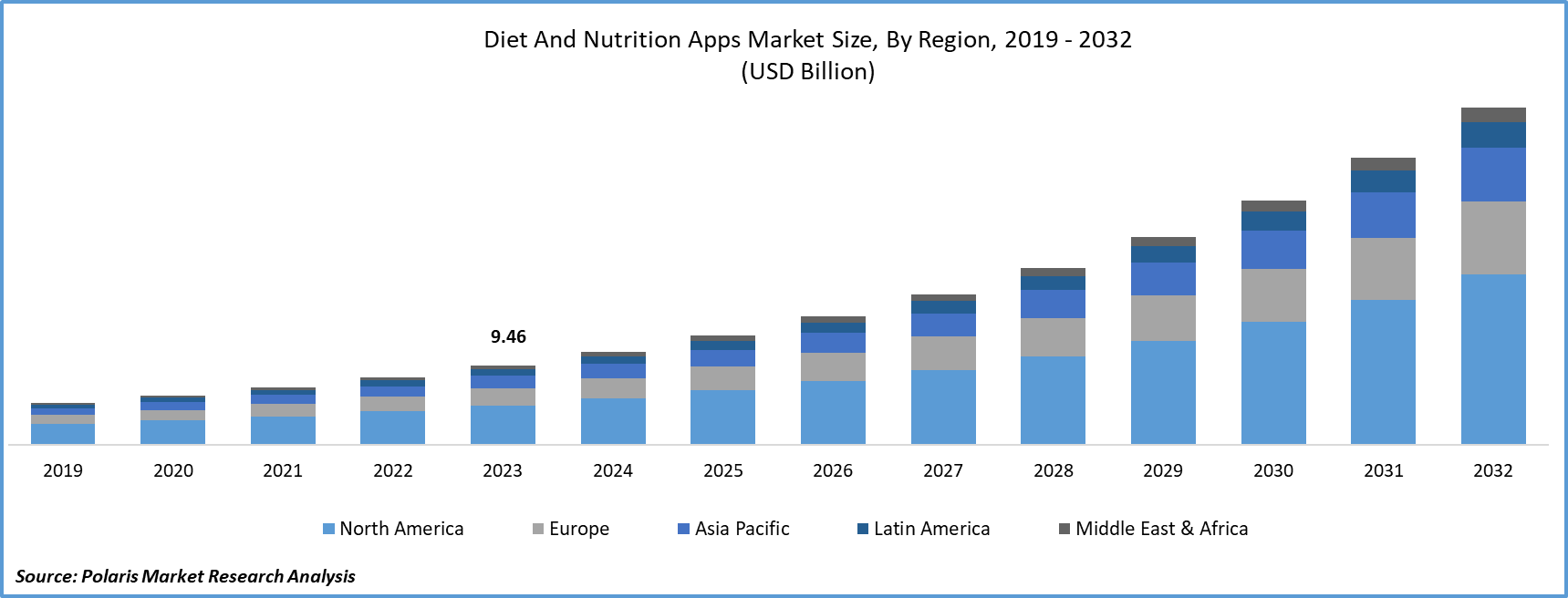

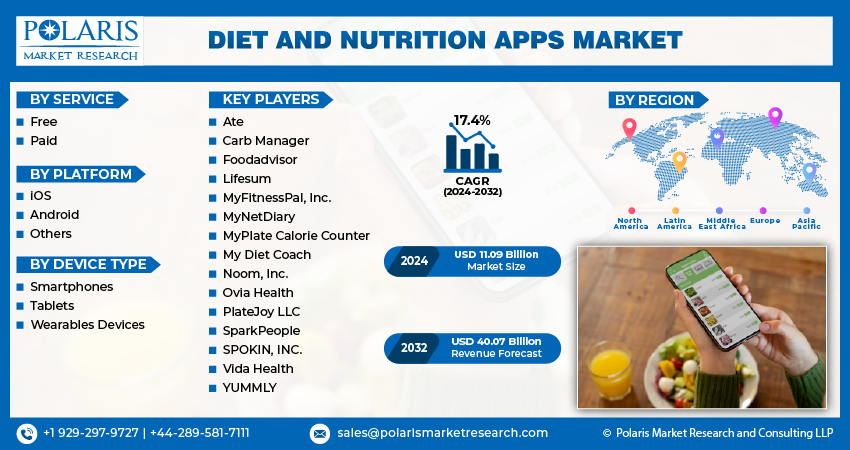

- Diet and Nutrition Apps Market size was valued at USD 9.46 billion in 2023.

- The market is anticipated to grow from USD 11.09 billion in 2024 to USD 40.07 billion by 2032, exhibiting the CAGR of 17.4% during the forecast period.

Market Introduction

Convenience and accessibility are key drivers fueling the expansion of the diet and nutrition apps market size. In today's fast-paced world, consumers seek effortless solutions to manage their health. These apps provide a convenient platform for users to track food intake, plan meals, and monitor nutritional content from their smartphones. The widespread use of mobile devices enhances accessibility, allowing users to access valuable nutrition resources. Additionally, the availability of a variety of apps catering to different dietary needs and lifestyles ensures that users can find one that suits their preferences. As technology continues to advance, the demand for convenient health management solutions provided by diet and nutrition apps is expected to grow further.

To Understand More About this Research: Request a Free Sample Report

In addition, entities operating in the market are introducing new offerings to expand market reach and strengthen their presence.

- For instance, in October 2023, AHARA introduced a complimentary edition of its prominent personalized nutrition program, granting individuals autonomy over their well-being.

Technological advancements are driving the growth of the market share by revolutionizing health management. Integration of AI and machine learning offers personalized recommendations tailored to individual health goals and preferences. Wearable and sensor technology provides real-time monitoring of physical activity levels and biometric data, complementing dietary tracking. Furthermore, advancements in data analytics and cloud computing enable robust features like comprehensive nutritional databases and interactive coaching programs. These innovations enhance user engagement and effectiveness, fueling greater adoption of diet and nutrition apps.

Industry Growth Drivers

Increasing health awareness is projected to spur the product demand

The market trends experience substantial growth driven by increasing health consciousness worldwide. As people prioritize healthy lifestyles, demand for tools aiding nutrition management surges. Diet and nutrition apps offer convenient solutions for users to track food intake, plan balanced meals, and monitor nutrition. Concerns over obesity, chronic diseases, and overall wellness prompt individuals to seek personalized health approaches, further boosting app adoption. Additionally, the COVID-19 pandemic underscores the importance of nutrition and immune health, fueling interest in such apps. Technological advancements like artificial intelligence and wearable integration enhance app capabilities, contributing to their appeal and widespread use.

Rise in chronic diseases is expected to drive diet and nutrition apps market growth

The surge in chronic diseases globally propels the growth of the market forecast. Conditions like obesity, diabetes, and cardiovascular diseases, exacerbated by sedentary lifestyles and poor dietary habits, necessitate ongoing management and lifestyle changes. Diet and nutrition apps empower individuals to monitor their dietary habits, make healthier food choices, and manage chronic conditions effectively. Offering features like food tracking, meal planning, and personalized recommendations, these apps help reduce disease risk and improve overall well-being. As the prevalence of chronic diseases rises, the demand for diet and nutrition apps is expected to escalate, driving market expansion.

Industry Challenges

Limited adoption in developing regions is likely to impede the market growth

Limited adoption of diet and nutrition apps in developing regions constrains market growth due to restricted smartphone access and internet connectivity. Digital literacy gaps and cultural attitudes towards health and technology also contribute to low adoption rates. Economic constraints further hinder app accessibility. Overcoming these challenges requires addressing infrastructure gaps, improving digital literacy, and tailoring apps to local dietary preferences and cultural contexts. Initiatives to make smartphones more affordable and accessible could expand the reach of diet and nutrition apps, unlocking growth potential in developing regions.

Report Segmentation

The diet and nutrition apps market analysis is primarily segmented based on service, platform, device type, and region.

|

By Service |

By Platform |

By Device Type |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Service Analysis

Paid segment held significant market revenue share in 2023

The paid segment held a significant revenue share in 2023. Paid diet and nutrition apps offer extensive databases of foods and recipes, personalized features like customized meal plans, and ad-free experiences. They provide enhanced customer support and regular updates, ensuring users receive ongoing assistance and access to the latest features. While free options exist, paid apps provide a premium experience with advanced functionalities and personalized guidance, making them a valuable investment for individuals committed to improving their dietary habits and overall health.

By Platform Analysis

iOS segment held significant market revenue share in 2023

The iOS segment held a significant revenue share in 2023. The iOS dominates the diet and nutrition apps market analysis due to its affluent user base, trust in the curated App Store, and seamless integration with the Health app. Many popular apps were initially developed for iOS, giving it a significant head start. Additionally, the brand loyalty and user experience associated with iOS devices contribute to their preference in this segment. Developers prioritize iOS due to its profitability and lower fragmentation.

By Device Type Analysis

Smartphones segment held significant market revenue share in 2023

The smartphone segment held a significant market revenue share in 2023. Smartphone diet and nutrition apps are invaluable for managing dietary habits and improving overall health. These apps offer features like food tracking, meal planning, and access to nutritional databases, enabling users to monitor calorie intake and make informed dietary choices. Integration with fitness trackers allows for comprehensive health management, tracking physical activity levels and progress toward health goals. Community support features facilitate connections with peers for sharing tips and recipes, fostering mutual support.

Regional Insights

North America held significant market revenue share in 2023

In 2023, the North American region accounted for a significant market share. The North American diet and nutrition apps market opportunities thrive due to widespread smartphone usage and a growing health-conscious population. Increased demand for apps offering food tracking, meal planning, and nutritional analysis stems from the region's proactive approach to wellness and persistent obesity challenges. Technological advancements like barcode scanning and personalized recommendations enhance user experience. Healthcare providers recognize these apps as valuable tools for patient support, leading to integration with electronic health records. With the smartphone market expanding and consumers prioritizing personalized health solutions, the North American market is positioned for sustained growth.

Asia-Pacific is expected to experience growth during the forecast period. The diet and nutrition apps industry in the Asia-Pacific region is rapidly expanding, driven by growing health awareness and changing dietary preferences. These apps cater to diverse needs like vegetarianism and gluten-free diets, offering convenience and accessibility to a tech-savvy population. Technological innovations such as AI and machine learning enable personalized recommendations, while localization efforts enhance user engagement. Partnerships with healthcare providers and food delivery services further bolster the market.

Key Market Players & Competitive Insights

The diet and nutrition apps market comprises a diverse array of players, and the expected entry of new contenders is poised to intensify competitive dynamics. Prominent leaders in the market continuously enhance their technologies, striving to maintain a competitive advantage by emphasizing efficiency, reliability, and safety. These entities prioritize strategic endeavors, including forming alliances, improving product portfolios, and participating in collaborative ventures. Their primary goal is to outperform others in the industry, ultimately securing a significant diet and nutrition apps market share.

Some of the major players operating in the global market include:

- Ate

- Carb Manager

- Foodadvisor

- Lifesum

- MyFitnessPal, Inc.

- MyNetDiary

- MyPlate Calorie Counter

- My Diet Coach

- Noom, Inc.

- Ovia Health

- PlateJoy LLC

- SparkPeople

- SPOKIN, INC.

- Vida Health

- YUMMLY

Recent Developments

- In August 2023, Albertsons Companies, Inc. unveiled digital upgrade to its Sincerely Health platform, introducing a nutrition analysis tool that evaluates grocery acquisitions according to the serving suggestions outlined in the USDA's MyPlate guidelines.

- In July 2020, Jumbo, a Dutch retailer, launched a complimentary application serving as a personal nutrition advisor tailored for cyclists. Known as Jumbo Foodcoach, this app offers a specialized nutrition regimen aimed at enhancing athletic performance during both sports training sessions and cycling events.

- In October 2023, tracking and recording on Wear OS by Google. Android users of MyFitnessPal can now monitor their dietary intake directly from their Wear OS by Google-enabled smartwatch, offering users a quick overview of their daily progress without the need to access their smartphone.

Report Coverage

The diet and nutrition apps market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, services, platforms, device types, and their futuristic growth opportunities.

Diet and Nutrition Apps Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 11.09 billion |

|

Revenue forecast in 2032 |

USD 40.07 billion |

|

CAGR |

17.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

key companies in Diet and Nutrition Apps Market are MyFitnessPal, Inc., MyNetDiary, MyPlate Calorie Counter, Noom, Inc

Diet and Nutrition Apps Market exhibiting the CAGR of 17.4% during the forecast period.

The Diet and Nutrition Apps Market report covering key segments are service, platform, device type, and region.

key driving factors in Diet and Nutrition Apps Market are Increasing health awareness is projected to spur the product demand

Diet and Nutrition Apps Market Size Worth $40.07 Billion By 2032