Endobronchial Ultrasound Biopsy Market Size, Share, & Industry Analysis Report

: By Product, By Procedure, By End Use (Hospitals, ASCs, and Specialty Clinics), and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5689

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

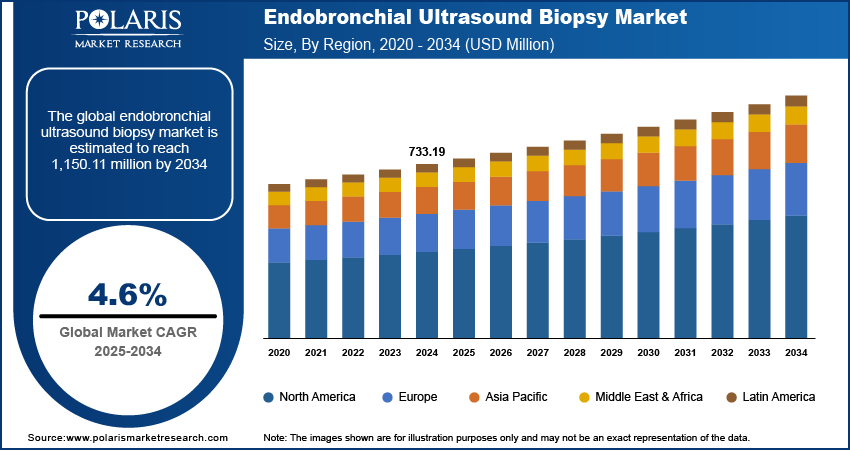

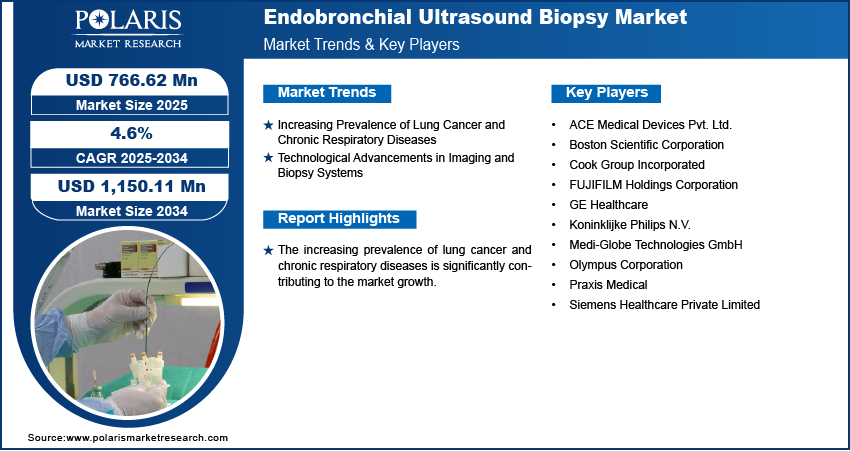

The global endobronchial ultrasound biopsy market size was valued at USD 733.19 million in 2024 and is expected to register a CAGR of 4.6% during 2025–2034. Growing preference for minimally invasive procedures drives market demand as patients and physicians favor less invasive techniques due to shorter recovery times, reduced complications, and lower costs compared to open surgeries.

Endobronchial ultrasound biopsy refers to the segment of the medical device and diagnostic that involves the use of endobronchial ultrasound (EBUS) technology combined with biopsy procedures for the diagnosis and staging of lung cancer, lymph node diseases, and other pulmonary conditions. EBUS biopsy allows real-time imaging and guided sampling of tissues within or adjacent to the airways, offering a minimally invasive surgery alternative to traditional surgical biopsies.

To Understand More About this Research: Request a Free Sample Report

Expansion of educational programs and specialized training in interventional pulmonology boosts the utilization of EBUS-guided biopsies. Moreover, public health campaigns promoting early detection of lung cancer increase screening and diagnostic activities, including the use of EBUS biopsy. The expansion of healthcare infrastructure in emerging sectors, such as improved access to advanced diagnostic facilities in developing regions, fuels overall growth by enhancing early disease detection, improving patient outcomes, and increasing the efficiency of medical services.

Market Dynamics

Increasing Prevalence of Lung Cancer and Chronic Respiratory Diseases

Increasing prevalence of lung cancer and chronic respiratory diseases is significantly contributing to the overall growth. According to the Lung Cancer Research Foundation, lung cancer is the leading cause of cancer mortality worldwide. In the US, around 226,650 new lung cancer cases are projected for 2025, with a lifetime risk of 1 in 16 for men and 1 in 17 for women. Rising global incidence of lung cancer, driven by factors such as tobacco use, industrial pollution, and aging populations, has intensified the need for precise, early-stage diagnostic tools. EBUS biopsy offers a minimally invasive alternative to traditional diagnostic procedures, enabling accurate sampling of mediastinal and hilar lymph nodes without the risks associated with surgical methods. Healthcare systems are prioritizing early diagnosis to improve treatment outcomes and reduce overall cancer burden, which further elevates the demand for EBUS technology. The increasing burden of chronic respiratory diseases such as COPD and tuberculosis also supports the widespread adoption of EBUS-guided diagnostics in clinical practice.

Technological Advancements in Imaging and Biopsy Systems

Technological advancements in imaging and biopsy systems are accelerating the adoption of EBUS biopsy techniques across diagnostic centers and hospitals. Recent innovations in ultrasound bronchoscope design, such as enhanced image resolution and greater maneuverability, have significantly improved the precision of transbronchial needle aspiration. The development of real-time navigation systems, elastography, and miniaturized biopsy tools allows clinicians to access difficult-to-reach lesions while maintaining procedural safety. Integration of artificial intelligence and machine learning for image interpretation is further refining diagnostic confidence. These continuous improvements are improving clinical outcomes and also streamlining procedures, reducing patient recovery time, and lowering overall healthcare costs. Robust R&D investments from medical device manufacturers are further fueling the evolution of EBUS biopsy systems, making them indispensable in modern thoracic oncology workflows.

Segment Insights

Market Assessment by Product

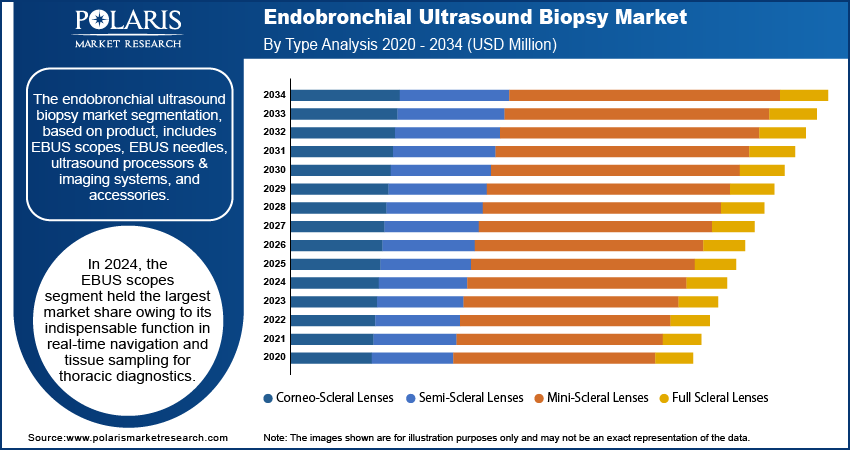

The endobronchial ultrasound biopsy market segmentation, based on product, includes EBUS scopes, EBUS needles, ultrasound processors & imaging systems, and accessories. In 2024, the EBUS scopes segment held the largest share owing to its indispensable function in real-time navigation and tissue sampling for thoracic diagnostics. EBUS bronchoscopes integrate ultrasound transducers within the bronchoscope tip, enabling visualization of peribronchial structures that were previously inaccessible via conventional bronchoscopy. Increasing clinical preference for minimally invasive approaches to diagnose lung cancer, mediastinal lymphadenopathy, and granulomatous diseases has driven demand for high-performance EBUS scopes. Surgeons and pulmonologists rely on these instruments to achieve greater procedural accuracy while avoiding surgical interventions such as mediastinoscopy. Growing training programs and procedural standardization have further facilitated the incorporation of EBUS scopes in routine pulmonary diagnostic workflows. Rapid technological enhancements, such as high-definition imaging and improved articulation, have also elevated the utility of these devices, solidifying their dominant position in the product landscape.

Market Evaluation by End Use

The endobronchial ultrasound biopsy market segmentation, based on end use, includes hospitals, ambulatory surgical centers (ASCs), and specialty clinics. The ambulatory surgical center segment is expected to witness the highest CAGR during the forecast period due to increasing procedural volumes, cost efficiency, and favorable reimbursement models. EBUS-guided procedures are being widely adopted in outpatient settings due to shorter patient recovery times and reduced hospital stays. Rising preference among patients and providers for day-care diagnostics that avoid the complexity of inpatient admissions has significantly strengthened the role of ASCs in pulmonary diagnostics. Advanced infrastructure, availability of skilled pulmonologists, and the adoption of compact, mobile EBUS systems have further optimized diagnostic turnaround in ASCs. Operational flexibility, lower overhead costs, and integration of streamlined diagnostic pathways are collectively contributing to segment growth across high-income and emerging healthcare sector.

Regional Analysis

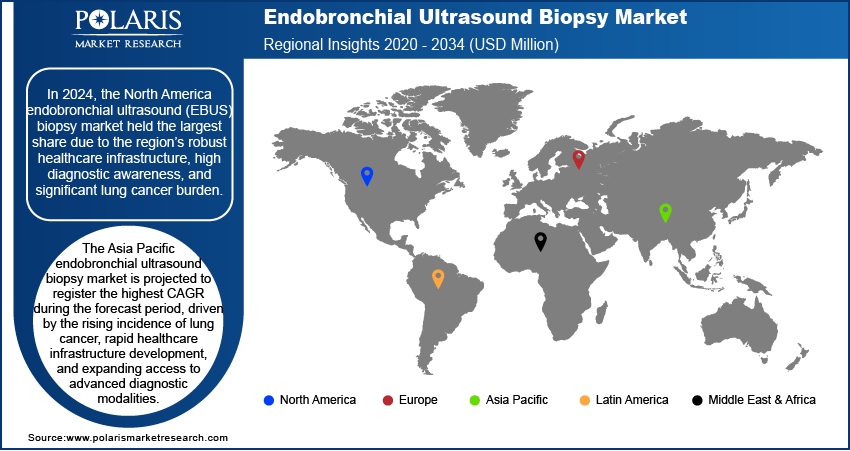

By region, the study provides insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America endobronchial ultrasound (EBUS) biopsy market held the largest share due to the region’s robust healthcare infrastructure, high diagnostic awareness, and significant lung cancer burden. Accelerated adoption of advanced minimally invasive diagnostic tools, supported by well-defined reimbursement frameworks, has positioned EBUS biopsy as a frontline procedure for mediastinal and hilar lymph node evaluation. Major academic and tertiary care institutions continue to integrate EBUS into standard diagnostic algorithms for suspected malignancies and staging of non-small cell lung cancer (NSCLC). Substantial product launches and investments in pulmonology-focused research, alongside increased training in interventional pulmonology, have further supported procedural volumes. Widespread availability of technologically sophisticated EBUS equipment and ancillary imaging systems, coupled with stringent clinical guidelines endorsing EBUS over conventional invasive methods, has enhanced regional procedure uptake. Continuous innovation, including real-time elastography and robotic bronchoscopy integrations, also contributes to sustained leadership in North America.

The Asia Pacific endobronchial ultrasound biopsy market is projected to register the highest CAGR during the forecast period, driven by the rising incidence of lung cancer, rapid healthcare infrastructure development, and expanding access to advanced diagnostic modalities. For instance, as reported by the National Institutes of Health, projections indicate that the incidence of cancer cases in India is expected to rise from approximately 1.46 million in 2022 to around 1.57 million by 2025. National screening programs and growing awareness of early-stage cancer diagnosis are accelerating the deployment of EBUS technologies in urban and semi-urban centers. Emerging economies such as China and India are witnessing increased public and private investment in respiratory diagnostics, spurring demand for minimally invasive procedures that can reduce diagnostic delays. Local manufacturing initiatives and regulatory reforms are improving access to cost-effective EBUS systems. The growing pool of trained pulmonologists, combined with strategic partnerships between global technology providers and regional healthcare institutions, is reinforcing procedural capacity across secondary and tertiary hospitals.

Key Players & Competitive Analysis Report

The competitive landscape of the endobronchial ultrasound biopsy market is marked by aggressive market expansion strategies, fueled by increasing demand for minimally invasive diagnostic modalities in pulmonary care. Industry analysis indicates a surge in strategic alliances, joint ventures, and technology licensing agreements aimed at strengthening product portfolios and expanding geographic presence. Key players are focusing on mergers and acquisitions to consolidate their market positions and accelerate innovation pipelines, particularly in imaging systems, ultrasound devices, and needle design enhancements. Launches of next-generation EBUS platforms featuring advanced imaging technologies such as elastography, Doppler guidance, and robotic navigation demonstrate a clear trend toward precision diagnostics and improved patient outcomes.

Technology advancements in EBUS scopes and real-time visualization systems are redefining clinical workflows, prompting manufacturers to invest in R&D for better ergonomics, resolution, and compatibility with AI in diagnostic tools. Post-merger integration efforts are emphasizing streamlined distribution, enhanced R&D efficiency, and access to global regulatory channels. Additionally, strategic collaborations with specialty clinics and ambulatory surgical centers are expanding procedural adoption in outpatient settings, driving growth in both developed and emerging economies. The market is also witnessing a shift toward bundled service offerings, where device makers partner with institutions to provide training, support, and integrated diagnostic solutions. Furthermore, regulatory compliance and standardization remain central to competitive differentiation, especially amid evolving clinical guidelines for lung cancer staging.

Fujifilm Corporation is involved in creating, selling, and distributing image, information, and document solutions. The three divisions through which the company functions are Imaging Solutions, Information Solutions, and Document Solutions. The imaging solutions business unit deals with electronic imaging, photofinishing equipment, lab services, film processing, color films, color paper, and chemicals. The information solutions cover visual arts, recording media, and medical and life sciences systems. The Document Solutions division offers printers, office supplies, document creation, and outsourcing services.

Siemens Healthineers offers healthcare solutions and services and operates in several nations worldwide. The Siemens Healthineers direct and indirect subsidiaries run the company's business activities. The four elements that make up its operation are Imaging, Diagnostics, Varian, and Advanced Treatments. The imaging sector offers ultrasound, computed tomography, X-ray, molecular imaging, and magnetic resonance imaging equipment. The Diagnostics business provides workflow solutions for laboratories and informatics products, and in-vitro diagnostic goods and services for point-of-care, molecular, and laboratory diagnostics to healthcare providers.

List of Key Companies in Endobronchial Ultrasound Biopsy Market

- ACE Medical Devices Pvt. Ltd.

- Boston Scientific Corporation

- Cook Group Incorporated

- FUJIFILM Holdings Corporation

- GE Healthcare

- Koninklijke Philips N.V.

- Medi-Globe Technologies GmbH

- Olympus Corporation

- Praxis Medical

- Siemens Healthcare Private Limited

Endobronchial Ultrasound Biopsy Industry Developments

In September 2024, FUJIFILM Healthcare Europe GmbH announced compatibility between the ARIETTA 750 FF ENDO ultrasound system and several ultrasound endoscopes (EG-580UR, EG-580UT, EG-740UT) as well as the EB-530US linear ultrasound bronchoscope. This integration enables physicians to maximize the benefits of FUJIFILM's ultrasound imaging during procedures.

In October 2023, Praxis Medical received 510(k) clearance from the FDA for the EndoCore EBUS-TBNA fine needle biopsy device. This tool is used for diagnosing and staging lung cancer by inserting a flexible needle through a bronchoscope to collect cellular material for analysis, helping to determine malignancy and identify treatment-specific mutations.

Endobronchial Ultrasound Biopsy Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- EBUS Scopes

- EBUS Needles

- Ultrasound Processors & Imaging Systems

- Accessories

By Procedure Outlook (Revenue, USD Million, 2020–2034)

- EBUS-Transbronchial Needle Aspiration (EBUS-TBNA)

- EBUS-Guided Biopsy

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Specialty Clinics

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Endobronchial Ultrasound Biopsy Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 733.19 million |

|

Market Size Value in 2025 |

USD 766.62 million |

|

Revenue Forecast by 2034 |

USD 1,150.11 million |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 733.19 million in 2024 and is projected to grow to USD 1,150.11 million by 2034.

The global market is projected to register a CAGR of 4.6% during the forecast period.

In 2024, the North America endobronchial ultrasound (EBUS) biopsy market held the largest share due to the region’s robust healthcare infrastructure, high diagnostic awareness, and significant lung cancer burden.

A few of the key players in the market are ACE Medical Devices Pvt. Ltd., Boston Scientific Corporation, Cook Group Incorporated, FUJIFILM Holdings Corporation, GE Healthcare, Koninklijke Philips N.V., Medi-Globe Technologies GmbH, Olympus Corporation, Praxis Medical, and Siemens Healthcare Private Limited.

In 2024, the EBUS scopes segment held the largest market share owing to its indispensable function in real-time navigation and tissue sampling for thoracic diagnostics.

The ambulatory surgical center segment is expected to witness the highest CAGR during the forecast period due to increasing procedural volumes, cost efficiency, and favorable reimbursement models.