Electronic Shelf Label Market Size, Share, Trends, Industry Analysis Report

By Product (LCD, Segmented E-Paper), By Component, By Display Size, By Communication Technology, By Store Type, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 129

- Format: PDF

- Report ID: PM3861

- Base Year: 2024

- Historical Data: 2020-2023

Overview

The global electronic shelf label (ESL) market size was valued at USD 1.95 billion in 2024, growing at a CAGR of 11.5% from 2025 to 2034. A few key factors driving demand for electronic shelf labels include the increasing adoption of automation in retail, rising need for real-time pricing and inventory management, and surging integration of technological advancements such as RFID and IoT.

Key Insight

- The LCD segment accounted for 41.8% of market revenue share in 2024.

- The displays segment accounted for a major revenue share in 2024.

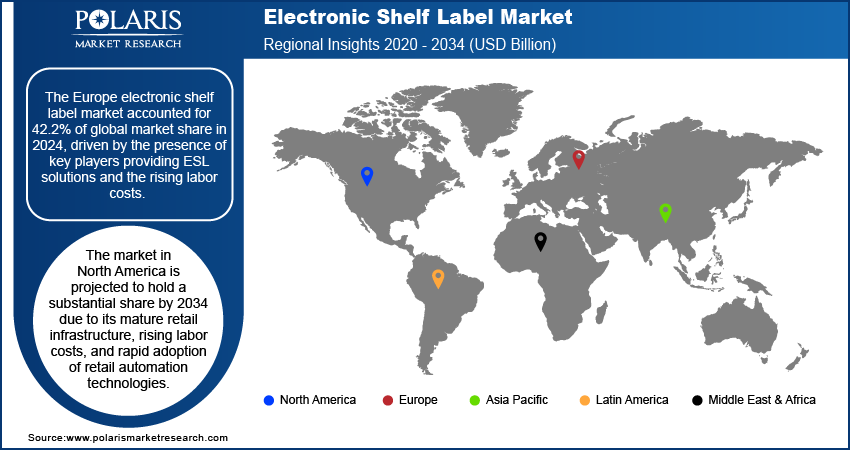

- Europe accounted for a 42.2% share of the global electronic shelf label market in 2024.

- Germany dominated the Europe electronic shelf label landscape in 2024.

- The market in Asia Pacific is projected to register a CAGR of 13.9% from 2025 to 2034.

- In Asia Pacific, countries such as China, Japan, and South Korea are investing heavily in biopharmaceutical innovation, with supportive government policies.

Industry Dynamics

- The increasing demand for operational efficiency in the retail sector is driving the market growth, as retailers seek automated solutions to streamline pricing and inventory management.

- The growing trend of smart retail environments and omni-channel retail solutions is propelling the adoption of ESLs, as they help retailers provide a more connected and seamless shopping experience for customers.

- The rising shift toward sustainability and eco-friendly practices in the retail industry is creating a significant market opportunity.

- One major restraint for the market is the substantial upfront expenses required for hardware, software, digital labels, AI infrastructure, communication networks, and backend systems.

Market Statistics

2024 Market Size: USD 1.95 Billion

2034 Projected Market Size: USD 5.91 Billion

CAGR (2025–2034): 11.5%

Europe: Largest market in 2024

AI Impact on Electronic Shelf Label Market

- The integration of artificial intelligence with ESL reduces the need for manual price updates. The use of technology helps lower operational costs and minimize human errors.

- AI-enabled labels provide continuous monitoring of inventory levels and automate product information updates. They help retailers maintain stock levels and reduce waste.

- Retailers embracing AI-based ESL are gaining a competitive as this adoption helps respond swiftly to market changes. Also, it offers customer-centric experiences.

Electronic shelf labels (ESLs) are used in retail to display product prices and information on shelves electronically. These labels are attached to store shelves and display real-time updates, providing retailers with the ability to change pricing and product information quickly and efficiently. ESLs use technologies such as e-ink, LCD, and LED screens to show product details and prices.

The scope of the electronic shelf label market is vast, covering applications in various retail sectors such as grocery stores, supermarkets, apparel stores, and electronics outlets. ESLs are increasingly used to improve store efficiency, reduce labor costs, and enhance the customer shopping experience. These labels are connected to the store's central system, allowing for automated updates and accurate pricing, ensuring that customers always get the most up-to-date information.

The rising demand for electronic shelf labels is driven by the increasing adoption of retail automation and digital solutions in this sector. As retailers seek to enhance operational efficiency, streamline inventory management, and improve customer experiences, ESLs are becoming an essential tool. The labels allow for real-time updates of pricing and product information, reducing the need for manual labor and minimizing pricing errors.

Increasing Demand for Operational Efficiency in Retail Sector: Electronic shelf labels allow seamless integration between inventory management systems and pricing updates, ensuring that product details and prices are always accurate and up-to-date. By automating these processes, ESLs reduce the reliance on manual labor, lowering operational costs and minimizing human error. This improves store efficiency and enhances the customer experience by providing consistent and real-time information. As retailers seek to streamline operations, ESLs have become an essential tool in driving efficiency and competitiveness.

Growing Trend of Smart Retail Environments and Omnichannel Shopping: The rise of smart retail environments and omnichannel shopping is significantly driving the demand for electronic shelf labels. As retailers increasingly adopt connected technologies to create more integrated, efficient, and personalized shopping experiences, ESLs play a crucial role. They enable seamless price and inventory updates across both physical and digital platforms, ensuring the up-to-date display of product information for customers. This integration improves operational efficiency and enhances customer engagement, allowing retailers to meet the expectations of modern shoppers who demand a smooth and connected experience across all channels.

Segmental Insights

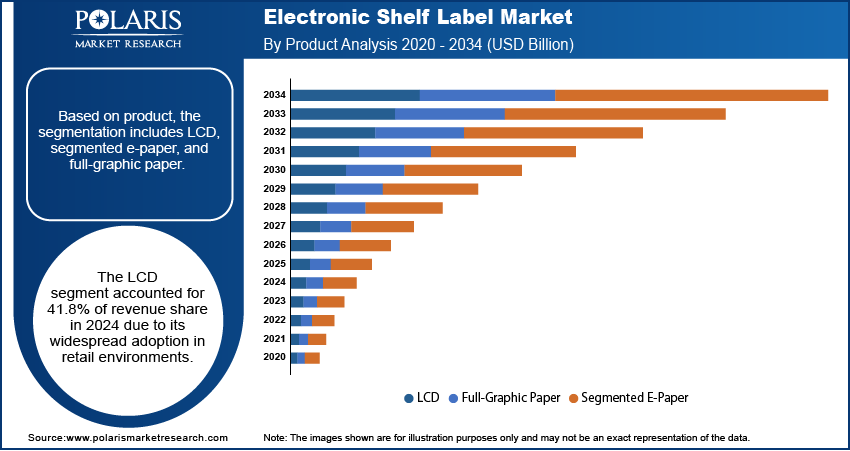

Product Analysis

Based on product, the segmentation includes LCD, segmented e-paper, and full-graphic paper. The LCD segment accounted for 41.8% of revenue share in 2024 due to its widespread adoption in retail environments. As retailers increasingly prioritize automation and digitization, the demand for LCD-based ESLs is accelerating. These labels provide a dynamic and efficient solution for real-time price adjustments and information updates, reducing manual interventions and enhancing operational efficiency.

The rise in specialty stores, which emphasize curated selections and unique customer experiences, has fueled the demand for ESLs. Additionally, the need for efficient inventory management and enhanced customer engagement are driving factors propelling this industry forward. As retailers continue to prioritize operational efficiency and customer satisfaction, the adoption of LCD ESLs is expected to further intensify, reshaping the retail landscape in the coming years.

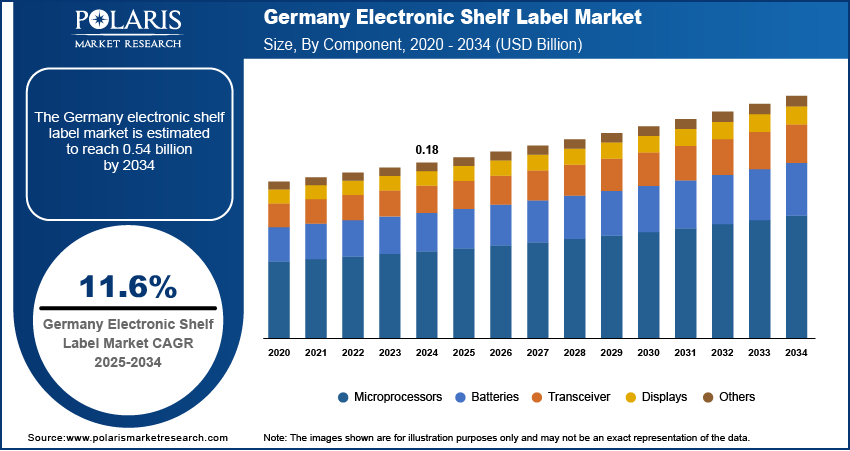

Component Analysis

In terms of component, the segmentation includes microprocessors, batteries, transceiver, displays, and others. The displays accounted for 29.7% of revenue share in 2024 due to their ability to enhance customer engagement and streamline operations by offering dynamic and customizable content. By offering dynamic content, such as real-time price updates, product information, and promotions, displays help retailers create an interactive and personalized shopping experience. This functionality improves customer satisfaction and allows retailers to efficiently manage inventory and pricing across multiple locations.

The microprocessors segment is expected to grow at a strong pace in the coming years. The rising need for real-time pricing updates and inventory management in large retail spaces necessitates the integration of robust microprocessors. These processors efficiently process vast amounts of data and communicate with centralized systems, ensuring accurate and timely information dissemination. Moreover, the evolution of smart retail environments, characterized by interconnected devices and data-driven insights, raises the importance of advanced microprocessors in ESLs. These processors enable seamless connectivity, allowing ESLs to interact with other store systems and adapt to changing industry conditions swiftly.

Regional Analysis

The Europe electronic shelf label market accounted for 42.2% global share in 2024. This dominance is attributed to the presence of key players providing ESL solutions and the rising labor costs. European retailers are increasingly adopting automated retail solutions such as ESLs to cut operational expenses in their stores substantially. The industry is expected to expand in the region, driven by the high adoption of full graphic e-paper displays and the concentration of a majority of electronics manufacturers. In Europe, companies such as VusionGroup, Displaydata, and Opticon Sensors Europe B.V. are at the forefront of innovation in Electronic Shelf Labels (ESL). These companies focus on developing and integrating advanced display platforms within ESL solutions, contributing significantly to the growth of the ESL market in the region.

Germany Electronic Shelf Label Market Insights

Germany dominated in Europe in 2024, as German retailers embrace advanced store automation, focus on complying with sustainability mandates, and seek to reduce high labor costs. These factors made dynamic price updating systems essential. Germany stood out with over 1,500 stores implementing advanced ESL systems, typically radio‑frequency full‑graphic e‑paper labels that reduced paper waste and manual labor while enabling real‑time pricing across supermarket chains. As major ESL providers deployed solutions tailored to German regulatory and operational requirements, Germany captured a leading share within Europe.

North America Electronic Shelf Label Market Trends

The market in North America is projected to hold a substantial share by 2034 due to its mature retail infrastructure, rising labor costs, and rapid adoption of retail automation technologies. Retailers across the U.S. and Canada are investing heavily in ESLs to streamline pricing, enhance inventory accuracy, and deliver real‑time pricing updates that improve customer experience and operational efficiency. Sobeys, one of the largest Canadian grocery and pharmacy chains, initiated deployment of multicolor ESLs across 50 stores in June 2024 and plans to scale to around 5 million labels across its ~1,500 stores by 2026 with Pricer’s system. This robust automation trend positions North America as a key growth region by 2034.

U.S. Electronic Shelf Label Market Overview

The U.S. is a key country in North America electronic shelf label industry due to its strong retail infrastructure and early adoption of digital technologies. Major supermarket chains and big-box retailers such as Walmart and Target are actively integrating ESL systems to improve pricing accuracy, reduce labor costs, and enhance customer experience.

Asia Pacific Electronic Shelf Label Market Overview

The market in Asia Pacific is projected to register a CAGR of 13.9% from 2025 to 2034, owing to region's abundance of cost-effective labor and the notable presence of major retail players catering to rising customer interest. Several factors, including the growing adoption of automation in the retail sector, increasing demand for business process optimization, a rising consumer purchasing power and economic growth, and ready access to processing machinery, contribute to the expansion of the regional market. Additionally, the high growth observed in full digital price tags, graphic e-paper displays, and the increasing popularity of non-food retail stores drives the market's positive trajectory in Asia Pacific.

Key Players and Competitive Analysis

The electronic shelf label industry features intense competition among global retail technology leaders, including VusionGroup; Pricer AB; Displaydata Ltd.; E Ink Holdings; Samsung Electro-Mechanics; SoluM; Teraoka Seiko Co., Ltd.; M2COMM; Huawei Technologies Co., Ltd.; and Opticon Sensors Europe B.V. The companies drive innovation in ESL systems by integrating low-power e-paper displays, wireless communication technologies, and IoT capabilities to enhance retail efficiency. VusionGroup and Pricer AB lead the global market with scalable solutions for major retailers, while Displaydata and SoluM focus on high-resolution displays and seamless pricing automation. E Ink Holdings remains a key player in energy-efficient display components, contributing significantly to the evolution of digital shelf labeling systems worldwide.

A few major companies operating in the electronic shelf label industry include VusionGroup; E Ink Holdings; Pricer AB; Displaydata Ltd.; Samsung Electro-Mechanics; Huawei Technologies Co., Ltd.; M2COMM; Teraoka Seiko Co., Ltd.; SoluM; and Opticon Sensors Europe B.V.

Key Players

- Displaydata Ltd.

- E Ink Holdings

- Huawei Technologies Co., Ltd.

- M2COMM

- Opticon Sensors Europe B.V.

- Pricer AB

- Samsung Electro-Mechanics

- SoluM

- Teraoka Seiko Co., Ltd.

- VusionGroup

Industry Developments

April 2023: Hanshow unveiled the Nebular Pro series of four-color ESLs at the "Revitalization and Excellence" product launch in China.

January 2023: Hanshow introduced a new generation HiLPC protocol and four-color ESL at NRF 2023, enhancing operability and offering advanced solutions for the digital transformation of the retail industry.

November 2023: RAINUS partnered with Toshiba Global Commerce Solutions, offering ESL technology for seamless dynamic pricing, enhancing store solutions, and addressing labor challenges in retail.

Electronic Shelf Label Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- LCD

- Segmented E-Paper

- Full-Graphic Paper

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Microprocessors

- Batteries

- Transceiver

- Displays

- Others

By Communication Technology Outlook (Revenue, USD Billion, 2020–2034)

- Near Field Communication (NFC)

- Infrared

- Radio Frequency

- Others

By Display Size Outlook (Revenue, USD Billion, 2020–2034)

- Less Than 3 Inch

- 3 Inch to 7 Inch

- 7 Inch to 10 Inch

- More Than 10 Inch

By Store Type Outlook (Revenue, USD Billion, 2020–2034)

- Supermarkets

- Hypermarkets

- Specialty Stores

- Non-Food Retail Stores

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Electronic Shelf Label Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.95 Billion |

|

Market Size in 2025 |

USD 2.22 Billion |

|

Revenue Forecast by 2034 |

USD 5.91 Billion |

|

CAGR |

11.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 1.95 billion in 2024 and is projected to grow to USD 5.91 billion by 2034.

The global market is projected to register a CAGR of 11.5% during the forecast period.

Europe dominated the market in 2024.

A few of the key players in the market are VusionGroup; E Ink Holdings; Pricer AB; Displaydata Ltd.; Samsung Electro-Mechanics; Huawei Technologies Co., Ltd.; M2COMM; Teraoka Seiko Co., Ltd.; SoluM; and Opticon Sensors Europe B.V.

The LCD segment dominated the market in 2024.

The displays segment is expected to witness the fastest growth during the forecast period.