Email Encryption Market Size, Share, Trends, & Industry Analysis Report

By Encryption Type (End-To-End Email Encryption, Gateway Email Encryption), By Deployment Type, By Offering, By Organization Size, By End User, and By Region – Market Forecast, 2025–2034

- Published Date:Jul-2025

- Pages: 130

- Format: PDF

- Report ID: PM5933

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

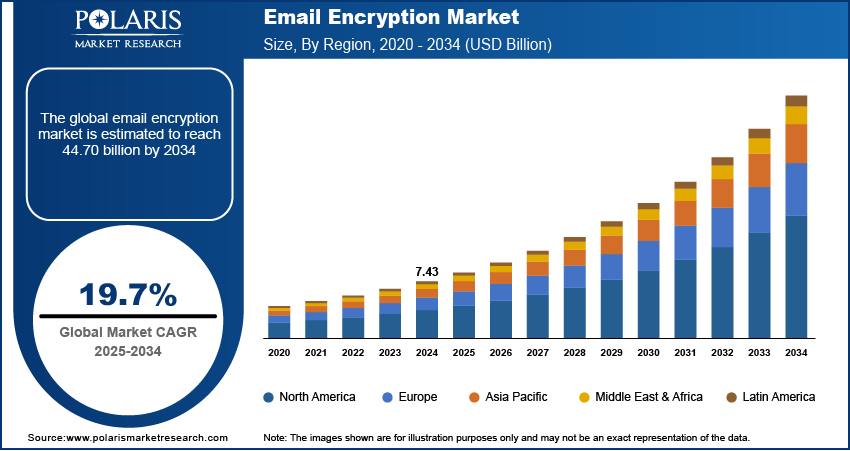

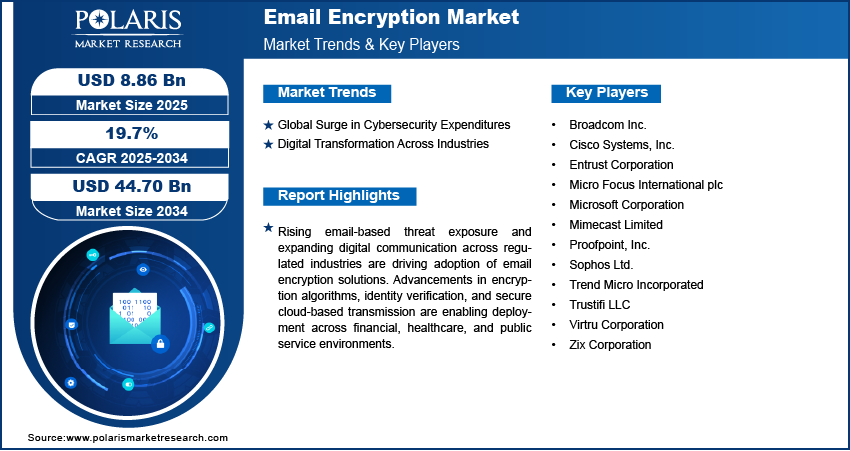

The global email encryption market size was valued at USD 7.43 billion in 2024, growing at a CAGR of 19.7% during 2025–2034. Rising cybersecurity investments and digital transformation across industries are driving the demand for advanced email encryption solutions.

Email encryption solutions are developed to safeguard sensitive communications from unauthorized access, interception, and data leakage. These solutions employ advanced cryptographic techniques, secure key management, and user authentication to maintain message confidentiality across corporate and public 5G networks. Real-time scanning, secure email gateways, and policy-based controls are deployed to detect potential threats while minimizing operational impact.

Rising concerns over data privacy and compliance obligations are increasing the use of scalable encryption platforms that enable seamless integration with enterprise systems, cloud computing services, and regulatory frameworks. Developers are advancing automated key lifecycle management, centralized policy enforcement, and user-friendly interfaces to streamline secure communication. Integration of quantum-resistant algorithms and metadata protection capabilities is pushing towards platform reliability through adoption of email encryption as an essential layer of enterprise cybersecurity infrastructure.

To Understand More About this Research: Request a Free Sample Report

Email encryption solution is boosting due to rising awareness towards safeguarding sensitive communication against unauthorized access, data interception and manipulation. Enterprises are integrating these tools into their communication workflows to maintain message confidentiality across all stakeholders. Encryption protocols are adopted to ensure secure transmission of financial records, legal documentation and personally identifiable information through standard email platforms.

Moreover, growing remote work environments and the adoption of cloud-based email services is driving the email encryption industry. This growth is witnessed due to businesses are seeking solutions that enable automated encryption, centralized policy control and seamless compatibility with cloud infrastructure. Recently, in June 2025, Infomaniak introduced a free email encryption service for all its users, aiming to make secure communication more accessible and widespread. These systems are integrated into broader cybersecurity frameworks to support compliance with sector-specific regulations and protect against evolving threats.

Industry Dynamics

Global Surge in Cybersecurity Expenditures

Rising cybersecurity budgets across public and private sectors is fueling the adoption of email encryption sector. According to Cybersecurity Ventures, global cybercrime costs rose by 15% each year and reached USD 10.5 trillion in 2025, up from USD 3 trillion in 2015. This is due to threat faced by the organizations to prevent data breaches and protect digital infrastructure. Email remains a primary channel for business communication, making it a frequent target for phishing, spoofing, and unauthorized data access. As a result, enterprises are prioritizing encryption solutions as part of their baseline security infrastructure to safeguard sensitive communication.

Additionally, vendors are focusing towards email encryption tools to meet with enterprise-wide cybersecurity frameworks to enhance centralized management, automated key handling and secure platform integration. The growing recognition of cybersecurity as a board-level priority is driving the adoption of encryption technologies as essential components of enterprise risk management strategies. This shift is leading to higher investment in secure communication tools, creating favorable conditions for sustained growth in the email encryption market.

Digital Transformation Across Industries

Digital transformation initiatives across industries for secure communication frameworks is driving the demand for email encryption industry. According to UNCTAD, greenfield investment in the digital economy reached USD 360 billion in 2024, nearly three times the value recorded in 2020, which was USD 131 billion. The rising shift toward cloud infrastructure, remote collaboration tools and modernization of legacy systems is driving the need for secure communication channels. As a result, businesses are integrating email encryption in their digital transformation strategies to protect sensitive information across evolving workflows.

Moreover, rising volume of sensitive data exchanged via email is driving strong demand for encryption solutions across highly regulated sectors such as healthcare, banking, legal, and government. These industries are prioritizing tools that ensure compliance, provide a seamless user experience, and operate effectively across hybrid IT environments.

Segmental Insights

Encryption Type Analysis

The segmentation, based on encryption type includes, end-to-end email encryption, gateway email encryption, boundary email encryption, hybrid email encryption, and client plugins. The end-to-end email encryption segment is projected to grow substantially by 2034. This growth is due to its ability to secure the entire communication path between sender and recipient without exposing data to intermediate servers. Organizations dealing with sensitive legal, financial, and healthcare data are prioritizing this encryption type to ensure confidentiality and compliance with regulatory standards. Rising concerns over data interception and unauthorized access are further accelerating adoption in industries where data privacy underpins operational integrity. This solution supports zero-trust security and gives enterprises full control over message content and encryption keys to protect sensitive data.

The hybrid email encryption segment is projected to grow at a robust pace in the coming years, driven by enterprise demand for flexible and scalable models that combine the strengths of multiple encryption approaches. This segment offers deployment adaptability, allowing organizations to balance control and convenience across complex IT environments. Its adaptability allows organizations to maintain control while streamlining operations across cloud and on-premise infrastructure. The model allows decentralization that suits businesses using cloud and on-premise systems, making it easier to apply security policies across different teams and user groups.

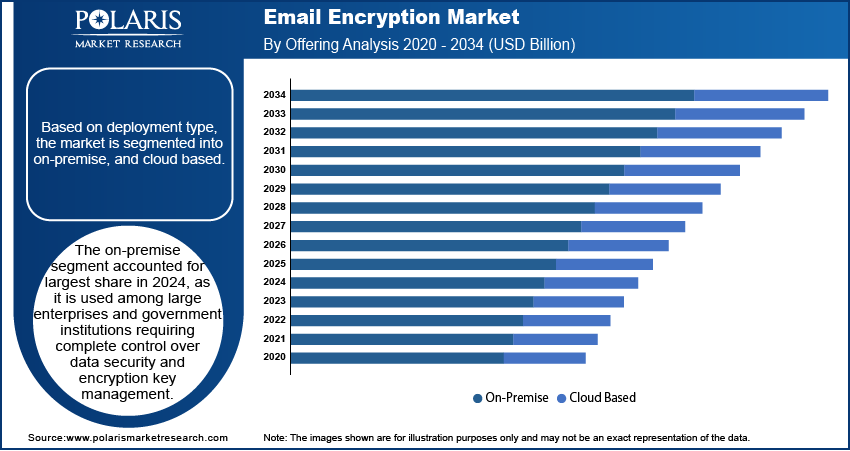

Deployment Type Analysis

The segmentation, based on deployment type includes, on-premise, and cloud based. The on-premise segment accounted for largest share in 2024, as it is used among large enterprises and government institutions requiring complete control over data security and encryption key management. For instance, in January 2024, Trend Micro launched an advanced email security solution in the Middle East and Africa to address the region’s growing cyber threat landscape and enhance email protection. These organizations maintain stringent internal policies and compliance mandates that favor in-house infrastructure, making on-premise solutions the preferred deployment model despite higher upfront costs. It also ensures minimal dependency on external vendors, enhancing risk management. Industries managing classified or sensitive national data continue to prioritize this deployment mode for compliance assurance.

The cloud-based segment is projected to grow at a significant pace during the assessment phase, due to its ease of implementation, scalability, and lower maintenance requirements. Small and medium-sized enterprises are embracing cloud-native email encryption to secure distributed workforces and remote communications. The increasing adoption of cloud platforms across industries is driving the rapid adoption of encryption solutions optimized for cloud environments. Frequent software updates and faster integration with productivity tools are accelerating adoption. Providers are also offering flexible subscription models, making it accessible to cost-sensitive businesses.

Offering Analysis

The segmentation, based on offering includes, solution, and service. The solution segment dominated the market, in 2024, as organizations focus on securing core communication systems with comprehensive tools. Businesses are prioritizing solutions that integrate seamlessly with email clients, support automatic encryption policies, and offer centralized control over secure communications in regulated industries where compliance is critical. These offerings are bundled with broader enterprise security platforms to provide organizations with a unified approach to threat protection and compliance management. Continuous upgrades and vendor-driven innovations are reinforcing demand for solution-based encryption.

The service segment is estimated to hold a substantial market share in 2034, driven by rising demand for managed security offerings. Companies with limited internal IT capacity are turning to service providers for deployment, monitoring, and support of encryption systems. The shift toward outsourcing cybersecurity functions is accelerating the demand for scalable and customizable service-based encryption models. Service-based models are increasing popularity for their predictable cost structure and technical support benefits. Adoption is further driven by increased emphasis on threat response capabilities managed by external experts.

Organization Size Analysis

The segmentation, based on organization size includes, small and medium size organizations, and large size organizations. The large size organizations segment is projected to grow at a significant CAGR during the forecast period. This rapid growth is attributed to their significant volumes of sensitive data and higher risk exposure to targeted cyber threats. These enterprises have the resources and compliance obligations that necessitate the adoption of robust encryption frameworks across global operations. Their need for multi-layered security policies and internal governance structures supports higher deployment volumes. Investments in global infrastructure protection further amplify their encryption requirements.

The small and medium size organizations segment is estimated to hold a significant market share in 2034, as the fastest-growing adopters due to increasing cybersecurity awareness and the availability of cost-effective, cloud-based encryption tools. These organizations are increasingly incorporating encryption into their security posture to meet client expectations, protect intellectual property to meet with evolving regulatory requirements. Government-led digitalization programs and SME-focused compliance incentives are further contributing to this trend. Affordable licensing models are also reducing entry barriers for these enterprises.

End User Analysis

The segmentation, based on end user includes, BFSI, healthcare, government, IT & telecom, telecommunication, manufacturing, energy & utilities, retail & e-commerce, and other end users. The BFSI segment dominated the market, in 2024. This dominance is due to the critical need to protect financial data, customer communications, and transaction records. In March 2024, Nightfall AI launched new features for data encryption and sensitive data protection in emails, enhancing secure communication for businesses. Regulatory pressure, combined with a high risk of fraud and phishing attacks, is leading financial institutions to prioritize encryption technologies as part of their standard cybersecurity protocols. Continuous online banking expansion and digital investment services are increasing encrypted communication volumes. Global compliance frameworks such as PCI DSS are reinforcing encryption mandates in the sector.

The healthcare segment is projected to grow at a robust pace during the forecast period. This growth is driven due to the rising focus on securing patient data and clinical communications by providers, insurers, and research institutions. Increasing digitalization of health records and the need to meet privacy regulations such as HIPAA are accelerating the adoption of encryption tools across the healthcare ecosystem. The industry’s rising use of telemedicine and email-based consultations is expanding the need for secure data exchange. Data integrity requirements in clinical trials and diagnostics are also boosting encryption usage.

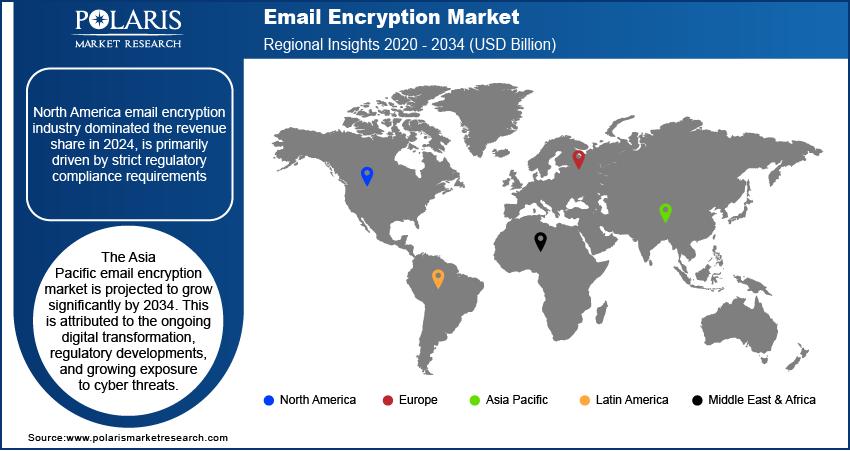

Regional Analysis

North America email encryption industry dominated the revenue share in 2024, is primarily driven by strict regulatory compliance requirements such as Health Insurance Portability and Accountability Act (HIPAA), Gramm-Leach-Bliley Act (GLBA), and California Consumer Privacy Act (CCPA). Enterprises across regulated sectors are actively investing in encryption tools to meet data protection standards and reduce legal risks. This regulatory pressure coupled with a well-established cybersecurity infrastructure, continues to accelerate adoption of email encryption solution across healthcare, financial, and government organizations.

US Email Encryption Market Insight

The US email encryption market dominated the regional share in 2024, fueled by strong regulatory enforcement and increasing investments in cybersecurity modernization. Government agencies and enterprises are prioritizing secure communication systems with advanced encryption protocols to comply with federal data protection mandates. This regulatory pressure is accelerating early adoption of email encryption across core IT infrastructures. As a result, leading companies in the US are actively developing advanced email encryption solutions to address rising cyber risks and compliance needs. For instance, in May 2024, Proofpoint introduced adaptive threat protection capabilities, setting a new industry benchmark in email security and encryption to counter evolving cyber threats.

Asia Pacific Email Encryption Market

The Asia Pacific email encryption market is projected to grow significantly by 2034. This is attributed to the ongoing digital transformation, regulatory developments, and growing exposure to cyber threats. According to ESCAP, the Asia-Pacific region is witnessing significant growth and investment in the digital sector, with internet market revenue projected to reach USD 436 billion by 2026, driven largely by smart cities comprising one-third of the market and digital finance leading the transformation. Countries including China, India, Japan, South Korea, and Australia are enhancing their data protection frameworks and introducing mandates for secure digital communication across sectors such as banking, healthcare, education, and public administration.

Europe Email Encryption Market Overview

Europe email encryption market accounted for substantial share in 2024, primarily driven by the imposition of the General Data Protection Regulation (GDPR) that mandates strict protection of personal and sensitive data. This regulatory environment is compelling organizations across key sectors such as finance, healthcare and public services to adopt robust encryption solutions with automated compliance features. In June 2025, the European Union Agency for Cybersecurity (ENISA) announced an initiative to enhance cybersecurity across the EU reinforce the critical role of robust email encryption in protecting sensitive communications. This is expected to boost the demand for email encryption services across infrastructure providers.

Key Players & Competitive Analysis Report

The email encryption industry is moderately competitive, driven by increasing data protection mandates and widespread digital communication adoption. Vendors are focusing on scalable, compliance-ready solutions that integrate with cloud platforms and enterprise tools. Lightweight modules, centralized key control, and policy automation are key development priorities. Companies are enhancing offerings through mobile support, identity verification, and endpoint integration. Strategic alliances and investment in zero-trust frameworks and quantum-resilient encryption are strengthening market positioning.

Key companies in the email encryption industry include Broadcom Inc., Cisco Systems, Inc., Microsoft Corporation, Proofpoint, Inc., Mimecast Limited, Zix Corporation, Sophos Ltd., Micro Focus International plc, Entrust Corporation, Trustifi LLC, Virtru Corporation, and Trend Micro Incorporated.

Key Players

- Broadcom Inc.

- Cisco Systems, Inc.

- Entrust Corporation

- Micro Focus International plc

- Microsoft Corporation

- Mimecast Limited

- Proofpoint, Inc.

- Sophos Ltd.

- Trend Micro Incorporated

- Trustifi LLC

- Virtru Corporation

- Zix Corporation

Industry Developments

June 2025: Trustifi received USD 25 million Series A funding round underscores growing investor confidence in advanced email encryption solutions for secure digital communication.

April 2025: Proofpoint launched a unified data security solution that strengthens email encryption by addressing data exfiltration, exposure, and insider threats.

April 2025: Google launched client-side end-to-end email encryption in Gmail marks a major step in strengthening email data privacy and boosting demand in the email encryption market.

Email Encryption Market Segmentation

By Encryption Type Outlook (Revenue, USD Billion, 2020–2034)

- End-To-End Email Encryption

- Gateway Email Encryption

- Boundary Email Encryption

- Hybrid Email Encryption

- Client Plugins

By Deployment Type Outlook (Revenue, USD Billion, 2020–2034)

- On-Premise

- Cloud Based

By Offering Type Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Service

- Professional Service

- Managed Service

- Training and Education

- Support and Maintenance

By Organization Size Outlook (Revenue, USD Billion, 2020–2034)

- Small and Medium Size Organizations

- Large Size Organizations

By End User Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- Healthcare

- Government

- IT & Telecom

- Telecommunication

- Manufacturing

- Energy & Utilities

- Retail & E-commerce

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Email Encryption Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.43 Billion |

|

Market Size in 2025 |

USD 8.86 Billion |

|

Revenue Forecast by 2034 |

USD 44.70 Billion |

|

CAGR |

19.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 7.43 billion in 2024 and is projected to grow to USD 44.70 billion by 2034.

The global market is projected to register a CAGR of 19.7% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Broadcom Inc., Cisco Systems, Inc., Microsoft Corporation, Proofpoint, Inc., Mimecast Limited, Zix Corporation, Sophos Ltd., Micro Focus International plc, Entrust Corporation, Trustifi LLC, Virtru Corporation, and Trend Micro Incorporated.

The on-premise segment accounted for largest share in 2024.

The service segment is estimated to hold a substantial market share in 2034.